Month: November 2008

Father Time

Watching Star Wars today is like watching It’s a Wonderful Life (1946) in 1977.

Here are more such comparisons.

The economics of spam

"After 26 days, and almost 350 million email messages, only 28 sales resulted," says the research paper. Yet even with this apparently abysmal response rate of less than 0.00001 per cent, the researchers still estimate that the controllers of a network the size of Storm are still bringing in about $7,000 (£4,430) a day or $3.5m (£2.21m) over a year.

Here is more.

Markets in everything

Restaurants for dogs with Hall of Fame baseball players as waiters edition.

I thank John de Palma for the pointer (and the name of the edition).

Can libertarianism limit corporate statism?

Matt Yglesias opines (the piece is interesting throughout):

… the larger problem is that libertarianism, even at its very best, tends to suffer from an impoverished set of ideas about how

corporate domination of the public policy space might be prevented. The

political left has, by contrast, the tradition of community organizing,

a set of public interest advocacy organizations, allies in the trade

union movement, efforts to improve the quality and independence of the

civil service, and various notions about changing the methods by which

campaigns are financed in the United States. This is hardly a perfect

toolkit, and it can be enhanced in some ways by drawing on libertarian

insights, but it’s something. And libertarians tend to be either

indifferent or hostile to it, campaigning against public financing,

strong labor unions, and the civil service.In practice, libertarianism seems to have little to say about how to

bring about political change except to work hand-in-hand with business

lobbies when the interests of business and free markets are aligned, or

else when business interests are masquerading as libertarianism.

Here is Will’s response. In my view at the margin it would be better to have both less corporate privilege and less labor union privilege. Maybe we have no good theory (much less a strategy) for how to get there, but surely some marginal improvements are possible and who knows maybe more. Chile is much less corporatist than it used to be and the relatively free economy of New Zealand was never that corporatist in the first place.

"Libertarianism in practice" will be excessively pro-corporate but so are most ideologies. Rahm Emanuel, for instance, served on the board of Freddie Mac and earned $16 million in a two-year stint at an investment bank. Wall Street has been the single biggest backer of his political career. He won’t be pushing to destroy this sector but I don’t take those facts to be some great refutation of Obama as a President.

Sometimes the left-wing tactics, especially supporting labor unions, are exactly what lead to greater corporatism. Look at the forthcoming GM bailout. Or consider France, which has strong labor unions but arguably it is also more corporatist than is the United States.

But let’s say that turning America over to the labor unions would in fact limit corporate power. It’s still difficult to get the unions more anti-corporate power, just as limiting corporate statism is difficult. And these two tasks are difficult for more or less the same reasons. The bottom line is this: ultimately the "feasibility objection" may cut against very radical change, but it doesn’t cut against change in one particular direction more than the other.

Book medley

Burton Folsom, New Deal or Raw Deal?: How FDR’s Legacy has Damaged America; this book has a good compendium of free market critiques of Roosevelt, although I would not look here for a balanced review of the evidence. Senselessness, by Horacio Castellanos Moya; this is now my favorite novel from either Honduras or El Salvador, depending how you classify the nationality of the author. Alex Beam, A Great Idea at the Time: The Rise, Fall, and Curious Afterlife of the Great Books. A fun inside history of the Chicago Great Books series. Lily Tuck, Woman of Rome: A Life of Elsa Morante; I liked this book very much, without even being a previous devotee of Morante. Gilles Kepel, Beyond Terror and Martyrdom: The Future of the Middle East. Both Kepel and Belknap Press are wonderful, but there’s not much here. Paul Krugman, The Return of Depression Economics, with a new section on the 2008 crisis. Joseph Schumpeter, Capitalism, Socialism, and Democracy, a new edition. I wanted to read this again but in fact it is unreadable, I am sorry to report. After about forty pages I believe that 2666 is as good as the reviews, here is the latest survey of them.

China fact of the day

Electrical power generated in October is 4% below a year earlier.

Is there any chance that this is more reliable information than the gdp statistics offered up by the Chinese government?

Headlines from *The Art Newspaper*

For the first time in history, the Grand Canal and St. Mark’s Square are carrying huge advertisements

Deutsche Bank offers 600 major post-war works cut-price…

Christie’s has "worst Islamic sale in 17 years"

Contemporary Chinese art levels off

This year’s Sao Paulo Bienal shows almost no art; is this conceptual choice or just lack of funding?

What should we now think about the bailout?

One very loyal, and libertarian, MR reader writes to me:

But I was actually somewhat (not altogether) surprised by your support for the bailout package. So let me ask you again, what would cause you to disagree with yourself? I guess I’m asking because I can’t provide good answers to the following questions: What information do policymakers have to get it right? And what incentive do they have to get it right? Therefore, I don’t see how they will get it right, and are more likely to do long and short run harm.

In my view the real bailout is the existence of the FDIC which, like it or not, is not a commitment we cannot walk away from. Had nothing been done, the required FDIC bailout of bank depositors would have been enormous, given frozen interbank credit markets plus a certain level of panic. So in reality I favored a smaller bailout than did most of the "purer" libertarians, although MR commentators rarely frame it as such.

A combination of bank recapitalization (which I was first skeptical about and thus have changed my mind on) and a greater emphasis on an "identify and isolate the bad banks" approach was the right bailout to do, not to allocate $700 billion for TARP. I agree with everything Arnold writes in this post, but still in my view "doing nothing" wasn’t really an option, again if only because of the preexisting FDIC commitment, not to mention the disaster associated with a plummeting money supply.

Now that financial confidence is partially restored, we can hope that the Obama administration redoes the deal. But the money is being committed rapidly and the demands of the interest groups are piling up, so I hardly expect much ex post improvement.

As for changing one’s mind, it is hard to get real evidence on this since we won’t be running the counterfactual of no bailout. If I learned that interbank exposure and counterparty credit risk was much less than I had thought, and that the number of potentially insolvent banks was quite small, then yes I would change my mind and favor no bailout at all. But I haven’t learned that.

Mexican alchemy?

A method of producing synthetic diamonds using tequila – Mexico’s favourite alcoholic drink – has been discovered, scientists there say.

Not from The Onion. I thank Michael Makowsky for the pointer.

Assorted links

1. Dark flow?

4. Is shipping food really an environmental problem?

Sentences to ponder

The scientific method & capitalism are similarly inhuman systems. They also happen to be the primary sources of our progress.

That is Kebko, from the MR comments section.

Now is the Time for the Buffalo Commons

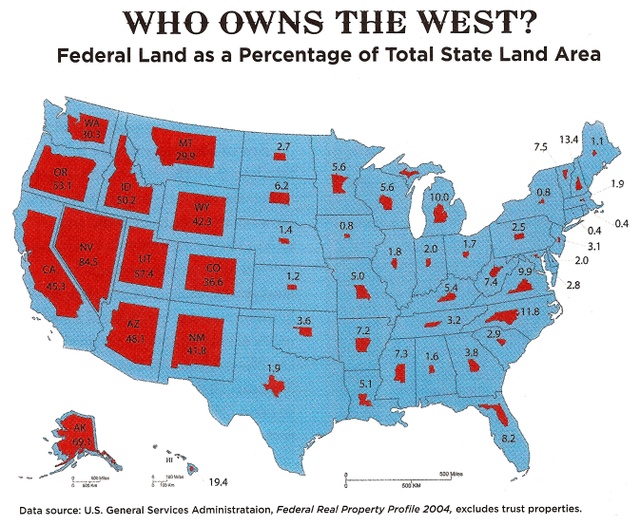

The Federal Government owns more than half of Oregon, Utah, Nevada, Idaho and Alaska and it owns nearly half of California, Arizona, New Mexico and Wyoming. See the map for more. It is time for a sale. Selling even some western land could raise hundreds of billions of dollars – perhaps trillions of dollars – for the Federal government at a time when the funds are badly needed and no one want to raise taxes. At the same time, a sale of western land would improve the efficiency of land allocation.

Does a sale of western lands mean reducing national parkland? No, first much of the land isn’t parkland. Second, I propose a deal. The government should sell some of its most valuable land in the west and use some of the proceeds to buy low-price land in the Great Plains.

The western Great Plains are emptying of people. Some 322 of the 443 Plains counties have lost population since 1930 and a majority have lost population since 1990.

Now is the time for the Federal government to sell high-priced land in the West, use some of the proceeds to deal with current problems and use some of the proceeds to buy low-priced land in the Plains creating the world’s largest nature park, The Buffalo Commons.

Hat tip to Carl Close for the pointer to the map.

The tonic, again

Best to clear your mind and emotions of group loyalties and resentments

and ask, if this belief gave me no pleasure of rebelling against some

folks or identifying with others, if it was just me alone choosing,

would my best evidence suggest that this belief is true? All else is the road to rationality ruin.

I don’t have to tell you who that is.

Credit Card Crunch?

Frankly, I am tired of this topic but every time I try to check the data – as best as I can – it doesn’t seem to support the rhetoric we are hearing from people at the top [despite real problems blah, blah, blah]. Here’s Paulson today:

At least some of the remainder [of the bailout money], Paulson said, should be used to

reinvigorate the market for credit cards, student and auto loans —

which combined account for some 40 percent of consumer credit."This market, which is vital for lending and growth, has for all practical purposes ground to a halt," Paulson said. (emphasis added)

I’ll focus on credit cards. It is true that credit card offers, i.e. junk mail, is down:

…one billion fewer offers mailed during the course of the year.

Households with incomes under $50,000 will receive about 700,000 fewer

offers in 2008 compared to 2007. These households account for the

majority of the cutback and clearly indicate a major change in strategy

by card issuers."The souring economy and industry consolidation have driven volumes

down to levels not seen since 2003 [Crisis! AT]" said Andrew Davidson, Vice

President of Competitive Tracking Services for Synovate’s Financial

Services Group. "Card issuers are taking a more cautious approach, with

lower income and high risk households receiving fewer offers or no

offers at all."

But even so:

Despite the decline in offers for new cards, US consumers still

have access to an increasing amount of credit. Household credit lines

across all cards edged up to an average of $27,626 per household (YTD

3Q 2008) from $26,902 in 2007 despite evidence that issuers are cutting

credit lines on certain customers.…"Much has been reported about issuers reducing credit lines for

certain customers but this is not the case for the majority of people.

Across the industry as a whole, we continue to see credit access and

usage at record high levels" said Davidson.

By the way, after listening to Tyler and me debate this topic Bob Murphy and Megan McArdle decided to run some tests. So if you prefer your data by anecdote you can read Bob’s results here and Megan’s here. I am partial to Megan’s hypothesis #5.

Should the federal government encourage more credit card borrowing?

No, and especially not with federal dollars. Give them back to the people who earned them! Many people use credit cards as charge cards and of course that is both a) efficient, and b) not where the problem is. We’re talking about credit card debt as a means of financing consumption expenditures. I am not sure what is the going credit card interest rate for the marginal borrowers who will be aided by this new change in the Paulson plan, but I believe it is over fifteen percent.

More spending today, in return for less spending in the future. At a rate of, say, fifteen percent. Or higher. Think of our government as "borrowing" aggregate demand at a rate of fifteen percent or higher. Of course our government can, on its own, borrow at a much lower rate of interest than that and then stimulate aggregate demand on its own, through state and local governments, or with a tax cut. Maybe our government is afraid of damaging its credit rating but is it really a good solution to have its poorer citizens do the borrowing on their credit cards instead?

This is not the time to be subsidizing credit card expenditures. And if our political discount rate is this high, I fear to think what other mistakes we will soon make.