Month: January 2008

Which sectors will prove technologically stagnant?

Megan McArdle writes:

As the Boomers age, they will consume fewer of the things that we produce efficiently, and more of the things that we provide relatively inefficiently.

Here is more, and I hereby take Megan to be a robot pessimist.

It is a revealing question to ask which sectors a person considers technologically stagnant. Baumol claimed it is the performing arts, but TV and the internet have belied this; it is true that those media are not *live* performance but that is substituting objective aesthetic judgment for what consumers really care about. People love Dexter, whether or not there is someone actually in the box. For stagnant sectors, I will nominate:

1. Haircuts, you might as well get them in Mexico

2. Automobiles (given the overall extent of technological progress, are they really so much better than in 1957?), although the $2500 car may change this

3. Spicy food, it seems best in relatively poor countries

I’m not yet sure about teaching. It seems to be a candidate but people are learning an awful lot from blogs these days; don’t fixate on delivering the old service the way we always have.

Your picks? Keep in mind that something has to be stagnant in relative terms, to date it sure isn’t computer chips but they raise the bar for the average. I expect pharmaceuticals and webcams to make it much easier to care for old people, but only on a per year of life basis; the number of years lived and thus total cost will rise too.

Assorted links

1. A new blog on movie box office

2. A video of Caroline Hoxby, on charter schools

3. Randall Collins on suicide bombers

Gang Leader for a Day

Here is my review of Sudhir Venkatesh’s Gang Leader for a Day: A Rogue Sociologist Takes to the Streets. I found this a difficult review to write. The book is very interesting and Venkatesh is one of the world’s best and leading social scientists (and I don’t say that lightly). Still, I thought his book was…how can I put it….somewhat evil, if I may call upon that old-fashioned concept. The book required him to work with, and often encourage, a vicious gang leader for up to six years. For instance:

J.T., the gang leader at the

center of the story, and of Mr. Venkatesh’s research, becomes wrapped

up in the idea of having his own biographer. Eventually it became his

obsession that Mr. Venkatesh record the details of his life, including

the shakedowns. In part, this was J.T.’s narcissism, and in part he

needed the motivation of an observer. Most of all, J.T. seemed to enjoy

having an audience: "I realized that he had come to rely on my

presence; he liked the attention, and the validation," Mr. Venkatesh

reports. None of J.T.’s underlings were qualified for the role of

courtier, but the highly intelligent and nonjudgmental Mr. Venkatesh

was perfect.

Here is my conclusion:

When it comes to understanding

the world, biography is truly the underappreciated method in the social

sciences. The life of the individual reveals what is otherwise hidden

in abstract numbers or faceless questionnaires. Mr. Venkatesh is to be

applauded for his path-breaking work and his compelling exposition.

He’s lucky that he didn’t have to pay a high price, but by the end of

the story the reader is wondering whether someone else might have, due

to Mr. Venkatesh’s unintended encouragement of J.T. Yes, evil really

can be attractive, and the biographical achievement here is splendid,

but when I return to the thought of encouraging and feeding the ego of

a gang leader for six years running, I can’t bring myself to be

attracted to this book.

I would recommend that you read Gang Leader for a Day, but ultimately I could not shy away from writing a negative review. Let me know what you think.

My micro-credit essay with Karol Boudreaux

From the Wilson Quarterly of this January, here is one excerpt:

For better or worse, microborrowing often entails a kind of Âbait Âand Âswitch. The borrower claims that the money is for a business, but uses it for other purposes. In effect, the cash allows a poor entrepreneur to maintain her business without having to sacrifice the life or education of her child. In that sense, the money is for the business, but most of all it is for the child. Such ÂlifeÂsaving uses for the funds are obviously desirable, but it is also a sad reality that many microcredit loans help borrowers to survive or tread water more than they help them get ahead. This sounds unglamorous and even disappointing, but the Âalternative–Âsuch as no doctor’s visit for a child or no school for a Âyear–Âis much Âworse.

The piece attempts to redress many myths of micro-credit. For instance it is often claimed that micro-credit doesn’t involve collateral, but that isn’t quite true. The borrowing is done in small groups, and if you don’t pay your share the neighbors come and take away your TV set. In reality micro-credit takes the collateral-seizing function away from the bank and puts it in the hands of our neighbors, thereby increasing loan repayment rates.

My favorite part of the piece is this:

Sometimes microcredit leads to more savings rather than more debt. That sounds paradoxical, but borrowing in one asset can be a path toward (more efficient) saving in other Âassets.

…Westerners typically save in the form of money or Âmoney-Âdenominated assets such as stocks and bonds. But in poor communities, money is often an ineffective medium for savings; if you want to know how much net saving is going on, don’t look at money. Banks may be a ÂdayÂlong bus ride away or may be plagued, as in Ghana, by fraud. A cash hoard kept at home can be lost, stolen, taken by the taxman, damaged by floods, or even eaten by rats. It creates other kinds of problems as well. Needy friends and relatives knock on the door and ask for aid. In small communities it is often very hard, even impossible, to say no, especially if you have the cash on Âhand.

…Under these kinds of conditions, a cow (or a goat or pig) is a much better medium for saving. It is sturdier than paper money. Friends and relatives can’t ask for small pieces of it. If you own a cow, it yields milk, it can plow the fields, it produces dung that can be used as fuel or fertilizer, and in a pinch it can be slaughtered and turned into saleable Âmeat or simply eaten. With a small loan, people in rural areas can buy that cow and use cash that might otherwise be diverted to less useful purposes to pay back the microcredit institution. So even when microcredit looks like indebtedness, savings are going up rather than down.

In other words, read Keynes’s chapter 17, go long on animals (liquidity premium exceeds carrying costs), go short on money (carrying costs exceed liquidity premium, at least in poor countries), and increase your future expected net wealth.

Vaccines don’t cause autism, in case you had residual doubts

Researchers from the [California] State Public Health Department found that the

autism rate in children rose continuously in the study period from 1995

to 2007. The preservative, thimerosal, has not been used in childhood

vaccines since 2001, except for some flu shots. Doctors

said that the latest study added to the evidence against a link between

thimerosal exposure and the risk of autism and that it should reassure

parents that vaccinations do not cause autism. If there was a risk, the doctors said, autism rates should have dropped from 2004 to 2007.

Here is the full story. Here are many other summaries.

Addendum: Kevin Drum and commentators add more.

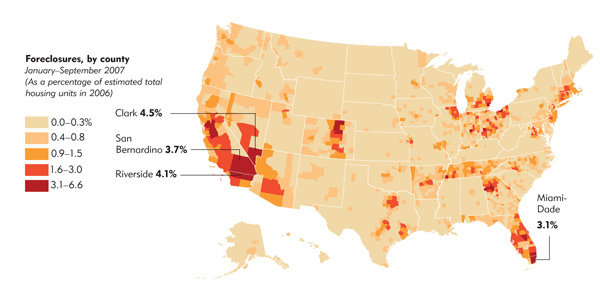

Foreclosures, by county

Markets in everything, Freakonomics style

A student is selling his spot in Steve Levitt’s Economics of Crime class.

The pointer is from Alec Brandon. And via Michelle, here is another installment in the Markets in Everything series. And here is yet another installment, I would call it obvious ("markets in food," can you believe that?) but apparently not to Professor Houston at Brown University.

Against Fiscal Stimulus

As the economy slows many people from Larry Summers to Martin Feldstein are calling for a fiscal stimulus. I am not convinced. Spending and tax decisions can

rarely boost an economy.

First, the money for any new spending or tax cuts has got to come from somewhere, right? Thus there is usually substantial crowding out of any stimulus.

Second, by the time the new spending or tax cut

gets through the political process the economy has moved on and the

stimulus is no longer relevant except by accident.

Third, there just

isn’t that much discretionary spending to play with and even a large

increase in spending, say tens of billions, is too small to make much of

a difference in a 13 trillion dollar economy.

Fourth, in their desperation to "do

something" politicians will often do something foolish. If a spending

increase or tax cut isn’t worthwhile on its own merits then it’s highly

unlikely to be worthwhile once we add in the benefits of "stimulus." Thus, it’s one thing to argue for extending unemployment benefits as a matter of welfare it’s quite another to think that an increase in unemployment benefits will so increase spending as to reduce unemployment! (The implicit view of Larry Summers.)

Economists may call for "temporary," "conditional," and "targeted" stimulus but they won’t be the ones designing the plan. Spending

increases and tax cuts are policies with long term

consequences that we need to think about carefully.

Thus, I do not favor a fiscal "stimulus"

package.

What is the right rate of capital gains taxation for art?

Sens. Pete Domenici (R., N.M.) and Charles Schumer (D., N.Y.) have been complaining for the past few years that the capital-gains tax rate of 28% for the sale of art and other collectibles, compared with only 15% for the sale of real estate and securities, unfairly puts art collectors at a disadvantage.

Here is the story. Here are some fallacious views:

Reducing capital-gains taxes on art to the same 15% as real estate and securities makes sense only if one believes that art is just one more and equally important investment realm. "The government is interested in encouraging people to invest in businesses and the housing market and other areas of risk-taking that stimulate job growth and generate tax revenues, and art doesn’t really do that," said Joseph Cordes…

That view was seconded by Leonard Burman, director of the Tax Policy Center of the Urban Institute, who noted that lowering the tax on art sales could result in "shifting into art and collectibles money that should go to more productive things, which would be taxed as ordinary income. To some extent, people would do that." As an example of more productive use of capital, he suggested investing in a factory or apartment house.

That’s the well-known Junker Fallacy. Buying art shifts money from one set of hands to another and it doesn’t discourage investment in factories or elsewhere. (And if it did, investing in houses would involve the same problem, I might add.) The recipient of the money, the art seller, can invest the money just as well as the spender might have. Or in other words, the transfer of the arts doesn’t consume much in the way of real resources. Admittedly there is a second-order effect: higher prices diverts more labor energy into the arts, although for Old Masters this effect is very small. Or you might cite shipping and transfer costs for the art, noting that on that logic we should tax shopping carts at higher rates as well.

There is a good argument for the higher tax rate on art, namely that art yields otherwise non-taxable pleasures — the pleasure of hanging it on your wall — unlike say holding Chrysler stock. Or you might think taxing art is another way to hike the tax burden on the rich. But the cited argument just doesn’t fly.

Thanks to Donn Zaretsky for the pointer.

Prophets of the Marginal Revolution, a continuing series

Guest blogger Fabio Rojas on Barack Obama, circa 2004. I remember reading that post and thinking: "Fabio is a great guest blogger, but who cares about that guy?"

Markets in everything?, self-constraint edition

An alarm clock to get you out of bed in the morning:

Connects via WiFi to your online bank account, and donates YOUR real money to an organization you HATE when you decide to snooze!

Hat tips to Kottke and Magnetbox, apparently there is doubt as to whether this is real. The wise guy also may wonder why you just don’t disable the snooze function on your alarm clock. But of course that is precisely the sort of non-convexity that markets seek to avoid. At times you will wish to sleep past your limit, even at your prespecified price, but perhaps you cannot always know in advance.

UK science is becoming “normal”

People sometime say that UK science is thriving, at other times that it has declined. But both assertions are true, because the UK is thriving with respect to the volume of ‘normal’ science production but at the same time declining in the highest level of ‘revolutionary’ science.

Here is much more, from loyal MR commentator Bruce Charlton. Note that the data set includes economists. I have noticed this pattern in UK economics; it no longer feels like UK and US economics are fundamentally different, unlike for instance in the 1980s.

Prediction markets at Google

According to the report, “Using Prediction Markets to Track Information Flows: Evidence From Google,”

which was presented Friday at the American Economic Association meeting

in New Orleans, the strongest correlation in betting was found among

people who sat very close to one another, trumping even friendship or

other close social ties.This is tangible evidence, the authors

argue, that information is shared most easily and effectively among

office neighbors, even at an Internet company where instant messaging

and e-mail are generally preferred to face-to-face discussion.It is an argument, the authors say, for giving greater importance to

“microgeography,” or how people interact in the workplace. The finding

that information moved fastest among people who were the closest

together is also an endorsement of the company’s “third rule for

managing knowledge workers: Pack Them In,” the authors say.

And Adam Smith is validated once again:

The other crucial finding of the report was that there was a

detectible “optimism bias” among Google employees. That is, results

that were good for the company tended to be overpriced, particularly

for “subjects under the control of Google employees, such as, would a

project be completed on time or would a particular office be opened.”This

optimism was most evident among new employees, the report found, and it

was bound to show up on days when Google stock had climbed.

Here is the story. Of course this is very important work. Thanks to Chris Masse for the pointer. Elsewhere in prediction markets land, InTrade has now started conditional prediction markets, which consider oil prices, interest rates, and U.S. troops in Iraq, conditional on who becomes President.

Museo Interactivo de Economia

Located at Tacuba 17 in Mexico City, here is their website. The building is splendid, the exhibits are insipid. There is lots on how money is coined (the museum is an initiative of the Bank of Mexico), the circular flow of economic activity, gdp, and social indicators. There are many buttons to press, although to what end is not clear. Opportunity cost gets one computer display and division of labor is mentioned. Taxonomy and description are favored above all. Overhead videos hang from the ceiling and a pulley system drags plastic copies of Mexican products through the room above your head.

Occasionally there is a propagandistic tinge: "Of all the services our government doles out to you, which do you value the most?"

The shop sells lovely 19th century ex votos for excellent prices.

The interesting question is what museums can teach well. Paintings and sculptures, for sure, and perhaps history. But can museums teach abstract concepts, modes of reasoning, and ways of thinking? Here is a science, economics, and technology museum in Milwaukee, is it any good?

At the Museo the bathrooms are clean, lavish, and architecturally superb, the nicest I have seen in downtown Mexico City.

Department of hmm….

People who suffer a life-threatening alteration

in heart rhythms are more likely to survive if they are in a casino or

airport than if they are in a hospital, researchers have reported.

Doctors

already knew that more than half of those who suffer such attacks in

airports and casinos survive. But a new study in hospitals shows that

only a third of victims there survive, primarily because patients do

not receive life-saving defibrillation within the recommended two

minutes.