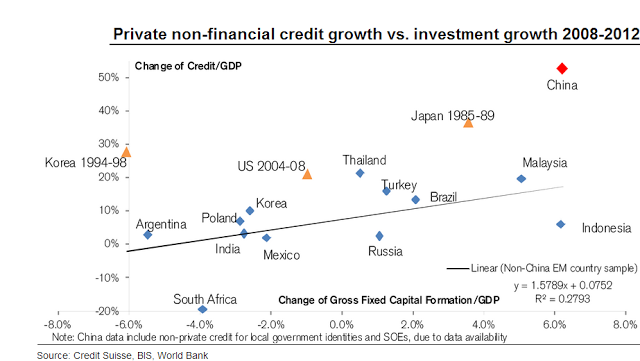

Credit growth vs. investment growth

That’s private non-financial credit growth, and the scatter plot of countries looks like this:

China appears to be well past the danger territory of Japan from the late 1980s. That is from Sober Look citing Credit Suisse.