Month: June 2015

Claims about liquidity

Robin Wigglesworth at FT Capital Markets has a long and interesting post on this currently important topic, most of all for corporate bond markets. The hot topic these days is why liquidity seems to have dried up along so many fronts at once. Here is one excerpt:

The causes of these illiquidity phenomena are manifold, and vary from market to market. But Matt King, a senior strategist at Citi, argues that the one common thread is the dominance of central banks over markets.

The paradox, he argues, is that the extra money pumped into the global economy by central banks is leading to “herding” by investors, as they run in and out of markets in a uniform fashion, prodded by shifts in monetary policy.

“Unfortunately, it leads to a rather ominous conclusion,” Mr King writes. “The bouts of illiquidity will continue until central banks stop distorting markets. If anything, they seem likely to intensify: unless fundamentals move so as to justify current valuations, when central banks move towards the exit, investors will too.”

Do read the whole thing, there are further points and charts of interest.

Thursday assorted links

1. Penguin nationalism. And does gravity collapse the cat?

2. A public assembly facilities manager considers Jurassic World. I thought the film was OK enough to watch, with some nice scenes, but not great or memorable.

3. An Italian parable: what is the financial future of Siena?

4. Noah Feldman has a good account of TPP and foreign policy considerations.

5. Photos of China.

6. What do surviving kamikaze pilots say? (And should we trust their accounts of why they survived?)

7. Potential problems with the California Uber ruling; Tim Lee is more optimistic.

Wage Effects of Transracialism

In today’s illustration of Cowen’s second law, here is a paper on what happens to wages when a worker’s subjectively reported race changes:

In Brazil, different employers often report different racial classifications for the same worker. We use this variation in employer-reported race to identify wage discrimination. Workers whose reported race changes from non-white to white receive a wage increase; those who change from white to non-white realize a symmetric wage decrease. As much as 40 percent of the raw racial wage gap is explained by the employer’s report of race, after controlling for all individual characteristics that do not change across jobs. The results are consistent with workers manipulating perceived race in an environment where racial classification is subjective, but discrimination persists.

Hat tip: Scott Cunningham.

Scott Sumner on digital deflation

He makes many good points, but this is my favorite:

From 1995 to 2004, productivity and real GDP rose at an unusually rapid rate. The IT cheerleaders told us that this fast productivity growth was the long delayed fruits of the IT revolution. Now we have very slow growth, and the digiterati tell us it’s also caused by the IT revolution, which is generating lots of stuff that doesn’t get picked up in the output data, because it’s free. While I’m impressed by an explanation that’s as flexible as a circus contortionist, I’d prefer something that isn’t consistent with any possible state of the universe. I’m no Popperian, but I like my theories to be at least a little bit falsifiable.

In other words, we know what a boom looks like, and this ain’t it. I would, however, assent to and indeed stress two propositions:

1. Infovores are indeed much better off from the recent digital revolution. And since most journalists and tech leaders are infovores (many academics too), they extrapolate too readily from themselves.

2. The “rate of productivity growth in consumption” is more mis-measured than is the rate of productivity growth in production. Facebook really is fun for a lot of people, and unpriced on the consumption side; I sometimes say that I am a happiness optimist and a revenue pessimist. But the production side of the economy matters in its own right, and indeed that is why they call it productivity. Debts and bills must be paid, and jobs must be created at wages people will take, whether or not you’re having fun with Angry Birds or cursing at your (least) favorite blogger. In fact we just had a recession where the jobless probably had more fun than ever before, due mostly to the internet. It was still an event of significance.

So don’t aggregate consumption gains (e.g., learning to enjoy your Brussels sprouts more) with productivity gains, proudly parading a single number and claiming that everything is fine. It is better, and more accurate, to say: “We’ve now learned to really love those Brussels sprouts, good for us, but we still may be in deep doo-doo.”

The time needed to fill jobs

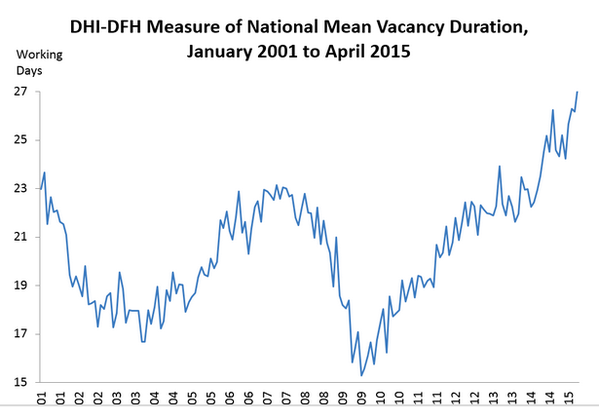

You can see a tightening labor market, and some of this you might interpret in terms of a growing skills gap:

The national time-to-fill average rose in February to the highest level in 15 years.

Sponsored by the career sites publisher Dice Holdings, the Dice-DFH Vacancy Duration Measure says it took an average of 26.8 working days to fill jobs in February. In January, according to the report, the average (as revised) was 25.7 working days.

“We are continuing to see signs of a tightening labor market,” said Michael Durney, president and CEO of Dice Holdings. “Unemployment rates are declining across several core industries, such as tech and healthcare, and the time-to-fill-open positions has hit an all-time high in the 15 years the data has been tracked.”

Jobs in the financial services sector took the longest to fill, averaging 43.1 days. Healthcare jobs averaged 42.6 days to fill. Both are historic highs for their respective industry sectors.

The full article, by John Zappe, is here, via David Wessel.

By the way, the skills mismatch hypothesis (not a substitute for AD hypotheses, let me stress) is stronger than you think. Catherine Rampell writes:

Companies themselves are indeed reporting difficulty acquiring talent. Nearly half of small and medium-size businesses with recent vacancies say they could find few or no “qualified applicants,” according to the latest monthly survey of the National Federation of Independent Business. Over the past couple of years, firms have also become increasingly likely to say that “quality of labor” is the “single most important problem” facing their businesses.

I have generally been skeptical of the “skills mismatch” story, mostly because wage growth has been so pitiful during this recovery. If qualified applicants were really so scarce, businesses should be bidding up the salaries of the few hot commodities available. But Steven J. Davis , an economics professor at the University of Chicago’s Booth School of Business and one of the creators of the vacancy duration metric, says it’s unclear how a widespread skills mismatch, if one exists, would actually affect wages. Maybe a shortage of some highly desirable skill would lead employers to bid up the price of that qualification, he says, but that same scarcity might also lead firms to instead settle “for workers who have less of [or] lower-quality versions of the desired skills.” That could, in theory, cause hourly wages to fall overall. Robust research on the connection between skills mismatch and wages is in short supply.

This point from Davis is appreciated only rarely.

The extreme durability of Lebron James

Over the past five seasons, LeBron’s played a total of 18,087 minutes, counting the regular season and the playoffs.

What that means: Compared to every other player, LeBron’s played at least 15% more minutes than anyone else in the league. He’s played nearly 2,500 more minutes than Kevin Durant, the runner-up.

Basically, pick any other NBA player. Since 2010, LeBron has played the equivalent of at least one extra season compared to that player — and likely, a lot more.

And over the past ten seasons, the minutes gap widens — LeBron has a 20% edge on Joe Johnson (who’s played the second-most minutes) and a 30% edge on Tim Duncan (who’s played the tenth-most).

And yet that is with very little in the way of injury, perhaps his most remarkable achievement. That is all from Dan Diamond.

Wednesday assorted links

1. Why are flamingos the most likely to escape a zoo successfully? (questions that are rarely asked)

3. Cheaper than dogs, department of why not? But will it increase the number of ZMP canines?

4. Yes, aquifers are subject to the tragedy of the commons and yes it does matter.

China fact (?) of the day

According to the latest official data, profits earned by Chinese manufacturers rose 2.6% from a year earlier in April, a turnaround from a drop of 0.4% in the previous month. Yet nearly all of that increase—97%—came from securities investment income, data from the National Bureau of Statistics show. Excluding the investment income, China’s industrial profits were up 0.09%.

Meanwhile, over the course of 2014, the value of stocks, bonds and other tradable securities owned by listed Chinese companies rose by 946 billion yuan ($152.4 billion), a 60% increase, according to an analysis by Mr. Zhu.

The trend is starting to worry Chinese regulators, who have been trying to make sure that banks and the stock markets ultimately channel money into parts of the economy that create jobs.

There is some real wisdom in this passage:

“Manufacturing is a very hard business these days,” said Mr. Dong, chairman of the company. “I want to make some money from the stock market and use the profits to restart my manufacturing business later, when the economy turns for the better.”

That is from the WSJ, covered by FTAlphaville.

TPP

“If this [TPP] collapses, Pacific Rim countries will be aghast,” said Shunpei Takemori, a professor at Keio University in Japan, the largest economy in the would-be trade zone after the United States. “China is pushing, and if the U.S. just stands aside, it would be a tragedy.”

And:

“If you don’t do this deal, what are your levers of power?” Singapore’s foreign minister, K. Shanmugam, said in Washington on Monday. “The choice is a very stark one: Do you want to be part of the region, or do you want to be out of the region?”

He argued that “trade is strategy” and that without economic leverage, the United States was left with only military clout in Asia “and that’s not the lever you want to use.”

“It’s absolutely vital to get it done,” he added, referring to the bill’s passage.

The full article is here. I find the willingness of progressiveness to toss this bill into the wind, for the purposes of indulging the usual memes, to be one of the most depressing features of American political life in years.

You will find an alternative perspective from David Henderson here: “If the U.S. government is a “less reliable ally,” that could be a good thing.” I don’t think they feel that way in Singapore, South Korea, or Taiwan.

By the way, the fourth edition of Doug Irwin’s trade book is coming out.

Bitcoin surges, it is a way of evading capital controls

Bitcoin surged by as much as 7 percent on Tuesday and was on track for its longest winning streak in 18 months, as concerns that Greece could tumble out of the euro drove speculators and Greek depositors into the decentralised digital currency.

I am fine with this, I should add. But no, I don’t think it represents the onset of a new monetary order. In case you doubt what is going on here:

Scigala said over the past two months, with Greece locked in talks with its creditors, the company had seen a 124 percent pick-up in inflows from Greek IP addresses—numerical labels that identify computers and other internet-enabled devices.

For the pointer I thank Jerry Brito. Here is my earlier post on Bitcoin, China, and capital controls.

Tuesday assorted links

Stephen Curry and the duration of the great stagnation

Stephen Curry set a record In May of this year:

It took Reggie Miller 22 games to set an NBA playoff record of 58 three-pointers for the Indiana Pacers in the 2000 playoffs. Now, Stephen Curry has broken that mark in just 13 games.

He is now up in the 80s I believe. Curry, by the way, is NBA MVP and his team is probably on the verge of winning the Finals. The three-point strategy seems to be working: for Curry, for the Golden State Warriors, and also for last year’s champions, the San Antonio Spurs.

Yet the three-point shot has been in the NBA since 1979 (!), and for most of those years it was not a dominant weapon.

What took so long? At first the shot was thought to be a cheesy gimmick. Players had to master the longer shot, preferably from their earliest training. Coaches had to figure out three-point strategies, which include rethinking the fast break and different methods of floor spacing and passing; players had to learn those techniques too. The NBA had to change its rules to encourage more three-pointers (e.g., allowing zone defenses, discouraging isolation plays). General managers had to realize that Rick Pitino, though perhaps a bad NBA coach, was not a total fool, and that the Phoenix Suns were not a fluke. People had to ponder the expected value concept a little more carefully. Line-ups had to be smaller. And so on. Most of all, coaches and general managers needed the vision to see how all these pieces could fit together — Arnold Kling’s patterns of sustainable trade and specialization.

In other words, this “technology” has been legal since 1979, yet only recently has it started to come into its own. (Some teams still haven’t figured out how to use it properly.) And what a simple technology it is: it involves only placing your feet on a different spot on the floor and then moving your arms and legs in a coordinated (one hopes) motion. The incentives of money, fame, and sex to get this right have been high from the beginning, and there are plenty of different players and teams in the NBA, not to mention college or even high school ball, to figure it out. There is plenty of objective data in basketball, most of all when it comes to scoring.

Dell Curry, Stephen’s father, was in his time also known as a three-point shooter in the NBA. But he didn’t come close to his son’s later three-point performance.

So how long do ordinary scientific inventions need to serve up their fruits? I am a big fan of Stephen Curry, but in fact his family tale is ultimately a sobering one.

Addendum: Tom Haberstroh fills in the history.

The Hidden World of Matchmaking and Market Design

Al Roth’s Who Gets What and Why: The Hidden World of Matchmaking and Market Design is an excellent addition to the pantheon of popular economics books. It’s engagingly written, covers new material and will be of interest to professional economists as well as to the broader audience of intelligent readers.

I review the book more extensively for the Wall Street Journal. (Google the title, Matchmaker, Make Me a Market to get beyond the paywall for non-subscribers). Roth is well known for helping to design kidney swaps–when donor A and patient A’ and donor B and patient B’ are mismatched it may yet be possible for A to give to B’ and B to give to A’.

Mr. Roth, however, wants to go further. The larger the database, the more lifesaving exchanges can be found. So why not open U.S. transplants to the world? Imagine that A and A´ are Nigerian while B and B´ are American. Nigeria has virtually no transplant surgery or dialysis available, so in Nigeria patient A’ will die for certain. But if we offered a free transplant to him, and received a kidney for an American patient in return, two lives would be saved.

The plan sounds noble but expensive. Yet remember, Mr. Roth says, “removing an American patient from dialysis saves Medicare a quarter of a million dollars. That’s more than enough to finance two kidney transplants.” So offering a free transplant to the Nigerian patient can save money and lives.

It’s hard to think of a better example of gains from trade (or a better PR coup for the U.S. on the world stage).

One of the most interesting aspects of the book is that Roth has created a new typology of market failure but a very different way of addressing such market failures. Read the whole review for more.

Prediction markets for Chinese exam winners

Cameron Campbell writes to me:

There was indeed betting on the outcomes of the examinations, at least in Guangdong province in the 19th century. At least one form of betting was on the surnames that would be represented in the pool of successful candidates. Such betting was quite widespread, so for example, there were publications dedicated to providing punters with background on exam takers.

It also seems that a Professor Haifeng Liu at Xiamen University last year gave a talk titled 闈姓賭博:清代廣東與澳門的科舉習俗, or “Examination hall surname gambling: Qing Guangdong and Macao examination customs.” (Cowen’s Second Law, though perhaps he still needs to write it up)

Here is my previous post on this topic. Here is Campbell’s blog. Campbell is still trying to find out whether the telegraph story cited in my earlier post can be verified, I thank him for his efforts, Robin Hanson will be happy.

What does the disappearance of Bitcoin price volatility mean?

The price has been pretty stable as of late. But I say this is bad news for Bitcoin. Instead it’s evidence for the Match.com theory of internet services, namely that they are up and running in more or less mature form pretty quickly. If there were an ongoing, fluctuating chance of Bitcoin “taking off,” its price likely would be more volatile. In the above-linked graph, however, you will see a slow downward trend, which may reflect a falling chance of the status quo ever being greatly different than it is right now.

Noah Smith offers related (but differing) remarks on the same issue.