Month: February 2014

Arrived in my pile

1. Michael Szenberg and Lall Ramrattan, editors, Secrets of Economics Editors.

2. Joel Slemrod and Christian Gillitzer, Tax Systems.

Facebook is introducing more choices for gender identification

You don’t have to be just male or female on Facebook anymore. The social media giant is adding a customizable option with about 50 different terms people can use to identify their gender, as well as three preferred pronoun choices: him, her or them.

I’m all for this development, and I’ll note one extra thing: people who write on “the paradox of choice” are unlikely to ever use this as an example.

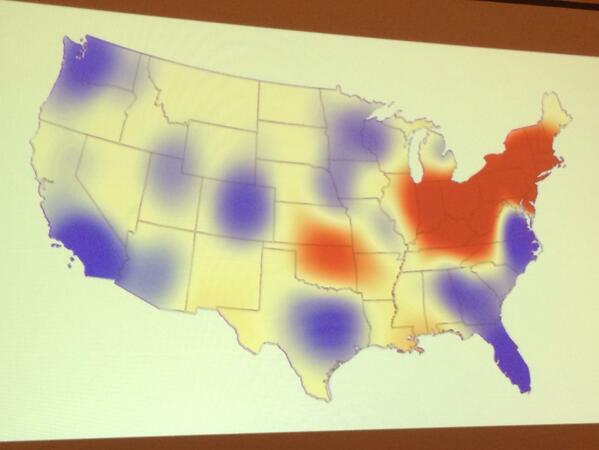

Personality by region

As indicated by words on blogs: red is high neurotic, blue is low. Highly speculative of course:

Assorted links

1. Dan Klein at The Atlantic on the history of the concept of liberalism, and the Scots tradition.

2. Lesser known improvements in the U.S. labor market. Also, proposed minimum wage hike to cover disabled workers.

3. Tandem-pawn chess, designed to put humans on an equal footing with computers.

4. The “hot hand” idea enjoys a resurgence.

5. Growing economies of scale in Bitcoin mining.

6. How a Pandora lawsuit may overturn the economics of the music industry.

7. Update on the Italian situation. And what is wrong with Finland?

How beautiful is mathematics?

From James Gallagher of the BBC:

Mathematicians were shown “ugly” and “beautiful” equations while in a brain scanner at University College London.

The same emotional brain centres used to appreciate art were being activated by “beautiful” maths.

The researchers suggest there may be a neurobiological basis to beauty.

The likes of Euler’s identity or the Pythagorean identity are rarely mentioned in the same breath as the best of Mozart, Shakespeare and Van Gogh.

The study in the journal Frontiers in Human Neuroscience gave 15 mathematicians 60 formula to rate.

Euler’s Identity is a particular favorite of mine, and indeed:

The more beautiful they rated the formula, the greater the surge in activity detected during the fMRI (functional magnetic resonance imaging) scans.

…To the untrained eye there may not be much beauty in Euler’s identity, but in the study it was the formula of choice for mathematicians.

Oh, and this:

In the study, mathematicians rated Srinivasa Ramanujan’s infinite series and Riemann’s functional equation as the ugliest of the formulae.

For the pointer I thank Joanna Syrda.

Why cosmopolitanism is utopian but useful nonetheless

On the topic of Swiss immigration restrictions, Bryan Caplan has an interesting (but I think quite wrong) recent post about the recent immigration vote in Switzerland. He writes:

The main hurdle to further immigration is insufficient immigration. If countries could just get over the hump of status quo bias, anti-immigration attitudes would become as socially unacceptable as domestic racism. Instead of coddling nativism with gradualism, we can, should, and must peacefully destroy nativism with abolitionism.

In other words, we should keep on letting more people in until nativist bias dwindles away into the dustbin of history. I say backlash will set in first, as I have never met a truly cosmopolitan Volk, the cosmopolitanites least of all. I would say Bryan has the moral high ground but not a practicable proposal. Nonetheless we can and should favor less nativism and more immigration at the margin.

Steve Sailer of course is far more skeptical about immigration and he serves up — repeatedly I might add — general strictures in favor of a particularist approach to policy and to immigration in particular. Try this bit from his discussion of Switzerland:

The Swiss, in contrast, put much value on what I call Citizenism. A Swiss Italian is expected to value the welfare of his fellow Swiss citizens more highly than his fellow Italian co-ethnics. And they do.

He expresses related ideas in other posts as well.

My perspective is a synthetic one. Citizenries will in fact always be Citizenist (surprise) and to some extent this is needed to encourage the production of public goods. Caplanian proposals to make citizens otherwise are doomed to fail and probably also to backfire in destructive ways.

Now enter the intellectuals, whom I call The False Cosmopolitanites. The intellectuals, for all of their failings, nonetheless see many of the defects and costs of Citizenism as we find it in the world. The intellectuals therefore should push for marginal moves toward a stronger cosmopolitanism, even though in a deconstructionist sense their inflated sense of superiority and smugness, while doing so, is its own form of non-cosmopolitanism. Sailer’s failing is to think or imply that the costs of The False Cosmopolitanites are higher, or more worthy of scorn, than the costs of Citizenism, and also the costs of other particularist doctrines, some of which are less savory than Citizenism by some degree. The comparison of where the major injustices are generated is not even close.

Both the Caplan memes and the Sailer memes can generate an unending supply of entertaining and indeed edifying blog posts. Caplan can point to the fallacies of the Citizenists, which are numerous, extreme, and which create high humanitarian costs, including through war and unnecessary immigration restrictions. Sailer can skewer The False Cosmopolitanites, who serve up a highly elastic and never-ending supply of objectionable, fact-denying, self-righteous nonsense. Blog post by blog post, either approach will appear to “work” in its own terms. And blog post by blog post, either approach will be susceptible to attack by outsiders who insist on the opposing perspective.

It is only the synthetic and marginalist cosmopolitan approach which sees its way through this thicket.

Embedded in all of this, Caplan is more particularistic than he lets on, embodying and glorifying a form of upper-middle class U.S. suburban culture of which I am personally quite fond. Sailer is de facto less on his actual professed side than his own writings will admit, and in fact a group of ardent Citizenists, if they were informed enough to apply their doctrines consistently, might cut him down some notches as a non-conformist and smart aleck who plays at the status games of The False Cosmopolitanites. Sailer insists on relativizing and deconstructing The False Cosmopolitanites, which is fine by me, but at the same time he overestimates their power and influence and thus he falsely imagines a need to take up common cause with the Citizenists, a group it seems he enjoys more from a distance.

You will find related ideas in my book Creative Destruction: How Globalization is Changing the World’s Cultures. And here are by the way are my previous posts on horse nationalism.

*Prisoners of War*

This is the Israeli-TV source for the better-known U.S. show Homeland. Homeland seems like and indeed is a completely implausible plot line, and that aside about a third of the episodes are downright awful. It is saved by having one of the most incandescent romances in screen history, namely between Carrie and Brody, a passion which burns so brightly yet collapses immediately into the banal once any hint of peaceful calm is introduced, thereby necessitating certain plot twists which close out season three.

Prisoners of War [Hatufim] avoids these problems and takes away the romantic gloss. The movie shows torture scenes repeatedly, and even if not with full realism it does not feel like typical Hollywood treatment. There is more than one captive and the pace is slower and more contemplative. Parents play a larger role in this story. The “Carrie figure” has a smaller and less narcissistic profile. The “Sol figure” remains Jewish. I have heard Israelis object to what you might call an…unsentimental…portrait of the Israeli state in the series. And “the first season of Hatufim was Israel’s highest-rated TV drama of all time.”

I recommend this show for most followers of intelligent TV. You can watch on Hulu or order the discs, season two is on its way in the post from Israel. The creator, Gideon Raff, plans to produce a season three as well. Here is a NYT review of the Israeli series. Here is a Guardian review. Here is The New Yorker. Here is a brief trailer.

Assorted links

1. Indians vs. tigers. Not baseball.

2. There is no great stagnation, laser pizza edition. And some positive results for fusion power. And how immigrants saved London.

3. Evidence for countersignaling, nerds rejoice.

4. Using NPR’s Planet Money to teach macroeconomics.

The Return of Command and Control

I spoke earlier this week at a conference on markets and the environment at the R Street Institute (I spoke about prizes). Many of the speakers were Reagan era politicians and appointees who are proud of Reagan and Bush’s successful approach to the environment and decry the inability to make progress today.

Back then, Republican’s were willing to accept environmental goals so long as they were achieved efficiently using market means and Democrats were willing to accept markets means to achieve environmental goals. Today, the Republicans are no longer willing to accept the environmental goals regardless of the means. The result, however, hasn’t been the ending of the goals it’s been that Democrats no longer accept market means.

Jeffrey Frankel argues that the net effect has been a disastrous return to command and control.

In the United States, the highly successful cap-and-trade system for sulfur-dioxide emissions has effectively vanished. In Europe, the Emissions Trading System (ETS), the world’s largest market for carbon allowances, has become increasingly irrelevant as well. On both sides of the Atlantic, market-oriented environmental regulation has in effect been superseded over the last five years by older “command-and-control” approaches, by which the government dictates who should use which technologies, in what amounts, to reduce which emissions.

As recently as 2008, the Republican candidate for US president, Senator John McCain, had sponsored legislative proposals to use cap and trade to address emissions of carbon dioxide and other greenhouse gases.

But Republican politicians now seem to have forgotten that this approach was once their policy. In 2009, they worked to defeat climate-change legislation by relying on anti-regulation rhetoric that demonized their own creation. This left only less market-friendly alternatives – especially after court cases upheld the validity of the 1970 Clean Air Act. Though such alternatives are less efficient, they are again the operative regime.

…government attempts to address market failures can themselves fail. In the case of the environment, command-and-control regulation is inefficient, discourages innovation, and can have unintended consequences (like Europe’s growing reliance on coal).

*House of Debt*

That is the new book by Atif Mian and Amir Sufi and the subtitle is How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again. As the title suggests, the argument focuses on household debt and also its subsequent effects on aggregate demand. Here is one bit:

From 2006 to 2009, large net-worth-decline counties cut back on consumption by almost 20 percent. This was massive. To put it into perspective, the total decline in spending for the U.S. economy was about 5 percent during these same years. The decline in spending in these counties was four times the aggregate decline. In contrast, small net-worth-decline counties spent almost the exact same amount in 2006 as in 2009.

There is much in this book of interest, but the problem is on the theoretical side. High debt means higher payments to banks and other intermediaries, and so that money need not disappear from the stream of aggregate demand. Investment is AD too, and more generally AD theories based on short-term changes in the distribution of wealth have not generally succeeded in the past (with apologies to Michael Kalecki). It is true that wealth redistribution will induce sectoral reallocations, perhaps significant ones, but then a debt-collapse theory requires a lot of the predictions of sectoral shift theories. At least for the recent crisis that is not obviously going to do the trick, even if sectoral shifts have been underrated by a lot of Keynesian commentators.

I would sooner start the foundations with multiple equilibria and then add on the Swedish and also Hayekian notion of intertemporal equilibrium, period analysis, and satisfied plans, or lack thereof. Excess household debt then can slot into that argument neatly, and without putting so much burden on wealth redistribution and sectoral shifts per se.

In any case this is a book worth reading and pondering. You can follow Sufi on Twitter here.

A merchant’s perspective on Bitcoin

From William Coates, here are a few points of note:

Transaction fees are fairly horrible with traditional payment providers, especially when it comes to smaller transactions, as there is often a minimum fee.

Let us, for example, consider the purchase of a music track costing 1.49 euro from our store. Paypal charges us 3.4%, plus a 35-cent fee for each transaction. So, in this case, Paypal would get 40 cents from this transaction: a 27% fee.

Now charges that high aren’t going to be sustainable for any low-margin business (they are probably fine if you are selling Bolivian marching powder, though!). To get round the problem, we at digital-tunes.net charge our customers a 35-cent surcharge on Paypal payments, to help us offset the exorbitant fees.

With bitcoin, transaction fees are entirely optional. The currency’s protocol allows you to set the transaction fee to zero if you so wish, however this might mean it takes a bit longer to process.

The idea behind bitcoin transaction fees is that the computers running the network (in an entirely distributed manner) get to keep the transaction fees associated with the transactions they have successfully processed.

It’s quite likely that, in the future, we will see the fees be determined by the market, and if you want your transaction processed as fast as possible, you will have to pay a premium. Currently, transaction fees are not the primary motivation for people to run the network, but that’s an entirely other topic. A useful graph showing the fees charged by the entire network over time can be viewed here.

The article offers other points of interest.

Gabriel Axel, RIP

He was the director of Babette’s Feast and he just passed away at age 95. What stuck with me most from that movie, and what is one of my favorite sentences ever, Axel himself cited upon receiving an Oscar:

Mr. Axel was a week shy of his 70th birthday when he took the podium in Los Angeles in April 1988 to accept the award. After saying his thank-yous, he quoted a line from his film: “Because of this evening, I have learned, my dear, that in this beautiful world of ours, all things are possible.”

The obituary is here.

How to hack the subway using fare arbitrage

Could you save swapping tickets with another commuter during your journey so that the total you both pay is less? This kind of riskless profit-taking, or arbitrage, is common in capital markets where traders aggressively seek out and exploit these inefficiencies in the market. Could commuters also benefit?

Today we get an answer thanks to the work of Asif Haque, a data scientist at Twitter, who has analysed the possibility of fare arbitrage on the San Francisco metro system, known as BART (Bay Area Rapid Transit). Haque says that not only are opportunities for fare arbitrage possible on BART, they occur on more than 13 per cent of all pair-wise combinations of journeys offering considerable potential for savings.

Spotting fare-arbitrage opportunities is relatively straightforward in principle. Armed with an up-to-date fare guide, it’s simple to find out whether a particular pair of trips allows for arbitrage.

People what are you waiting for? This sounds almost as good as arbitrage using the Forever Stamp:

Haque says that 60,334 of these pairs or 13.5 per cent, have an arbitrage opportunity of at least 5 cents. And 4,666 of these pairs of trips could save commuters at least $1. Haque has generously posted the full list of these 4,666 fares here.

There is further discussion, with examples, here. For the pointer I thank Tom Fowler.

Improving GDP

Under EU rules Britain will add illegal drug sales and prostitution to its calculations of GDP:

HPost: Britain makes £10 billion a year thanks to drug dealers and prostitutes, the government’s statistics watchdog is set to confirm.

The Office for National Statistics is expected to comply with new EU rules by revealing its first estimates for the size of the illegal industries and how it has reached these calculations as soon as March or April.

Prostitution in Britain is set to be valued at around £3 billion a year while the drug dealing sector is set to be valued at £7 billion, with both of them factored into the UK’s £1.6 trillion gross domestic product, according to the Times.

Assorted links

1. Signaling, part I, and signaling part II. And reminiscences of former heroin users.

2. Arthur Chu on the science of winning Jeopardy.

4. Predicting medals at the Winter Olympics.

5. Which out of print books do people search for the most?

6. You, Sir, are a fish face. And some species of crocodiles can climb trees. And my instinct is always to side with Robert Trivers.