Month: October 2011

IS-LM Keynesianism, why not and which alternatives?

I am sad that the IS-LM debate devolved into IS-LM vs. close substitutes, because I meant to raise a broader set of objections to one particular kind of technocratic curve-shifting as the foundation for macroeconomic thought. Let me list a few alternative starting points for macroeconomics:

1. Public choice economics (still the most underrated, in today’s profession)

2. Growth theory (as distinct from the view that all business cycles are simply fluctuations in the rate of growth)

3. The New Institutional Economics of property rights and incentives

4. Financial asset pricing theory (as distinct from the view that financial markets are always efficient)

To see what this all means, let’s consider the euro crisis. I start with #4, financial asset pricing theory, and consider whether, if “euros in Greek banks” and “euros in German banks” are fundamentally different assets, perhaps they should have different prices. If prices cannot adjust, quantities will.

An IS-LM approach will focus on flows and be distracted — incorrectly — by claims that Ireland, Spain, etc. were not in bad fiscal positions before the crisis hit. That’s wrong, they were writing intolerable naked puts all along.

A macro approach should then move to public choice theory and interpret the governance of the EU and ECB and the coalitions in the various European governments. It wasn’t (for the most part) deliberately set up so that politicians could play short-run fiscal games, but that is in fact why a lot of politicians supported the eurozone. Cheap borrowing brought a big party, but it was a ticking time bomb from the beginning, as recognized by Milton Friedman and others. Based on Buchanan and Tullock (Calculus of Consent), the analysis can move forward with some understanding of why its governance is unworkable in a crisis, and with an understanding of why the Germans originally insisted on such a governance scheme at all. I also wouldn’t mind a citation to Hayek and his critique of French rationalist constructivism, you won’t find that in the IS-LM model either.

We can put all that together, combined with a theory of bank runs, and then we see there will be strong and perhaps intolerable deflationary pressures. Maybe one could use IS-LM for this part of the modeling, but I’ll stick with the kind of ideas you find in Irving Fisher or Scott Sumner. They are simpler and retain the core point that deflationary pressure can be very bad. As Scott notes, the sort of interest rate issues raised by IS-LM are more of a distraction than anything, at this point for this problem. And no, the eurozone for the most part has not been in a liquidity trap. Nonetheless aggregate demand really does matter in this setting.

One often reads that Italy is the linchpin of the euro crisis. To understand Italy we should look to growth theory, the new Institutional Economics, the theory of corruption, theories of political gridlock, and related ideas. Toss in Edward Banfield. Italy’s growth problems predate the immediate mess in the eurozone and they are not plausibly pinned on deflationary forces; the country hasn’t grown much in a decade. IS-LM is absolutely silent here, but if Italy were growing at two percent a year probably the whole mess would be manageable. Demographics matter too, and if this is a messier version of economics sign me up.

The idea that Ireland is seeing a partial recovery, piled on top of some deep structural problems in its domestic sectors, flows more naturally from institutions-based approaches than from IS-LM.

The all-important interplay between monetary and fiscal policy, critical for understanding this crisis, is forced out of the box by IS-LM.

For the final denouement, if indeed it arrives, there is Minsky and the theory of speculative attacks. Keynes in his chapter 12 of the GT had a good understanding of how expectations can switch so suddenly, a key factor at several stages of the euro crisis.

There is more, but you get the point. IS-LM should not be foundational for an analysis of this problem, IS-LM is not necessary, and arguably it is better not to invoke the model at all. And if I had to give undergraduates only one point on one part of the blackboard, I would use the comparison between Greek and German banks.

IS-LM leads one to the mistaken attitude that macro is fundamentally simple, and that all would be well if only people and politicians understood the need to “get tough” with expansionary policy rather than austerity. It’s a lot more complicated than that, yet we can understand these complications by building up from some fairly simple and intuitive models. It’s a better approach to use public choice incentives to understand why the current situation is unworkable, rather than preaching about why the flows should be different than they are. When I hear so much preaching, I tend to think the preacher is using a model with a missing variable or two.

Here is a good post from Philip Levy on why macro is hard, and how that relates to the recent Nobel Prizes.

Soon I’ll turn my attention to whether IS-LM Keynesianism has been making uniquely good predictions during this crisis.

Markets in a Few Things

NYTimes: “The Rason government will do our best to provide favorable conditions for investment,” said Hwang Chol-nam, the vice mayor in charge of economic development. “Please tell the world.”

A common refrain from a mayor, unremarkable, except for the fact that Rason is in North Korea.

North Korean leaders are slowly opening their isolated nation to foreign investment.

A thrust of their strategy is to develop previously created “free trade and economic zones” on the borders that have languished. Here, about 30 miles from China, the combined towns of Rajin and Sonbong, called Rason, are central to the new push.

…“The policy environment has been improving continuously,” said Zheng Zhexi, 58, the company’s vice president. “It’s moving towards a market economy.”

He pointed to the official tolerance for the bazaar, where merchants rent stalls from the government to sell goods that they buy from Chinese traders. Prices fluctuate and shoppers haggle. The bazaar has proved so successful that it is expanding to six times the current size.

An interesting experiment that one hopes will expand. Don’t expect too much, however, consider this rather amazing survey of Chinese business people and what they say North Korea needs.

The Peterson Institute for International Economics, based in Washington, recently published conclusions from a 2007 survey of 250 Chinese companies doing business in North Korea. The authors found that while nearly 90 percent were profitable, the companies “generally have a negative assessment of the business environment” for reasons like poor infrastructure and lack of rule of law.

Amish mob violence

An Amish mob is accused of breaking into several homes and cutting off the beards and hair of other Amish men.

Now, the group is the focus of four police investigations in Ohio.

Police say the assaults are the work of members of the “Bergholz Clan.”

In one attack, the men allegedly packed a horse-drawn buggy, rode to a home and cut the hair off some men and women in the house.

The violent haircuts are meant to humiliate and punish those Amish who are supposedly weak in the faith.

The link is here, hat tip goes to Yana.

*Thinking, Fast and Slow*, by Daniel Kahneman

It is a very good book, clearly written, engaging yet sober, substantive in every chapter, and it does not oversell its material. If you are familiar with the underlying papers you will not see much new here, but as a readable introduction to the work of Kahneman (and Tversky) I give it an A or A+.

It is evident throughout that the author is a psychologist and not an economist; your mileage may vary, but you will not find a response to John List in here. Here is a bit about those unreliable judges, this time in Germany rather than Israel:

The power of random anchors has been demonstrated in some unsettling ways. German judges with an average of more than fifteen years of experience on the bench first read a description of a woman who had been caught shoplifting, then rolled a pair of dice that were loaded so every roll resulted in either a 3 or a 9. As soon as the dice came to a stop, the judges were asked whether they would sentence the woman to a term in prison greater or lesser, in months, than the number showing on the dice. Finally, the judges were instructed to specify the exact prison sentence they would give to the shoplifter. On average, those who had rolled a 9 said they would sentence her to 8 months; those who rolled a 3 said they would sentence here to 5 months; the anchoring effect was 50%.

You can pre-order the book here; it is due out October 25th.

Italy fact of the day

Italy’s guarantees make up 18 per cent of the [EFSF] system.

That’s Italy as guarantee source, not Italy as recipient! The bottom line is this:

If you double or treble the size of the EFSF without changing its underlying structure,all you do is double or treble the lack of credibility. If you really want to increase the size of the EFSF without destroying it, then you are left with two options: you have to back it through an unlimited guarantee by the ECB, the only organ in the eurozone that is in a position to give such a commitment. Or you have to change the EFSF’s legal status through the adoption of joint and several liability. This means that member states jointly agree everybody’s debt. The two options ultimately mean the same. The liabilities of the system will be shared jointly by all of its participants. If you want to annoy certain people, you could also call the latter a eurobond.

The article, by Wolfgang Münchau, is excellent throughout.

Assorted links

1. Are transmission lines holding back green energy?

2. U. Chicago’s ambitious plan to build out law and economics.

4. Round-up of complaints choirs, excellent link, rich with content and humor.

6. Further Russ Roberts response on TGS, Karl Smith responds to Russ. My view is not “no male progress since 1969,” but rather far less than we would have expected at the time.

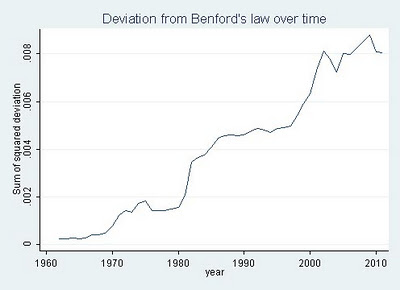

Deviations from Benford’s Law over time, in U.S. accounting data

Jialan Wang writes:

So according to Benford’s law, accounting statements are getting less and less representative of what’s really going on inside of companies. The major reform that was passed after Enron and other major accounting standards barely made a dent.

There is much more at the link. If you are new to the party, Benford’s Law is that:

…in lists of numbers from many (but not all) real-life sources of data, the leading digit is distributed in a specific, non-uniform way. According to this law, the first digit is 1 about 30% of the time, and larger digits occur as the leading digit with lower and lower frequency, to the point where 9 as a first digit occurs less than 5% of the time. This distribution of first digits is the same as the widths of gridlines on the logarithmic scale.

There is more at the link or more here. Here are two previous MR posts on Benford’s Law.

Slovakia rejects EU bailout

Yup, the story is here. Nie pozwalam!

The culture that is California

Nice:

The University of California last week tentatively agreed to a deal with UC-AFT that included a new provision barring the system and its campuses from creating online courses or programs that would result in “a change to a term or condition of employment” of any lecturer without first dealing with the union.

Bob Samuels, the president of the union, says this effectively gives the union veto power over any online initiative that might endangers the jobs or work lives of its members. “We feel that we could stop almost any online program through this contract,” Samuels told Inside Higher Ed.

Bone Marrow Bounty Hunters

Amit Gupta has leukemia and needs to find a bone-marrow transplant. Gupta is the founder of the do-it-yourself photography site Photojojo and the collaborative-working community Jelly and many of his high-tech friends have jumped to his aid including Seth Godin. Here’s Virginia Postrel:

[Godin offered] to pay $10,000 to anyone who became a match for Gupta and made the stem-cell donation, or to give the money to that person’s favorite charity. The offer, he says, was “a chance to say to my readers, ‘Hey, I care about this. A lot. Money where my mouth is.’”

He picked $10,000 because, he says, it’s “enough money to matter to both the giver and the recipient, without being enough money to sue over, cheat over or corrupt.”

Gupta’s friend Michael Galpert, one of the co-founders of the photo-editing site Aviary.com, quickly matched Godin’s offer. “I would do anything that could contribute to helping save his life,” he says.

With $20,000 at stake, the cause did indeed take on new urgency….There was only one problem. The offer was illegal.

Paying a marrow donor is currently illegal under the same law that makes paying organ donors illegal, despite the fact that marrow donation (technically blood stem cells from marrow) is much more like blood donation or egg donation than donating a kidney. (To avoid the law Godin has modified his offer.) Fortunately, the law might be overturned.

In February, the 9th U.S. Circuit Court of Appeals heard arguments in a lawsuit challenging the constitutionality of the ban on valuable consideration for bone-marrow donations. The suit was brought by the Institute for Justice, a libertarian public-interest law firm, on behalf of plaintiffs who include patients, parents of sick children, a doctor who does bone- marrow transplants and a charity that would like to offer incentives, such as scholarships, to encourage more donations.

The lawsuit argues that since marrow cell transplants aren’t significantly different from blood transfusions, the federal government has no “rational basis” for outlawing the kind of compensation that is perfectly legal not only for blood but also for other regenerating tissues, such as hair and sperm, not to mention eggs, which don’t regenerate. This disparate treatment of essentially similar processes, it maintains, violates the Constitution’s guarantee of equal protection. A decision could come down any day.

Assorted links

1. Economic analysis of where the NBA stands.

2. How NYU lured Thomas Sargent, who by the way seems to like Borges, and Henderson on Sargent, and a rude guy in Italian.

3. Via Cafe Hayek, Henry Simons reviews Keynes.

4. Bernanke and Sims on the price of oil and recessions.

5. Complaints Choir of Tokyo, hat tip Yana.

Steven Pinker on violence

It is an important and thoughtful book, and I can recommend it to all readers of intelligent non-fiction, reviews are here But I’m not convinced by the main thesis.

Might we run an econometrics test on regime changes? The 17th century was much more violent than the preceding times, as was the early 19th century, albeit to a lesser extent. Perhaps the distribution is well-described by “long periods of increasing peace, punctuated by large upward leaps of violence”, as was suggested by Lewis Richardson in his 1960 book on the statistics of violent conflict? Imagine a warfare correlate to the Minsky Moment. In the meantime, there will be evidence of various “great moderations,” though each ends with a bang.

Pinker does discuss these ideas in detail in chapter five, but at the end of that section I am not sure why I should embrace his account rather than that of Richardson. I am reminded of the literature on the peso problem in finance.

Another hypothesis is to see modern violence as lower, especially in the private sphere, because the state is much more powerful. Could this book have been titled The Nationalization of Violence? But nationalization does not mean that violence goes away, especially at the most macro levels. In a variant on my point above, one way of describing the observed trend is “less frequent violent outbursts, but more deadlier outbursts when they come.” Both greater wealth (weapons are more destructive, and thus used less often, and there is a desire to preserve wealth) and the nationalization of violence point toward that pattern. That would help explain why the two World Wars, Stalin, Chairman Mao, and the Holocaust, all came not so long ago, despite a (supposed) trend toward greater peacefulness. Those are hard data points for Pinker to get around, no matter how he tries.

We now have a long period between major violent outbursts, but perhaps the next one will be a doozy.

How would this book sound if it were written in 1944? Maybe there is a regime break at 1945 or so, with nuclear weapons deserving the credit for a relative extreme of postwar peace. Pinker’s discussion of the nuclear question starts at p.268, but he underrates the power of nuclear weapons to reach the enemy leaders themselves and thus he does not convince me to dismiss the nuclear issue as central to the observed improvement, throw in Pax Americana if you like.

In one of the most original sections of the book (e.g., p.656), Pinker postulates the greater reach of reason, and the Flynn effect, working together, as moving people toward more peaceful attitudes. He postulates a kind of moral Flynn effect, whereby our increasing ability to abstract ourselves from particulars, and think scientifically, helps us increasingly identify with the point of view of others, leading to a boost in applied empathy. On p.661 there is an excellent mention of the wisdom of Garett Jones. Pinker’s thesis implies the novel conclusion that those skilled on the Ravens test have an especially easy time thinking about ethics in the properly cosmopolitan terms; I toy with such an idea in my own Create Your Own Economy.

What is the alternative hypothesis to this moral Flynn Effect? Given that the private returns to supporting violence are rare — most of the time — and violence has been nationalized, people will have incentives to invest in greater empathy and to build their self-images around such empathy. This empathy will be real rather than feigned, but it also will be fragile rather than based in a real shift in cognitive and emotive faculties; see 1990s Mostar and Sarajevo or for that matter Nagasaki or British or Belgian colonialism.

When doing the statistics, one key issue is how to measure violence. Pinker often favors “per capita” measures, but I am not so sure. I might prefer a weighted average of per capita and “absolute quantity of violence” measures. Killing six million Jews in the Holocaust is not, in my view, “half as violent” if global population is twice as high. Once you toss in the absolute measures with the per capita measures, the long-term trends are not nearly as favorable as Pinker suggests.

Here is John Gray’s (excessively hostile) review of Pinker. In my view this is very much a book worth reading and thinking about. And I very much hope Pinker is right. He has done everything possible to set my doubts to rest, but he has not (yet?) succeeded. I find it easiest to think that the changes of the last sixty years are real when I ponder nuclear weapons.

Claims about Kyrgyzstan, bridenapping edition

In Kyrgyzstan – one of the few places to collect data – the practice has been on the increase since the fall of communism. Some believe this violent subversion of a tradition (which was historically for show and done with the consent of the wife) has become popular to avoid the embarrassment of being unable to afford a dowry.

Up to a third of all ethnic Kyrgyz women in Kyrgyzstan are kidnapped brides, and some studies suggest that, in certain regions, the rates of bride kidnapping account for up to 80 per cent of marriages.

In six villages scrutinised for a recent survey, almost half of the 1322 marriages registered were from bride kidnapping, and up to two-thirds were non-consensual.

…”Once bride kidnapping was characteristic mostly in rural areas, but it has become widespread everywhere, including the capital, Bishkek,” says Gazbubu Babayarova, founder of the Kyz Korgon Institute, an organisation that campaigns to eliminate bridenapping in Kyrgyzstan.Most people in Kyrgyzstan view the practice as a tradition rather than a crime. There is such a thing as “consensual” bridenapping, where the bride agrees to be taken as part of a custom, but a more violent version of this “tradition” has grown in the 21st century.

Russell Kleinbach, a professor at Philadelphia University who is an expert on the issue, believes it is only since the 1950s that this tradition has morphed into something that is widespread, brutal and non-consensual.

Ms Babayarova is herself an example of how this custom has spread to urban, educated Kyrgyz communities.

Seven years ago, she was kidnapped by one of her closest friends, who was a medical student. He did not accept her protestations that she did not want anything more than friendship and entered into an arrangement with both their parents to kidnap her.

The rest of the story is here.

Question from Slovakia

Today is vote day on the EFSF, here is the question:

Today, Slovakia has the lowest average salaries in the euro zone. How am I supposed to explain to people that they are going to have to pay a higher value-added tax (VAT) so that Greeks can get pensions three times as high as the ones in Slovakia?

Here is more.

Assorted links

1. Karl Smith on Russ Roberts on TGS. Karl also has had some excellent posts on IS-LM and related matters, start here but scroll backwards through the blog.

2. When was the phrase “Great Depression” first used? More from the extraordinary Barry Popik.

3. 1982 interview with Thomas Sargent. And the Thomas Sargent academic family tree. And Sargent’s (very short, and very good) graduation speech at Berkeley. An excellent short overview of what economics has to contribute to human understanding. Here is his Dad’s speech, from his Dad’s 90th birthday.

4. Carolyn Sargent’s guide to the art of Florence; she is related to Thomas.