Results for “alesina” 33 found

Alberto Alesina has passed away at age 63

He was one of the great economists of our time and a possible candidate for a Nobel Prize. Here is his Wikipedia page. Here are previous MR discussions and mentions of Alesina. Here is a short biography. Here are his most cited papers. Here are Twitter tributes.

Alesina and co-authors respond on European fiscal austerity

They have a new NBER working paper on this topic, here is one key part of the abstract:

Fiscal adjustments based upon cuts in spending appear to have been much less costly, in terms of output losses, than those based upon tax increases. The difference between the two types of adjustment is very large. Our results, however, are mute on the question whether the countries we have studied did the right thing implementing fiscal austerity at the time they did, that is 2009-13.

They also consider, and cannot reject, the possibility that the output declines of recent times were due to additional negative variables, such as credit crunches, rather than higher values for the fiscal multiplier.

I predict this paper will be ignored rather than responded to. For a while now it has been the practice to criticize “austerity” rather than to disaggregate the policies, or describe them with greater specificity, even though that is easy to do. And it is incorrect to describe this paper as defending austerity, rather I read it as being anti-tax hike, and suggesting that “austerity” is not a very useful concept.

There is an ungated version of the paper here.

Immigration Backlash

In a new paper Ernesto Tiburcio (on the job market) and Kara Ross Camarena study the effect of illegal immigration from Mexico on economic, political and cultural change in the United States. Studying illegal immigration can be difficult because the US doesn’t have great ways of tracking illegal immigrants. Tiburcio and Camerena, however, make excellent use of a high-quality dataset of “consular IDs” from the Mexican government. Consular IDs are identification cards issued by the Mexican government to its citizens living in the United States, regardless of US immigration status. Consular IDs are used especially, however, by illegal immigrants because they can’t easily get US IDs whereas legal migrants have passports, visas, work authorizations and so forth. Tiburcio and Camarena are able to track nearly 8 million migrants over more than a decade.

Our main results point to a conservative response in voting and policy. Recent inflows of unauthorized migrants increase the vote share for the Republican Party in federal elections, reduce local public spending, and shift it away from education towards law-and-order. A mean inflow of migrants (0.4 percent of the county population) boosts the Republican party vote share in midterm House elections by 3.9 percentage points. Our results are larger but qualitatively similar to other scholars’ findings of political reactions to migration inflows in other settings (Dinas et al., 2019; Dustmann et al., 2019; Harmon, 2018; Mayda et al., 2022a). The impacts on public spending are consistent with the Republican agenda. A smaller government and a focus on law-and-order are two of the key tenets of conservatism in the US. A mean inflow of migrants reduces total direct spending (per capita) by 2% and education spending (per child), the largest budget item at the local level, by 3%. The same flow increases relative spending on police and on the administration of justice by 0.23 and 0.15 percentage points, respectively. These impacts on relative spending suggest that the decrease in total expenditure does not simply reflect a reduction in tax revenues but also a conservative change in spending priorities.

The main reason for this, however, appears not to be economic losses such as job losses or wages declines–these are mostly zero or small with some exceptions for highly specific industries such as construction. Rather it’s more about the salience of in and out groups:

We study individuals’ universalist values to capture preferences for redistribution and openness to the out-group. Universalist values imply that one is concerned equally with the welfare of all individuals, whether they are known or not. By contrast, people with more communal values assign a greater weight to the welfare of ingroup members relative to out-group members. We find that counties become less universalist in response to the arrival of new unauthorized migrants. A mean flow of unauthorized migrants shifts counties 0.06 standardized units toward less universalist, i.e., more communal (Panel B, Column 5, std coeff: -0.16). This result is the most direct indication that some of the shift to the political right occurs because migrants trigger anti-out-group bias and preferences for less redistribution. Although this evidence is based on a smaller subset of counties, the impact is large. The change toward more communal values is consistent with theories that hinge on out-group bias. Ethnic heterogeneity breaks down trust, makes coordination more difficult, and reduces people’s interest in universal redistribution (Alesina et al., 1999).

These results are consistent with the larger literature that finds “Across the developed world today, support for welfare, redistribution, and government provision of public goods is inversely correlated with the share of the population that is foreign-born and diverse.” (Nowrasteh and Forreseter 2020). Similarly, one explanation for the smaller US welfare state is that white-black salience reduces people’s interest in universal redistribution.

Contra Milton Friedman, it is possible to have open borders and a significant welfare state but it may be true that the demand for a welfare state declines with immigration, especially when the immigrants are saliently different.

The Cream Rises to the Top

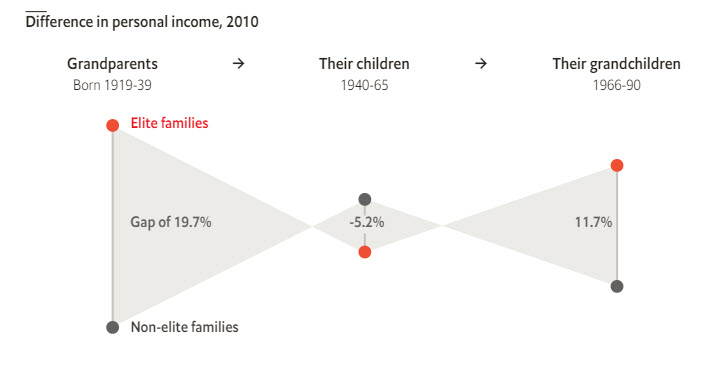

NBER: Can efforts to eradicate inequality in wealth and education eliminate intergenerational persistence of socioeconomic status? The Chinese Communist Revolution and Cultural Revolution aimed to do exactly that. Using newly digitized archival records and contemporary census and household survey data, we show that the revolutions were effective in homogenizing the population economically in the short run. However, the pattern of inequality that characterized the pre-revolution generation re-emerges today. Almost half a century after the revolutions, individuals whose grandparents belonged to the pre-revolution elite earn 16 percent more income and have completed more than 11 percent additional years of schooling than those from non-elite households. We find evidence that human capital (such as knowledge, skills, and values) has been transmitted within the families, and the social capital embodied in kinship networks has survived the revolutions. These channels allow the pre-revolution elite to rebound after the revolutions, and their socioeconomic status persists despite one of the most aggressive attempts to eliminate differences in the population.

That’s the abstract of Persistence Despite Revolutions one of Alberto Alesina’s last papers (with

Hat tip: The excellent Stefan Schubert.

What should I ask Nathan Nunn?

I will be doing a Conversation with him, he is an economist at Harvard, you could call much of his work economic history and economic development. Wikipedia notes:

A recurrent theme in Nunn’s research is the long-term impact of historical processes on economic development, often mediated through institutions, culture, knowledge and technology.

Key findings of his research include the following:

- Countries’ ability to enforce contracts is possibly a more important determinant of their comparative advantage than skilled labour and physical capital combined.

- A substantial part of Africa’s current underdevelopment appears to be caused by the long-term effects of the Atlantic and Arab slave trades.

- Current differences in trust levels within Africa are attributable to the impact of the Atlantic and Arab slave trades, which have caused the emergence of low-trust cultural norms, beliefs, and values in ethnic groups heavily affected by slavery (with Leonard Wantchekon).

- By impeding not only trade and technological diffusion but also the depredations of slave traders, the ruggedness of certain African regions’ terrain had a significant positive impact on these regions’ development (with Diego Puga).

- The introduction of the potato within the Columbian exchange may have been responsible for at least a quarter of the population and urbanisation growth observed in the Old World between 1700 and 1900 (with Nancy Qian).

- In line with Boserup’s hypothesis, the introduction and historical use of plough agriculture appears to have given men a comparative advantage and made gender norms less equal, with historical differences in the plough use of immigrants’ ancestral communities predicting their attitudes regarding gender equality (with Alberto Alesina and Paolo Giuliano).

- U.S. Food Aid is driven by U.S. objectives and can lead to increased conflict in recipient countries (with Nancy Qian).

So what should I ask him?

Social Planners Do Not Exist

Enrico Spolaore on his friend, co-author, and mentor Alberto Alesina:

I first met Alberto thirty years ago at Harvard, where he had received his Ph.D. in Economics in 1986, and had returned as faculty, after a couple of years at Carnegie-Mellon. He was already deservedly famous. In 1988, The Economist had presciently picked him as one of the decade’s eight best young economists, as he was transforming the way we approach macroeconomics and economic policy by explicitly bringing politics into the analysis. In his influential contribution to the NBER Macroeconomics Annual 1988, he had forcefully stated that “social planners do not exist.” Economists should not just assume that governments would implement optimal policies (presumably following the economists’ own recommendations). Instead, we should strive to understand actual policies as resulting from the strategic interactions of partisan politicians with each other and with the public, and often leading to socially inefficient outcomes.

Exactly right. Alesina was one of the most important scholars extending and integrating public choice, especially to macroeconomic questions.

Wednesday assorted links

1. Nominal wage flexibility and what it looks like.

2. Alesina overview and tribute.

3. “Reproduction rates seem to stabilize around one, as my little behavioral model suggested.”

4. Being quarantined on arrival in Korea.

5. Only half of Americans would get a Covid-19 vaccine?

6. Estimating the costs of lockdown, often highest for the elderly by the way.

7. Vaccine update.

8. Why no one can explain the drop in coronavirus cases in Israel.

Monday assorted links

4. “Historically, immigrant men were more likely to be employed than native men. The COVID-related labor market disruptions eliminated the immigrant employment advantage. By April 2020, immigrant men had lower employment rates than native men.” Link here.

5. Further evidence that violent media content lowers violence.

8. What the development of penicillin tells us about coronavirus vaccines. The piece makes several interesting points about speed.

Sunday assorted links

1. Timeline of new ideas in science fiction.

2. Richard Timberlake has passed away.

3. Bolivian orchestra stranded at haunted German castle surrounded by wolves.

4. Hong Kong super-spreaders. And WSJ on the same, potentially important.

5. Too many pop-ups, but still a useful piece on the India-China border flare-up.

6. Radio stations are playing more positive and upbeat music.

7. Amihai Glazer is now on Twitter.

Trump understands this, perhaps you do not

Given the very negative baseline views that respondents have of immigrants, simply making them think about immigration in a randomized manner makes them support less redistribution, including actual donations to charities.

That is from research by Alesina, Miano, and Stantcheva. And don’t forget this:

We also experimentally show respondents information about the true i) number, ii) origin, and iii) “hard work” of immigrants in their country. On its own, information on the “hard work” of immigrants generates more support for redistribution. However, if people are also prompted to think in detail about immigrants’ characteristics, then none of these favorable information treatments manages to counteract their negative priors that generate lower support for redistribution.

Nation-building, nationalism, and wars

That is the new NBER working paper by Alberto Alesina, Bryony Reich, Alessandro Riboni, here is the abstract:

The increase in army size observed in early modern times changed the way states conducted wars. Starting in the late 18th century, states switched from mercenaries to a mass army by conscription. In order for the population to accept to fight and endure war, the government elites began to provide public goods, reduced rent extraction and adopted policies to homogenize the population with nation-building. This paper explores a variety of ways in which nation-building can be implemented and studies its effects as a function of technological innovation in warfare.

That is related to some recent work by Ferejohn and Rosenbluth.

Which kind of countercyclical fiscal policy is best?

Miguel Faria-e-Castro, on the job market from NYU, has a very interesting paper on that question. Here are his findings:

What is the impact of an extra dollar of government spending during a financial crisis? How important was fiscal policy during the Great Recession? I develop a macroeconomic model of fiscal policy with a financial sector that allows me to study the effects of fiscal policy tools such as government purchases and transfers, as well as of financial sector interventions such as bank recapitalizations and credit guarantees. Solving the model with nonlinear methods allows me to show how the linkages between household and bank balance sheets generate new channels through which fiscal policy can stimulate the economy, and study the state dependent effects of fiscal policy. I combine the model with data on the fiscal policy response to assess its role during the financial crisis and Great Recession. My main findings are that: (i) the fall in consumption would had been 1/3 worse in the absence of fiscal interventions; (ii) transfers to households and bank recapitalizations yielded the largest fiscal multipliers; and (iii) bank recapitalizations were closest to generating a Pareto improvement.

Bank recapitalizations — just remember that the next time you hear someone talking about “G” in the abstract.

See also this new Alesina NBER paper, indicating that the how of fiscal adjustment is much more important than the when. No tax hikes!

Does Diversity Reduce Freedom or Growth?

The founding father of Singapore, Lee Kuan Yew, credits ‘social discipline’ for the phenomenal economic rise of his country (Sen, 1999). Countries such as Singapore apparently demonstrate that autocratic measures are probably necessary, particularly in culturally fractionalized societies for creating the social stability necessary for economic growth (Colletta et al., 2001). Such thinking informs the so-called “Asian model” (Diamond, 2008).1 Recent studies, particularly in economics, support the logic (Alesina et al., 2006 and Easterly et al., 2006). According to these scholars, the more congruent territorial borders are with nationality, the better the chances for good economic policy to appear endogenously from within these societies because social cohesion determines good institutions and policies for development (Banerjee et al., 2005 and Easterly, 2006b). This paper addresses the question of whether or not social diversity hampers the adoption of sound economic policies, including institutions that promote property rights and the rule of law. We also examine whether democracy conditions diversity’s effect on sound economic management, defined as economic freedom, because the index of economic freedom is strongly associated with higher growth and is endorsed by proponents of the ‘diversity deficit’ argument (Easterly, 2006a).2

…Using several measures of diversity, we find that higher levels of ethno-linguistic and cultural fractionalization are conditioned positively on higher economic growth by an index of economic freedom, which is often heralded as a good measure of sound economic management. High diversity in turn is associated with higher levels of economic freedom. We do not find any evidence to suggest that high diversity hampers change towards greater economic freedom and institutions supporting liberal policies.

Paper here. The data is a panel from 116 countries covering 1980–2012 so this doesn’t rule out a negative long-run effect but it is prima facie evidence that diversity need not reduce freedom or growth.

Monday assorted links

1. English departments are better than you think.

2. Angus Deaton on stuff, including what TV he watches (good taste).

3. More Alesina, on fiscal adjustments.

4. The Iranian film “About Elly” is one of the best movies to come out this year. It is by the director of “A Separation,” and it will take you forty-five minutes to start realizing how good it is.

5. Michael Specter CRISPR article from The New Yorker, very interesting, more than just the usual.

Does immigration undermine public support for social policy?

Mostly not. Again, Kevin Lewis points us to a fascinating paper:

Does Immigration Undermine Public Support for Social Policy?

David Brady & Ryan Finnigan

American Sociological Review, February 2014, Pages 17-42Abstract:

There has been great interest in the relationship between immigration and the welfare state in recent years, and particularly since Alesina and Glaeser’s (2004) influential work. Following literatures on solidarity and fractionalization, race in the U.S. welfare state, and anti-immigrant sentiments, many contend that immigration undermines public support for social policy. This study analyzes three measures of immigration and six welfare attitudes using 1996 and 2006 International Social Survey Program (ISSP) data for 17 affluent democracies. Based on multi-level and two-way fixed-effects models, our results mostly fail to support the generic hypothesis that immigration undermines public support for social policy. The percent foreign born, net migration, and the 10-year change in the percent foreign born all fail to have robust significant negative effects on welfare attitudes. There is evidence that the percent foreign born significantly undermines the welfare attitude that government “should provide a job for everyone who wants one.” However, there is more robust evidence that net migration and change in percent foreign born have positive effects on welfare attitudes. We conclude that the compensation and chauvinism hypotheses provide greater potential for future research, and we critically consider other ways immigration could undermine the welfare state. Ultimately, this study demonstrates that factors other than immigration are far more important for public support of social policy.

There is an ungated version here.