Detroit Taxes and the Laffer Curve

Detroit’s Emergency Manager Kevyn Orr has issued a clearly written report that outlines Detroit’s situation and its improvement plan. Here are a few highlights on taxes:

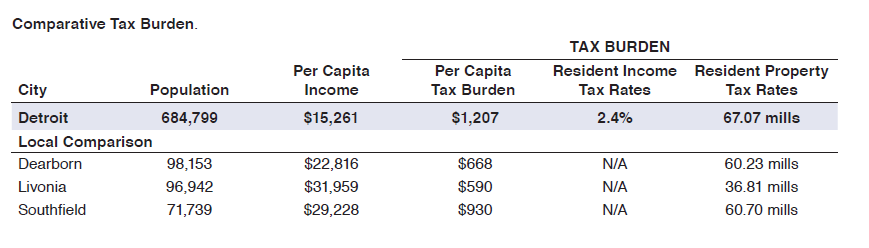

- [The] per capita tax burden on City residents is the highest in Michigan. This tax burden is particularly severe because it is imposed on a population that has relatively low levels of per capita income.

- The City’s income tax… is the highest in Michigan.

- Detroit residents pay the highest total property tax rates (inclusive of property taxes paid to all overlapping jurisdictions; e.g., the City, the State, Wayne County) of those paid by residents of Michigan cities having a population over 50,000.

- Detroit is the only city in Michigan that levies an excise tax on utility users (at a rate of 5%).

Detroit taxes are high not only relative to per-capita income but also, of course, relative to the delivery of services. Forty percent of Detroit’s street lights aren’t working, the violent crime rate is the highest in the country (for cities over 200,000) and fire and police services are slow and outdated. Although taxes are high they often aren’t paid. Only 53% of city property owners, for example, paid their 2011 property taxes.

As the report notes, Detroit is probably on the wrong end of the Laffer curve–lower rates would increase revenues in the long run.

Hat tip: Brian Blase.