Month: March 2013

*Why Growth Matters*

That is the new book by Jagdish Bhagwati and Arvind Panagariya. I reviewed the slightly earlier UK/India version briefly and very favorably here, and next month it will be out under this new title in the U.S. The subtitle is How Economic Growth in India Reduced Poverty and Lessons for Other Developing Countries. It is no surprise that they did not keep the India title — India’s Tryst with Destiny — for the US market. Who wants to read about India per se? Who knows what a tryst is?

Assorted links

The overtime boom

The last time U.S. factory workers put in longer weeks than they averaged in February, Rosie the Riveter was on the assembly line and American GIs were fighting Nazis in Europe.

All those extra hours helped to drive five straight months of manufacturing growth in the U.S., racking up 52,000 new factory jobs, according to Labor Department data. That includes 14,000 positions in February alone.

Good news of course, but there is a dark lining to the cloud. I take the heavy reliance on overtime to be another sign of labor market polarization, and of low employer demand for a large number of the unemployed.

The story is here, hat tip goes to this chain.

Addendum: As Matt Yglesias reports, retail sales are strongly up too.

Can we agree that…(more on fiscal policy, and hurdle rates)

Ryan Avent puts forward some propositions on fiscal policy that he hopes we can agree on (I agree with most of them, dissenting on the multiplier discussion by wanting explicit time horizon considerations, the overall importance given by multiple mentions of ZLB, and being confused but not disagreeing with the wording of the first part of #13). And in general I am supportive of such attempts to find common ground.

I wish, however, to add to the list. I wish to nominate a few more items, noting that this does not exhaust my wish list. Here goes:

1. Debt-financed government spending must eventually be paid off and the estimated deadweight loss of taxation is at least twenty percent. That immediately puts a hurdle rate of twenty percent or more on projects, even when real borrowing rates are very low.

2. Private companies, when making investment decisions, often use hurdle rates as high as twenty or thirty percent, even when their cost of capital is much lower. Often it is believed this is to constrain overeager empire builders, or “cowboys.” For sure, the agency problems in the public sector differ considerably from those in the private sector, but arguably there should be a “cowboy premium” for the public sector as well, even if that premium should be lower for the public sector.

3. The real risk of public sector investment is not measured by the borrowing rate, but rather by the covariance of the value of public sector outputs with a very broad notion of the market portfolio. I call this the Jensen premium, since Michael Jensen first outlined this argument clearly.

This is all standard stuff, none of it is like reading the “he said, she said” debates over the proper size of the fiscal policy multiplier.

To do some adding up, we have twenty percent plus the cowboy premium plus the Jensen premium. Plus of course the real time preference rate, if that should be positive too. It is hard to get a good sense of the size of the cowboy and Jensen premia but still we are running clearly over twenty percent, perhaps a good deal over twenty percent.

I also believe (more controversially, this point is not consensus) that the cowboy premium is considerably higher for debt-financed expenditures, relative to balanced budget expenditures.

Now let’s come to my complaint (which is not directed against Ryan). I have read dozens — or is it now hundreds? — of blog posts arguing that low borrowing rates make for a very strong case for fiscal policy. I do not often if ever see these posts admit that the hurdle rate for government investment still can be quite high and still is likely quite high. I do not see these posts discussing the DWL of taxation, the cowboy effect, or the Jensen effect. I see only the mention of a very low borrowing rate.

Of course you should adjust the social costs of the project downward to the extent it is mobilizing specific unemployed physical resources (which is quite distinct from the existence of a low borrowing rate per se; for one thing, it is easy to have projects which reshuffle resources and a low borrowing rate, plus the crowding out may come on the labor side). I see this point about unemployed resources mentioned many, many times, though not with the proper caveats, and I see the points about hurdle rates hardly mentioned at all. And note by the way that the DWL of taxation premium should be applied to all upfront pecuniary costs, whether or not they are true social costs.

Addendum: Brad DeLong comments. His #1, if I understand it properly, confuses “spending at all” with “taxing vs. borrowing” calculations. #2 ignores agency problems and #3 assumes a rather definite view on the understanding of risk. You will note that my post is quite agnostic on the size of #2 and #3 in any case.

Further assorted links

1. Resource mobility in Japan.

2. The culture that is New York; “You likely wouldn’t have sex with someone who took you to the wrong restaurant (or at least wouldn’t be happy about it).”

3. Bryan Caplan on the minimum wage.

4. Vivek Wadhwa on the great stagnation.

5. I favor the campus right to a guinea pig.

Good sentences about John Stuart Mill

He was so bewildered by his lack of books that he even began sleeping late, once not getting up till nine o’clock. One of the daughters [in Toulouse] pitying his plight gave him Legendre’s Geometry. He dissected it eagerly, although its muddled thinking on Ratio took away a good deal of its merits as an elementary work. The confusion in the house grew worse; a dog went mad and terrorized the servants. To John’s orderly mind the Benthams seemed to live in a state of constant uproar. They were always interrupting him for other things. He was never left to himself. They took him to see peasant dances…

That is from Michael St.John Packe, The Life of John Stuart Mill.

Sentences of interest

People whose results were closer to the fatal cut-off point of p=0.05 were less likely to share their data.

That is from Robert Trivers, about psychologists, source here.

You are fairly predictable, perhaps

The new article is “Private traits and attributes are predictable from digital records of human behavior,” by Michal Kosinski, David Stillwell, and Thore Graepel. Here is the abstract:

We show that easily accessible digital records of behavior, Facebook Likes, can be used to automatically and accurately predict a range of highly sensitive personal attributes including: sexual orientation, ethnicity, religious and political views, personality traits, intelligence, happiness, use of addictive substances, parental separation, age, and gender. The analysis presented is based on a dataset of over 58,000 volunteers who provided their Facebook Likes, detailed demographic profiles, and the results of several psychometric tests. The proposed model uses dimensionality reduction for preprocessing the Likes data, which are then entered into logistic/linear regression to predict individual psychodemographic profiles from Likes. The model correctly discriminates between homosexual and heterosexual men in 88% of cases, African Americans and Caucasian Americans in 95% of cases, and between Democrat and Republican in 85% of cases. For the personality trait “Openness,” prediction accuracy is close to the test–retest accuracy of a standard personality test. We give examples of associations between attributes and Likes and discuss implications for online personalization and privacy.

For the pointer I thank Brandon Robison.

What is your long Kindle book?

Everyone should have a long book on their Kindle that they otherwise would never read. Then, when you don’t feel like starting a whole new book on your Kindle, you dig into a small piece of your long book. And stop. As the years pass, you may eventually finish your long book (or not).

The long book on my Kindle is John Calvin’s The Institutes of the Christian Religion. It’s impressive. I don’t agree with Calvin, either theologically or temperamentally, but he is an extremely sharp thinker and writer, too often neglected for his extreme “Calvinism.”

After three years, I’m about eighteen percent finished. And someday I hope to read more works by Calvin, although not someday anytime soon.

What is the long book on your Kindle?

Addendum: Kevin Drum comments.

Assorted links

Calgary notes

They refer to themselves as Calgarians, which makes them sound more closely related to science fiction than in fact they are. On Saturday I walked around in a sweater only. In the span of little more than an hour, I was told numerous times that Calgary and southern Alberta have more U.S. citizens living there than any other region in the world.

Canada just had a very good job creation month. About a third of the Albertan provincial budget comes from resource revenue, and bitumen prices have been falling, leading to some tough fiscal choices.

The city has elected a Muslim mayor.

On Snowquester virtually all flights out of DC were cancelled, even though Reagan National Airport had literally no snow. Only Air Canada was flying a normal schedule and thus I arrived.

There are some excellent food choices in Calgary, although it is a city for ordering main courses, not appetizers.

There is no good reason to turn down a trip to Calgary, even in the winter.

Assorted links

1. Obscene titles for refereed journal articles.

2. Video about concrete tents.

3. Video about how the Japanese are demolishing one building.

4. Ryan Avent on labor force participation and structural unemployment.

5. New blog on monetary economics.

6. Do the Democrats face a demographic problem of their own?

7. A tale of status competition (and read the comments too).

The jobs of the future?

Katherine Young, 23, is a Google rater — a contract worker and a college student in Macon, Ga. She is shown an ambiguous search query like “what does king hold,” presented with two sets of Google search results and asked to rate their relevance, accuracy and quality. The current search result for that imprecise phrase starts with links to Web pages saying that kings typically hold ceremonial scepters, a reasonable inference.

Her judgments, Ms. Young said, are “not completely black and white; some of it is subjective.” She added, “You try to put yourself in the shoes of the person who typed in the query.”

How smart do you need to be to do this? How well-educated? How is the quality of your work to be judged? The full article is here, interesting throughout.

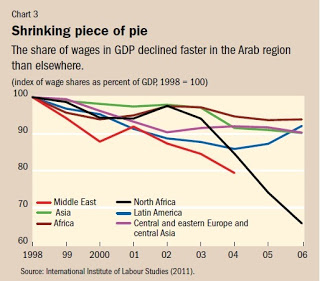

Wage share of gdp in Middle East and North Africa

From Timothy Taylor, here is more.

Testing Doux Commerce in the Lab

In a famous priming experiment it was shown that changing the name of a prisoner’s dilemma type problem from “The Community Game” to “The Wall Street Game” reduced the amount of cooperation. The suggestion is that Wall Street evokes in the mind concepts of exploitation and self-regarding behavior thus making these behaviors more likely. Wall Street is a very particular aspect of capitalism, however, what about the idea of markets and trade more generally? Montesquieu famously noted that

Commerce is a cure for the most destructive prejudices; for it is almost a general rule, that wherever we find agreeable manners, there commerce flourishes; and that wherever there is commerce, there we meet with agreeable manners.

In fact, market economies are associated with greater levels of trust and cooperation, so might we not expect markets and trust to be associated in the mind? Al-Ubaydli, Houser, Nye, Paganelli, and Pan (the list includes several GMU colleagues) prime experimentees with words associated with markets and then have them play a trust game; they find evidence in support of the hypothesis:

Using randomized control, we find evidence that priming markets leaves people more optimistic about the trustworthiness of anonymous strangers and therefore increases trusting decisions and, in turn, social efficiency. Given the general mechanisms by which priming affects behavior–that an individual’s mental representation of markets is the result of the individual’s experiences with markets–we can interpret our results as evidence in favor of the hypothesis that market participation increases trust.

…Absent markets, economic interactions with strangers tend to be negative. Market proliferation allows good things to happen when interacting with strangers, thus encouraging optimism and leading to more trusting behaviors. Participation in markets, rather than making people suspicious, makes people more likely to trust anonymous strangers. Our results seem therefore to corroborate the idea of doux commerce….We stress, however, that this is cautious evidence; a wider array of evidence is necessary for the solidification of this conclusion.