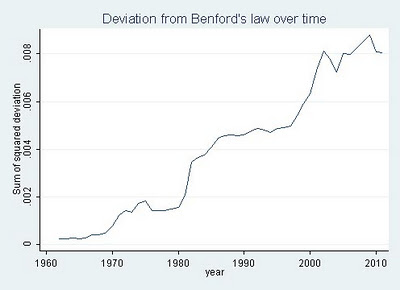

Deviations from Benford’s Law over time, in U.S. accounting data

Jialan Wang writes:

So according to Benford’s law, accounting statements are getting less and less representative of what’s really going on inside of companies. The major reform that was passed after Enron and other major accounting standards barely made a dent.

There is much more at the link. If you are new to the party, Benford’s Law is that:

…in lists of numbers from many (but not all) real-life sources of data, the leading digit is distributed in a specific, non-uniform way. According to this law, the first digit is 1 about 30% of the time, and larger digits occur as the leading digit with lower and lower frequency, to the point where 9 as a first digit occurs less than 5% of the time. This distribution of first digits is the same as the widths of gridlines on the logarithmic scale.

There is more at the link or more here. Here are two previous MR posts on Benford’s Law.