Month: September 2014

Just a reminder about Abenomics in Japan

Unemployment is at 3.7 per cent. Recently, it has been as low as 3.5 per cent, considered by some economists to be pretty much full employment.

That’s one big reason why all that stimulus just won’t have all that much oomph. It is odd how rarely you hear this mentioned, perhaps because “free lunch” thinking is back in vogue these days. The entire piece, by David Pilling at the FT, is interesting, it focuses on job market polarization in Japan. Here is on bit on that:

Outside the ranks of the protected “job-for-lifers” – a much rarer breed these days – nearly 40 per cent of workers are about as flexible as you get. They work in poorly paid jobs for hourly rates. Benefits are all but non-existent. For most of these workers, sometimes referred to as the “precariat”, unemployment is a mere “sayonara” away.

dyfalu

In Welsh poetry, dyfalu is the piling on of comparisons, definition through conceit. The word also means “to guess” in Welsh, and many poems of dyfalu have an element of guesswork, a fanciful and riddling dimension. “The art of dyfalu, meaning “to describe” or “to deride,” rests in the intricate development of a series of images and extended metaphors which either celebrate or castigate a person, animal, or object,” the encyclopedia of Celtic Culture explains. Dafydd ap Gwilym’s poems to the mist and the wind are classic fourteenth-century examples.

That is from Edward Hirsch, A Poet’s Glossary, which I am quite enjoying. There is interesting material on every page and it is written with passion. A hendiatris is a “figure of speech in which three words are employed to express an idea, as in Thomas Jefferson’s tripartite motto for the Declaration of Independence: “Life, liberty, and the pursuit of happiness.”” When there are only two words so employed, it is of course a hendiadys.

Jason Sorens on Scottish independence

From a longer post:

A closer look reveals that different stocks responded differently to the poll news. Two transportation companies, FirstGroup and Stagecoach Group, lost virtually nothing, and Aggreko, which rents temperature control systems, lost absolutely nothing. Financial and energy/power companies were pounded. An engineering company closely linked to the oil industry, the Weir Group, took a more modest 1.0% loss.

How to sum up?

So far capital markets seem to be telling us that the economic costs of independence to Scotland would be significant but not catastrophic, and that they would be virtually nil to the rest of Britain. How much of those costs are due to the policies Scotland would implement after independence, rather than secession as such? It is difficult to know, but the differential returns to particular firms give us a clue. Transportation companies have closer links to the state, so a more statist policy regime might not hurt them. Financial companies might lose because of the lender of last resort issue (Scotland might not have a credible one). Energy and engineering companies might lose because nationalists want to tax oil heavily to fund social programs. Also, stricter environmental laws may hurt the electric utility SSE, which lost heavily on Monday.

Speculatively, then, capital markets seem to be telling us that the costs of secession as such are modest, but that the costs of dramatically different economic policies are substantial.

But I find this earlier bit less optimistic:

What would happen to these firms’ value if independence were dead certain? Expected utility analysis helps us here. They lost $800 million in value on an increase in the probability of independence of 5.5+2.7=8.2%. We can infer that an increase from 20% to 100% would wipe out $800 million*8/.6=$7.8 billion. That’s a fair proportion of their existing value: about 16%.

There is more here, and for the pointer I thank Chaim Katz.

DJs are now making mistakes on purpose

Graham writes:

DJs all over the world are now deliberately making mistakes during their mixes to prove to fans and critics that they are in fact real DJs.

The latest craze, known as miss-mixing, is proving very popular amongst digital DJs as a way of highlighting that they are actually manually mixing tracks rather than using the sync button.

Michael Briscoe, also know as DJ Whopper, spoke about miss-mixing with Wunderground, “Flawless mixing is now a thing of the past, especially for any up and coming digital DJs. You just can’t afford to mix without mistakes these days or you’ll be labelled as a ‘sync button DJ.’”

“I learned how to mix on vinyl years ago so naturally I’m pretty tight when it comes to matching beats,” continued the resident DJ. “I swapped to digital format a couple of years ago because it’s convenient, now I spend more time practicing making mistakes than I do practicing actual mixing.”

Of course the software can toss in some mistakes too…good luck.

For the pointer I thank Will Ivy.

Assorted links

1. Progress on making graphene more commercially viable.

2. The chocolate teapot (there is no great stagnation).

3. Podcast of Ray Dalio and Larry Summers (I haven’t heard it yet myself).

4. Why the current campaign against inversion will prove counterproductive.

What should we infer from Obamacare rate increases?

Robert Laszewski writes:

The 2015 rate increases have been largely modest. Does that prove Obamacare is sustainable? No. You might recall that on this blog months ago my 2015 rate increase prediction was for increases of 9.9%.

You might also recall my reason for predicting such a modest increase. With almost no valid claims data yet and the “3Rs” Obamacare reinsurance program, insurers have little if any useful information yet on which to base 2015 rates and the reinsurance program virtually protects the carrier from losing any money through 2016. I’ve actually had reports of actuarial consultants going around to the plans that failed to gain substantial market share suggesting they lower their rates in order to grab market share because they have nothing to lose with the now unlimited (the administration took the lid on payments off this summer) Obamacare reinsurance program covering their losses.

We won’t know what the real Obamacare rates will be until we see the 2017 rates––when there will be plenty of valid claim data and the Obamacare reinsurance program, now propping the rates up, will have ended.

The post has other interesting points.

Scotland fact of the day

Scottish banking assets 1,200% of GDP, more than Iceland, Ireland and Spain in 2007.

That is from Robin Wigglesworth. Of course exactly for this reason, RBS probably would not end up domiciled in a newly independent Scotland.

Let’s hope the #royalbaby manages to keep the Scots on board.

Roving Bandits

Yesterday, Tyler linked to an important report from the Washington Post showing how “aggressive police take hundreds of millions of dollars from motorists not charged with crimes.” The report and video are shocking.

The aggressive tactics documented by the Post have mostly been deployed against motorists who are unlucky enough to be stopped for a moving violation. An apparently leaked document, however, shows that these programs are likely to expand far beyond motorists.

The economics of reclining your airplane seat

I believe Josh Barro started this mess of a debate.

I would emphasize the endogeneity of transaction costs. The airlines could do a lot to encourage Coasean bargaining between fliers, but they don’t. How about handing out little cards?: “Have a friendly haggle with the person behind you. Last year the average price for a non-reclined seat was $16.50.” They could print up standardized contracts, like how they distribute customs forms, including contracts for trading seat assignments or distance from the bathrooms or how you shush your child, or not. Imagine being nudged toward a deal through the in-flight internet system, so you don’t have to turn around to face the other party in the bargain. They could take a cue from Alvin Roth and his matching algorithms or help you set up complex multi-party deals, like how the Denver Nuggets used to construct (and then dismantle) their rosters.

Nada.

The disutility of bargaining in this environment is high relative to the value at stake. The chance of irritation or hurt feelings is non-negligible, and perhaps people on a flight are crankier anyway. So the airlines deliberately keep the transactions costs high, as the gains from the potential bargain are low relative to the ickiness of the process. The airlines wish to keep a lot of people away from the process altogether, if only out of fear of having to arrest people, divert flights, and so on.

That implies the more we debate this problem, the worse it becomes. It also gives us the true Coasean answer to what is best. Relative to current norms, who does more to make the whole question “an issue” — the seat recliner or the purchaser of the recliner-blocker? Clearly it is the purchaser of the blocker and thus Josh Barro is broadly in the right, the norm should continue to allow people to recline their seats as that minimizes fuss, which is more important than getting the right outcome with the seat itself.

If you don’t like that, United does sell coach seats with extra space, which makes the recline of the person in front of you less bad.

Assorted links

1. Very good Krugman column on why Scottish independence is a dangerous idea.

2. History of the Darien Project.

3. “They’re manipulating all of us.”

4. Do limited health network plans in fact control costs?

5. Larry Summers on secular stagnation and the importance of the supply side.

6. Is American military spending equal to that of the rest of the world?

What I’ve been reading

1. Michael Ignatieff, Fire and Ashes: Success and Failure in Politics. A genuinely interesting book about why someone with tenure at Harvard might be crazy enough to run for high public office, and then what it is like to lose somewhat ignominiously.

2. Ha-Joon Chang, Economics: The User’s Guide. A genuinely humble and pluralistic introduction to the economic way of thinking, from a “developmentalist,” linkages are important for economic growth, anti-free trade point of view.

I disagree with both Ignatieff and Chang pretty thoroughly, but of the last few dozen books I read, these are the two which are truly philosophical, in the best sense of that word. There is no need to list the others, except there is Umberto Eco on Peanuts, scroll down about four paragraphs to start reading.

More than Half of Workers Have New Jobs Since the End of the Recession

Many people continue to call for greater inflation to solve our current economic problems. A classic argument for why inflation can help is downward nominal wage rigidity. It is difficult to believe that nominal wage rigidity is important now, years after the end of the recession. The main reason nominal wages don’t fall is that wages are an anchor around which expectations and understandings are built and when wages are cut workers get angry and upset. But when a worker begins a new job with a new employer it’s anchors away! New job, new wage and no feelings of loss even if the wage is less than what some other person earned sometime in the past for doing something sort of similar.

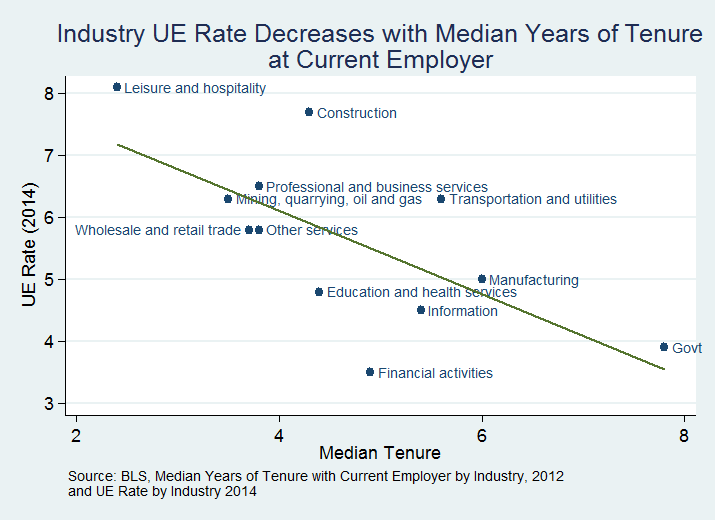

Now here is an important fact: the median number of years that current wage and salary workers have been with their current employer is about four and a half. In other words, more than half of current workers have jobs that are new since the end of the recession. A majority of workers have new jobs, some workers have wages that are increasing (and thus a fortiori not downwardly rigid) and quite a few workers have flexible wages due to piece rates, commissions, bonuses and so forth. Not all of these categories perfectly overlap. Thus, the scope for nominal wage rigidity as an explanation for current problems appears to be small.

Moreover, here’s an interesting test. If nominal wage rigidity explains unemployment and if wages are more rigid at old jobs than at new jobs then we ought to see a positive correlation between unemployment rates and job tenure. Instead, we see the exact opposite, unemployment rates are lowest in the industries with the higher tenure. Of course, this is a raw correlation not a causal estimate. Nevertheless, some of the points are striking.

In the leisure and hospitality industry, for example, the median worker has been in their job only about 2.4 years–that means that well over the half of the jobs in this industry are new since the end of the recession–yet the unemployment rate in that industry is over 8%. With that kind of turnover in jobs its difficult to believe that wages have not adjusted. Or to put it differently, if one were to ask apriori which will have a greater influence on reducing nominal wage rigidity either a) turning over more than half the jobs in the industry or b) a few extra points in the inflation rate then I think most economists would, without hesitation, answer the former. Inflation is not magic.

A simple rule for making every restaurant meal better

This one is so simple it is stupid, yet you hardly ever hear it. If anything it is mocked, but I will go on record:

Eat at 5 p.m. or 5:30.

The quality of the food coming out of the kitchen will be higher. Only the very top restaurants (and even then not always) can maintain the same quality at say 8 p.m. on a Saturday night. It is also the easiest time for getting a reservation.

The best time to eat at @ElephantJumps is 4:20 p.m. They’re all just sitting around, waiting to cook for you.

Oyamel is a good example of a D.C. restaurant which can be quite iffy, but is tasty and consistent first thing in the evening.

There is a beauty to having a restaurant all to yourself. And if you don’t like the timing, have no more than an apple for lunch.

This is also a better system for getting work done, if the nature of your workplace allows it. Few people who do the 7:30 dinner work through to 11 p.m. If you have dinner 5-6:30, you are ideally suited to get back into the saddle by 7:15.

But please, I hope not too many of you follow this advice. The funny thing is, you won’t. You will leave the low-hanging fruit behind, you strange creatures you.

Civil forfeiture cash seizures

Under the federal Equitable Sharing Program, police have seized $2.5 billion since 2001 from people who were not charged with a crime and without a warrant being issued. Police reasoned that the money was crime-related. About $1.7 billion was sent back to law enforcement agencies for their use.

Often the cash is seized from motorists (carrying costs now exceed liquidity premium, I suppose). There is this too:

- Only a sixth of the seizures were legally challenged, in part because of the costs of legal action against the government. But in 41 percent of cases — 4,455 — where there was a challenge, the government agreed to return money. The appeals process took more than a year in 40 percent of those cases and often required owners of the cash to sign agreements not to sue police over the seizures.

- Hundreds of state and local departments and drug task forces appear to rely on seized cash, despite a federal ban on the money to pay salaries or otherwise support budgets. The Post found that 298 departments and 210 task forces have seized the equivalent of 20 percent or more of their annual budgets since 2008.

There is much more here, by Michael Sallah, Robert O’Harrow Jr., and Steven Rich at The Washington Post, give them a Pulitzer.

And please note, this may seem like an Alex post but it is a Tyler post.

The chance of Scottish independence this September?

PredictWise and Betfair both say 28.4%. Last I checked, that is.

Hat tip goes to David Rothschild.