The Supply and Demand Model Predicts Behavior in Thousands of Experiments

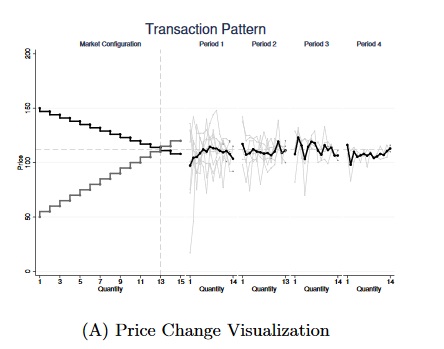

It is sometimes said that economics does not predict. In fact, Lin et al. (2020) (SSRN) (including Colin Camerer) find that the classic supply and demand model predicts behavior and outcomes in the double oral auction experiment in thousands of different experiments across the world. The model predicts average prices, final prices, who buys, who sells, and the distribution of gains very well as Vernon Smith first showed in the 1960s.

It is sometimes said that economics does not predict. In fact, Lin et al. (2020) (SSRN) (including Colin Camerer) find that the classic supply and demand model predicts behavior and outcomes in the double oral auction experiment in thousands of different experiments across the world. The model predicts average prices, final prices, who buys, who sells, and the distribution of gains very well as Vernon Smith first showed in the 1960s.

Indeed, the results from simple competitive buyer-seller trading appear to be as close to a culturally universal, highly reproducible outcome as one is likely to get in social science about collective behavior. This bold claim is limited, of course, by the fact that all these data are high school and college students in classes in “WEIRD” societies (Henrich et al.,2010b). Given this apparent robustness, it would next be useful to establish if emergence of CE in small buyer-seller markets extends to small-scale societies, across the human life cycle, to adult psychopathology and cognitive deficit, and even to other species.

It is true that economic theory is less capable of explaining the process by which prices and quantities reach equilibrium levels. Adam Smith’s theory about how competitive equilibrium is reached (“as if by an invisible hand”) has been improved upon only modestly. The authors, however, are able to test several theories of market processes and find that zero-intelligence theories tend to do better, though not uniformly so, than theories requiring more strategic and forward thinking behavior by market participants. The double-oral auction is powerful because the market is intelligent even when the traders are not.

The authors also find that bargaining behavior in the ultimatum game is reproducible in thousands of experiments. Simple economic theory makes very poor predictions (offer and accept epsilon) in this model but the deviations are well known and reproducible around the world (participants, for example, are more likely to accept and to accept quickly a 50% split than a split at any other level).

The experiments were run using MobLab, the classroom app, and were run without monetary incentives.

Tyler and I use Vernon Smith’s experiments to explain the Supply-Demand model in our textbook, Modern Principles, and it’s always fun to run the same experiment in the classroom. I’ve done this many times and never failed to reach equilibrium!