Month: December 2007

The monetary economics of Ron Paul

Here, here, and here. I agree all around, noting only that inflation does, for mysterious reasons, seem to be a slight tax on savings (nominal interest rates don’t adjust completely to inflationary expectations, but don’t ask me why not). But that doesn’t change the overall argument very much. I’ll put the main point yet another way: with a commodity standard the money supply is often pro-cyclical, shrinking during business downturns. Who wants to risk that?

I haven’t followed Ron Paul closely, and while I like many of his libertarian ideas, I am discomforted by his overall anti-intellectual demeanor. He strikes me as the kind of person who has a natural attraction to conspiracy theories. However he is only allowed to believe the ones that coincide with his libertarian ideology. Which isn’t so many (most of those theories are dreamt up by non-libertarians and thus have anti-libertarian elements), and that means he ends up sounding more somewhat sensible than he really is.

I don’t doubt Paul’s sincerity, but I would like to know his theory of why most economists — even market-oriented ones — don’t agree with him on monetary policy. I suspect he thinks he knows some secret that others do not.

There’s what a politician believes, and how a politician believes. As I get older I put increasing weight on the latter. As a protest vote, Ron Paul seems fine, but hearing him or reading about him just makes me depressed. A good rule of thumb is not to get too excited about any candidate whose actual election would make the Dow lose thousands of points.

Addendum: If you’d like a different point of view, here is Alina Stefanescu on Ron Paul.

Veracruz bleg

The second part of our Mexico trip will be to Veracruz. Again your suggestions are most welcome…

Can theory override intuition?

Robin Hanson writes:

For good policy advice, what is the best weight to place on economic theory, versus (individual or cultural) intuitive judgment? [TC: that’s Robin reproducing someone else’s words]

My guess is over 75% weight, so I try to mostly just straightforwardly apply economic theory, adding little personal or cultural judgment [TC: that’s Robin].

In a nutshell, this is the major difference between Robin and me. In my view there is no such thing as "straightforwardly applying economic theory," unless your prescriptions are limited to "we cannot prove that Giffen goods do not exist." Theories are always applied and interpreted through our personal and cultural filters and there is no other way it can be. Robin believes in an Archimedean point for using theory, I do not. Furthermore we often need to apply personal and cultural judgment to offset the sometimes-erroneous judgments and biases built into the economic way of thinking. Robin’s post is the clearest example I have seen of what I call Robin’s logical atomism.

Further meta-list selections for the year

Again, this is me reporting what I think are the consensus picks, not my personal opinions:

1. Best jazz album of the year: Charles Mingus Sextet with the Eric Dolphy, Cornell 1964. Personally I like this CD very much, but I wouldn’t recommend it to anyone who doesn’t already know most of the essential Mingus. Dee Dee Bridgewater, who sings jazz over a kora background from Mali, was another popular selection. I often find jazz singing too facile but the African mix provides an appropriately meaty counterweight.

2. World music: Tinariwen, Aman Iman: Water Is Life. They’re the desert nomads who were described as the world’s greatest rock and roll band by Slate.com. Runner-up would be Segu Blue, by Bassekou Kouyate and Ngoni Ba. Acoustic string music from Mali is in this year, plus there is Bembeya Jazz National, from Guinea. Here is a very good NPR list of top world music picks.

3. Haitian CD: Erol Josue, Regleman. A clear winner in this category.

4. Lee Perry collection: Ape-ology. The best of the best. Again. It’s funny, but this category has a winner just about every year. In the Coasian durable goods monopoly game, price is falling rapidly…

The year in books, economics

Here is David Leonhardt’s list. Here is David Leonhardt’s very good column on why fee-for-service is such a fundamental problem behind American health care institutions.

Now he tells us

Jim Cramer says buy index funds.

Markets in everything

Yes, everything, drive your friend (or enemy) crazy with obscure postcards:

You are bidding on a

rare chance to traumatize a treasured friend or relative with baffling,

mind-numbing, mystery correspondence from abroad.Here is the arrangement:

I

will be spending the Christmas holiday in Poland in a tiny village that

has one church with no bell because angry Germans stole it. Aside from

vodka, there is not a lot for me to do.During the course of my holiday I will send three postcards to one person of your choosing.

These postcards will be rant-ravingly insane, yet they will be peppered with unmistakable personal details about the addressee. Details you will provide me.

The postcards will not be coherently signed, leaving your mark confused, guessing wildly, crying out in anguish.

"How do I know this person? And how does he know I had a ferret named Goliath?"

Your

beloved friend or relative will try in vain to figure out who it is.

Best of all, it can’t possibly be you because you’ll have the perfect

alibi: you’re not in Poland. You’re home, wherever that is, doing

whatever it is you do when not driving your friends loopy with

international prankery.Your target will rack their brains in the shower. At dinner. During long drives. At work. On the golf course.

"Who did I tell about the time I got fired by a note on my chair?" they’ll ponder, "And where the hell is Szczeczinek?"

But wait, there’s more.

To

add to the sheer confusion and genuine discomfort, one missive will be

on an original promotional postcard announcing the 1995 television

premiere of Central Park West on CBS.Another will be a postcard celebrating Atlanta’s disastrous hosting of the 1996 summer Olympic games.

Your mark will be at a complete loss, desperate for answers, debating contacting people he or she hasn’t talked to in years.

"I

know this will sound weird," they’ll say, "but by any chance were you

in Eastern Europe ranting about cantaloupe… twelve years ago… right

before some show with Mariel Hemingway debuted?"When you decide

to end the torment is completely up to you. If you can, I recommend

owning up on 1 April 2008 – giving you nearly half a year of joy and a

George Clooney-esque level of prankage. If you can’t hold it in that

long, I totally understand.

Here is the ebay link, so far there are 35 bids, and thanks to George Whitfield for the pointer.

The best sentence I read tonight

This might be the best written tedious fantasy book that I have come across for a while.

That’s from an Amazon review of Patrick Rothfuss’s The Name of the Wind, which is in fact the best written tedious fantasy book that I have come across for a while. Recommended.

The scope of mortgage fraud

BasePoint Analytics LLC, a recognized fraud analytics and consulting firm, analyzed over 3 million loans originated between 1997 and 2006 (the majority being 2005-2006 vintage), including 16,000 examples of non-performing loans that had evidence of fraudulent misrepresentation in the original applications. Their research found that as much as 70% of early payment default loans contained fraud misrepresentations on the application.

That is from a Fitch Ratings report (summary here, with an eventual link to buy it), the rest makes for very gory reading as well. Thanks to a loyal MR reader for the copy of this report.

Buy self-constraint at StickK.com

The Yale Economic Review informs me:

…stickK.com , scheduled to launch in December 2007, will provide "commitment contracts" that let individuals set a goal, choose consequences for failing to comply, and decide how to verify their progress. With the options of choosing to lose money every time they fail and designating third-party verifiers to check their success, users will face powerful incentives to meet their goals.

The very smart Dean Karlan and Ian Ayres are behind the idea. I’ve long predicted this won’t work; one group of potential customers doesn’t really want to change, the other group is unwilling to give up control. It’s not exaggerating to say that human nature is on the line here, and that if I am wrong this is probably the most important idea you will ever encounter.

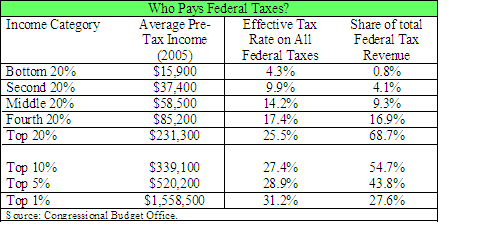

The Rich Pay for the Federal Government

Despite all the deductions, loopholes and clever accountants the federal income tax is strongly progressive. Moreover the federal tax system remains progressive even if you include the payroll tax, corporate taxes and excise taxes. The chart below with data from the Congressional Budget Office, shows the effective tax rate by income class from all federal taxes. Effective tax rates are considerably higher on the rich than the poor.

The effective tax rate is higher on the rich and the rich

have more money – put these two things together and we can calculate who pays

for the federal government. The final

column in the table shows the share of the 2.4 trillion in federal tax

revenues that is paid for by each income category. The remarkable finding is that the rich and

especially the very rich bear by far the largest share of the federal tax

liability. The top 10% of households by

income, for example, pay more than half of all federal taxes and the top 1% alone pay over a quarter of all federal taxes.

(Click the table if it is not clear.)

Who Killed Davey Moore?

Matt Yglesias points us to the following:

Federal Reserve Chairman Alan Greenspan said Monday [February 2004] that Americans’ preference for long-term, fixed-rate mortgages means many are paying more than necessary for their homes and suggested consumers would benefit if lenders offered more alternatives.

By the way, Greenspan’s recent Op-Ed claims he is not to blame, plus he disavows blame in his NPR segment the other morning.

The other day I wrote of widespread fraud; I was referring to the fact that many lower income borrowers lied on their mortgage applications or failed to provide documentation of income. Do any of you have figures here?

The New York Times today blames many factors, including lax and fragmented regulators, but most of all the irresponsible practices of mortgage-lending affiliates of nationally chartered banks. Here are the now well-known warnings of Ed Gramlich.

If you are curious to evaluate my record as a prognosticator, my earlier posts on whether we are in a housing bubble are here [TC: it turns out I didn’t buy close to the peak] and here. Am I to blame? Here is Alex’s insightful post. Most to the point, here is my post "If I Believed in Austrian Business Cycle Theory."

Some of the Austrians blame Greenspan for lowering short-run interest rates to one percent. From another direction, here are tales of a real estate bubble on the moon.

I browsed through a New York Fed conference summary the other day; it was about "systematic risk" and it was held about a year ago. I did not see a word about housing bubbles. The surprise was not the bubble, but rather than its collapse could be such a source of systemic risk and that it could freeze broader credit markets so much.

Paul Krugman claimed that the fundamental problem is lack of solvency, but he doesn’t make a clear enough distinction between insolvent homeowners (for sure) and insolvent banks (has he bought puts?). I haven’t seen an estimate of the losses that is large enough to imply anything close to widespread bank insolvency.

Matters would be easier to understand if they were either much better or much worse than they are; it is the current state of hovering which is so puzzling.

Here is Bob Dylan on what went wrong. It’s the best account I’ve heard so far.

Singapore fact of the day

Using the latest data available, the United Nations Department of

Economic and Social Affairs puts Singapore’s foreign-born population in

2006 at 42.6 percent.

That’s by Kerry Howley of Reason, here is the full article, which argues that Singapore’s guest worker program is working. But such high levels of immigration work through:

Singapore’s willingness to accommodate conservatives through policies

of segregation that Americans would probably find odious…[Singapore has] a

system that invites immigration while emphasizing legality and

distance. A comfort with hierarchy expresses itself as a comfort with

inequality, and countries that can tolerate inequality can allow huge

influxes of poor people.

The same could be said for many of the Gulf States; few members of the Dubai ruling class are saying to themselves: "We wanted workers but we got human beings in return." Loyal MR readers will know that I am generally pro-immigration, but this article is a good place to start for thinking through possible conflicts between immigration and liberalism.

The best sentence I read today

Trying stuff is cheaper than deciding whether to try it.

That’s in the context of the internet, here is the link and full argument.

Demand curves slope downward, even in the humanities

A series of new policies in the humanities and the social sciences at Harvard University are premised on the idea that professors need the ticking clock, too. For the last two years, the university has announced that for every five graduate students in years eight or higher of a Ph.D. program, the department would lose one admissions slot for a new doctoral student. The results were immediate: In numerous departments that had for years had large clusters of Ph.D. students taking eight or more years to finish, professors reached out to students and doctorates were completed.

No exceptions were made, and Harvard officials believe that their shift shows that there is no reason for a decade-long humanities Ph.D.

Here is more, I would say only that they did not go far enough. You might think that this causes a lowering of standards, but I’ll predict that the people who leave sooner are no less smart (do some of you wish I had written "stupider"?) or accomplished than if they had stayed longer.

Elsewhere from InsideHigherEd.com, here is a study of economists and plagiarism.