Month: May 2014

Economic Revolution: Song China & England

There is a new and lengthy paper (pdf) by Ronald A. Edwards on this topic. It starts quite slow, becomes much more interesting, and even incorporates numerous Japanese sources. It is worthwhile if read selectively, and with some knowledge of the relevant historical background. It deals with the key question of why there wasn’t an industrial revolution in Song China, in the 10th century A.D. and afterwards. Or was there? Here is the abstract:

I claim that China during the Song Dynasty (960 – 1279 AD) (Song China hereafter) experienced the onset of an Economic Revolution, preceding England’s by nearly a millennium. The concept of Economic Revolution is defined to include two types – one Premodern (non-science based) with a low growth rate of per capita product and one Modern (science-based) with a high growth rate of per capita product. It is argued that the Song China vs. England comparison is more relevant than other comparisons with England. Using both the Song China and England episodes, I introduce a new definition of the “onset of an Economic Revolution” that identifies preliminary social changes. I call this the Embryonic Stage and contend that it causes firm formation, household changes and an increase in the pace of technological innovation. I argue the Embryonic Stage more clearly identifies and dates the onset of an Economic Revolution. This has important implications for causal theories.

For the pointer I thank Daniel Houser.

The free rider problem as illustrated by a Japanese fencing video

Jason Kottke blogs:

A Japanese TV show took three expert fencers and pitted them against 50 amateurs.

I honestly didn’t think this would be that interesting and expected the Musketeers to easily get taken out right away or, if they survived more than 30 seconds, to handily finish off the rest of the crowd…nothing in between. But it’s fascinating what happens. The crowd, being a crowd, does not initially do what it should, which is rush the experts and take them out right away with little regard for individual survival. But pretty much every person fights for themselves. And instead of getting easier for the Musketeers near the end, it gets more difficult. The few remaining crowd members start working together more effectively. The survival of the fittest effect kicks in. The remaining experts get sloppy, tired, and perhaps a little overconfident. The ending was a genuine shock.

https://www.youtube.com/watch?v=PgKg0Hc7YIA

How many World Bank reports are downloaded or cited at all?

About 13 percent of policy reports were downloaded at least 250 times while more than 31 percent of policy reports are never downloaded. Almost 87 percent of policy reports were never cited. More expensive, complex, multi-sector, core diagnostics reports on middle-income countries with larger populations tend to be downloaded more frequently. Multi-sector reports also tend to be cited more frequently. Internal knowledge sharing matters as cross support provided by the World Bank’s Research Department consistently increases downloads and citations.

By the way, about 49 percent of these reports have the stated objective of informing the public debate. There is more here, from the World Bank itself, by Doerte Doemeland and James Trevino.

A prediction: from MR alone, this will be one of the Bank’s most widely downloaded reports.

Hat tip goes to Justin Sandefur.

Wednesday assorted links

2. So what happens if Scotland votes yes? (highly speculative)

3. Minimum wages and the deserving poor.

4. Gary Becker’s policy views.

5. Minimum viable block chain.

6. How to price a milkshake? And stuff cheap, people expensive.

7. How will the world of work change? Martin Wolf hosting myself, Diane Coyle, more.

Two Surefire Solutions to Inequality

Here is a surefire solution to inequality–Increase fertility among the rich. If the rich had more children, capital would grow more slowly across the generations and perhaps not at all. If r=4 and g=2 then capital doubles as a share of the economy in 35 years (using the rule of 70). That figure is actually too low as it assumes that the wealthy save all of their capital income but let’s stick with 35 years and call that a generation. Wealth per rich person, however, only doubles if every wealthy family has just 2 children. If every wealthy family has 4 children, wealth per person doesn’t increase and so inequality does not increase even when r>g. If the wealthy consume about 20% of their capital income (still a very high savings rate) and have just 3 children then again we have approximate balance and no increase in inequality over the generations. With a more reasonable figure on r-g or with more children, wealth per person actually declines.

Thus, Piketty’s “patrimonial capital” contains its own internal contradiction. The more patrimony the less capital.

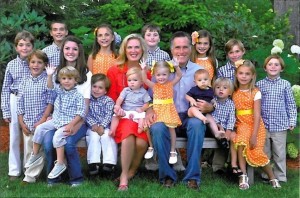

So how can we increase fertility among the rich? Mormon fertility is higher than average so capital inequality could decline if more rich people will be or become Mormons. Had we elected a President Romney (5 children and some 22 grandchildren! Or is it 23? Romney has lost count), perhaps that would have encouraged greater fertility among the rich.

So how can we increase fertility among the rich? Mormon fertility is higher than average so capital inequality could decline if more rich people will be or become Mormons. Had we elected a President Romney (5 children and some 22 grandchildren! Or is it 23? Romney has lost count), perhaps that would have encouraged greater fertility among the rich.

It’s an evolutionary puzzle why the rich don’t have more children as the costs to them are low and at very high levels of wealth there is no quantity-quality tradeoff. Perhaps this is a temporary response to the shock of birth control. If so, the effect of the shock is likely to fade over time as evolution works its logic.

In Selfish Reasons to Have More Kids Bryan Caplan notes that we overestimate the effect of parental investment on children and we underestimate the pleasures of grandchildren, in both cases choosing too few children. The rich should read Bryan’s book.

In these calculations I have assumed that primogeniture won’t make a comeback, that seems solid. Assortative mating, however, will slow wealth dispersion. I have also assumed that savings and fertility are independent which is unlikely to be the case. Becker and Barro (1988) suggest that more children will increase savings but less than proportionally so the logic continues to hold. Note also that this works both ways, wealthy people with fewer children will save less. Bill Gates has three children but has already given away a substantial fraction of his fortune and he has pledged to give away much more. Even parental altruism has its limits and Bill Gates has decided that on the margin he would rather give money to poor children in Africa than to his own children. Bill Gates’s shadow will not eat our future.

So what is the second surefire method to reduce capital inequality? Reduce fertility among the rich! If the rich as a class have fewer than 2 children then it follows inexorably that their time is numbered, albeit without first creating a small number of very rich people.

The logic of r-g turns out to be highly dependent on savings behavior, fertility decisions and the nature of altruistic bequests.

Points of view contrary to my own

1. Here is Timothy Lee on the Comcast merger.

2. Will Obamacare help you live longer? This result seems too rapid and too large to be attributable to improved access to health care, and out of line with other more general (non-policy) estimates.

Still, many people are touting this result. In any case we are committed to providing you with a broad range of perspectives, including those contrary to our own, so do read these. I am in the midst of travel and will not have a chance to read the health care study for a while.

19th century inequality and the arts

Here is a well-written piece by Epicurean Dealmaker (ED) on the arts and economic inequality. Another response is here from Salon, also see the pieces that ED links to, such as Henry Farrell (and more here and Matt here). Unfortunately, ED cannot get beyond his preferred framing of the problem in terms of inequality and inequality alone. He has “inequality on the brain.”

Here is the nub of the critique:

Cowen takes a detour to praise the cultural dynamism and productivity of 19th Century France, which he claims results from the substantial socioeconomic inequality of the period. This is a pivot too far.

ED fails to note that:

1. Much of the artistic creativity of the 19th century stemmed from its wealth creation, not from its inequality per se. He specifies a setting where a robber baron stole from a working man, and supposes I am defending the theft by arguing it brought us some good art. That is an imaginary creation of ED. The very passage from me he cites refers to the virtues of wealth but does not refer to inequality.

2. For much of the latter three-quarters of the 19th century, consumption inequality appears to have declined. Oops.

3. Many of his intemperate statements about the history of art are wrong or doubtful or exaggerated and have been answered or at least contested, including in the five books I have written on the economics of the arts, including In Praise of Commercial Culture.

4. Let’s not talk about “the arts.” Reproducible and non-reproducible art forms will respond very differently to income inequality, as Alex and I argued in the SEJ. Cooking is yet another story, if we are going to call that art.

5. Piketty himself neglects the “wealth can generate additional TFP” possibility, and that remains a significant hole in his argument.

Overall this ED post is a good example of how easily and quickly one can go awry by an obsession with framing everything in terms of inequality. It also shows the drawbacks of a relative unfamiliarity with the basic literature, including for that matter the recent book by Piketty.

Qatari license plate markets in everything

A Qatari man with far too much money and way too little common sense has bought Qatar’s most expensive license plate. The registration ’55555′ cost just under $4 million. I’ve never felt the urge to steal a license plate before just to inconvenience someone, now, however…

Still, I am sure that this guy feels hugely inadequate as compared to the Emirati who splashed the practically immoral sum of $14.3 million dollars for the licence plate ’1′ in 2008.

Calling Robert H. Frank…

Background is here, price information is here.

For the pointer I thank Paul Musgrave.

Cornwall and Wales under purchasing power parity (British average is over)

The grim truth about pay and living standards in some the regions of the UK has also been highlighted by official EU figures showing that parts of Britain are effectively poorer that countries from former communist countries in Eastern Europe.

People in Cornwall and the Welsh Valleys are worse off than residents of Estonia and Lithuania, according to Eurostat figures comparing wealth across the EU using a measure known as “purchasing power standards” – which takes into account GDP per person and cost of living.

In addition, Durham and the Tees Valley, in the north east of England, are poorer than those in the wealthiest regions of Bulgaria and Romania, the two most deprived countries in the EU.

By contrast, the Eurostat figures show that London is the richest place in Europe.

There is more here.

Assorted links

Is Brooklyn getting poorer?

At the median, yes, according to Daniel Kay Hertz:

I recently ran across a post from data-crunching blog extraordinaire Xenocrypt, which noted that from 1999 to 2011, median household income in Brooklyn fell from $42,852 to $42,752…

Furthermore in large parts of Brooklyn real estate prices are falling. You can read more here, with interesting pictures.

The pointer is from Hugo Lindgren.

Further Gary Becker links

Russ Roberts on Gary Becker. And Steve Levitt on Gary Becker. And Heckman’s 181 pp. of notes on Becker (correct link here), many superb photos, large font and lots of space, I had not known Jacob Viner called Becker his best student ever, or how much Solow and Becker were rivals. And Justin Wolfers on Becker.

All are excellent and fascinating pieces.

A loyal MR reader on high-frequency trading

He/she writes to me:

Since there is a lot of confusion in the media regarding HFT, I wanted to clear some of it up. Disclaimer: this is my personal view, I am not representing any firm or group and I wish to remain anonymous.

Colocation is a practice, whereby any market participant can pay the exchange a fee which allows them to locate their trading computers in the same building as the exchange itself ( the matching engine ).

Colocation is actually good for investors. Why? Suppose a mutual fund from Kansas City wants to execute orders to buy stocks on an exchange which physically located in New Jersey. If this mutual fund is looking at the market data feed directly from Kansas City, then it is at a disadvantage relative to investors who just happen to accidentally be in New Jersey. So, what are the options? Well, the fund can either rent space in a New Jersey data center or execute through a bank/broker which is doing exactly that. However, all New Jersey data centers would still have to somehow connect to the exchange. And their location within New Jersey would matter – some data centers would be better to locate at relative to some other ones.

With co-location, all investors are given the opportunity to trade from the right data center – the same one that houses the exchange.

If exchanges operated on some sort of discrete auctions rather than continuous matching, some of the issues above would be mitigated. But other issues would arise, for example, lack of synchronization of auctions between different exchanges, as well as increased incentives to trade more prices within a given amount of time, thus generating increased volatility

Furthermore, exchanges, as private for-profit businesses, are able to grow their profit and bottom line by selling co-location services to speed sensitive traders, thus mitigating the need to grow the revenues in other ways, such as raising commissions and trading fees on all investors

Direct Data Feeds and Accusations of Insider Trading

Exchanges sell access to direct data feeds to all investors. When high frequency traders subscribe to a real time direct feed in the colocated facility and they observe the order book as well as trades, they have no idea who is trading – a customer, a big bank or another HFT firm. They see the same exact trades in this feed as all other market participants. Many, if not most, HFT firms do not deal in any way with customers whatsoever. The ones that do are supposed to have a clear separation (a Chinese Wall) between customers and proprietary trading, so no customer information can flow through to the prop desk – the same thing is true of big banks and other broker/dealers.

Consider, for example, the trade that is described in Flash Boys. HFT places 100 shares on the offer at 100.01 on BATS and when it trades, it goes and buys the same offer price of 100.01 at Nasdaq, thereby running up the price to 100.02 and selling back the liquidity at 100.02 to the non-HFT customer

This doesn’t actually work. Why? because in order to sell successfully at 100.02, HFT algorithm had to have priority in the order book queue and the only way to do that is to continuously quote that price, not knowing at all whether or not anyone is going to buy at 100.01 on BATS, and facing market risk of market running though 100.02

Secondly, just because the offer price on BATS traded, that doesn’t mean that the market cannot go down right after that and the HFT has no way of knowing who bought the price they bought and why they bought it. It could have easily been a fund or a retail trader who have no alpha (no predictive power ).

Contrast this with the main protagonist of Flash Boys Brad Katsuyama, who was getting paid multiple millions at RBC for executing customer order flow.

Suppose a customer called Brad and asked to buy 3 million shares of IBM right now and 2 million potentially later in the day

The current market on public ( “lit” ) exchanges is 188.00 bid 188.01 offered

Brad says, ok, I will do the deal for 188.15 ( 14 ticks above the current market ) and then proceeds to work the 3 million shares in the market in order to buy back what he sold at a price lower than 188.15

Now, Brad is trading in the market, having material non-public information about his customer’s order flow. This trading has to be immensely profitable for the bank to pay Brad millions a year. So to the extent that there is any insider trading going on, and not market making, it is being done by Brad and not by the HFT algorithm because Brad really is using truly non public information and HFT is reading the direct data feed available to anyone who cares to sign up for it

Bank Equity Trading Revenues

Indeed, as a result of HFT which quotes much tighter spreads than the banks, bank equity trading revenues have gone down dramatically, by much more than the profits generated by HFTs in equities. Where did the difference go? it accrued to investors in the form of lower trading fees

Ok. Is There Anything Wrong With US Equity Markets?

Yes. Dark pools are destructive to all investors, including HFTs. An HFT firm that derives its edge from mining statistical patterns in the data cannot do this very well for dark pool data because it is simply not available in a clean format. But neither can any other investors

In order to promote transparency and reduce conflicts of interest between broker/dealers and their customers, our regulatory agencies should force all equity trading to happen on lit exchanges

By the way, this is a problem not just with equity dark pools. Consider trading in off-the-run treasuries ( off the run meaning not the latest issue ) or interest rate swaps, or many other securities that Wall Street banks trade for their customers

Since none of these are on the exchanges, and there is no transparent data, effective spreads paid by customers are wide, lining the bank pockets. If regulators were able to force trading in these instruments to happen on exchanges, it would reduce fragility of the financial system and create pricing transparency

What about Reg NMS

Reg NMS was designed to make sure that if a better price is available on any exchange, that price has to be filled before taking out worse prices on other exchanges

In practice, it has created a lot of complexity in the market and forced market participants to all implement their own software solutions to comply and monitor with it

All this compliance should be fully shifted to exchanges and other trading venues themselves, where it’s much easier for regulatory bodies to verify compliance

Conservatives eat here. Liberals eat there.

From a set of national chains, liberals most favored (in relative terms) California Pizza Kitchen.

Conservatives favored Cracker Barrel and Papa Murphy’s and Marie Callender’s and Hooter’s.

For fast food outlets there is a big liberal margin in favor of Chipotle, Boston Chicken, Qdoba, and most of all Au Bon Pain.

There is more here.

Profiting from Machine Learning in the NBA Draft

There is a new paper by Philip Maymin:

I project historical NCAA college basketball performance to subsequent NBA performance for prospects using modern machine learning techniques without snooping bias. I find that the projections would have helped improve the drafting decisions of virtually every team: over the past ten years, teams forfeited an average of about $90,000,000 in lost productivity that could have been theirs had they followed the recommendations of the model. I provide team-by-team breakdowns of who should have been drafted instead, as well as team summaries of lost profit, and draft order comparison. Far from being just another input in making decisions, when used properly, advanced draft analytics can effectively be an additional revenue source in a team’s business model.

Note these are “partial equilibrium” estimates, namely given rivalry not every team can draft better to this extent.