Month: May 2011

Selling Government Assets

In November of 2008 I wrote:

The Federal Government owns more than half of Oregon, Utah, Nevada, Idaho and Alaska and it owns nearly half of California, Arizona, New Mexico and Wyoming. See the map (PDF) for more [N.B. the vast majority of this land is NOT parks, AT 2011]. It is time for a sale. Selling even some western land could raise hundreds of billions of dollars – perhaps trillions of dollars – for the Federal government at a time when the funds are badly needed and no one want to raise taxes. At the same time, a sale of western land would improve the efficiency of land allocation.

The Obama administration is beginning to implement just such a proposal. Jonathan Easley of Salon summarizes:

The administration has identified a massive asset class worth unloading. The federal government is the largest owner of real estate in the nation, sitting on hundreds of millions of acres of land that takes up about 30 percent of the country’s surface. The value of Uncle Sam’s nondefense real estate portfolio is estimated at $230 billion, and it carries a maintenance cost of around $20 billion a year.

If Congress moves ahead on the White House’s recommendation, 60 percent of sale proceeds from properties the White House has deemed excess will go to paying down the deficit, with 40 percent to cover costs on other government-run facilities. In addition to the one-time cash from the sale, the government can begin generating tax revenues on land that was previously an expense.

The first set of assets proposed to go on the auction block are mostly empty or little used warehouses, office buildings, barracks and other properties, quite a few of which are now scheduled to be demolished. The total acreage up for sale is very small so Easley greatly exaggerates when he says the proposed sale is Obama’s “libertarian turn,” but heh, it’s a start.

Karl Smith on aggregate demand

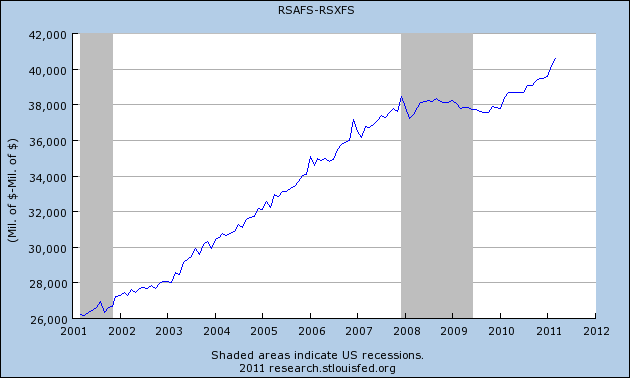

It is an excellent post, read the whole thing. To pull out one point, here is the hospitality sector, expressed in levels:

It’s clearly below trend, had there been no financial crisis. But will sticky nominal wages cause significant unemployment? In terms of absolute levels, business is above where it was before the crisis. At first glance, that should seem enough to support the nominal wage levels of 2007. You also can see that the initial downward dip really doesn’t last for long (two months?) before the older absolute level of business activity is restored.

One approach is to place a lot of the explanatory power in the labor market lags, thereby invoking real variables, above-average risk premia and option values, zero marginal product workers, credit constraints, and so on.

To save an AD story for this sector, one might try the “wandering relative prices” add-on. This graph shows an aggregate. As time passes, especially when AD is relatively stagnant, some prices in this sector fall quite a bit, more so than is indicated by measures of totals or averages. The more that some prices are otherwise inclined to “wander” quite low, the more that rising nominal expenditure flows are required to keep demands high enough so that those sectors aren’t faced with having to cut nominal wages.

The funny thing is, the data on relative prices don’t exactly fit the standard Keynesian story; read this excellent post by Stephen Williamson.

Basically, it’s complicated.

Assorted links

TEDx talk on Monday

My TEDx New York talk is sometime right at or slightly after 4:50 p.m. Monday, EST. I will cover The Great Stagnation. You can watch on-line the other talks too, the link, which includes a list of speakers, is here.

The new Florida Medicaid plan

It has passed the legislature, there is a 1/20 summary here, and an ungated piece here. Here are a few salient points:

1.Most of the patients will be moved into managed care.

2. In most cases malpractice awards — for Medicaid patients only — will be capped at $300,000.

3. “Last month, the federal government advised legislators to choose the payment system that would guarantee that a percentage of the money, in this case 90 percent, would go to patient services. Instead, the Legislature chose the other option: to share profits with managed-care companies.”

By what percentage will the real value of Florida Medicaid benefits be eroded? What does this imply about the future political equilibrium of where spending cuts will come? Will Medicaid as we know it survive?

It remains to be seen whether the Federal government, which has the ability to veto the plan, will approve the proposal.

One reason why independence for Scotland would be a bad idea

There is now talk of a referendum, but let’s scroll back to 2008:

The massive bailout of banks has been widely received as welcome and necessary across the United Kingdom. But it has not been lost on Scots that the largest shareholder in Scotland’s two largest banks is now the British government.

…Brown said the $65 billion bailout of the Royal Bank of Scotland and the bank formed by the merger of Lloyds TSB and the Halifax Bank of Scotland (HBOS) proved that the United Kingdom was “stronger together.”

“We were able to act decisively with 37 billion pounds; that would not have been possible for a Scottish administration,” said Brown, whose own political fortunes have been boosted by his handling of the crisis.

Others have pointed out that the bailout for eight major British banks — including capital for banks and government loan guarantees — is worth a total of almost $700 billion, which is about five times Scotland’s annual gross domestic product.

Here is more. The conceptual point is simple. If you think that the world is now more prone to financial crises (and I do), the optimal size for a nation-state has gone up. Risk-sharing really matters.

Robert Clower passes away at 85

First mentioned by Brad DeLong, it is now confirmed by Wikipedia. Here is an obituary, and another from UCLA. Clower is well known for rethinking the microfoundations of macroeconomics, assigning a primary role to money as a medium of exchange and the double coincidence of wants, liquidity constraints, and emphasizing the coordination problems behind Keynesian economics. He showed how a lot of Keynesian concepts made microeconomic sense, even without invoking the macro notion of aggregate demand or IS-LM analysis. He opposed what is now called “hydraulic Keynesianism” and was a wise man for doing so.

He was part of the UCLA department in its glory years and for several years in the early to mid 1980s he was the main editor of the American Economic Review, the flagship journal of the profession. During those years, he favored and published many unorthodox economists, often disgruntling the more mainstream members of the economics profession. He was good to me.

Here is Clower on whether economic theory is an inductive science (pdf), and Clower on axiomatics (pdf). Here is his famous paper with Leijonhufvud on Keynes and coordination (pdf). Here is his famous paper with Howitt on the microfoundations of monetary theory (pdf). For a full view of his work, you need to search scholar.google.com for both “Robert Clower” and “Robert W. Clower.”

Assorted links

1. I have not yet been assimilated.

3. Ecological footprint feedback can discourage people.

5. Perception vs. reality in NBA ref bias, with reference to Pat Riley.

Morgan Kelly writes from Ireland

The IMF, which believes that lenders should pay for their stupidity before it has to reach into its pocket, presented the Irish with a plan to haircut €30 billion of unguaranteed bonds by two-thirds on average. Lenihan was overjoyed, according to a source who was there, telling the IMF team: “You are Ireland’s salvation.”

The deal was torpedoed from an unexpected direction. At a conference call with the G7 finance ministers, the haircut was vetoed by US treasury secretary Timothy Geithner who, as his payment of $13 billion from government-owned AIG to Goldman Sachs showed, believes that bankers take priority over taxpayers. The only one to speak up for the Irish was UK chancellor George Osborne, but Geithner, as always, got his way. An instructive, if painful, lesson in the extent of US soft power, and in who our friends really are.

The negotiations went downhill from there. On one side was the European Central Bank, unabashedly representing Ireland’s creditors and insisting on full repayment of bank bonds. On the other was the IMF, arguing that Irish taxpayers would be doing well to balance their government’s books, let alone repay the losses of private banks. And the Irish? On the side of the ECB, naturally.

In the circumstances, the ECB walked away with everything it wanted. The IMF were scathing of the Irish performance, with one staffer describing the eagerness of some Irish negotiators to side with the ECB as displaying strong elements of Stockholm Syndrome.

Here is much more, interesting throughout, essential reading I would say. By the way, here is the game theory if Ireland simply bails on some previous commitments to bank creditors:

At a stroke, the Irish Government can halve its debt to a survivable €110 billion. The ECB can do nothing to the Irish banks in retaliation without triggering a catastrophic panic in Spain and across the rest of Europe. The only way Europe can respond is by cutting off funding to the Irish Government.

Are you seeing a pattern emerge? I thank a loyal MR reader for the pointer.

Addendum: Good update on the euro gossip here.

Some simple game theory

…if any one euro zone country were to start exiting the euro, there would be bank runs on the other fiscally ailing countries. The richer European Union nations know this, and so they are toiling to keep everyone on board. But that conciliatory approach creates a new set of problems because any nation with an exit strategy suddenly has enormous leverage. Ireland or Portugal [or Greece!] need only imply that without more aid it will be forced to leave the euro zone and bring down the proverbial house of cards. In both countries, aid agreements already are seen as a “work in progress,” and it’s not clear that the subsequent renegotiations have any end in sight, because an ailing country can always ask for a better deal the following year.

That is from me. Today’s Bloomberg headline reads: “EU Finance Chiefs See More Aid for Greece, Reject Euro Exit.” Yet a stable game this is not.

Is the downturn all about weak aggregate demand?

Here is one report from yesterday:

Dining out will cost more this year as U.S. restaurants take advantage of the nearly two-year long expansion to boost prices on food and drinks.

Higher-priced menus reflect growing confidence by eateries that consumers can afford to pay more to eat out. Restaurants are emboldened in part by the success of U.S. airlines, which have raised fares almost 10 percent since a year ago, according to Dean Maki, chief U.S. economist at Barclays Capital in New York.

And another (1/20):

Retailers expected a good April, and they got it. Sales at stores open at least a year, a measure of retail buoyancy known as same-store sales, increased 8.9 percent on average in April, according to Thomson Reuters’ tracking of 25 retailers. That was one of the biggest increases in the last few years, and it topped analyst expectations of 8.2 percent.

The beginning of the end of the beginning

Sources with information about the government’s actions have informed SPIEGEL ONLINE that Athens is considering withdrawing from the euro zone. The common currency area’s finance ministers and representatives of the European Commission are holding a secret crisis meeting in Luxembourg on Friday night.

Story here, and I do believe this rumor. For the pointer I thank the excellent Catherine Rampell. Here is my recent column on this issue, it applies very directly. Unless this rumor ends very quickly, it means a run on a number of different countries.

The culture that is Buenos Aires

Argentina is to consider granting a special pension to writers on the grounds that they generate “social richness” but often end up impoverished.

The lower house of congress will study a proposal presented on Tuesday that would give published authors a monthly stipend of £565, well above the state minimum pension.

The idea, inspired by similar initiatives in France and Spain, would offer the pension to those who are aged over 65 and have published at least five books or invested more than 20 years in “literary creation”.

…The city of Buenos Aires, proud of a national literary tradition which boasts Roberto Arlt, Julio Cortázar and Jorge Luis Borges, approved a similar proposal in 2006 which granted a monthly pension of almost £400.

Of around 100 applicants to date 72 have been approved, a low number which should calm those worried about the fiscal implications of the scheme going national, Victor Redondo, a poet and member of the Argentine Writers’ Society, told the BBC.

The article is here.

Assorted links

1. Watch markets in everything, why not just run faster?

3. The macro learned in economics grad school, though I disagree that ideology is the reason for RBC popularity.

4. Singapore allows political competition on the internet (1/20), ungated version here.

The demand for affiliation (the dogs of war)

Economists should write more papers on this general topic (affiliation that is):

Ezra:

We sent 79 commandos to get Osama bin Laden — and one dog. A lot of people want to know about that dog, but unfortunately, the military isn’t telling…

NYT (1/20):

Suzanne Belger, president of the American Belgian Malinois Club, said she was hoping the dog was one of her breed “and that it did its job and came home safe.” But Laura Gilbert, corresponding secretary for the German Shepherd Dog Club of America, said she was sure the dog was her breed “because we’re the best!”

Here is more information about the dogs.