Month: March 2013

Assorted links

1. What are the consequences of late marriage?

2. A closer look at the health care cost slowdown.

3. Update on Chinese plans for Iceland.

4. The black box that is Google (a redo of “I, Pencil,” arguably).

6. ZeroHedge speculates on Cyprus. I don’t see how even the “good bank” will be able to survive under the plan in the works. The key question is whether any enacted plan has a deposit guarantee backed by the EU as a whole and right now that looks quite unlikely. Capital controls will sever the “Cypriot euro” from the euro more generally and de facto end the euro era in Cyprus. It will be very hard to ever take them off (how soon can you imagine Cyprus rebuilding its credibility?) Another question is what Cypriot legislators actually will vote for, given their connections to Russia and perhaps also their fear of Russian reprisals against their persons. There is a very good Cyprus post here, and another here. Here is a very good post on what is in the capital controls, lots.

From State Welfare to Federal Disability

In an excellent report on disability NPR’s Planet Money notes :

A person on welfare costs a state money. That same resident on disability doesn’t cost the state a cent, because the federal government covers the entire bill for people on disability. So states can save money by shifting people from welfare to disability. And the Public Consulting Group is glad to help.

PCG is a private company that states pay to comb their welfare rolls and move as many people as possible onto disability.

…In recent contract negotiations with Missouri, PCG asked for $2,300 per person [moved from state welfare to federal disability].

In other words, money and real resources are being paid to redistribute wealth from one set of taxpayers to another.

A sentence from Neil Munro

He emailed this to me:

Let me summarize; Diversity = the self-assembling, self-serving ideology of high-IQ, complexity-arbitraging professionals.

My view by the way is different, and can be found in my book Creative Destruction: How Globalization is Changing the World’s Cultures.

Open banking resolution in New Zealand

The excellent Eric Crampton sends me this by email:

NZ’s wound down the temporary deposit insurance we had in place post 2008 in favour of Open Banking Resolution: freeze a part of all deposits, keep the banks open, liquidate the shareholders and unsecured creditors, then (if necessary) haircut the depositors.

The Greens here have been comparing it to Cyprus, which is obviously rather different.

Anyway, if interested:

RBNZ: http://www.rbnz.govt.nz/research/bulletin/2007_2011/2011sep74_3HoskinWoolford.pdf

http://www.rbnz.govt.nz/finstab/banking/4933917.html

TVHE critique (on credibility): http://www.tvhe.co.nz/2013/03/21/political-equilibrium-obr-and-deposit-insurance

Me: http://www.offsettingbehaviour.blogspot.co.nz/2013/03/deposit-insurance.html

A 10-yr old piece by then RBNZ Deputy Governor, now U Canterbury Vice Chancellor, Rod Carr, on related topics: http://www.rbnz.govt.nz/speeches/0104984.html

Here, the Reserve Bank distances its policies from those of Cyprus.

NGDP in Cyprus

It seems to be falling:

Luscious strawberries – €3.50 a box on Monday – are now €1.45. The prices of other perishables have also plummeted. “People are buying only what they needed.”

No one knows how telephone, water and electricity bills paid monthly on instructions to banks will be settled. No one knows when and if they will be paid their salaries.

Here is more.

*Robot Futures* (and fan out)

This is a very good short book by Illah Reza Nourbakhsh. Here is one excerpt:

In USAR, the effective number of robots controlled by a single human operator has a formal term: fan out…Ironically, fielded robots have very low fan out scores today. For instance, the Predator-class drones, unmanned aerial vehicles that fight proxy battles for the United States in distant lands, have a fan out of less than 0.2. That is, more than five people are required at all times, just to manage a single robot. In USAR, researchers have begun to demonstrate ever-increasing fan out — exceeding 6.0 — by providing the robots with more and more autonomy so that the human operator is only responsible for the most strategic decisions, with robots making every tactical choice. Critical to this success is the ability of robots to decide when they need to ask for human help — when they face a survivor, or are stuck in the rubble in a way that the robot cannot extract itself, or when the robot has suffered a serious hardware of software error. This “intelligent reasoning” for deciding when to ask for help means that one human can manage even more robots to achieve a higher fan out…They do not need true autonomy so much as a willingness to call for help whenever required. This alleviates the pressure to create perfect robots, and instead good-enough robots can play meaningful roles in a USAR team because humans will bridge the gap between the robot’s capabilities and what the situation demands.

File under “meta-rational robots,” and buy the book here.

Assorted links

Shout it from the Rooftops! Performance Pay for Teachers in India

Several years ago I reported on a very large, randomized experiment (JSTOR) on teacher performance pay in India that showed that even modest incentives could significantly raise student achievement and do so not only in the incentivized subjects but also in other non-incentivized subjects, suggesting positive spillovers. The earlier paper looked at the first two years of the program. One of the authors, Karthik Muralidharan, now has a follow-up paper, showing what happens over 5 years. The results are impressive and important:

Students who had completed their entire five years of primary

school education under the program scored 0.54 and 0.35 standard deviations (SD) higher than

those in control schools in math and language tests respectively. These are large effects

corresponding to approximately 20 and 14 percentile point improvements at the median of a

normal distribution, and are larger than the effects found in most other education interventions in

developing countries (see Dhaliwal et al. 2011).Second, the results suggest that these test score gains represent genuine additions to human

capital as opposed to reflecting only ‘teaching to the test’. Students in individual teacher

incentive schools score significantly better on both non-repeat as well as repeat questions; on

both multiple-choice and free-response questions; and on questions designed to test conceptual

understanding as well as questions that could be answered through rote learning. Most

importantly, these students also perform significantly better on subjects for which there were no

incentives – scoring 0.52 SD and 0.30 SD higher than students in control schools on tests in

science and social studies (though the bonuses were paid only for gains in math and language). There was also no differential attrition of students across treatment and control groups and no

evidence to suggest any adverse consequences of the programs.…Finally, our estimates suggest that the individual teacher bonus program was

15-20 times more cost effective at raising test scores than the default ‘education quality

improvement’ policy of the Government of India, which is reducing class size from 40 to 30

students per teacher (Govt. of India, 2009).

In another important paper, written for the Government of India, Muralidharan summarizes the best research on public schools in developing countries. His conclusion is that there are demonstrably effective and feasible policies that could improve the public schools thereby increasing literacy and numeracy rates and raising the incomes of millions of people.

The generation entering Indian schools today is the largest that has ever, or for the foreseeable future, will ever enter Indian schools so the opportunity to raise educational quality for essentially the entire Indian workforce over the next several generations is truly immense.

Eleven weird solutions to the Fermi paradox?

In my group at least half of these don’t count as weird at all. Yet I had never thought of this one, “They’re All Hanging Out At the Edge of the Galaxy”:

This interesting solution to the Fermi Paradox was posited by Milan M. Ćirković and Robert Bradbury.

“We suggest that the outer regions of the Galactic disk are the most likely locations for advanced SETI targets,” they wrote. The reason for this is that sophisticated intelligent communities will tend to migrate outward through the Galaxy as their capacities of information-processing increase. Why? Because machine-based civilizations, with their massive supercomputers, will have huge problems managing their heat waste. They’ll have to set up camp where it’s super cool. And the outer rim of the Galaxy is exactly that.

Subsequently, there may be a different galactic habitable zone for post-Singularity ETIs than for meat-based life. By consequence, advanced ETIs have no interest in exploring the bio-friendly habitable zone. Which means we’re looking for ET in the wrong place. Interestingly, Stephen Wolfram once told me that heat-free computing will someday be possible, so he doesn’t think this is a plausible solution to the Fermi Paradox.

Once again, air conditioning really does influence location, at least if this is true (which I doubt). The other ten are here, and the pointer is from George Dvorsky.

“Cyprus needs to lay its hands on one-third of its gdp by Monday”

From Kevin Drum, that is a very good blog post title.

It seems, by the way, that the basic Cypriot strategy is to pile together a load of illiquid and indeed even imaginary assets into a “fund,” claim they have met the target, and dare the ECB to cut them off on Monday.

I wonder what is the nominal rate of interest on Cypriot street loans?

*How Revolutionary were the Bourgeois Revolutions?*

This is quite an extraordinary book, remarkably informationally dense, interesting on almost every page, though I would pass on the extended discussions of methodological Marxism. Did the so-called bourgeois revolutions have relatively little to do with the bourgeoisie? (This leads some readers to the further question, namely if so, how should this reshape our understanding of “neo-liberalism” today?) What is a bourgeois revolution anyway? This far-ranging book is a kind of esoteric blockbuster, to be worshiped by the handful of people who are familiar with Hotman’s Francogallia and its role in 1570s French politics, or who carry around in their heads some underlying sense of why 17th century Scottish and Polish feudal rule might have had significant common features.

Ideally, CrookedTimber should do a symposium on this book, though I am not sure they can find commentators who are up to the task.

Enthusiastically recommended, sort of, to some of you, maybe.

The author is Neil Davidson, a Scot, and the Amazon link is here.

U.S. government regulations for virtual currencies

Here is part of one summary:

The major boon from the document for Bitcoin is this: users get off lightly. In fact, FINCEN does not intend to touch mere users of virtual currency at all; the document states, “a user who obtains convertible virtual currency and uses it to purchase real or virtual goods or services is not an MSB under FinCEN’s regulations. Such activity, in and of itself, does not fit within the definition of “money transmission services” and therefore is not subject to FinCEN’s registration, reporting, and recordkeeping regulations for MSBs.” The document also offers protection from “prepaid access” laws that regulate gift cards and the like, saying that “a person’s acceptance and/or transmission of convertible virtual currency cannot be characterized as providing or selling prepaid access because prepaid access is limited to real currencies.” Finally, even exchanges are safe from “foreign exchange” regulation, the set of rules governing businesses that offer exchange between two or more national currencies.

The regulations are here, and the pointer is from Jeff Garzik. On the topic, there is a very good short essay by Eli Dourado.

Assorted links

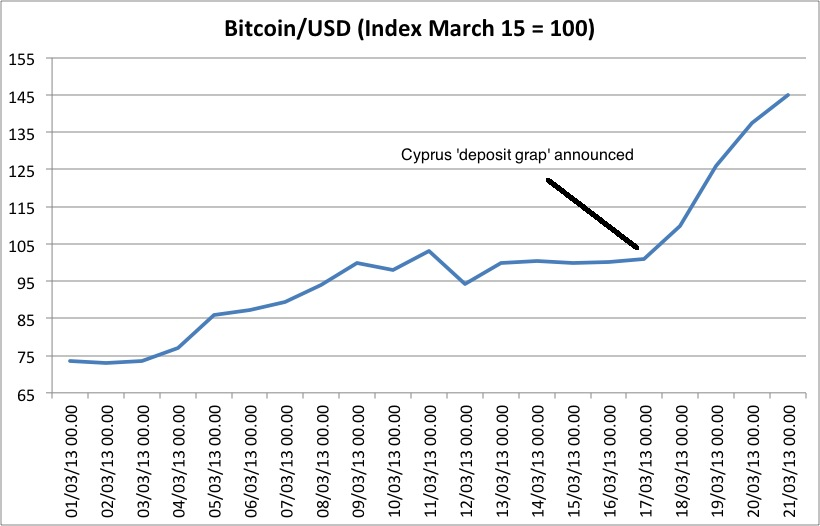

Bitcoin Demand

The Market Monetarist points us to this graph. I wonder whether this is generalized demand or demand from Cypriots/Russians specifically.

The productivity crisis in the UK

This is not mainly an AD crisis:

The latest jobs numbers out Wednesday morning show the British economy continues to generate good jobs growth. Yes, unemployment also rose, but that’s only because more people were coming back into the workforce — generally a good thing.

These employment numbers would normally offer at least some explanation for why inflation has been persistently sticky above the Bank of England’s 2% target. Except that none of the price pressure is coming from wages, which continue to trend down, and overall economic growth has been flat.

These conflicting forces — strong employment, poor GDP growth, sticky inflation — are in part reconciled by Britain’s terrible labor productivity. The most recent data showed that output per hour worked for the whole economy declined 2.4% during the third quarter of last year from the same period a year earlier.

That is from Alen Mattich. He offers one possible hypothesis:

…[it] reflects a deeper restructuring of the economy from high value added financial services and oil production (deceptively so in the case of financial services) to generally lower value added activities. Productivity might be poor because the economy’s new activities are actually old ones–retail, distribution, low value added manufacturing.

On the new budget, Martin Wolf has interesting comments, mostly it won’t matter.