Karl Smith on aggregate demand

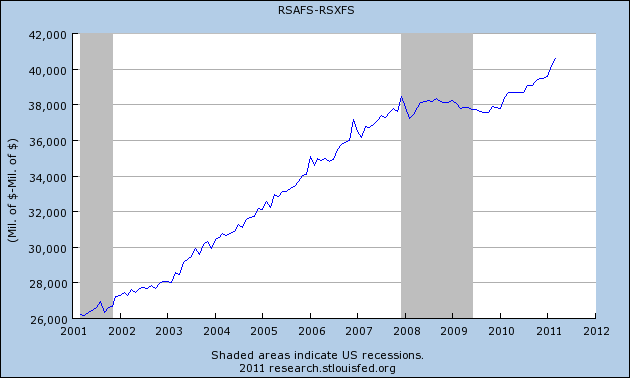

It is an excellent post, read the whole thing. To pull out one point, here is the hospitality sector, expressed in levels:

It’s clearly below trend, had there been no financial crisis. But will sticky nominal wages cause significant unemployment? In terms of absolute levels, business is above where it was before the crisis. At first glance, that should seem enough to support the nominal wage levels of 2007. You also can see that the initial downward dip really doesn’t last for long (two months?) before the older absolute level of business activity is restored.

One approach is to place a lot of the explanatory power in the labor market lags, thereby invoking real variables, above-average risk premia and option values, zero marginal product workers, credit constraints, and so on.

To save an AD story for this sector, one might try the “wandering relative prices” add-on. This graph shows an aggregate. As time passes, especially when AD is relatively stagnant, some prices in this sector fall quite a bit, more so than is indicated by measures of totals or averages. The more that some prices are otherwise inclined to “wander” quite low, the more that rising nominal expenditure flows are required to keep demands high enough so that those sectors aren’t faced with having to cut nominal wages.

The funny thing is, the data on relative prices don’t exactly fit the standard Keynesian story; read this excellent post by Stephen Williamson.

Basically, it’s complicated.