Month: April 2011

Assorted links

1. Ten Korean dishes you should try, a conservative list.

2. Who owns a Mac?

3. Good profile of Paul Krugman, good bits on Obama meeting, Summers, other matters.

4. Paul Seabright on RCT; see also Pritchett and Toma at that link.

*A Great Leap Forward: 1930s Depression and U.S. Economic Growth*

In his masterpiece, Alexander J. Field writes:

This book is built around a novel claim: potential output grew dramatically across the Depression years (1929-1941), and this advance provided the foundation for the economic and military success of the United States during the Second World War, as well as for what Walt Rostow (1960) called “the age of high mass consumption” that followed. This view, if accepted, leads to important revisions in our understanding of the sources and trajectory of economic growth to the second quarter of the century and, more broadly, over the longer sweep of U.S. economic history since the Civil War.

…Although the Second World War provided a massive fiscal and monetary boost that eliminated the remnants of Depression-era unemployment, it was, on balance, disruptive of the forward pace of technological progress in the private sector.

During 1929-1941, the annual total factor productivity (measure of economic progress due to new ideas) increase in the trucking sector was 12.61 (!) and for airline transport it was 14.45 (!).

This is a) one of the best economics books of the last ten years, b) one of the best books on the Depression era, c) the only economic interpretation of WWII which makes sense, and is supported by the numbers, and d) one of the must-reads of the year.

Here is an interview with Field. You can buy the book here.

The Samuelson-Stolper theorem

U.S. multinational corporations, the big brand-name companies that employ a fifth of all American workers, have been hiring abroad while cutting back at home, sharpening the debate over globalization’s effect on the U.S. economy.

The companies cut their work forces in the U.S. by 2.9 million during the 2000s while increasing employment overseas by 2.4 million, new data from the U.S. Commerce Department show. That’s a big switch from the 1990s, when they added jobs everywhere: 4.4 million in the U.S. and 2.7 million abroad.

From David Wessel, there is more here. Somewhat heretically, I see at least a fifty percent chance that our next decade will be marked by a) slow technological progress, and b) the Samuelson-Stolper factor price equalization theorem. Before 2000, trade helped boost real wages in the United States, but it is much less clear that is true post-2000. If you’re not thinking about these issues seriously, I would say you are asleep at the wheel.

By the way, I have no problem giving these developments a positive cosmopolitan interpretation. And rather than leading to massive calls for left-wing redistribution (a common prediction), I sooner expect the opposite, more on that soon.

Haitian real estate update

More than half of the Haitians driven into tent cities and makeshift camps by the January 2010 earthquake have moved out of them, officially bringing down the displaced population to 680,000 from a peak of 1.5 million, according to the International Organization for Migration.

But what may seem like a clear sign of progress, officials warn, is also a cause of concern.

Very few of the people who left the camps — only 4.7 percent, by the group’s estimate — did so because their homes had been rebuilt or repaired. Instead, a vast majority appear to have been forced out through mass evictions by landowners, or to have left the camps on their own to escape the high crime and fraying conditions there.

Now, most of the former camp dwellers are doubled up in their friends’ or families’ homes, scattered at random in tents and improvised dwellings, or living in “precarious housing” that is dilapidated, damaged or partly collapsed, the organization says. In some cases, the cinder blocks that were toppled by the quake are being cobbled together to make walls again, only more unevenly and wobbly than before.

As for the camps (arguably a step better than the evolving status quo):

Where toilets are provided, each one is shared by an average of 273 people.

Assorted links

1. Photos of robots.

2. Royal wedding betting markets in everything, which color for the Queen’s hat?

3. Earl B. Hunt, Human Intelligence, a good introduction to current debates.

4. China’s investments in the Caribbean; sign of bubble or not? (e.g., “A 2011 commitment by Beijing to build a $600 million deep-sea harbor, highway and port in Suriname that will link the country to its natural resource rich southern neighbor, Brazil.”)

5. The Canadians do fiscal stimulus the right way.

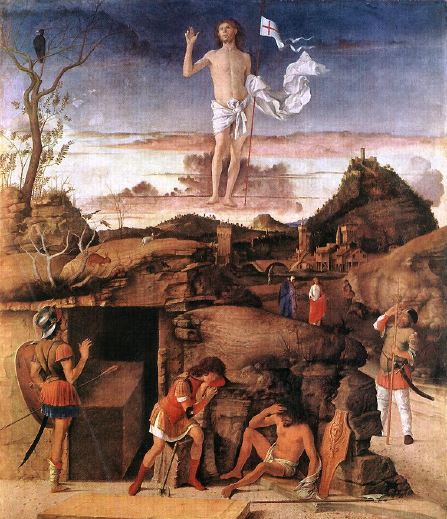

Happy Easter

From KurtFML.

Happy Easter

Scott Sumner, from the comments

This is on “The People’s Budget“:

Matt Yglesias has a much better solution for progressives; a progressive consumption tax.

This capital gains proposal is especially silly. I’m 99% sure they won’t allow unlimited write-offs of capital losses, which means the effective cap gains rate would be even higher, and risk-taking would be discouraged. And why even have a corporate income tax system? Even from a progressive perspective it makes no sense at all.

This proposal taxes rich guys who live a hedonistic lifestyle at a much lower rates than equally rich guys who are thrifty, and leave something for others. That’s progressive?

A progressive consumption tax system composed of a mixture of modestly progressive VAT and steeply progressive payroll taxes and carbon taxes and land taxes. That’s all you need. K.I.S.S.

Assorted links

1. “…the studio audience gave the Pope a hearty round of applause.”

2. The economics of The Jetsons.

3. $23 million book on flies, it must be really good.

4. The science behind college football helmet stickers.

5. Vibrators.

*How To Live*

The author is Sarah Bakewell and the subtitle is Or a Life of Montaigne in One Question and Twenty Attempts at an Answer. This book truly brings Montaigne to life — a task I would have thought impossible in a popular publication. I view Montaigne as one of the most important writers and thinkers and perhaps the single most important for anyone in the blogosphere. I had not known, by the way, that Montaigne was mayor of Bordeaux for four years.

Here is Tim Harford on why we are all too sure of ourselves.

For the pointer to the book I thank the excellent Christopher Weber, Citizen of the World.

The State of the Union

I can understand, although not agree with, wanting to penalize firms for “sending jobs overseas.” I am stunned, however, that the Obama administration’s National Labor Relations Board is trying to penalize Boeing for sending jobs from the state of Washington to the state of South Carolina.

AP: The NLRB complaint filed on Wednesday quotes public statements by Boeing executives saying they put the plant in South Carolina in part to avoid future labor disruptions. The government complaint says this amounts to discriminating based on union activity.

Politicians in South Carolina (mostly Republicans, natch) are not surprisingly outraged but, to its credit, even the Seattle Times editorializes against this move so its hard to see how this will stand. Nevertheless, it’s a bad signal.

Addendum, hoisted from the comments: Jeff Smith: “Perhaps a special tax on Colorado is in order?”

“The People’s Budget”

It is endorsed by Paul Krugman and also Jeffrey Sachs, so I thought I would give it a look. It is from the Congressional Progressive Caucus. One simple question is to ask how the rich are taxed:

1. There are separate rates in the mid- to high forties for millionaires, with strict limits on itemized deductions.

2. “Raise the taxable maximum on the employee side to 90% of earnings and eliminate the taxable maximum on the employer side.” With volatile incomes, it’s tricky to translate that into an expected marginal rate or to figure out how much is infra-marginal. See the technical appendix, p.8, for more details, though I find the entire proposal here poorly explicated. In any case, it’s a big tax increase.

3. Tax capital gains and dividends at the normal income rates. (I am not sure how loss offsets are to be treated, though it could make a big difference and significantly boost the demand for volatile stocks.)

4. I’m not sure what happens with state-level income tax rates but there’s certainly, in the proposal, no talk of them going down. And since they’re probably not free market deregulators at the state and local level, I suppose I expect those taxes to go up, given Medicaid burdens, pension problems, ailing educational systems, and so on.

5. Estate taxes would be raised significantly (sock it to Boy Mankiw!), as would corporate income taxes, there would be new financial transactions taxes, there would be a new bank tax, and tax enforcement would be stiffer.

6. There are, by the way, no proposed cuts in benefits.

What is the final net income and also capital gains rate for wealthy taxpayers? It’s hard to say exactly, but north of seventy percent for income rates (including state and local rates), and near fifty percent for capital gains rates, is not hard to believe.

Quick quiz #1: What are the capital gains tax rates in the European social democracies?

Quick quiz #2: From the climate change debates we learn the value of scientific consensus; what percentage of Democratic public finance economists would favor top income and capital gains rates in the neighborhood of seventy and fifty percent? Some of them have read and digested, for instance, this paper by the impressive Raj Chetty.

Quick quiz #3: Does the technical report offer estimated labor supply and investment elasticities in response to these higher tax rates? (p.s. the answer is “no.”)

I can tell you this: in the technical appendix; the assumption is that the net effect on growth, from investment changes, after all the new public sector investment is called into place, is a positive [sic] 0.3%.

There have been some good criticisms of the funny assumptions behind the Ryan plan, but actually this budget isn’t better, either in terms of its final conclusions, its adherence to best scientific practices, or its transparency in getting to its results. Should we not apply equally high standards to both the Ryan budget and this? There are plenty of good arguments that taxes have to go up, but this particular proposal isn’t one of them. INSERT SNARKY CLOSING OF YOUR CHOICE I WON’T DO IT FOR YOU.

Why are so many Russian Jews Republicans?

I wouldn’t exactly describe my family this way, but here are some data (do read the whole article):

The most recent data, from the 2004 election, show that Russian Jews preferred Bush to Kerry by a margin of 3 to 1. Israel, national security, and the economy topped the list of concerns among Russian Jews, but there was also a cultural component to their preference; they were among the so-called Values Voters who voted Republican based on cultural wedge issues. A month before the election, 81 percent of Russian Jews supported a constitutional amendment banning same-sex marriages—nearly the inverse number of Jews nationally. They also expressed heavy opposition to affirmative action and showed less support for on-demand abortion, according to numbers compiled by the Research Institute for New Americans, which tracks the Russian-speaking community.

And here is more evidence. Why might this be? The stronger record of Republicans, in particular Reagan, as anti-communists is one obvious reason, but that doesn’t explain the broader conservative tendency. The Russian Jews are not anti-gay marriage because the U.S. Republicans are. The more hawkish stance of Republicans on Israel is another reason, but again that doesn’t seem to explain why the connection is such a fundamental one. It doesn’t sound as if these Russian Jews are yearning to become Democrats, if only for the Israel issue.

I would suggest that many Russian Jews, compared to American Jews, are much less hesitant to affiliate with the American brand of Christianity found in the Republican Party. Related strains of thought have been prevalent in Russia for a long time, yet for a long while their Christian nature was covered up by communist rule. Furthermore attachment to Israel, rather than a lifelong felt contrast with American Christians, or strict Judaic observance, is the source of Jewish identity for many Russian Jews. So affiliation with a fairly Christian party is not jarring for the Russian Jews and indeed it may be welcomed, especially if it dovetails with pro-Israel attitudes.

The implied prediction is that Russian Jews who assimilate more in American life, and who marry Americans, are less likely to be Republicans.

I found this part of the article interesting:

Theirs is no country-club Republicanism. Russian Jews in New York, the nation’s largest Russian-Jewish community, numbering 350,000, are largely under-employed; a majority earns less than $30,000. (These numbers do not reflect under-education. The average Russian Jewish immigrant has more higher education that his average American Jewish counterpart.)

On related questions, here is Ilya Somin. Here is another opinion:

“Russians respect power,” says Gary Shteyngart, a novelist who emigrated to New York from Leningrad at age 7. “Many immigrants give lip service to democracy but in the end they want some patriarchal white guy to run things with a strong hand. Feelings of oppression that began within the anti-Semitic confines of the Soviet Union are turned from a defensive to an offensive stance under the false perception that the Democratic Party is indistinguishable from the Communist Party of the USSR.”

I thank Natasha, a loyal MR reader, for the pointer.

Assorted links

1. Maundy money coincides with Queen’s birthday!

3. Bureaucratics (photo show, excellent, recommended, I am glad I went through them all).

4. “Imagining the button” – worth a reread.

Are “green” products declining?

The number of household cleaners with green claims introduced in 2008 was 144, up from 29 in 2007. By 2009 that had dropped to 105, according to Mintel, a research firm. Green dishwashing liquid followed a similar pattern, with 14 introductions in 2007, 85 in 2008, then 58 in 2009.

The story (1/20) is here, and it is adequate to stick with that quotation above (not worth one of your twenty). Some of this switch is due to the recession, but I wouldn’t assume that green products will make a big comeback with better times (there is related comment here). Consumer brand stickiness is legendary, altruistic trends need a big oomph to get off the ground and they need to be seen as cool and up-and-coming, and consequently there is no reason to favor a Whig interpretation of history in this matter. Possibly the bubble has been burst.