Results for “control premium” 56 found

How large is the control premium?

Cass Sunstein on Twitter directs us to this paper (AEA gate), by David Owens, Zachary Grossman, and Ryan Fackler, entitled “The Control Premium: A Preference for Payoff Autonomy.” The abstract is here:

We document individuals’ willingness to pay to control their own payoff . Experiment participants choose whether to bet on themselves or on a partner answering a quiz question correctly. Given participants’ beliefs, which we elicit separately, expected-money maximizers would bet on themselves in 56.4 percent of the decisions. However, participants actually bet on themselves in 64.9 percent of their opportunities, reflecting an aggregate control premium. The average participant is willing to sacrifice 8 percent to 15 percent of expected asset-earnings to retain control. Thus, agents may incur costs to avoid delegating and studies inferring beliefs from choices may overestimate their results on overconfidence.

There are ungated versions here.

Is the college wealth premium *zero*?

Now this one is a stunner:

The college income premium—the extra income earned by a family headed by a college gra duate over an otherwise similar family without a bachelor’s degree—remains positive but has declined for recent graduates. The college wealth premium (extra wealth) has declined more noticeably among all cohorts born after 1940. Among non-Hispanic white family heads born in the 1980s, the college wealth premium is at a historic low; among all other races and ethnicities, it is statistically indistinguishable from zero [emphasis added]. Using variables available for the first time in the 2016 Survey of Consumer Finances, we find that controlling for the education of one’s parents reduces our estimates of college and postgraduate income and wealth premiums by 8 to 18 percent. Controlling also for measures of a respondent’s financial acumen—which may be partly innate—, our estimates of the value added bycollege and a postgraduate degree fall by 30 to 60 percent. Taken together, our results suggest that college and post-graduate education may be failing some recent graduates as a financial investment. We explore a variety of explanations and conclude that falling college wealth premiums may be due to the luck of when you were born, financial liberalization and the rising cost of higher education.

That paper is by William R. Emmons, Ana H. Kent and Lowell R. Ricketts, and comes from the St. Louis Fed, not from some bunch of (college-educated) cranks.

Via the excellent Samir Varma.

On the so-called “beauty premium”

Very unattractive respondents always earned significantly more than unattractive respondents, sometimes more than average-looking or attractive respondents. Multiple regression analyses showed that there was very weak evidence for the beauty premium, and it disappeared completely once individual differences, such as health, intelligence, and Big Five personality factors, were statistically controlled.

…Past findings of beauty premium and ugliness penalty may possibly be due to the fact that: 1) “very unattractive” and “unattractive” categories are usually collapsed into “below average” category; and 2) health, intelligence (as opposed to education) and Big Five personality factors are not controlled. It appears that more beautiful workers earn more, not because they are beautiful, but because they are healthier, more intelligent, and have better (more Conscientious and Extraverted, and less Neurotic) personality.

That is from

How much of the attractiveness premium is really about grooming?

For women, most of it, at least according to Wong and Penner:

This study uses data from the National Longitudinal Study of Adolescent to Adult Health (Add Health) to (1) replicate research that documents a positive association between physical attractiveness and income; (2) examine whether the returns to attractiveness differ for women and men; and 3) explore the role that grooming plays in the attractiveness-income relationship. We find that attractive individuals earn roughly 20 percent more than people of average attractiveness, but this gap is reduced when controlling for grooming, suggesting that the beauty premium can be actively cultivated. Further, while both conventional wisdom and previous research suggest the importance of attractiveness might vary by gender, we find no gender differences in the attractiveness gradient. However, we do find that grooming accounts for the entire attractiveness premium for women, and only half of the premium for men.

Those results are consistent with my intuition, and here is some Ana Swanson discussion of the results. That is via Samir Varma, and here is Allison Schrager on whether female scientists should try to look frumpy.

The Ebola risk premium

Underpaid or overpaid?:

They’re looking for the few, the proud — and the really desperate.

For a measly $19 an hour, a government contractor is offering applicants the opportunity to get up close and personal with potential Ebola patients at JFK Airport — including taking their temperatures.

Angel Staffing Inc. is hiring brave souls with basic EMT or paramedic training to assist Customs and Border Protection officers and the Centers for Disease Control and Prevention in identifying possible victims at Terminal 4, where amped-up Ebola screening started on Saturday.

EMTs will earn just $19 an hour, while paramedics will pocket $29. Everyone must be registered with the National Registry of Emergency Medical Technicians.

The medical staffing agency is also selecting screeners to work at Washington Dulles, Newark Liberty, Chicago O’Hare and Hartsfield-Jackson Atlanta international airports.

There is more here, via Matthew E. Kahn. How much does the regular (non-Ebola) staff earn?

Dan Klein responds to Bryan Caplan on immigration

Here is one bit from the longer piece, graciously reproduced by Bryan on his Substack:

Big changes have large and unknowable consequences, including critical consequences about basic political stability, functionality, and integrity. Liberal civilization is not entirely natural to man. Alexis de Tocqueville worried that despotism is.

And:

Would Bryan call for Sweden to open its country of 10 million people to the world’s 8 billion people? (Listen to the UnHerd conversation with Swede Ivar Arpi here.)

Would he call for New Zealand to do so?

If the ranking shown above would not go for Sweden or New Zealand but would go for the United States, why the difference? What is there in the Swedish case that changes the ranking?

On the same premise: You’d think that open border advocates would confront that matter directly, telling us which countries should have open borders and which shouldn’t. Maybe they do this. A discussion of where open borders is/is not recommended would, I should think, also elaborate the basis for the separating nations into those two bins.

I would stress that I favor a 3x increase in immigrant flow for the United States, but not Sweden. I do not favor Open Borders for any country that large numbers of people might want to move to. I also observe that the nations that have done the most to take in more immigrants — Canada and Australia — maintain a pretty “hard ass” control over their borders. There is a lesson here. When a citizenry feels “in control,” they are more likely to be generous to arriving outsiders. Some of us call that “the control premium,” following I think Cass Sunstein.

*Three Identical Strangers*

Few movies serve up more social science. Imagine three identical triplets, separated at a young age, and then reared separately in a poor family, in a middle class family, and in a well-off family. I can’t say much more without spoiling it all, but I’ll offer these points: listen closely, don’t take the apparent conclusion at face value, ponder the Pareto principle throughout, read up on “the control premium,” solve for how niche strategies change with the comparative statics (don’t forget Girard), and are they still guinea pigs? Excellent NYC cameos from the 1980s, and see Project Nim once you are done.

Definitely recommended, and I say don’t read any other reviews before going (they are mostly strongly positive).

Friday assorted links

1. Will wild puffins go extinct?

2. Do neurotics spend more time doing chores? Is the control premium” lowest in Japan?

3. Is this good or bad advice? (“Don’t mention the war!”) And “The University of Colorado’s Board of Regents will consider a proposal to remove the word “liberal” from a description of the university’s academic freedom principles.”

4. How Lebron James masters the media.

5. Alternatives to detention are usually cheaper.

6. Further update on EU internet regulation.

7. How corrupt are judges at musical competitions barter markets in everything?

Coin flip experiments as a measure of status quo bias

That is what the new Steve Levitt paper looks at and it does seem people stick with their current circumstances too much:

Little is known about whether people make good choices when facing important decisions. This paper reports on a large-scale randomized field experiment in which research subjects having difficulty making a decision flipped a coin to help determine their choice. For important decisions (e.g. quitting a job or ending a relationship), those who make a change (regardless of the outcome of the coin toss) report being substantially happier two months and six months later. This correlation, however, need not reflect a causal impact. To assess causality, I use the outcome of a coin toss. Individuals who are told by the coin toss to make a change are much more likely to make a change and are happier six months later than those who were told by the coin to maintain the status quo. The results of this paper suggest that people may be excessively cautious when facing life-changing choices.

Of course not all coin flips turn out the right way. And furthermore we all know that the control premium is one of the most underrated ideas in economics…

Why it is difficult for Milei to rein in inflation

Like the heat in the austral summer, inflation in Argentina is high and showing no sign of meaningful relief anytime soon. It rose from a monthly 13% in November to 25% in December and, according to the latest central bank survey, may come in at around 20% in both January and February…

Argentina’s central bank in December lowered real interest rates to deeply negative territory, hoping to reduce the issuance of pesos to pay for those interests—a move that pushes consumers to spend or dollarize their savings, adding to inflation and to the exchange rate premium. In addition, the early lifting of price controls, including administered prices such as health insurance or gas, frontloaded the relative price correction at the expense of inflation.

All this, combined with the lack of a price reference—the central bank is still working on its monetary program—may have led to a so-called “repricing overshooting.”

And:

Moreover, if inflation persists, the December devaluation may soon look insufficient, feeding expectations of a new realignment that, in turn, would give inflation inertia a new push—ultimately leading to a stop-and-go exchange rate pattern that sacrifices the only remaining nominal anchor of the economy.

Add to that that a large portion of the fiscal plan has just been withdrawn from the Omnibus Bill currently under heated debate in Congress, and we are left with only one bullet to bring monthly inflation back to single digits in the near term: a severe—and politically fraught—economic recession.

That is all by Eduardo Levy Yeyati, there is much more and the piece is useful throughout.

Nigeria reform of the day (again)

President Bola Ahmed Tinubu signed the Electricity Bill 2023 into an Act (Electricity Act 2023) on June 10, 2023, to much frenzy and a bit of confusion – erstwhile president, Muhammadu Buhari, signed into law an amendment enabling states in the country to license, generate, transmit, and distribute electricity earlier in March 2023.

To begin, let’s distinguish between the recent assents by President Buhari and President Tinubu in relation to electricity. President Buhari’s amendment to the constitution marked a necessary initial step toward decentralizing the electricity sector, granting states greater control over generation, regulation, and distribution. However, it did not establish specific laws or regulations for the sector itself.

President Tinubu’s recently signed Electricity Act, on the other hand, constitutes the second phase of decentralization. This Act sets the stage for the electricity market by introducing rules governing generation, transmission, and distribution. Moreover, it empowers states to develop their own laws and regulations tailored to their unique circumstances.

In summary, President Buhari’s constitutional amendment laid the foundation for increased state autonomy, while President Tinubu’s Electricity Act provides the framework for implementing this autonomy.

Here is the full discussion from Basil Abia, who tells me his Substack will be covering Nigeriam reforms in more detail.

Earnings Are Greater and Increasing in Occupations That Require Intellectual Tenacity

That is the title of a new paper by Christos Makridis, Louis Hickman, and Benjamin Manning, here is the abstract:

Automation and technology are rapidly disrupting the labor market. We investigated changes in the returns to occupational personality requirements—the ways of thinking, feeling, and behaving that enable success in a given occupation—and the resulting implications for organizational strategy. Using job incumbent ratings from the U.S. Department of Labor’s Occupational Information Network (O*NET), we identify two broad occupational personality requirements, which we label intellectual tenacity and social adjustment. Intellectual tenacity encompasses achievement/effort, persistence, initiative, analytical thinking, innovation, and independence. Social adjustment encompasses emotion regulation, concern for others, social orientation, cooperation, and stress tolerance. Both occupational personality requirements relate similarly to occupational employment growth between 2007 and 2019. However, among over 10 million respondents to the American Community Survey, jobs requiring intellectual tenacity pay higher wages—even controlling for occupational cognitive ability requirements—and the earnings premium grew over this 13-year period. Results are robust to controlling for education, demographics, and industry effects, suggesting that organizations should pay at least as much attention to personality in the hiring and retention process as skills.

Of course that is very much accord with some of the claims Daniel Gross and I make in our book on talent. Via the excellent Kevin Lewis.

Long Social Distancing

From Jose Maria Barrero, Nicholas Bloom, and Steven J. Davis:

More than ten percent of Americans with recent work experience say they will continue social distancing after the COVID-19 pandemic ends, and another 45 percent will do so in limited ways. We uncover this Long Social Distancing phenomenon in our monthly Survey of Working Arrangements and Attitudes. It is more common among older persons, women, the less educated, those who earn less, and in occupations and industries that require many face-to-face encounters. People who intend to continue social distancing have lower labor force participation – unconditionally, and conditional on demographics and other controls. Regression models that relate outcomes to intentions imply that Long Social Distancing reduced participation by 2.5 percentage points in the first half of 2022. Separate self-assessed causal effects imply a reduction of 2.0 percentage points. The impact on the earnings-weighted participation rate is smaller at about 1.4 percentage points. This drag on participation reduces potential output by nearly one percent and shrinks the college wage premium. Economic reasoning and evidence suggest that Long Social Distancing and its effects will persist for many months or years.

That is a new NBER working paper.

Catching up with the news cycle

1. The British government has done a fiscal policy U-Turn, but yields are back up again. I am not suggesting those market prices are the final verdict, but I do take that as a sign that the issue all along has been a) the competence of the government and its decision-making procedures, and b) general difficulties facing the UK, and not the absolute size of the fiscal policy changes under consideration.

2. The U.S. semiconductor chip controls on China are quite significant. Like price controls on Russian gas, they will either raise or lower the probability of war, and thus I find them difficult to evaluate. That does not mean we should do nothing, but it does mean I don’t have a very strong judgment. It might accelerate Chinese self-sufficiency in chip development, or perhaps accelerate an attempt to seize TSMC in Taiwan. Or it might simply cripple a major geopolitical rival. How good are the models and the empirics that we use to evaluate such situations? Not very good.

3. I’ve long considered Sunflowers a much overrated van Gogh painting. There were even longstanding debates over whether one version of it (not the version that was just attacked by eco-terrorists) was a fake, a sign that it actually isn’t the artist’s most subtle work. It seems it was a fake, but it took people a long time to figure this out. His portraits or sketches of shoes are often much better.

Gender Differences in Peer Recognition by Economists

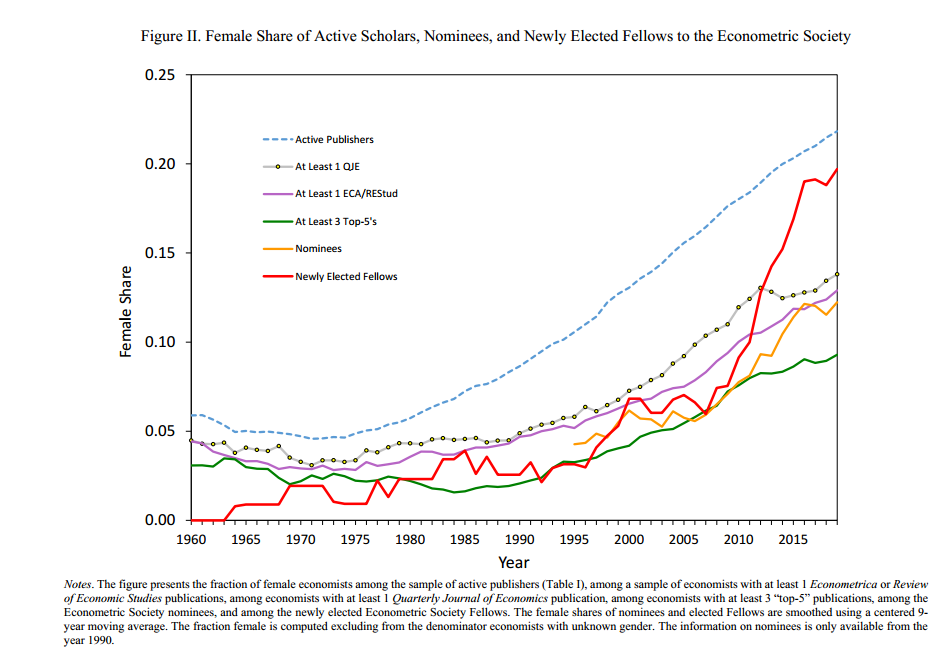

Card et al. study the selection of fellows to the prestigious Econometrics Society showing essentially that prior to about 1980 there was modest discrimination against women. Between 1980 and 2005 about equal access but since 2005 a large bias towards women. Not surprising but citation metrics give us a way of comparing selection with achievement.

The key result can be seen in the raw data–compare the green line of at least 3 top-5s with the red line of selection as an ES fellow.

Here is the abstract to the paper with more details.

We study the selection of Fellows of the Econometric Society, using a new data set of publications and citations for over 40,000 actively publishing economists since the early 1900s. Conditional on achievement, we document a large negative gap in the probability that women were selected as Fellows in the 1933-1979 period. This gap became positive (though not statistically significant) from 1980 to 2010, and in the past decade has become large and highly significant, with over a 100% increase in the probability of selection for female authors relative to males with similar publications and citations. The positive boost affects highly qualified female candidates (in the top 10% of authors) with no effect for the bottom 90%. Using nomination data for the past 30 years, we find a key proximate role for the Society’s Nominating Committee in this shift. Since 2012 the Committee has had an explicit mandate to nominate highly qualified women, and its nominees enjoy above-average election success (controlling for achievement). Looking beyond gender, we document similar shifts in the premium for geographic diversity: in the mid-2000s, both the Fellows and the Nominating Committee became significantly more likely to nominate and elect candidates from outside the US. Finally, we examine gender gaps in several other major awards for US economists. We show that the gaps in the probability of selection of new fellows of the American Academy of Arts and Sciences and the National Academy of Sciences closely parallel those of the Econometric Society, with historically negative penalties for women turning to positive premiums in recent years.