The Obama tax plan

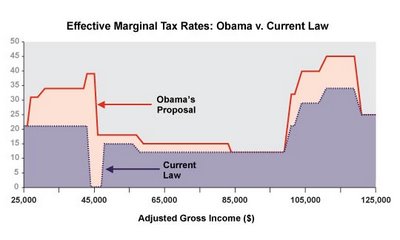

Those are the marginal tax rates and how they would change, analyzed here, via Greg Mankiw. The key point is this: "Reducing a person’s tax credit as his income goes up also reduces his incentive to earn more income." But before some of you get all upset, I do not intend this presentation as an endorsement of John McCain’s utterances on fiscal policy.

Addendum: I am not saying that Obama is "raising taxes on the poor." It is about marginal rates and yes marginal rates do matter for incentives. This is a genuine problem of many indeed most anti-poverty programs, it is not an attempt to mislead anyone. Don’t treat everything as necessitating a response to right- or left-wing talking points. You still ought to look at this diagram and think that the "notches" are too discrete and too strong.

Second addendum: Here is an Econ4Obama response.