Results for “multiplier” 112 found

The “multiplier,” circa 2021

A recent U.S. Chamber of Commerce survey found that 88 percent of commercial construction contractors reported moderate-to-high levels of difficulty finding skilled workers, and more than a third had to turn down work because of labor deficiencies. The industry could face a shortage of at least two million workers through 2025, according to an estimate from Construction Industry Resources, a data firm in Kentucky.

The pandemic has compounded labor shortages, as sectors like construction see a boom in home projects with more people teleworking and moving to the suburbs. Contractors have also faced a scarcity of supplies as prices soared for products like lumber and steel.

Here is the full NYT article. And this I found interesting for other reasons:

Infrastructure workers tend to be older than average, raising concerns about workers retiring and leaving behind difficult-to-fill positions. The median age of construction and building inspectors, for instance, is 53, compared with 42.5 for all workers nationwide. Only 10 percent of infrastructure workers are under 25, while 13 percent of all U.S. workers are in that age group, according to a Brookings Institution analysis.

So men are going to college less and also working on infrastructure less? Hmm…

Returning to the main point, one reason I often am skeptical of multiplier talk is that the same economists and analysts recommend the same policies when the multiplier is…um…not so high.

The fiscal multiplier during World War II

WWII is viewed as the quintessential example of fiscal stimulus and exerts an outsized influence on fiscal multiplier estimates, but the wartime economy was highly unusual. I use newly-digitized contract data to construct a state-level panel on U.S. spending in WWII. I estimate a relative fiscal multiplier of 0.25, implying an aggregate multiplier of roughly 0.3. Conversion from civilian manufacturing to war production reduced the initial shock to economic activity because war production directly displaced civilian manufacturing. Saving and taxes account for 75% of the income generated by war spending, implying that the add-on effects from increased consumption were minimal.

That is from a 2018 paper by Gillian Brunet, and you will note that it reflects the consensus of the literature as a whole. I do favor the federal government borrowing and spending a great deal of money right now on things that we need. If you think we are in a traditional Keynesian scenario, or are pulling out a traditional AS-AD model, you are going to be very badly disappointed. Most of all, we need to be spending more on public health and remedies for Covid-19. Here is my earlier Bloomberg column on analogies and disanalogies between Covid-19 and World War II. And again, see Garett Jones and Dan Rothschild on the 2009 stimulus.

Why was the fiscal multiplier so small in World War II?

That is the topic of a new and fascinating paper by Gillian Brunet, who is on the job market this year from UC Berkeley. Here goes:

“Stimulus on the Home Front: The State-Level Effects of WWII Spending” (job market paper)

World War II is often viewed as a quintessential example of government spending stimulating the economy. In this paper I use war production spending to quantify the idiosyncratic factors affecting estimates of the fiscal multiplier during World War II. Newly digitized war supply contract data allow me to construct state-level panel data on U.S. defense spending for 1940-45 and examine state-level outcomes. Using within-state variation I estimate a multiplier of 0.25 to 0.3, depending on the estimation approach. This implies an aggregate multiplier of roughly 0.3 to 0.4 given wartime economic conditions. I also find small employment effects: an additional job-year is associated with $165,000 – $255,000 of spending (in 2015 dollars). I find evidence that the effects of stimulus were systematically larger in states that had lower employment levels pre-war. To explain why the stimulative effects of war spending were so small, I look for guidance from the historical narrative. I show that unique features of the wartime economy significantly reduced the stimulative impact of wartime spending. Conversion from civilian manufacturing to war production reduced the initial stimulus from war production. At least 75 percent of the income generated by war spending went into increased saving and income taxes, implying that the add-on effects from increased consumption were minimal in the short run.

This seems exactly right to me. When an economy is rationing-constrained and doing supply-side switching at such a rapid pace, I don’t think it is very easy to simply pull unemployed resources out of nowhere into new production. This raises the bigger question, however, of what exactly did drive economic recovery. I say don’t be fooled by wartime gdp figures, there was not a true wartime recovery in terms of consumption, quite the contrary. But come the postwar era, so many of the right pieces seemed to be in place. Dare I mention “increased saving”? I know that is anathema to the usual Keynesian approach, at the very least this remains a mystery and the simple stories would seem to fail.

The multiplier just isn’t very large right now

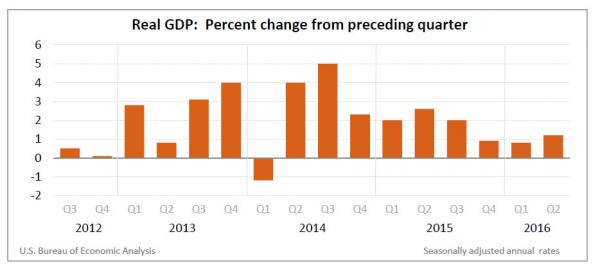

If the multiplier were large, more economic growth would beget yet more growth, but is that what you see for the post-2014 period?

You can think of this as another sign that aggregate demand policy has reached its limits. Advocates of large multipliers write as if government-sponsored economic activity will bring forth more activity yet. But “economic activity” – whether government-sponsored or not — has not been having a multiplicative effect since 2014 or arguably earlier yet.

I call this “The Multiplier for Me, but Not for Thee.” Favored policies are supposed to have large multipliers, but as for the growth we actually get, what kind of multiplier is that bringing? That’s not a question to be asked too many times because the answer will disappoint.

Robin Hanson on the real multiplier

Yes doing things now can have good side effects, but unless something changes in the side-effect processes, doing things later should have exactly the same sort of side effects. And because of positive interest rates, you can do more later, and thus induce more of those good side effects. (Also, almost everyone can trade time for money, and so convert money or time now into more money or time later.)

For example, if you can earn 7% interest you can convert $1 now into $2 a decade from now. Yes, that $1 now might lend respectability now, induce others to copy your act soon, and induce learning by the charity and its observers. But that $2 in a decade should be able to induce twice as much of all those benefits, just delayed by a decade.

In math terms, good side effects are multipliers, which multiply the gains from your good act. But multipliers are just not good reasons to prefer $1 over $2, if both of them will get the same multiplier. If the multiplier is M, you’d just be preferring $1M to $2M.

…I think one should in general be rather suspicious of investing or donating to groups on the basis that they, or you, or now, is special. Better to just do what would be good even if you aren’t special. Because usually, you aren’t.

There is more here.

The QE multiplier

Felix Salmon writes:

If you take the amount of tapering that the market expected yesterday, and the amount of tapering that the market expects today, what’s the difference, in dollar terms? In other words, by the time tapering ends, and the Fed is no longer engaging in quantitative easing, how much extra money will it have spent buying bonds, if current market expectations hold, compared to what the market expected on Wednesday?

Then comes the next question, which is this: how much did the value of US fixed-income assets rise on Thursday? And, for that matter, how much did the value of US stocks rise on Thursday?

I don’t know the exact answers to the questions, but I’m pretty sure that the latter numbers are much larger than the former — that the market reaction, in dollar terms, was hugely greater than the extra amount of QE that the market now expects.

If that is indeed the case, then what we’re seeing is what you might call the QE multiplier — the amount by which every dollar of QE effects the markets as a whole. I don’t know what we thought the QE multiplier was on Wednesday, but in light of Thursday’s market action we might need to revise our guesses: the QE multiplier is, I suspect, much larger than most of us would have pegged it at.

Unlike Felix, I am, these days, made nervous by the size of the QE multiplier.

Are Government Spending Multipliers Greater During Periods of Slack?

The embarrassing result here is that no, it seems they are not:

A key question that has arisen during recent debates is whether government spending multipliers are larger during times when resources are idle. This paper seeks to shed light on this question by analyzing new quarterly historical data covering multiple large wars and depressions in the U.S. and Canada. Using an extension of Ramey’s (2011) military news series and Jordà’s (2005) method for estimating impulse responses, we find no evidence that multipliers are greater during periods of high unemployment in the U.S. In every case, the estimated multipliers are below unity. We do find some evidence of higher multipliers during periods of slack in Canada, with some multipliers above unity.

That is from a new paper by Michael T. Owyang, Valerie A. Ramey, and Sarah Zubairy.

I see a few views (among others) of the multiplier:

1. The crude form of Say’s Law is true and fiscal policy simply remixes funds with no real impact.

2. Say’s Law is not really true as stated, but why should we be so impressed with a one-time uptick in monetary velocity, also called fiscal policy, unless the supply-side effects are also really good?

3. Fiscal policy effectively targets and mobilizes unemployed resources.

4. Fiscal policy postpones adjustment issues (this can be from AD too, it doesn’t have to be a “structural” problem), and may usefully smooth consumption, but it doesn’t do a good job targeting and mobilizing unemployed resources.

5. The size of the multiplier is determined by the expected monetary policy accommodation, and not by the quantity of unemployed resources.

I would say this paper provides evidence against #1 and #3.

The multiplier and the rate of return on aid

Critics of “austerity” are often weak or a bit mumbly on what is the relevant alternative or counterfactual. When it comes to the U.S., the relevant alternative is borrowing more, but in many cases, such as in the European periphery, the alternative is/was more aid.

So, in these cases, a multiplier of one means that a dollar of aid — the alternative to the fiscal consolidation — is worth a dollar. I find that easy to believe. It’s not really a claim about fiscal policy or Keynesian economics.

A multiplier of 1.4 means that a dollar of aid brings $1.40 in benefits. Imagine receiving aid, and not just benefiting from the dollar, but avoiding a fire sale of your assets or investing the money wisely or maybe just avoiding a civil collapse. That’s more of a stretch, but also not outside the realm of the possible.

As the IMF becomes more critical of austerity, the IMF therefore should believe in higher rates of return to aid. But does it?

@Yannikouts nailed it here:

It’s one thing IMF economists to argue for softer austerity and a totally other thing to convince IMF Board members to commit to extra funds

Few people believe in austerity when it is someone else’s money on the line. Here is my earlier post How emigrants try to run their fiscal policies.

Fiscal multipliers at the zero bound in an open economy

Let’s continue our look at debates over UK fiscal adjustment.

Will fiscal policy work in an open economy? The standard view has

been that in a Mundell-Fleming model fiscal expansion appreciates

the exchange rate and hurts the trade balance, thus offsetting

the fiscal policy. The U.S. may be too closed an economy for this

to be a big deal, but for the UK it seems this might apply, at

least if one is operating within Keynesian frameworks.

The recent Keynesian response has cited the “lower bound” as a

reason why fiscal policy still may be effective in an open

economy. But what does this literature really show? Let’s take a

brief tour of it, starting with the August 2012 piece by Emmanuel Farhi and Ivan Werning,

brilliant Harvard and MIT guys. Their piece is clear and

excellent, and it shows what the case for fiscal policy in this

setting looks like. (I don’t read them as offering concrete

advice to current governments and thus I have no criticism of

their paper, which I am pleased to have spent time with.)

Here are a few points:

1. “…the effects of government consumption work through

inflation.” In other words, if you think the BOE has greater

influence over inflation than UK government spending, you do not

need the other results of this paper for macro policy. I get the

point of “the central bank cannot precommit to elaborate

targeting schemes over time,” but that’s not what we need here.

We just need some basic money-induced price inflation to render

monetary policy dominant over fiscal policy, even in this case.

And pretty much everyone thinks the BOE can influence the rate of

price inflation. The rates of price inflation we are getting are

not some kind of strange coincidence.

By the way, even with a so-called liquidity trap, the BOE also

can play QE with the exchange rate, as do the Swiss.

2. The zero bound open economy model predicts that fiscal

tightening leads to exchange rate appreciation (contra the usual

Mundell-Fleming case), yet here is the British pound against the

dollar:

Not an obvious fit to the prediction. There are countervailing

factors, to be sure, but maybe that’s the broader story too.

3. The model in the paper suggests that “current” fiscal policy

won’t much help aggregate demand. Fiscal policy does best the

further away in time it is, provided it does not happen

after the liquidity trap goes away. This makes sense if you view

inflation as the channel for the effectiveness of fiscal policy.

Getting the inflation over with won’t help much, but if it hangs

over people’s heads they will spend more in response. In fact

there is even a problem that the multiplier can be infinite if

fiscal policy is sufficiently well-time and back-loaded.

None of this corresponds with the advice we actually are hearing.

4. The greater the nominal stickiness of prices in the model, the

weaker the Keynesian effects and in the limiting case they

approach zero. Yet we are told (by the policy commentators) that

nominal stickiness is of the utmost importance.

Let’s consider a few other pieces and points:

5. It is common for these papers to rely on squirrely mechanisms

of intertemporal substitution, which in other contexts are mocked

by Keynesians. Consider

Fujiwara and Ueda, a commonly cited paper on fiscal

multipliers and the zero bound:

Incomplete stabilization of marginal costs due to the existence

of the zero lower bound is a crucial factor in understanding

the effects of fiscal policy in open economies. Thanks to

this, government spending in the home country raises the

marginal costs of home-produced goods, which increases expected

inflation rates and decreases real interest rates.

Intertemporal optimization causes consumption to increase, so

that the fiscal multiplier exceeds one. While government

spending continues, the price of home-produced goods increases

more than that of foreign-produced goods. Expecting that two

countries are at symmetric equilibrium when government spending

ends, the home currency depreciates and the home terms of trade

worsen on impact when government spending begins. That shifts

demand for goods from foreign-produced goods to home-produced

ones. The fiscal spillover thus may become negative depending

on the intertemporal elasticity of substitution in consumption.

If a passage like that came from an RBC theorist it would be

mocked, but in support of activist fiscal policy it passes

without critical comment.

6. When it comes to Japan and the Japanese lower bound, the

empirical evidence seems to show that “standard theory” predicts

quite well and the stranger zero bound theories do not predict

well. Here is Braun and

Korber:

We show that a prototypical New Keynesian model fit to Japanese

data exhibits orthodox dynamics during Japan’s episode with

zero interest rates. We then demonstrate that this

specification is more consistent with outcomes in Japan than

alternative specifications that have unorthodox properties….

Those same zero bound Keynesian models predict that economies

should have quite volatile responses to real shocks, yet they do

not:

We also considered specifications of the model that have larger

government purchase multipliers and some which also exhibit

unorthodox predictions for the response of output to labor tax

and technology shocks. We found that these specifications are

difficult to square with the fact that the period of zero

interest rates in Japan between 1999 and 2006 was a period of

low economic volatility. All of the specifications predict the

opposite should have occurred. The specifications with

unorthodox properties also have other problems. They predict

large resource costs of price adjustment which are difficult to

reconcile with empirical evidence that menu costs are small and

they require that households expect the period of zero interest

rates to be counterfactually long.

Need I state the irony that proponents of the relevance of the

zero bound often insist that real shocks simply aren’t making

such a big difference in recent years? That is inconsistent with

the basic model which they otherwise are citing.

7. In these settings (and assuming away all the problems above),

a lot of the effectiveness of fiscal policy, or sometimes all of

it, comes from “beggar thy neighbor” effects. Read Cook

and Devereux for some illustrative cases. Beggar thy neighbor

strategies are criticized and rejected when Germany (supposedly)

does them through its export prowess, but in the context of

fiscal policy they seem to be given a free pass.

8. In fact I could make further points but I believe that is

enough.

The bottom line: A look at this new and

interesting literature shows it does not support the

interpretations which the “policy commentariat” Keynesians are

putting on it and in some regards it even opposes those

interpretations. When it comes to UK fiscal policy, we are seeing

again what I described

last week: exaggeration and a lack of transparency in

argumentation.

Sentences to ponder (the IMF on fiscal policy and multipliers)

For the countries where the full data is available on the IMF website, the results lose statistical significance if Greece and Germany are excluded.

Moreover, the IMF results are presented as general but are limited to the specific time period chosen. The 2010 forecasts of deficits are not good predictors of errors in growth forecasts for 2010 or 2011 when the years are analysed individually. Its 2011 forecasts are not good predictors of anything.

Economists contacted by the FT worried about the robustness of the techniques used. Jonathan Portes, director of the UK’s National Institute of Economic and Social Research, worried that cross-country studies with small samples never prove anything, even though he strongly believes multipliers are large.

I suspect that FT blog post is not one which will be shouted by many from the rooftops. Multiple hat tips are expressed here.

The balanced budget multiplier?

A Spanish mayor who became a cult hero for staging robberies at supermarkets and giving stolen groceries to the poor sets off this week on a three-week march that could embarrass the government and energise anti-austerity campaigners.

Juan Manuel Sanchez Gordillo, regional lawmaker and mayor of the town of Marinaleda – population 2,645 – in the southern region of Andalusia, said food stolen last week in the robberies went to families hit hardest by Spain’s economic crisis.

Seven people have been arrested for participating in the two raids, in which labour unionists, cheered on by supporters, piled food into supermarket carts and walked out without paying while Mr Sanchez Gordillo (59) stood outside.

He has political immunity as an elected member of Andalusia’s regional parliament, but says he would be happy to renounce it and be arrested himself.

Here is more.

Confusions about the multiplier < 1 (me defending fiscal policy, sort of)

I've been having discussions with some associates about what it means when a measured short-run multiplier is positive yet less than one. It is occasionally suggested that a multiplier less than one means that fiscal policy is necessarily a bad idea, but I don't see it that way.

Keep in mind there is no a priori argument that the government purchases "don't count," even though sometimes they don't produce much value ex post. And the borrowed dollar isn't "taken out" of the economy in a meaningful way. It can come from abroad or it can accelerate velocity, at least potentially.

Let's say the multiplier is 1.0. That typically means a dollar is spent on a road (or whatever), which is in the plus one column. There is some crowding out of private investment but not usually one hundred percent. Let's say that's minus 30 cents. The spending on the road, and road workers, has some positive second-order effects. Let's say those are plus thirty cents per dollar.

In that particular case, the multiplier ends up as equal to one and that is net, all things considered. The spending still would yield a short-term positive for gdp if the multiplier were 0.5.

The case against fiscal policy should examine long-term budgetary costs, possible confidence factors, implementation lags, political economy problems, difficulties in targeting unemployed resources, and also the (underrated) notion that sometimes fiscal policy postpones problems into the medium run rather than solving them through jump-starting a recovery. But it is difficult to deny that fiscal policy brings some economic benefits in the short run, or can brake an economic decline, even if the measured multiplier is less than one or for that matter well under one.

As an aside, I do not prefer to emphasize the notion of "investment crowding out" for analyzing fiscal policy. The notion is a coherent one, but frequently analysts, and audiences, end up confusing nominal flows of finance with real resource opportunity costs. I instead prefer to ask how effectively the fiscal policy is targeting real unemployed resources and to deemphasize the financial angle, at least for the first-order analysis.

New evidence on the multiplier

Here is an interview with Joshua Coval, of Harvard Business School, about his current research. I would urge caution on interpreting these results, but this is what the data toss back out at us:

Q: One of your findings was that the chairs of powerful congressional committees truly bring home the bacon to their states in the forms of earmark spending. Can you give a sense of how large this effect is?

A: Sure. The average state experiences a 40 to 50 percent increase in earmark spending if its senator becomes chair of one of the top-three committees. In the House, the average is around 20 percent. For broader measures of spending, such as discretionary state-level federal transfers, the increase from being represented by a powerful senator is around 10 percent.

Q: Perhaps the most intriguing finding, at least for me, was the degree and consistency to which federal spending at the state level seemed to be connected with a decrease in corporate spending and employment. Did you suspect this was the case when you started the study?

A: We began by examining how the average firm in a chairman's state was impacted by his ascension. The idea was that this would provide a lower bound on the benefits from being politically connected. It was an enormous surprise, at least to us, to learn that the average firm in the chairman's state did not benefit at all from the increase in spending. Indeed, the firms significantly cut physical and R&D spending, reduce employment, and experience lower sales.

The results show up throughout the past 40 years, in large and small states, in large and small firms, and are most pronounced in geographically concentrated firms and within the industries that are the target of the spending.

For the pointer I thank Alex Prado.

Addendum: Megan McArdle comments on the difficulty of interpretation.

Multipliers

Lately everyone is blogging multipliers. It is frequently suggested that the multiplier today is best estimated at 1.5 or 1.6. My point today is this: if you postulate a potent multiplier you cannot easily also postulate a liquidity trap. The whole point of the multiplier is that if the government buys cement from my company (say for a road) I as the company owner take those cash receipts and spend them elsewhere. Maybe so but that means people are willing to spend cash when they receive it. It means that a helicopter drop (and maybe other forms of monetary policy as well) would stimulate AD quite readily and for free. You don't need exotic or balance sheet-distorting QE here, a simple injection of cash will do.

Indeed, the Christiano, Eichenbaum, and Rebelo model of fiscal policy in a liquidity trap, no matter what you think of it (e.g., I am not sure that the derivation of equations 2.19 and 2.20 takes the non-smooth, black hole properties of the liquidity trap assumption seriously enough; also the critical p.13 sentence about how the MU of consumption rises with employment is the kind of Minnesota macro that Krugman justly complains about) both implies and states that monetary policy will work too. And if that monetary policy is truly a free lunch in terms of gdp, it should be quite credible (if it's not credible in the real world maybe the problem wasn't AD in the first place).

There are other models in which fiscal policy has a potent multiplier yet there is a liquidity trap. For instance fiscal policy may be a "sunspot" which gets you out of the liquidity trap. I have at least two objections. First, these models are question-begging. (Might not monetary policy be the sunspot? Why is fiscal policy the sunspot if indeed fiscal policy would otherwise not have much of a multiplier?) Second, no one much believed these models ex ante, before the current set of policy debates came along.

I am also puzzled by Paul Krugman's point:

…this [Barro's paper] tells us very little about what would happen under current

conditions: during World War II there, um, was a war on: consumption

goods were rationed, construction required special permits, and so on.

The government was, in other words, deliberately suppressing private

spending, through direct controls. So WWII is not a useful data point

for determining what the multiplier is under other conditions.

As I view it, during the war the government suppressed private spending because the government did not in fact believe there was much of a multiplier (at least at those margins). The suppression of private spending was not an exogenous accident but rather it reflected the very real trade-offs which had to be faced between guns and butter. At the beginning of the war unemployment was still quite high yet rationing came quickly, not only after full employment was restored, precisely because the trade-offs were faced quickly. Are we to believe that without rationing U.S. private consumption would have risen during WWII? Something like the following can be argued: "there is a multiplier for small acts of public investment but at some margin, such as we faced in WWII, that multiplier goes away for sufficiently large acts of public investment." I don't read Krugman as making that claim, but it would be his best available response to Barro.

Richard Clarida on multipliers

The always-keen John de Palma sent me this:

(…)policy multipliers

are likely to be disappointingly small compared with historical

estimates of their importance. Many of you will remember from Econ 101

the idea of the Keynesian multiplier, which is that the impact of

traditional macro policies is "multiplied" by boosting private

consumption by households and capital investment by firms as they

receive income from the initial round of stimulus(…) Policy

multipliers are greater than 1 to the extent the direct impact of a

policy on GDP is multiplied as households and companies increase their

spending due to the increased income flow they earn from the

debt-financed purchase of goods and services sold to meet the demand

generated by the initial round of stimulus. Historically, multipliers

on government spending are estimated to be in the range of 1.5 to 2,

while multipliers for tax cuts can be much smaller, say 0.5 to 1. But

these estimates are from periods when households could – and did – use

tax cuts as a down payment on a car or to cover the closing costs on a

mortgage refinance(…)With the credit markets impaired, tax cuts, as

well as income earned from government spending on goods and services,

will not be leveraged by the financial system to nearly the same

extent, resulting in (much) smaller multipliers(…)