Month: February 2012

*Buckley: William F. Buckley and the Rise of American Conservatism*

By Carl T. Bogus. It is an excellent and admirable book, highly readable, and also a good example of how liberals should write about conservatives.

You can order it here. My previous coverage of Carl T. Bogus is here.

Toy nationalism the polity that is Russia

There hadn’t been many – indeed any – rallies like it before in Russia. Last month saw dozens of toys, from teddy bears to Lego figurines, standing out in the snow of a Siberian city with banners complaining about corruption and electoral malpractice.

At the time, Russian authorities in Barnaul declared the protest “an unsanctioned public event”.

Now a petition to hold another protest featuring 100 Kinder Surprise toys, 100 Lego people, 20 model soldiers, 15 soft toys and 10 toy cars has been rejected because the toys have been deemed not to be “citizens of Russia”.

“As you understand, toys, especially imported toys, are not only not citizens of Russia but they are not even people,” Andrei Lyapunov, a spokesman for Barnaul, told local media.

The story is here and for the pointer I thank Michelle Dawson.

Not from Atlas Shrugged

The Hill: Six House Democrats, led by Rep. Dennis Kucinich (D-Ohio), want to set up a “Reasonable Profits Board” to control gas profits.

The Democrats, worried about higher gas prices, want to set up a board that would apply a “windfall profit tax” as high as 100 percent on the sale of oil and gas, according to their legislation.

…The Gas Price Spike Act, H.R. 3784, would apply a windfall tax on the sale of oil and gas that ranges from 50 percent to 100 percent on all surplus earnings exceeding “a reasonable profit.” It would set up a Reasonable Profits Board made up of three presidential nominees that will serve three-year terms.

And here directly from the proposed bill:

(4) REASONABLE PROFIT.—The term ‘reasonable profit’ means the amount determined by the Reasonable Profits Board to be a reasonable profit on the sale.

Addendum: Here is Bryan Caplan’s classic, Atlas Shrugged and Public Choice: The Obvious Parallels and here is the award-winning Atlas Shrugged app.

The economics of higher non-profit and for-profit education

Here is a 2009 paper of mine with Sam Papenfuss (pdf), a later version of which was published in this book edited by Joshua Hall. The paper deliberately sidesteps the recent scandals and focuses on fundamentalist explanations of why higher education might be provided on a non-profit or for-profit basis.

The key stylized facts are this:

Two primary features characterize the observed educational for-profits. First, for-profits tend to specialize in highly practical or vocational forms of training. For-profits are especially prominent in areas where student performance can be measured by a relatively objective, standardized test. Nonprofits, in contrast, have a stronger presence in the liberal arts, although they are by no means restricted to that arena..

This is a general pattern, and not unique to the United States today:

A comparison of for-profit and non-profit institutions in the Philippines [in the 1970s] bears out many of the differences noted above. Filipino for-profits tend to charge lower fees, specialize in education of lower academic reputation, spend less on capital equipment, and serve students who plan on pursuing vocational careers or taking a standardized vocational test upon graduation…Students at for-profits are approximately ten times more likely to take the tests. Adjusting for the lower pass rate from for-profits, the for-profits are putting about five times the number of students through the tests as the non-profits, even though for-profits educated no more than three-fifths of all Filipino students at the time.

Here is one possible (partial) resolution:

Faculty governance implies that for-profits and nonprofits place different relative weight on reputation and profits. The for-profit selects students and faculty on the basis of how easily their reputational benefits can be captured by shareholders, whereas the non-profit places greater weight on the reputational benefits that are kept by faculty. The for-profit pursues “reputation as valued by students in dollar terms” and the nonprofit pursues “reputation with the external world,” or “reputation as a public good.” In the resulting equilibrium, for-profits achieve lower status.

…The hypothesis therefore predicts a segmented market for higher education. Students who seek the highest levels of certification and reputation will attend non-profit institutions, which are run by faculty and use their prestige to raise donations. Students whose quality can be certified by an outside vocational exam do not need the non-profit reputational endorsement. They will pursue the more efficient instruction offered by for-profits.

There is a good recent paper by David Deming, Claudia Goldin, and Lawrence F. Katz on educational for-profits, available here. Here is a 2010 Dick Vedder piece on for-profits, more positive than most recent accounts.

Department of Yikes

…his German counterpart [finance minister] suggested postponing Greek elections and installing [sic] a new government without political parties.

I do understand the financial motive here, but this is not a good idea! It is even less of a good idea to say so in public. Is the goal simply to irritate the Greeks so much that they leave the Eurozone on their own? Twitter rumors are suggesting that Finland and the Netherlands are raising similar ideas, namely postponing elections and, it seems, simply ruling the country through its budget? I am not sure how this is supposed to work, or to be received in Greece, or why it should be a good precedent for the European Union. The FT story is here.

Why is there so little money in politics?

With campaign season approaching, maybe it is time to reprise this public choice classic from Stephen Ansolabehere, John M. de Figueiredo and James M. Snyder Jr. (pdf), here is the abstract:

In this paper, we argue that campaign contributions are not a form of policy-buying, but are rather a form of political participation and consumption. We summarize the data on campaign spending, and show through our descriptive statistics and our econometric analysis that individuals, not special interests, are the main source of campaign contributions. Moreover, we demonstrate that campaign giving is a normal good, dependent upon income, and campaign contributions as a percent of GDP have not risen appreciably in over 100 years – if anything, they have probably fallen. We then show that only one in four studies from the previous literature support the popular notion that contributions buy legislators’ votes. Finally, we illustrate that when one controls for unobserved constituent and legislator effects, there is little relationship between money and legislator votes. Thus, the question is not why there is so little money [in] politics, but rather why organized interests give at all. We conclude by offering potential answers to this question.

For the pointer I thank Matt Mitchell.

Assorted links

1. DasParkHotel, and claims about German humor.

2. A Joke.

3. Noah Smith has a new job, and the tale.

4. Model this: Edward Elgar prices are falling.

5. Sales of Charles Dickens books in his lifetime, and how much does movie piracy matter?

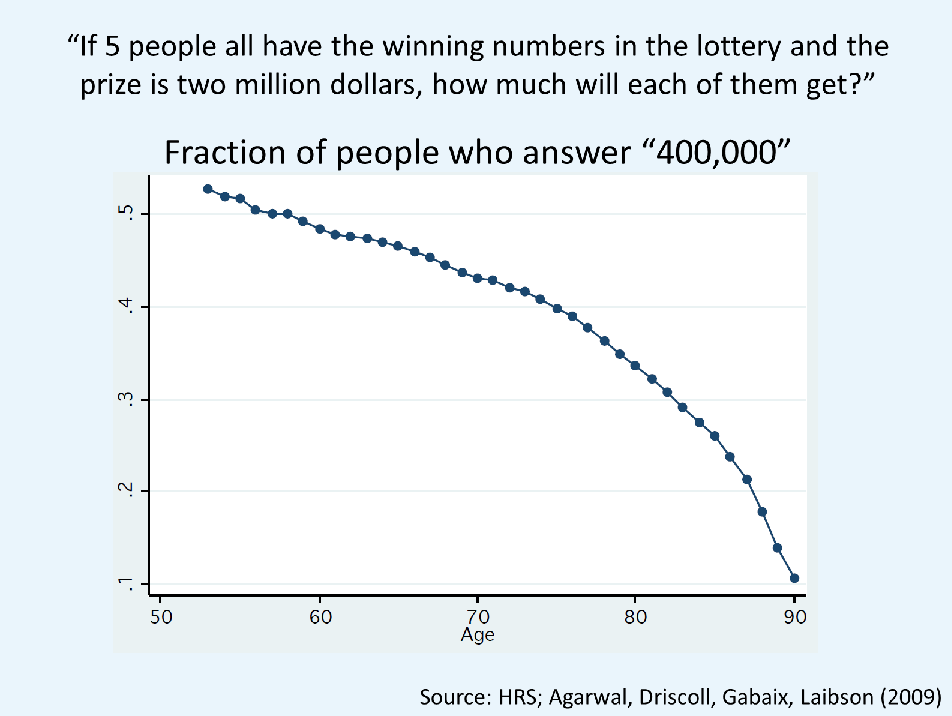

The Age of Reason

I don’t know which is scarier the height of the curve around age 50 or the slope of the curve (fyi, my guess is cohort effects are small). The slide is from David Laibson who has much more on aging and dementia; also raises issues of the value of medical care that maintains the body but not the mind.

Sentences to ponder

…when Prime Minister Mario Monti remarked that having a job for life in today’s economy was no longer feasible for young people — indeed, it was “monotonous” — he set off a barrage of protests, laying bare one of the sacrosanct tenets of Italian society that the euro zone crisis has placed at risk.

Reaction was fast, furious, bipartisan and intergenerational. “I think the prime minister has to be careful with the words he uses because people are a little angry,” Claudia Vori, a 31-year-old Rome native who has had 18 different jobs since graduating from high school in 1999…

This point is not irrelevant:

Debate has been especially intense over Article 18 of the 1970 Workers Statute, which forbids companies with more that 15 employees from firing people without just cause. The unions say that line cannot be crossed.

The article is here. How many years does it take to a) undo this, and b) have it kick in as a positive for growth? This again also gets back to the question of why Germany does not wish to pay for everything. By the way, is anyone writing a behavioral economics piece about how “crisis fatigue” increasingly is shaping eurozone policy?

Life as a pure rent-seeker? Or as the ultimate Kirznerian entrepreneur?

Or both. Gary Bemsel has visual acuity:

He can scan hundreds of video slots a minute, with an eagle eye honed by the past 15 years making his living as a racetrack stooper — someone who bends down to gather betting slips off the track floor in the hope of finding a mistakenly discarded winner.

…“It’s a legitimate living — the money’s been left behind,” he said on Wednesday. “It’s surer money than stooping; it’s steadier, and it’s cleaner — you don’t have to fish through garbage cans.”

Mr. Bemsel has not given up stooping. After a loop through the racino, he has enough cash to hit the betting window in the track and then scour the floor and trash for winning tickets. Slipping deftly through crowds of cheering and swearing horseplayers, he can read slips on the ground and tell immediately if they are winners. For face-down slips, he has developed a nimble, soccer-style flip move using both feet — so he barely has to stoop at all.

Yet returns are down:

“The first few weeks you could hit the A.T.M. machines for stray $20 bills lodged up in the dispenser,” Mr. Bemsel said. “But certain guys caught onto it, and now they stake out a machine all day, snatching them up.”

Nor has it worked out entirely well for him:

He works 12-hour days and finds $600 to $1,200 a week, Mr. Bemsel said, but winds up blowing most of it on bad horse picks. “The whole reason I do this is to feed my gambling addiction,” he said. “It’s an illness.”

The excellent article is here, and for the pointer I thank Ben Greenfield.

Labor market fact of the day

Although Latinos make up only a seventh of the population, they have “racked up half the employment gains posted since the economy began adding jobs in early 2010”, the Los Angeles Times reported this morning. In 2011, the trend accelerated. Of the 2.3 million jobs added in 2011 according to the Household Survey of the Bureau of Labor Statistics, 1.4 million, or 60 percent, were won by Latinos.

This remarkable statistic is a keyhole into America’s two-speed recovery. One true story of the recession is that employment gains have been biased toward the highly educated. More than half of the jobs added in 2011 went to Americans with a college education. Another true story of the recession is that most of the other jobs have been low-paid and went to the less-educated. Educational attainment among Hispanics remains very low. Just 10% of foreign-born and 13.5% of native Latinos have finished college, placing the group’s completion rate at about a third of the national average.

That is from Derek Thompson, there is much more here. Here is one piece of the explanation:

Finally, it’s not just where they’re working. It’s where they’re not working. As a group, Hispanics have low employment in local, state, and federal governments, which lost about 300,000 jobs in 2011, the vast majority of net job losses last year. The upshot is that Hispanics are growing as a population faster than other groups; more likely to work in states with growing jobs, such as Texas; more likely to seek out low-wage positions in health care and hospitality that are fast-growing industries; and less likely to be sitting in the way of the austerity bulldozer that took down total government in 2011.

Romney v. Romney

The joke going around last week was that a liberal, a conservative and a moderate walk into a bar. “Hi Mitt,” says the bartender. Here’s Mitt proving the point:

“This week, President Obama will release a budget that won’t take any meaningful steps toward solving our entitlement crisis,” Romney said in a statement e-mailed to reporters. “The president has failed to offer a single serious idea to save Social Security and is the only president in modern history to cut Medicare benefits for seniors.”

Hat tip on this one to Paul Krugman.

Assorted links

1. Valentine homage to Romer, and a continuous time approach (is it?), and PubMed research papers related to Valentine’s Day. Here are data on spending. Here is a Chris Coyne video on the economics of Valentine’s Day; it is a non-Hansonian, non-Keynesian, Treasury view of the day, he is not impressed by a one-time increase in monetary velocity.

Apple fact of the day

Courtesy of Ajay Makan and Dan McCrum at the FT, Barclays Capital estimates that based on reporting thus far earnings growth for S&P 500 companies was 7 percent in Q4. But if you strip out Apple, that plummets to 2.9 percent.

One company, in other words, is responsible for most of the earnings growth among the large cap firms in the index.

(Pulls out Albert Hirschman for re-read…)

Seven ways to improve U.S. infrastructure spending

Here is a column full of good sense from Edward Glaeser, excerpt:

SPLIT UP THE PORT AUTHORITY: Last week gave us another painful audit of the work by the Port Authority of New York and New Jersey to manage the World Trade Center site. I’m not going to pile on, but this super-entity is too big to succeed. How can the Port Authority possibly focus on tasks such as making New York’s airports more functional when it has so much else on its plate?

The problems at John F. Kennedy International Airport aren’t evidence of the need for a new federal infrastructure agenda, they indicate only that the Port Authority has too much to do. Splitting off the airports, probably into two separate entities (for New York and New Jersey), could generate managerial focus and more competition. The airports can fund themselves if they are free to charge higher landing fees. Millions of fliers into New York should be perfectly willing to pay a bit more to ensure a more pleasant experience. More nimble and less restricted airports would help that happen.

It is one of my “hobby horses” to note that for all the money we spent on fiscal stimulus, air transport in and out of America’s major city remains a total, unworkable mess.