Results for “"Decentralized finance"” 8 found

Decentralized Finance and Innovation

Decentralized finance to date seems mostly to be about speculatively trading one cryptocurrency for another. I see little real investment. But in my post on Elrond, I also wrote, “The DeX’s or decentralized exchanges have shown that automated market makers can perform the services of market order books used by the traditional exchanges like the NYSE at lower cost while being easily accessible from anywhere in the world and operating 24/7/365. Thus, every exchange in the world is vulnerable to a DeX.”

One of the reasons that I think DeFi has a big future is that there is much more innovation in the space than in traditional finance. Decentralization is really not a big deal for consumers–it’s even a negative in some respects–but it’s a huge factor for producing innovation.

As an illustration the excellent Bartley Madden (note my biases!) has an interesting idea for reformulating order books on size rather than time.

- One patented concept is that at a specified limit price, priority is based, not on the time when the order was received, but on order size, which incentivizes placing larger orders.

- Additional issued patent claims concern variable prices on limit orders depending on the number of shares traded and other technical details for new ways to facilitate the matching of institutional orders with large retail orders.

- The reason this platform would actually build liquidity is because of the preference given to the largest orders. In operation, a slight price advantage is achieved by the larger investors while the counterparty smaller investors achieve a very quick fill of their entire order.

Or consider the Budish, Crampton, Shim idea for batch auctions to avoid resource waste (rent-seeking) from high-frequency trading. Are these good ideas? I don’t know. But what I do know is that there is little chance that either will be adopted by a major exchange–the transactions costs, including bureaucracy, fear and complacency (why rock the boat?) make it very difficult to innovate. But these ideas could be implemented very quickly by a DeX.

DeFi illustrates “the perennial gale of creative destruction,” and right now we are in the creative phase. New ideas about how to exchange assets are being rapidly deployed and destroyed but a few will prove robust and then watch out. The destruction phase has yet to be begin. Wall Street is unprepared for the onslaught.

Addendum: See also Tyler’s post Will the Future be Decentralized?

Blockchains: A Promise Enforcement Engine

Anthony Lee Zhang on blockchains

How do blockchains change the state of things? Blockchains are an alternative system for promise enforcement, fundamentally different from any system human history has seen before. Promises in blockchain systems are enforced by miners, who — in reasonably competitive mining markets — have limited ability, and weak incentives, to do anything other than execute others’ promises roughly according to the gas fees they pay. In other words, the blockchain can be thought of as a universal, extremely low-discretion promise enforcement engine.

Consider, for example, automated market maker (AMM) protocols, such as Uniswap. An automated market maker allows anyone to become a liquidity provider, that is, to contribute capital, to make markets in a pair of tokens. Fees are collected from anyone trading with the market maker, and can be programmatically redistributed to liquidity providers. These “terms” are promises in the same way classic financial contracts are — but, rather than promises stated in English enforced in courts of law, they are written in Solidity and “enforced” by Ethereum miners.

Lending protocols, such as Aave, allow agents to borrow if they pledge their risky assets to the system as collateral. Aave values the collateral automatically using price oracles, and automatically seizes and liquidates collateral when the amount borrowed is worth too much compared to the collateral staked. MakerDAO similarly functions like a virtual “pawn shop”, taking risky assets and printing tokens whose value derives from the fact that they are overcollateralized by risky collateral, automatically valued using collateral price feeds. Aave and Maker function similarly to margin lending systems in traditional finance, except that the lenders are bots instead of banks. A nontrivially large fraction of the useful promises that are traded in financial systems, it seems, can be approximately as easily expressed in Solidity as they can in English, and thus can be enforced by miners rather than by courts.

The consequences of the existence of blockchains are thus that, for the first time in human history, we have a real alternative to governments and legal systems for the enforcement of promises. What are the effects this will have on the world?

Governments in developed economies are imperfect but they are adequate promise enforcers and they have reasons to suppress their competitor, blockchains. Hence Zhang argues:

…The future of finance will not be built on Wall Street, by a handful of privileged graduates from a handful of top colleges in a handful of high-income countries. The future of finance will be built on blockchains, in Africa, South America, Southeast Asia, through the combined efforts of many billions of people, who for the first time in human history will be able to participate on an equal footing in the market for promises.

This is similar to what Tyler and I write in cryptoeconomics:

Traditional finance relies on legal documents like contracts, titles, and personal identification and thus it ultimately relies on a legal system that can enforce those contracts quickly, reliably, and at low cost. Relatively few countries in the world have all the required abilities, which is why traditional finance clusters in a handful of places like New York, London, Singapore, and Zurich.

Decentralized finance, in contrast, relies on smart contracts and cryptographic identification that work exactly the same way everywhere. Decentralized finance, therefore, could be broader based and more open than traditional finance. Indeed, decentralized finance could prosper in precisely those regions of the world that do not have reliable legal systems or governments with the power to regulate heavily.

Cryptoeconomics!

The crypto market is up! The crypto market is down! The roller coaster can be fearfully thrilling but as thoughtful academics and people interested in ideas let’s look away from the daily ups and downs and focus on the big picture. What is crypto? What is cryptoeconomics?

Tyler and I have written a new chapter for our textbook, Modern Principles. In Cryptoeconomics we explain just enough cryptography–namely cryptographic hash functions and public-private keys–to understand what new forms of communication and organization have been made possible by these breakthroughs. We then use these fundamentals to explain NFTs, blockchains, Bitcoin, smart contracts and decentralized finance–all in a crisp, compact format accessible to everyone.

Not everyone wants to teach crypteconomics, of course, or has the time (scarcity!) so this chapter will be available as an option to anyone using our book and the Achieve online course management system (in fact, it’s available now). Tyler and I have found, however, that our students, colleagues, even people at dinner parties ask us about crypto. Probably your students and friends will ask you as well. Plus our textbook is called Modern Principles so we thought we were obligated to teach these new ideas!

Cryptoeconomics is a good guide to some fundamentally new ways of trading, communicating, and cooperating.

Addendum: If you want to learn more about DeFi, my talk goes into greater depth.

An Introduction to DeFi

Interested in decentralized finance, Uniswap, automated market makers, flash loans and more? Check out my new webinar:

Dominant Assurance Contracts and Quadratic Funding

Here is my keynote talk for the ACM Advances in Financial Technologies conference. I discuss Two Novel Mechanisms for Funding and Discovering Public Goods, namely dominant assurance contracts (with experimental support here) and the Buterin, Hitzig, Weyl work on quadratic funding.

Lots of other excellent talks on blockchains, AMMs, decentralized finance and so forth are at the link.

How the crypto skeptics changed their minds

That is a Walter Frick feature story at Quartz, the other answers are interesting throughout, here is my contribution:

What was your original reaction to cryptocurrencies and blockchain?

Just for a bit of background, I wrote a series of papers on monetary economics, and then a book (Explorations in the New Monetary Economics, with Randall Kroszner) which argued that technological changes were going to fundamentally revolutionize monetary institutions and finance over the next few decades. Those papers start in the mid-1980s and the book comes in the early 90s. So I was primed to see this coming, but in fact utterly failed.

I just wasn’t expecting crypto!

When bitcoin first came out, someone sent me the link and I put it on my blog Marginal Revolution —we were one of the first places to report on it.

But after that, the thing seemed to sour. It looked like a bubble. I didn’t see the use cases for bitcoin. So I became pretty crypto negative. Perhaps I was also turned off by the dogmatism shown by many crypto advocates.

What changed your perspective on blockchain’s potential?

A few things. First, in decentralized finance (DeFi) I began to see viable and important use cases. Superior returns for depositors might now drive broader crypto adoption

Second, after a market price crash, prices came back. That suggested to me this was not just a bubble. Crypto had its chance to go away and never come back, but it didn’t. Third, I have seen incredible energy and vitality in the crypto community. Many of the best discussions are held there, it attracts amazing talent, and the conversations are overwhelmingly positive. All big pluses and signs of a movement that is going somewhere. I am still broadly agnostic, but now see the positive scenarios as more likely than the negative scenarios.

What projects or trends in crypto are you most excited about right now?

DeFi, or Decentralized Finance.

NFTs, not only for the art world but also as a new system of property rights for the metaverse, and as a new method of fundraising.

Use of crypto to lower the costs of sending remittances abroad to poorer countries.

What would you recommend our readers watch / listen to / read / follow to better understand crypto’s potential?

I am learning the most through conversations, meetings, and WhatsApp chatter—I am not sure how that easily can be replicated!

Books and most articles on this topic are simply too out of date, even if they are factually accurate, which is not always the case. The fact that the field is moving so fast is another reason for optimism.

The symposium is a good way to catch up quickly on many different views.

Integrate Crypto with the India Stack

In India Should Embrace Not Ban Cryptoc I said “the irony is that India has one of the world’s most advanced identity and payments systems, the India stack” and by integrating the India stack with crypto India could take in important step and leapfrog slower to adapt countries. Now iSpirit, the team behind the India Stack, are pushing the idea. They note that the technology developed for India’s Goods and Service Tax can help by providing verified invoice data that can be used for lending.

India’s Goods and Services Tax (GST) helps to address this by generating invoice and payment data in a format suitable for credit underwriting and risk analysis. The GST data also enables a small enterprise in a large value system to provide data and visibility across the supply chain; for example, one can track the progress of parts from a small parts supplier to an auto component manufacturer to a large passenger car maker all the way through to distributors, sub-dealers, and retail sales.

The digital version of an SME’s sales and purchase invoices ledger thus amounts to informational collateral on both the company and the larger ecosystem within which it sits, that could become the basis for extending credit, as an alternative to the hard asset or collateral-based financial system. This is similar to how Square Capital and Stripe Capital already function in the West.

In addition to credit-based financing, the trustworthy records furnished by GST’s informational collateral can also support equity or quasi-equity financing, to support growth without increasing debt. These might take the form of direct equity investments in small businesses, or even personal micro-equity investments in individual consultants or students.

India’s innovation: use new pools of crypto capital to address long-standing financing needs

Accompanying the iSpirit post is a great manifesto by Balaji Srinivasan that explains the India Stack, crypto, and how they fit together.

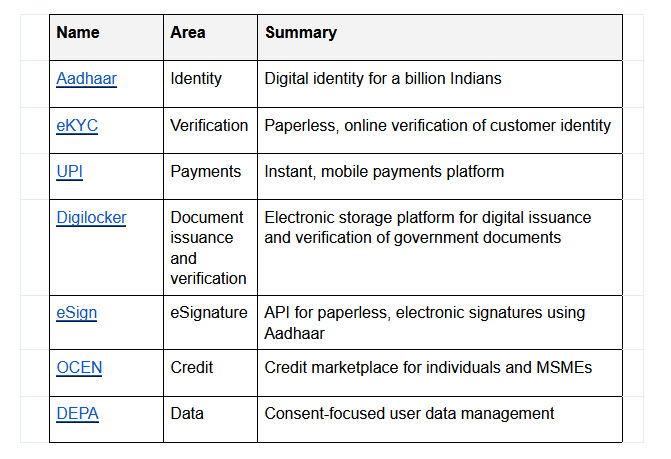

The first step in understanding Crypto IndiaStack is to understand IndiaStack itself. It is a set of national APIs for payments, identity, KYC, e-signature, and document verification that scales to a billion people. Here’s a quick overview of the IndiaStack APIs:

… crypto is now bigger than Bitcoin. It also includes newer blockchains like Ethereum, which have enabled the new world of decentralized finance or “defi” for short. This new space is growing at an astonishing pace, with >25X year-over-over growth. It’s putting Wall Street on the internet and changing the very foundations of how money is represented and invested around the world. And most importantly for our purposes, defi is making huge pools of capital newly available to any Indian with a digital wallet, in the same way the internet made huge swaths of information available to any Indian with a cellular phone.

…defi is to finance what the internet was to information.

By adding both a digital rupee and crypto support to IndiaStack, we could turn every phone into not just a bank account but a bonafide Bloomberg Terminal, giving every Indian the ability to make both domestic and international transactions of arbitrary complexity, attracting crypto capital from around the world, and leapfrogging the 20th century financial system entirely.

How do we get there? In four easy steps:

- Understand what a digital rupee is.

- Add digital wallet support to IndiaStack.

- Add crypto assets to the IndiaStack digital wallet.

- Extend IndiaStack APIs with crypto concepts.

Read the whole thing.

Addendum: On defi see also my earlier piece on Elrond.

Elrond and the New Crypto Spaces

I’m an advisor to a number of firms, including several in the crypto space such as Elrond (eGLD coin). When I signed on as an advisor more than two years ago, Elrond was almost completely unknown, which wasn’t surprising as they were based in Romania. I thought the Romanian base was a positive, however, because it meant that Elrond could hire extremely well-educated computer scientists, mathematicians and software engineers at below Silicon Valley prices. Moreover, the blockchain world, true to its foundations, is decentralized. Like a modern day Erdos, Vitalik Buterin operates out of his suitcase. The Silicon Valley of the blockchain is the internet. Why the blockchain world has evolved differently than Silicon Valley is an interesting question (with implications for whether SV could loses its centrality) but because it is decentralized I thought location was less important than the quality of the team. And the team, led by hard-charging founder Beniamin Mincu, is excellent. In the last two years the Elrond team has built a completely modern blockchain from the ground up using secure proof of stake and sharding to achieve a potential throughput of upwards of 16 thousand transactions per second with 6s latency and $.001 transaction cost and a toolkit for developers. I was also impressed by the commitment Elrond had to security, including formal verification methods, and especially to making Elrond accessible to the masses. Today Elrond/eGLD is on a tear and by market cap it is one of the top 50 projects in the space with a strong upward trend.

Will Elrond take over the world? I hope so! But, of course, it is unclear. Aside from ranking Elrond versus other projects the space itself still doesn’t have a killer app for the masses. In 2017 near the peak of the market at that time, Vitalik Buterin tweeted:

So total cryptocoin market cap just hit $0.5T today. But have we *earned* it?

How many unbanked people have we banked?

How much censorship-resistant commerce for the common people have we enabled?

How much value is stored in smart contracts that actually do anything interesting?…

The total market cap is now close to a trillion, about twice the level when Vitalik tweeted, and these are still good questions. Bitcoin has established itself as a new asset class that is rapidly supplanting gold as a store of value (gold is lame) but not as a payments platform. Ethereum, Elrond and competitors like Algorand were built for smart contracts, including things like stable coins which will be used for payments, but smart contracts are capable of doing much more. In theory, smart contracts let people cooperate in new ways, potentially unlocking trillions in value. But we aren’t there yet.

Decentralized finance or DeFi is one suggestive hint of where things are going. Already many billions of dollars are “lent” and “saved” using DeFi. The lending and saving, however, is almost entirely done in one cryptocurrency for another. In essence, the DeFi system is leveraging off of crypto speculation and trading.

Nevertheless, something interesting is happening in DeFi. The DeX’s or decentralized exchanges have shown that automated market makers can perform the services of market order books used by the traditional exchanges like the NYSE at lower cost while being easily accessible from anywhere in the world and operating 24/7/365. Thus, every exchange in the world is vulnerable to a DeX.

Also, although DeFi is a place where you can easily lose all your money to mistakes, scams, and bugs (not to mention changes in asset values), DeFi is rapidly developing state-of-the-art security. Only the paranoid survive on the blockchain which means that the systems that do survive are robust. Balaji Srinivasan recently tweeted that Bitcoin is the most powerful algorithm in the world and few algorithms have been as battle-tested as Bitcoin. In a similar way, DeFi will be secure or die and security in a blockchain world will be more secure than anywhere else.

Combining security with accessibility is what’s hard. It’s telling that Coinbase is one of the most successful firms in the crypto space despite performing services which are in some tension with the philosophical foundations of crypto. Satoshi Nakamoto would probably be a little disappointed to learn that people were depositing their Bitcoins in a bank! I can understand the impulse, however. It’s almost magical how you can move money on a blockchain without input or permission from any authority. But when you click the button and your money disappears it’s terrifying as you pray for the invisible hand of the miners to restore your money in another account. Elrond’s soon to be released Maiar app, a wallet that interacts with the Elrond blockchain using only a phone number, will be an interesting test of whether a blockchain platform can duplicate the ease of use of something like PayPal or Zelle.

The other interesting development in the space are zero knowledge proofs. Zero knowledge proofs let someone prove that they know a piece of information or the results of a computation without revealing the information. ZK proofs started in the academic literature but research in their uses and applications has exploded as computer scientists like Silvio Micali start blockchains and blockchains like ZCash hire computer scientists who advance the scientific literature (to give just one example). Truly anonymous digital cash is one application but more generally zero knowledge proofs let people buy and sell information in a way which has always been difficult and seemed impossible (how can you sell a piece of information without showing it to someone first but then having seen the information why would they buy it?).

Bottom line is that crypto is still waiting for the killer app which will make it 21st century infrastructure but there has been tremendous scientific progress in blockchains since the ur-date, 1/3/2009. Modern platforms like Elrond are faster, more robust, and more powerful than past platforms and the potential is there for transformative growth.