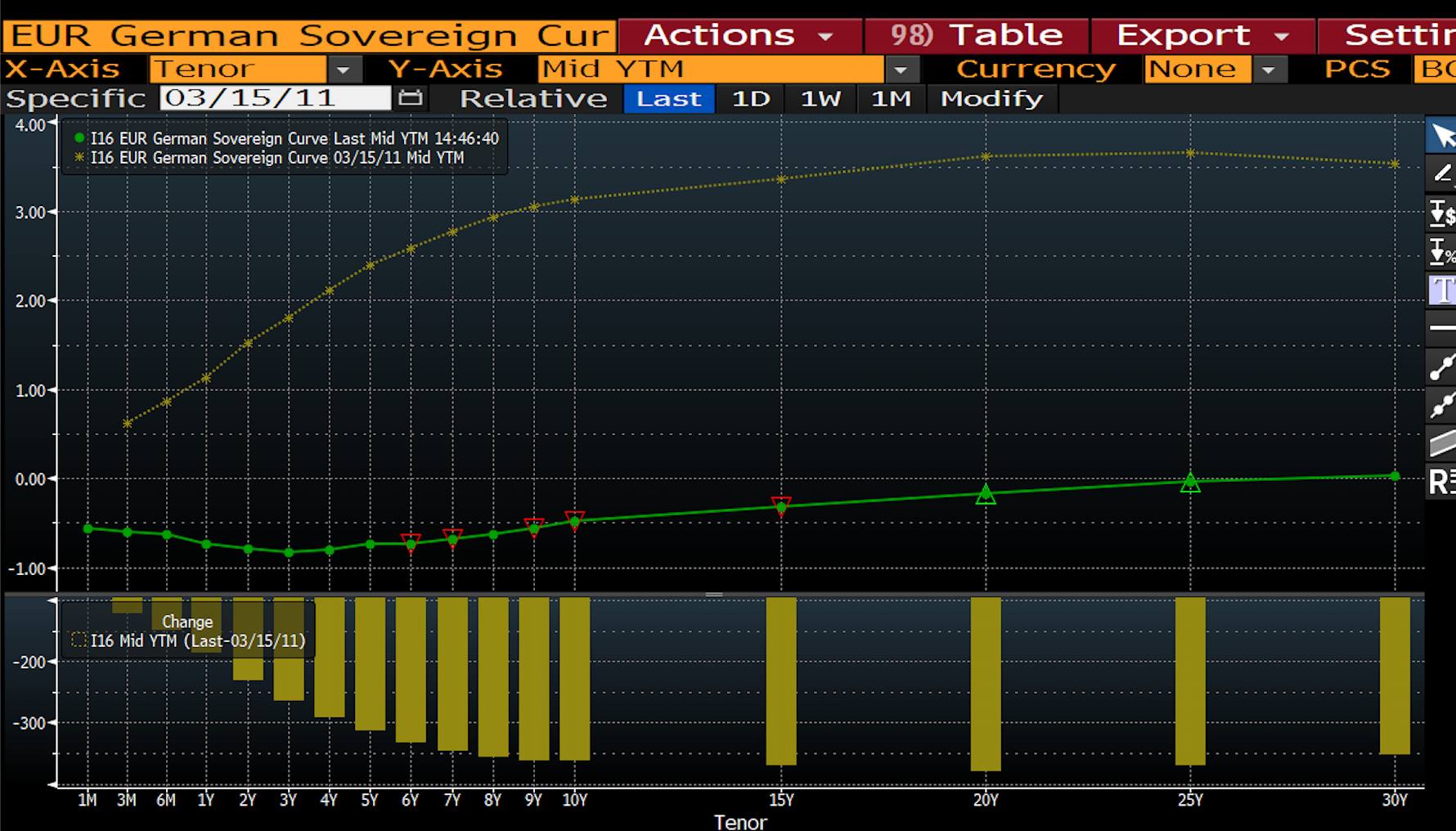

The Entire German Yield Curve is Trading Below Zero

The German government could today borrow billions of Euro and in a decade they could give back to investors less than they borrowed and the investors would be happy. Does the German government have no net positive investments to make?

The global savings glut which drives asset prices higher and makes them more volatile is very much still with us. Around the world there is now over 15 trillion in negative interest debt.