Month: June 2013

Claims about the United Kingdom

It is not the state that the British object to, but other people.

That is from Terry Eagleton’s Across the Pond: An Englishman’s View of America, which is sometimes amusing.

Assorted links

1. 210 reasons for the fall of the Roman Empire, and the Chinese vision for the future of humanity, short film promotional video with Dwight Howard and Scottie Pippen among others; subtle, Straussian, involves genetic engineering.

2. Claims about self-control and happiness.

3. Why apes cannot pitch, and there will soon be a new Bruno Latour book, two of them in fact.

4. Markets in everything: a company with professional liars.

5. Raghuram Rajan on unconventional monetary policy after the crisis, much wisdom in this talk.

True sentences based on lots of data

His overall conclusion is that adverse supply shocks have undesirable effects for economies even when they are at the interest rate zero lower bound.

That is from James Hamilton, citing and discussing research by Johannes Wieland.

Luck, Investment and the One Percent

Jon Chait criticizes Mankiw’s defense of the 1% for focusing on productivity as a reason why the rich earn more:

Mankiw’s essay is a sprawling mess, but it hinges on a few key premises. One is that market wealth reflects a person’s productivity. Higher taxes on the rich, he writes, would take from “the most productive members” of society and give to “society’s less productive citizens,” and he uses “productive” and rich” as synonyms throughout….

But there are lots and lots of ways that a person’s income does not measure his contribution to society. Many of us see them every day. We all know people in our field who earn too much, or too little, because of social connections, or race, or gender, or luck, or willingness to cut ethical corners of one variety or another.

But later in that same article and in a followup he argues that greater productivity is an important explanation for inequality:

Krugman noted (as did I) that more affluent parents spend far more than poor children do on “enrichment expenditures” — “books, computers, high-quality child care, summer camps, private schooling, and other things that promote the capabilities of their children.” (ital added)

Mankiw’s response is that this enrichment spending is all wasted.

…Really — high-quality child care, private schools, camps — it’s all just for fun?…There is, in fact, an enormous amount of research on this very question. And the findings overwhelmingly suggest that nonschool enrichment matters an enormous amount. A huge portion of the achievement gap between poor and nonpoor children is attributable to summer vacation.

The first claim is that the wealthy aren’t more productive than the less wealthy and the latter claim is that they are more productive but that this is unfair. The two claims are in tension (perhaps a synthesis is possible but none is offered). Note also that the two claims have quite different implications. In the former case the rich are lucky and you can tax them without generating large incentive problems. In the latter case the rich have benefited from investment and taxing the benefits is likely to reduce such investment.

Addendum: Mankiw, of course, takes the opposite end of the stick, productive people but unproductive summer camps. Mankiw, however, is not inconsistent as he offers another explanation for productivity, namely earlier developed talents and capabilities possibly even genetic in origin. I don’t want to discuss that issue in this post but here is one relevant earlier post with a bit more here for those interested .

Is the labor market return to higher education finally falling?

Peter Orszag considers that possibility in his recent column. About one in four bartenders has some kind of degree. Orszag draws heavily on this paper by Beaudry and Green and Sand, which postulates falling returns to skill. It’s one of the more interesting pieces written in the last year, but note their model relies heavily on a stock/flow distinction. They consider a world where most of the IT infrastructure already has been built, and so skilled labor has not so much more to do at the margin. This stands in noted contrast to the common belief — which I share — that “IT-souped up smart machines” still have a long way to go and are not a mature technology. You can’t hold that view and also buy into the Beaudry and Green and Sand story, unless you think we have suddenly jumped to a new margin where machines build machines, with little help from humans.

Rather than accepting “falling returns to skill,” I would sooner say that education doesn’t measure true skill as well as it used to.

The more likely scenario is that the variance of the return to having a college education has gone up, and indeed that is what you would expect from a world of rising income inequality. Many people get the degree, yet without learning the skills they need for the modern workplace. In other words, the world of work is changing faster than the world of what we teach (surprise, surprise). The lesser trained students end up driving cabs, if they can work a GPS that is. The lack of skill of those students also raises wage returns for those individuals who a) have the degree, b) are self-taught about the modern workplace, and c) show the personality skills that employers now know to look for. All of a sudden those individuals face less competition and so their wages rise. The high returns stem from blending formal education with their intangibles (there is also more pressure to get an advanced degree to show you are one of the privileged, but that is another story.)

This polarization of returns — among degree holders — explains both why incomes are rising at the top end, and why the rate of dropping out of college is rising too. At some point along the way in the college experience, lots of students realize they won’t be able to “cross the divide,” and the degree alone won’t do it for them. They foresee their future tending bar and act accordingly.

Too many discussions of the returns to education focus on the mean or median and neglect the variance and what is likely a recent increase in that variance.

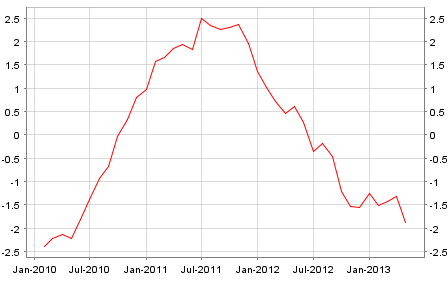

YoY growth in eurozone loans to non-financial companies

There is more here.

My new favorite question to ask over lunch

“So, are you a regional thinker?”

If they say no, fail them. If they say yes, ask them to explain. Here is my old favorite question to ask, and therein you find links to the very first question of this kind.

Assorted links

2. Automated coach to practice conversations (pdf).

3. Will Wilkinson on fairness, norms, and inequality.

4. Food trucks for dogs (MIE), and use Kinect to control your cockroaches.

5. The shadow banking culture that is China.

6. Miles Kimball and Matt Rognlie on wage stickiness, price stickiness, and TFP. That is also a good post showing some differences between blogospheric economics and academic economics.

What’s the most intellectual joke you know?

That query is from AskReddit, the link is here, and here are a few of the nominations:

It’s hard to explain puns to kleptomaniacs because they always take things literally.

And:

Jean-Paul Sartre is sitting at a French cafe, revising his draft of Being and Nothingness. He says to the waitress, “I’d like a cup of coffee, please, with no cream.” The waitress replies, “I’m sorry, Monsieur, but we’re out of cream. How about with no milk?”

And:

Werner Heisenberg, Kurt Gödel, and Noam Chomsky walk into a bar. Heisenberg turns to the other two and says, “Clearly this is a joke, but how can we figure out if it’s funny or not?” Gödel replies, “We can’t know that because we’re inside the joke.” Chomsky says, “Of course it’s funny. You’re just telling it wrong.”

I don’t find that latter one funny at all, as they are telling it wrong.

The pointer is from Jodi Ettenberg of Legal Nomads fame.

What are your picks? You get mine every day.

The gravity equation for on-line education

…about 70 percent of students turn to online programs based at colleges within 100 miles of their home.

Here is more.

On the Hayek-Pinochet connection

Corey Robin has a long post on this, here is one part:

Hayek complied with the dictator’s request. He had his secretary send a draft of what eventually became chapter 17—“A Model Constitution”—of the third volume of Law, Legislation and Liberty. That chapter includes a section on “Emergency Powers,” which defends temporary dictatorships when “the long-run preservation” of a free society is threatened. “Long run” is an elastic phrase, and by free society Hayek doesn’t mean liberal democracy. He has something more particular and peculiar in mind: “that the coercive powers of government are restricted to the enforcement of universal rules of just conduct, and cannot be used for the achievement of particular purposes.” That last phrase is doing a lot of the work here: Hayek believed, for example, that the effort to secure a specific distribution of wealth constituted the pursuit of a particular purpose. So the threats to a free society might not simply come from international or civil war. Nor must they be imminent. As other parts of the text make clear, those threats could just as likely come from creeping social democracy at home. If the visions of Gunnar Myrdal and John Kenneth Galbraith were realized, Hayek writes, it would produce “a wholly rigid economic structure which…only the force of some dictatorial power could break.”

Hayek came away from Chile convinced that an international propaganda campaign had been unfairly waged against the Pinochet regime (and made explicit comparison to the campaign being waged against South Africa’s apartheid regime). He set about to counter that campaign.

He immediately wrote a report lambasting human rights critics of the regime and sought to have it published in the Frankfurter Allgemeine Zeitung. The editor of this market-friendly newspaper refused, fearing that it would brand Hayek as “a second Chile-Strauss.” (Franz Josef Strauss was a right-wing German politician who had visited Chile in 1977 and met with Pinochet. His views were roundly repudiated by both the Social Democrats and the Christian Democrats in Germany.) Hayek was incensed. He broke off all relations with the paper, explaining that if Strauss had indeed been “attacked for his support for Chile he deserves to be congratulated for his courage.”

There is much more at the link.

Bangalore food bleg

Yana is hungry — now — and I will be there in July. Please tell us how and where to eat! And indeed how to think about that eating. I thank you in advance for your contributions.

Turning efficiency wage theory on its head

The co-founder of Florida-based Specialty Medical Supplies has been held since Friday in the executive quarters of his factory on the outskirts of Beijing, he said. About 80 of his 110 employees are blocking doors and locking gates, refusing to let the 42-year-old entrepreneur go until they get severance packages, according to Chip Starnes, the co-founder.

It’s not all bad, however:

Speaking on Monday from behind the bars of a window of the 10-year-old factory that makes alcohol pads and diabetes equipment, Mr. Starnes apologized for his fatigue. He said during the first few nights of his entrapment that employees treated him like a prisoner of war, depriving him of sleep by making jarring noises and shining bright lights in his eyes. There are no guns, however, and Mr. Starnes said that he hasn’t been physically harmed in any way.

And:

Despite becoming a prisoner in his own offices, Mr. Starnes said he is willing to stick it out in China and even a few more weeks in his present confines. “Thankfully when I built the place, I put a toilet in it,” he said.

I noted this sentence from the article:

It is unclear how often executives are held hostage.

Perhaps this should be added to the Doing Business index as a new variable. (Update: it’s pretty common.) In any case, you can read more here.

Life after Google Reader

Via Michael Rosenwald, here is one list of options, with attached evaluations. I have been using Feedly and it is working fine for me. I expected high transition costs, but within a minute or two, and then a system reboot, everything was up and running without a hitch. I did not feel confused by the shift in visual fields, as I had been expecting. I don’t pretend to know it is best, and I may not stick with Feedly forever, but this has not turned out to be a crisis and there is no reason to resent Google for axing their Reader.

Assorted links

1. Jesse Friedman is not cleared.

2. Story on the Millennium Village disputes.

3. Inequality in conducting opportunities.

4. Is there too much co-authorship in economics?

5. Claims about Treasuries and LTRO paydowns, speculative. From Scott here are various market monetarist perspectives on China, Treasuries, and Bernanke.

6. Markets in everything, Great Mutiny of 1857 edition.