Month: November 2013

Should the U.S. destroy its stockpile of ivory?

Here is one of the latest developments in economic policy:

The US government hopes to send a crushing message to anyone involved in the illegal ivory trade — by decimating a 6-ton stockpile of seized elephant ivory.

In an announcement posted online, the US Fish and Wildlife Services (FWS) describes plans to “pulverize” a cache of ivory on November 14th. All of the ivory was obtained, the agency notes, from law enforcement efforts to crack down on trafficking over the last two decades. “Destroying this ivory tells criminals who engage in poaching and trafficking that the United States will take all available measures to disrupt and prosecute those who prey on, and profit from, the deaths of these magnificent animals,” reads a statement on the FWS website.

There is more here, via Viktor Brech and Bruce Ryan and Kaushal Desai.

Bruce suggests the government announce it has created an artificial form of ivory, to lower expected prices and discourage future poaching. If they can get away with that lie, great. Otherwise, we all know the 2000 Kremer and Morcom piece entitled simply “Elephants”:

Many open-access resources, such as elephants, are used to produce storable goods. Anticipated future scarcity of these resources will increase current prices and poaching. This implies that, for given initial conditions, there may be rational expectations equilibria leading to both extinction and survival. The cheapest way for governments to eliminate extinction equilibria may be to commit to tough antipoaching measures if the population falls below a threshold. For governments without credibility, the cheapest way to eliminate extinction equilibria may be to accumulate a sufficient stockpile of the storable good and threaten to sell it should the population fall.

That emphasis is added. Sell it, not destroy.

The (gated) AER version of the paper is here. The Montclair State version is here. A few comments and responses are here.

In other words, our government is pursuing symbolic value but at the same time implementing the wrong incentives.

Here is a piece on elephant music-making.

My *Politico* piece on Isaac Asimov and the ideologies of the future

Here is the second paragraph of the piece:

In Asimov’s tale [“Franchise”], set in November 2008, democratic elections have become nearly obsolete. A mysterious supercomputer said to be “half a mile long and three stories high,” named Multivac, absorbs most of the current information about economic and political conditions and estimates which candidate is going to win. The machine, however, can’t quite do the job on its own, as there are some ineffable social influences it cannot measure and evaluate. So Multivac picks out one “representative” person from the electorate to ask about the country’s mood (sample query: “What do you think of the price of eggs?”). The answers, when combined with the initial computer diagnosis, suffice to settle the election. No one actually needs to vote.

The full article is here. There is an on-line version of Asimov’s Franchise here.

Assorted links

1. How Kenyan police receive bribes on their cell phones.

2. Jon Gruber on Obamacare and who is being deceptive and who is not. And claims about the role of the Cabinet in the Obama administration.

4. John Elder Robison quits Autism Speaks.

5. MIE: educate your nanny

6. The new Obamacare fix will create a big mess. Another question is when the insurance companies will start rebelling against ACA.

IBM’s Watson will be made available in a more powerful form on the internet

Companies, academics and individual software developers will be able to use it at a small fraction of the previous cost, drawing on IBM’s specialists in fields like computational linguistics to build machines that can interpret complex data and better interact with humans.

That is a big deal, obviously. The story is here.

What are some of the biggest problems with a guaranteed annual income?

Maybe this isn’t the biggest problem, but it’s been my worry as of late. Must a guaranteed income truly be unconditional? Might there be circumstances when we would want to pay some individuals more than others? Many critics for instance worry that a guaranteed income would excessively reduce the incentive to work. So it might be proposed that the payment be somewhat higher if low income individuals go get a job. That also will make the system more financially sustainable. But wait — that’s the Earned Income Tax Credit, albeit with modifications.

Might we also wish to pay more to some individuals with disabilities, perhaps say to help them afford expensive wheelchairs? Maybe so. But wait — that’s called disability insurance (modified, again) and it is run through the Social Security Administration.

As long as we are moving toward more cash transfers, why don’t we substitute cash transfers for some or all of Medicare and Medicaid health insurance coverage benefits, especially for lower-value ailments? But then we are paying more cash to the sick individuals. That doesn’t have to be a mistake, but it does mean that an initially simple, “dogmatic” payment scheme now has multiplied into a rather complex form of social welfare assistance, contingent on just about every relevant factor one might care to cite.

You can see the issue. Whether on grounds of justice, practicality, or just public choice considerations (“you can keep your current welfare payments if you like them”), we should not expect everyone to be paid the same under a guaranteed annual income. And with enough tweaks, this version of the guaranteed income suddenly starts resembling…the welfare state, albeit the welfare state plus. Unemployment insurance benefits wouldn’t end. More people could get on disability, and without those pesky judges asking so many questions.

The potential problem is that we inherit and in some ways magnify the problems with the current welfare state, rather than doing away with those problems.

Or we could be truly dogmatic about it, and simply pay each person the same amount of money no matter what. But then do we take away the various forms of in-kind aid which are already in place? And what about all those former EITC recipients, whose incentive to work is now lower than ever?

Part of the original appeal of the guaranteed income idea, especially as expressed by Milton Friedman, is that it would substitute for welfare programs and bureaucracies, not all of which work well. On first hearing, the guaranteed income proposal sounds quite “clean.” In reality, that is unlikely to be the case.

And once we recognize the proposal may be “the current welfare state plus some extra and longer-term payments,” one has to ask whether this is really what we had in mind in the first place. It seems that if you wanted to reform current programs and also pay people more (debatable, of course), there may be better and easier ways of doing that than reforms which have to fit under the umbrella of “a guaranteed annual income.”

I still think the core idea is a good one, but perhaps “what the core idea is” is less pinned down than I might have wished.

Here is again Annie Lowrey’s very useful piece, which provides an overview of current proposals.

Pinternet

Very cool.

Inefficient forms of aid

A group of Occupy Wall Street activists has bought almost $15m of Americans’ personal debt over the last year as part of the Rolling Jubilee project to help people pay off their outstanding credit.

Rolling Jubilee, set up by Occupy’s Strike Debt group following the street protests that swept the world in 2011, launched on 15 November 2012. The group purchases personal debt cheaply from banks before “abolishing” it, freeing individuals from their bills.

By purchasing the debt at knockdown prices the group has managed to free $14,734,569.87 of personal debt, mainly medical debt, spending only $400,000.

There is more here, and here. One question is how many of these people will go into bankruptcy anyway. Another is why not just send the money to even poorer individuals? The low market value of the debt, of course, means these individuals (mostly) would not have paid anyway, so the leveraged return on this investment is not as high as is being claimed.

For pointers I thank Mitch Berkson and Samir Varma.

Attempting to insure against your own destruction, enslavement, and cultural abnegation

A new finance product has been proposed:

Funding the Search for Extraterrestrial Intelligence with a Lottery Bond

(Submitted on 11 Nov 2013)I propose the establishment of a SETI Lottery Bond to provide a continued source of funding for the search for extraterrestrial intelligence (SETI). The SETI Lottery Bond is a fixed rate perpetual bond with a lottery at maturity, where maturity occurs only upon discovery and confirmation of extraterrestrial intelligent life. Investors in the SETI Lottery Bond purchase shares that yield a fixed rate of interest that continues indefinitely until SETI succeeds—at which point a random subset of shares will be awarded a prize from a lottery pool. SETI Lottery Bond shares also are transferable, so that investors can benefact their shares to kin or trade them in secondary markets. The total capital raised this way will provide a fund to be managed by a financial institution, with annual payments from this fund to support SETI research, pay investor interest, and contribute to the lottery fund. Such a plan could generate several to tens of millions of dollars for SETI research each year, which would help to revitalize and expand facilities such as the Allen Telescope Array. The SETI Lottery Bond is a savings product that only can be offered by a financial institution with authorization to engage in banking and gaming activities. I therefore suggest that one or more banks offer a lottery-linked savings product in support of SETI research, with the added benefit of promoting personal savings and intergenerational wealth building among individuals.

The pointer is from Mark Rodeghier.

Assorted links

1. How smart software discovers new recipes.

2. Photos of abandoned Christmas and Santa Claus parks.

3. England employed camels and elephants on the home front in World War I.

4. John Tavener has passed away.

5. Barter markets in everything: thirty squats for a train ticket. And the culture that is Sweden: invisible bike helmets.

Firearms and Suicides in US States

Suicides outnumber homicides in the United States by 3:1. (In 2010 there were 38,364 suicides and 12, 996 homicides.) Lots of studies have investigated the relationship between firearms and homicide but the potential for reverse causality makes this a difficult problem. More homicides in a region, for example, might cause an increase in gun ownership so a positive correlation between guns and homicide doesn’t tell you which is cause and which is effect. Reverse causality is less of a problem for understanding the guns to suicide link because it’s less likely that a rash of suicides would encourage gun ownership.

In my latest paper, Firearms and Suicides in US States, (written with the excellent Justin Briggs) we examine the easier question, what is the relationship between firearms and suicide? Using a variety of techniques and data we estimate that a 1 percentage point increase in the household gun ownership rate leads to a .5 to .9% increase in suicides.* (n.b. slight change in language from earlier version for clarity.)

Even if one thinks that suicides don’t cause gun ownership one might imagine that they are correlated due say to a third factor such as social anomie. We have an interesting test of this in the paper. If suicides and gun ownership were being driven by a third factor we would expect gun ownership to be correlated with all suicides not just gun-suicide. What we find, however, is that an increase in gun ownership decrease non-gun suicide. From an economics perspective this makes perfect sense. As gun ownership increases, the cost of gun-suicide falls because guns are easier to access and as the cost of gun-suicide falls there is substitution away from non-gun suicide.

Put differently, when gun ownership decreases other methods of suicide increase. Substitution among methods is not perfect, however, so when gun ownership decreases we see a big decrease in gun-suicide and a substantial but less than fully compensating increase in non-gun suicide so a net decrease in the number of suicides.

Our econometric results are consistent with the literature on suicide which finds that suicide is often a rash and impulsive decision–most people who try but fail to commit suicide do not recommit at a later date–as a result, small increases in the cost of suicide can dissuade people long enough so that they never do commit suicide.

The results in the paper appear to be robust but the data on gun ownership is frustratingly sparse due to political considerations.

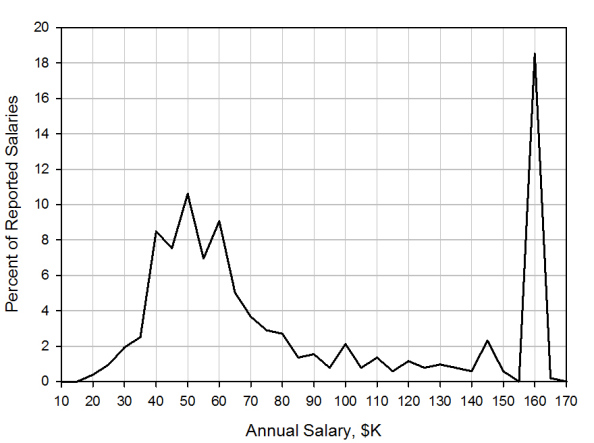

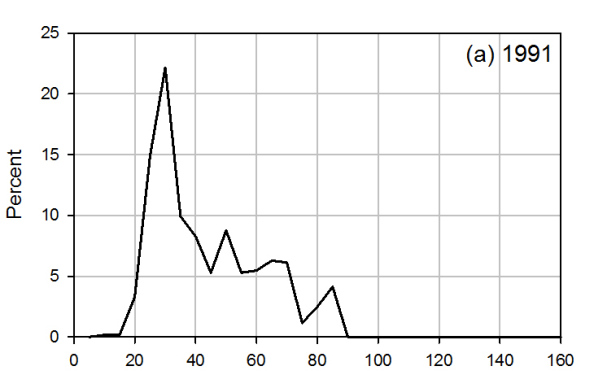

The changing income distribution for lawyers (Average is Over)

As of 2010, a graph of starting salaries looks like this:

As of 1991, it looked like this:

That is from Peter Turchin. Here is a WSJ article by Ben Casselman on the widening job market gap more generally.

*Deliberating American Monetary Policy: A Textual Analysis*

The author is Cheryl Schonhardt-Bailey and that is a new book published by MIT Press. The Amazon link is here. Here is a bit from the book’s home page:

In this book, Cheryl Schonhardt-Bailey provides a systematic examination of deliberation on monetary policy from 1976 to 2008 by the Federal Reserve’s Open Market Committee (FOMC) and House and Senate banking committees. Her innovative account employs automated textual analysis software to study the verbatim transcripts of FOMC meetings and congressional hearings; these empirical data are supplemented and supported by in-depth interviews with participants in these deliberations. The automated textual analysis measures the characteristic words, phrases, and arguments of committee members; the interviews offer a way to gauge the extent to which the empirical findings accord with the participants’ personal experiences.

The new “carry trade”?

Loosely regulated non-bank lenders have emerged as among the biggest beneficiaries of the Federal Reserve’s ultra-low interest rates with three specialist categories increasing their assets by almost 60 per cent since the height of the financial crisis.

Such lenders, widely considered part of the “shadow banking” system, have expanded rapidly on the back of investors who are clamouring for the higher returns on offer from financing riskier types of lending.

From the FT, there is more here.

Assorted links

1. The 100 best novels, as selected in 1898. How many have you never even heard of?

2. Beyond Medicaid? And the Swiss proposal for a guaranteed minimum income.

3. On Krugman and the eurozone, by Anders Aslund. I don’t agree with everything in the piece, but it makes some good points and in any case this perspective is underrepresented in the economics blogosphere.

4. Which animals dislike their own pooh and why.

5. Mirowski responds to critics (pdf). In the end section, he should have been more gracious to Diane Coyle.

6. “He’s my best friend.” (Department of Why Not?) And maybe books do change peoples’ minds after all (NFL player quits after reading Noam Chomsky and the Dalai Lama).

Markets in everything

The words on the website say it all:

Monetize without ads

Let your visitors help you mine Bitcoins

The pointer is from the excellent Ashok Rao.