Month: March 2014

Nate Silver’s 538 is up and running

You will find it here.

Here is a piece on economic data. What it says is fine, but it won’t interest me. I wished this piece on hockey goalies had been longer and more analytic. The same is true for this piece on corporations hoarding cash, which also could use more context. Maybe it is I rather than they who is misjudging the market, but to me these are “tweener” pieces, too superficial for smart and informed readers, yet on topics which are too abstruse for the more casual readers. I want something more like the very good Bill Simmons analytic pieces on Grantland, with jokes too, and densely packed narrative, yet applied to a much broader range of topics. Barring that, I am happy to read one very good sentence or two on a topic.

Here is a piece on whether guessing makes sense on the new SAT. It is fine but presents material already covered in places such as NYT.

Here is Silver’s introductory essay as to what they are about. It is too sprawling and evinces a greater affiliation to rigor with data analysis than to rigor with philosophy of science or for that matter rigor with rhetoric.

I have long been a fan of Nate Silver, but so far I don’t think this is working.

Lucy Kellaway on advice

In the process of sounding like Robin Hanson, she refers to:

…something important about advice in general. From the issuer’s point of view, admonitions are not meant to be followed at all. In fact, they are positioning statements that tell the world about the values the issuer would like it to think they hold.

From the recipient’s perspective there is no question of following the advice anyway. As John Steinbeck pointed out “Nobody wants advice – only corroboration.”

From the FT there is more here which you should read.

Only Singapore markets in everything

For the pointer I thank Michelle Dawson, citing David Dobbs.

Assorted links

1. From Neal Stephensohn’s Reamde. It concerns aviation and other issues in recent current affairs.

2. New blog on robot economics.

3. Dubious but interesting claims about new ways of punishing prisoners.

4. Is there still communism in China? And the PRC according to Baidu autocomplete.

5. Are some of the traditional ladders out of poverty disappearing?

What happened to the Malaysian plane?

I have read many of the accounts and I am following this story with interest. As to what happened, I don’t care to hazard a very particular guess. But I wish to make a general point about puzzles. When an event appears extremely puzzling, there are often a few ways out:

1. One or more of the agents in the story has a capacity to behave more irrationally than you might think. Even if you believe people are reasonably rational, by examining a puzzle you are to some extent selecting for a situation with irrational behavior from some of the participants. And sometimes the line between irrational behavior and totally incompetent behavior is a thin one or it is absent altogether.

2. Our own ability to use the argument from exclusion (it cannot be A, B, or C, therefore only D remains) to reach reliable conclusions is extremely dubious and limited.

3. There are more conspiracies than we are usually aware of, and sometimes these conspiracies shape events.

I tend to favor #1 and #2 over #3. The core insight perhaps is that it is easier for coordinated events to fail to happen than to happen. That does not explain what went on, but it does slant me away from some of the more extreme (and worrying) scenarios.

The fate of the plane and its passengers is of course a matter of intrinsic interest. But I also find interesting the question of whether a social scientist, or an economist, should have a systematically different interpretation of what might be going on, if only stochastically. And if we don’t…what good are we?

#LimitsofRatiocination

Which of the new mega-web sites will succeed?

There is the NYT’s and David Leonardt’s The Upshot, Nate Silver’s and ESPN’s 538, and the Ezra Klein and Melissa Bell-led Vox.com. Probably they don’t want to be compared to each other, but they will be anyway so why can’t I make the same mistake? I would ask the following questions, among others:

1. Which group has a cohesive core of initial workers, loyal to each other, and loyal to a common mission and vision for the project?

2. Which group has a charismatic leader who understands his role is now that of leader, and who can credibly sit down with venture capitalists, bosses, donors, and the like?

3. Which group has the capability to scale from a small operation to a larger, more bureaucratized level, without completely losing its initial inspiration and cohesion?

4. Which group has the best core idea for how to deliver a sustainable and interesting product?

5. Which group has the tightest connection to a web-obsessed back-up firm for project development and support?

6. Which group has the best and deepest collection of talent?

7. Which group has the strongest brand name behind it?

It seems to me The Upshot wins on #7, although arguably that is a partial weakness as well. It helps them “survive at all,” but gives them less incentive to come up with a new and workable model. ESPN is a strong TV and sports brand, but maybe not so strong among those who crave data-driven analysis. The ESPN connection might even give 538 too many readers who want something else, at least insofar as the ESPN home pages are used as feeders. It is hard to write for uninspired readers. I would think Vox wins on #2, possibly on #1, and at least tie on #5 and possibly win on it. About #4 — which of course is central — we are quite uncertain and thus we must be highly uncertain overall.

For legal reasons, U.S. lags in commercial drone use

In Japan, the Yamaha Motor Company’s RMAX helicopter drones have been spraying crops for 20 years. The radio-controlled drones weighing 140 pounds are cheaper than hiring a plane and are able to more precisely apply fertilizers and pesticides. They fly closer to the ground and their backwash enables the spray to reach the underside of leaves.

The helicopters went into use five years ago in South Korea, and last year in Australia.

Television networks use drones to cover cricket matches in Australia. Zookal, a Sydney company that rents textbooks to college students, plans to begin delivering books via drones later this year. The United Arab Emirates has a project underway to see if government documents like driver’s licenses, identity cards and permits can be delivered using small drones.

In the United Kingdom, energy companies use drones to check the undersides of oil platforms for corrosion and repairs, and real estate agents use them to shoot videos of pricey properties. In a publicity stunt last June, a Domino’s Pizza franchise posted a YouTube video of a “DomiCopter” drone flying over fields, trees, and homes to deliver two pizzas.

But when Lakemaid Beer tried to use a drone to deliver six-packs to ice fishermen on a frozen lake in Minnesota, the FAA grounded the “brewskis.”

Andreas Raptopoulous, CEO of Matternet in Menlo Park, Calif., predicts that in the near term, there will be more extensive use of drones in impoverished countries than in wealthier nations such as the U.S.

He sees a market for drones to deliver medicines and other critical, small packaged goods to the 1 billion people around the globe who don’t have year-round access to roads.

There is more here, via Claire Morgan.

Open Borders Day!

Today, March 16, is Open Borders Day, a day to celebrate the right to emigrate and the right to immigrate; to peacefully move from place to place. It is a day worth celebrating everywhere both for what has been done already and for the tremendous gains in human welfare that can but are yet to be achieved. It is also a day to reflect on the moral inconsistency that says “No one can be denied equal employment opportunity because of birthplace, ancestry, culture, linguistic characteristics common to a specific ethnic group, or accent” and yet at the same time places heavily armed guards at the border to capture, imprison, turn back and sometimes kill immigrants.

Crimea through a game theory lens

That is my latest NYT column and you will find it here. Here is one excerpt:

Long before Malcolm Gladwell popularized the concept [of tipping points], Mr. Schelling created an elegant model of tipping points in his groundbreaking work “Micromotives and Macrobehavior.” The theory applies to war, as well as to marketing, neighborhood segregation and other domestic issues. In this case, the idea of negotiated settlements to political conflicts may be fraying, and the trouble in Crimea may disturb it further, moving the world toward a very dangerous tipping point.

First, some background: With notable exceptions in the former Yugoslavia and in disputed territories in parts of Russia and places like Georgia, the shift to new governments after the breakup of the Soviet Union was mostly peaceful. Borders were redrawn in an orderly way, and political deals were made by leaders assessing their rational self-interest.

In a recent blog post, Jay Ulfelder, a political scientist, noted that for the last 25 years the world has seen less violent conflict than might have been expected, given local conditions. Lately, though, peaceful settlements have been harder to find. This change may just reflect random noise in the data, but a more disturbing alternative is that conflict is now more likely.

Why? The point from game theory is this: The more peacefully that disputes are resolved, the more that peaceful resolution is expected. That expectation, in turn, makes peace easier to achieve and maintain. But the reverse is also true: As peaceful settlement becomes less common, trust declines, international norms shift and conflict becomes more likely. So there is an unfavorable tipping point.

In the formal terminology of game theory, there are “multiple equilibria” (peaceful expectations versus expectations of conflict), and each event in a conflict raises the risk that peaceful situations can unravel. We’ve seen this periodically in history, as in the time leading up to World War I. There is a significant possibility that we are seeing a tipping point away from peaceful conflict resolution now.

Do read the whole thing.

More generally, here is a new edited volume on the economics of peace and conflict, edited by Stergios Skaperdas and Michelle Garfinkel.

And here is the new forthcoming Robert Kaplan book Asia’s Cauldron: The South China Sea and the End of a Stable Pacific. I have pre-ordered it.

Yet another case where prediction markets would come in handy

From the Financial Times (not Pravda):

Nikolai Vasiliev, a Crimean businessman, can hardly wait for his region to be annexed by Russia. It would “give us a new lease of life”, he says.

Mr Vasiliev is the general manager of AO Pnevmatika, a former state-owned engineering company that has struggled since the Soviet break-up. Now, he hopes, a bold future beckons in a newly minted Russian province.

“A huge market will be opened up to us,” he says. “We will have access to cheap Russian raw materials and low-priced gas and electricity. And the wages of our workers will rise to Russian levels.”

…Alexander Basov, head of the local chamber of commerce, echoes a widely held view that a Russian-ruled Crimea would garner more attention – and investment – from Moscow than it ever got from Kiev.

“Since independence, Ukraine has treated Crimea like an unloved stepchild, not a real son,” he says. “No big factory has been built here in the last 20 years. The only spending was on repairs to the road from Simferopol to the state dacha in Yalta.”

Yet on the other hand:

There are plenty of dissenting voices. One leading Simferopol businessman, who asked not to be named, said the impact of union with Russia on Crimea’s economy would be devastating, especially if the rest of the world refused to recognise it. “There will be no foreign investment in a place with such a dodgy legal status,” he says. “And the odds are that even Russians will not want to invest here.”

There is also concern that Crimea could not survive a total break from mainland Ukraine, the source of much of its water and electricity, with fears that if the peninsula votes to secede in a referendum planned for Sunday, Kiev could retaliate by switching off the lights or imposing an economic blockade. Already, Mr Vasiliev said, train links between Crimea and other parts of Ukraine had been cut or scaled back and online bank transfers from the Ukrainian Treasury shut down.

The huge bureaucratic headaches any change in Crimea’s status would cause are also worrying the business community. “I’ll have to get a new passport, re-register my business, my house,” said Ibrahim Zinedin, who trades in construction materials. “All that will take time and cost a lot.”

Loyal MR readers will not be surprised to read I would put my bets on the more negative scenario. There is more here.

Assorted links

1. Are cash transfers overrated?

2. The behavioral benefits of castration (a new topic for behavioral economics?)

3. METRICS: waging war on sloppy science.

Bill Gates on poverty

Should the state be playing a greater role in helping people at the lowest end of the income scale? Poverty today looks very different than poverty in the past. The real thing you want to look at is consumption and use that as a metric and say, “Have you been worried about having enough to eat? Do you have enough warmth, shelter? Do you think of yourself as having a place to go?” The poor are better off than they were before, even though they’re still in the bottom group in terms of income.

The way we help the poor out today [is also a problem]. You have Section 8 housing, food stamps, fuel programs, very complex medical programs. It’s all high-overhead, capricious, not well-designed. Its ability to distinguish between somebody who has family that could take care of them versus someone who’s really out on their own is not very good, either. It’s a totally gameable system – not everybody games it, but lots of people do. Why aren’t the technocrats taking the poverty programs, looking at them as a whole, and then redesigning them? Well, they are afraid that if they do, their funding is going to be cut back, so they defend the thing that is absolutely horrific. Just look at low-cost housing and the various forms, the wait lists, things like that.

As you would expect, the interview is interesting throughout. For the pointer I thank Samir Varma.

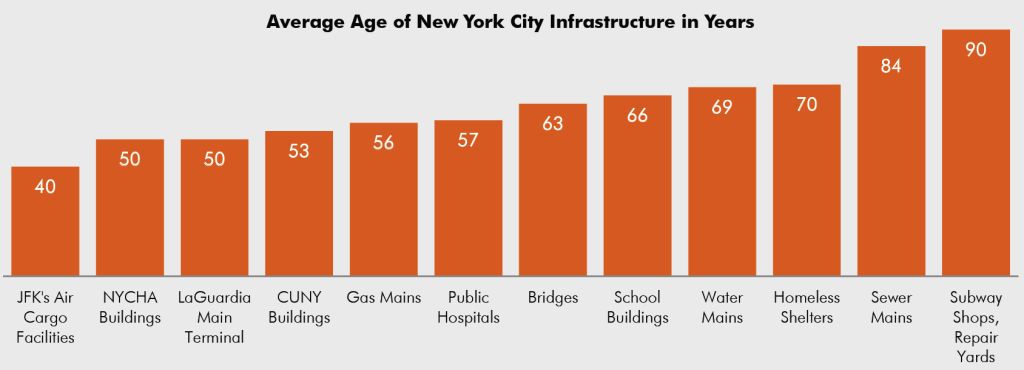

The Cost of Aging Infrastructure

The complete destruction of a building in NYC from a gas explosion makes this report (pdf, summary here), from which the graphic is drawn, from the Center for an Urban Future timely. The Center also reports that the cost of building infrastructure in NYC has risen by 50% since 2000 alone. As I said in Launching the Innovation Renaissance:

Building in the United States today, for example, requires navigating a thicket of environmental, zoning and aesthetic regulations that vary not only state by state but county by county. If building a house is difficult, try building an airport. Passenger travel has more than tripled since deregulation in 1978, but in that time only one major new airport has been built: Denver’s. That airport is now the fourth busiest in the world. Indeed the top seven busiest airports are all in the United States, not so much because we are big but because without new construction we are forced to overcrowd our existing infrastructure. The result is delays and inefficiency. Meanwhile, China is building 50 to 100 new airports over the next 10 years.

…Our ancestors were bold and industrious. They built a significant portion of our energy and road infrastructure more than half a century ago. It would be almost impossible to build that system today. Could we build the Hoover Dam today? We have the technology. We seem to lack the will. Unfortunately, we cannot rely on the infrastructure of our past to travel to our future.

Can we trust online physicians’ ratings?

That is a new paper by Susan F. Lu & Huaxia Rui, here is the abstract:

Despite heated debate about the pros and cons of online physician ratings, very little systematic work examines the correlation between physicians’ online ratings and their actual medical performance. Using patients’ ratings of physicians at RateMDs website and the Florida Hospital Discharge data, we investigate whether online ratings reflect physicians’ medical skill by means of a two-stage model that takes into account patients’ ratings-based selection of cardiac surgeons. Estimation results suggest that five-star surgeons perform significantly better and are more likely to be selected by sicker patients than lower-rated surgeons. Our findings suggest that we can trust online physician reviews, at least of cardiac surgeons.

The pointer is from Andres Marroquin.

Which countries will fare worst from a Chinese slowdown?

If you want to look at some good tables ranking the vulnerability of emerging countries to China, you could do worse than check Craig Botham of Schroders’ views summarised at http://blogs.ft.com/beyond-brics/2014/03/13/ranking-em-vulnerability-to-china/#axzz2vlzb3Xby. According to this, Chile, Columbia, Russia, South Africa and Peru are the most exposed, but few countries in Asia get off lightly, or Brazil for that matter. And while Australia doesn’t figure, of course, Perth should. And because of other concerns people have about the lack of demand in Australia ex-Perth, creeping weakness in employment, and looming instability in housing and mortgage markets, this is definitely a ‘watch-this-space’.

Looking at copper, half of China’s usage is accounted for by infrastructure and construction, and a further third by consumer and industrial goods. To the extent this reflects China’s development model, i.e. with an emphasis on fixed investment and exports, respectively, it is clear that economic rebalancing away from these sectors to household goods and services must entail a significant fall-out in terms of the commodity intensity of growth.

China’s consumption of other commodities also accounts for a hefty share of global production, though not as large as for base metals. In the case of non-renewable energy resources, the proportion is 20%, and for major agricultural crops, it’s 23%.

That is from George Magnus.