Month: September 2015

Sunday assorted links

1. Dept. of secondary consequences, Syria edition. Elasticities of supply are indeed greater in the long run, sometimes in the medium run too.

2. Rogoff on the rate hike, he is skeptical.

3. “A robot has taken the first step towards becoming a working actor by applying for a Screen Actors Guild (SAG) card.” And what happened to Google Books?

4. The sprout heads culture that is China.

5. Where in Europe do people still live with their parents?

6. Are we near peak environmental impact? (speculative) And a much longer study here (pdf).

Is Schengen dead? Or just pining for the fjords?

They are solving for the equilibrium, so to speak:

Germany is reinstating controls at its borders with Austria as Europe’s top economy struggles to cope with a record influx of refugees, according to media reports.

Passport checks had been abolished for countries within Europe’s Schengen zone, but the decision to bring back controls is expected to be announced by Interior Minister Thomas de Maiziere at a press conference on Sunday evening.

Bild newspaper cited security sources as saying that the state government in Bavaria had asked the federal police to help deal with the task. The newspaper said the federal police would send 2,100 officers to Bavaria to help it secure its borders.

Here is the technological shock. Here is my earlier post on Germany and the backlash. Here is my earlier post on the moral regression of Syria. Put those all together and mix…

Drum Solo

Rush’s Neil Peart was recently voted the greatest drummer of all time. Here’s Neil demonstrating why:

To appreciate the artistry, I like this best on headphones without visuals but the video captures the amazing physicality of the performance. Some backstory here.

Chilean copper and Chinese SOEs

One reason the Chilean reforms went well was that the state had nationalized the copper mines. That provided a steady flow of money, thus minimizing the need for revenue-raising distorting policies elsewhere. More generally the revenues helped build a stable state backed by a secure coalition, which in turn liberalized much of the rest of the economy. For all the talk about laissez-faire and the Chicago boys, the Chilean privatizers never gave up their hold on those mines. And the mines proved easy enough to run and convert into revenue…and they are still a lucrative source of foreign exchange.

One reason the Chinese reforms went well was that the state had nationalized the SOEs. That provided a steady flow of money, thus minimizing the need for revenue-raising distorting policies elsewhere. More generally that ownership helped build a stable state backed by a secure coalition, which in turn liberalized much of the rest of the economy. For all the talk about dismantling communism, the Chinese reformers never gave up their hold on those SOEs. And the companies proved easy enough to run and convert into revenue, at least until the low-hanging fruit was plucked…and they are still…?

The problem of course is that privatizing the SOEs is the economic reform China needs over the medium term, yet it may not be consistent with their political economy in support of broader market forces.

How will the Fed actually raise interest rates?

…the Fed has found itself forced to experiment. The immense stimulus campaign that it started in response to the 2008 financial crisis changed its relationship with the financial markets. It has pumped so many dollars into the system that it cannot easily drain enough money to discourage lending, its traditional approach. Instead, the Fed plans to throw more money at the problem, paying lenders not to make loans.

The Fed, embedded in the banking system, has also concluded that working through the banks is no longer sufficient to influence the broader economy. It plans to strengthen its hold by working directly with an expanded range of lenders.

Fed officials have repeatedly expressed confidence that the plan will work.

…And if the new approach does not work at first, Mr. Potter said in a recent speech, then his team of monetary mechanics “stands ready to innovate” until it does.

That is from Binyamin Appelbaum, there is much more detail at the NYT link. Here is one extra bit:

…the Fed plans to pre-empt the market, paying banks 1 percent interest on reserves in their Fed accounts, so banks have little reason to lend at lower rates. “Why would you lend to anyone else when you can lend to the Fed?” Kevin Logan, chief United States economist at HSBC, asked rhetorically.

But there is more to it than that, so here is a primer on overnight reverse repurchase agreements (pdf). Here is a shorter FAQ. Time to bone up on this stuff, people…

I consider this an under-discussed topic.

Saturday assorted links

1. Freddie, in the NYT, against campus corporatism.

2. What if Uber buys your robotics department?

3. Peter Thiel on biotech: “Can you get rid of randomness in building a company?”

4. Clower and Leijonhufvud would be happy, #Russia, #bricks.

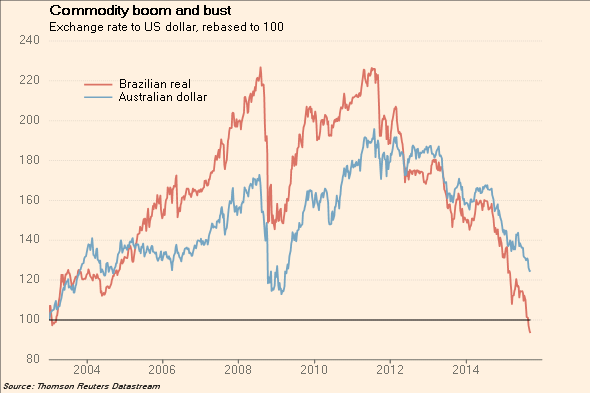

Brazil vs. Australia, model this

James Mackintosh has more to say.

*Good Profit* by Charles G.Koch

I am pleased to have received an advance review copy. The subtitle is How Creating Value for Others Built One of the World’s Most Successful Companies, and here are three excerpts:

One of the many schools I attended was a Catholic school, to which I was sent at age five for a couple of years. But I was a skeptic even at that young age. I rejected the nuns’ claim — which I took literally — that Jesus was behind the altar. They offered graham crackers and milk as reward for good behavior, but the incentive wasn’t strong enough for me.

And:

…Barbara Walters included David [Koch] on her television special The 10 Most Fascinating People of 2014.

His selection highlights the difference in our lifestyles. His is interesting; mine is not. When I am not in the office, I’m either studying praxeology, working out in our basement gym, analyzing the twenty-four components of the golf swing, enjoying one of Liz’s “heart-healthy” meals in our kitchen, or trying to understand what my toddler grandsons are saying when we FaceTime.

And:

…Koch [Industries] has enjoyed better results hiring from Wichita State or Kansas State than from Harvard. (The four employees who have succeeded me as president of Koch Industries hailed from the Murray State University School of Agriculture, Texas A&M, the University of Tulsa, and Emporia State University.)

This is no dull, ghost-written tome, rather it is interesting throughout. You can pre-order the book here.

Top scientists are more artistic

The average scientist is not statistically more likely than a member of the general public to have an artistic or crafty hobby. But members of the National Academy of Sciences and the Royal Society — elite societies of scientists, membership in which is based on professional accomplishments and discoveries — are 1.7 and 1.9 times more likely to have an artistic or crafty hobby than the average scientist is. And Nobel prize winning scientists are 2.85 times more likely than the average scientist to have an artistic or crafty hobby.

There is more here, by Rosie Cima. The original research is here, by Root-Bernstein, Allen, and Beach.

For pointers I thank Samir Varma and Robert Wiblin.

*The Princeton Companion to Applied Mathematics*

I have not yet had time to peruse my copy, but it appears to be a definitive achievement of sorts, 994 double column pages. The topics include the Navier-Stokes equations, communications networks, the Black-Scholes equations, finite differences, foams, the flight of a golf ball, and the mathematics of sea ice. The book’s home page is here. The lead editor is Nicholas J. Higham.

Friday assorted links

1. William Nordhaus tells us “…the Singularity is not near.”

2. Joel Mokyr wins the Balzan Prize. And is the smart money on East African economic growth?

3. Which colleges and universities have produced the greatest advances in science?

4. Data manipulation is a bigger problem than data theft.

5. Felix Salmon on effective altruism, and also finance.

6. Syrians in Erfurt. Not just anyone is allowed to teach them German.

*Black Earth*

The author is Timothy Snyder and the subtitle is The Holocaust as History and Warning. Here is one bit:

The Germans had come to understand that pogroms were not an effective way to eliminate Jews, but that the production of lawlessness was an appropriate way to find murderers who could be recruited for organized actions. Within weeks they grasped that people liberated from Soviet rule could be drawn into violence for psychological, material, and political reasons.

In per capita terms more Jews from Estonia died than from any other country at the time. As of 1944 there were still three-quarters of a million Jews in Hungary and ultimately more than half of Hungary’s Jews survived the Second World War, even though Hungary was both a German ally and it was later invaded by Germany. More generally:

Jews who were citizens of Germany’s allies lived or died according to certain general rules. Jews who maintained their prewar citizenship usually lived, and those who did not usually died…Jews from territories that changed hands were usually murdered. Jews almost never survived if they remained on territories where the Soviet Union had been exercising power when German or Romanian forces arrived…In all, about seven hundred thousand Jews who were citizens of Germany’s allies were killed. Yet a higher number survived. This is a dramatic contrast to the lands where the state was destroyed, where almost all Jews were killed.

Recommended, interesting throughout, and gripping throughout, including the discussions of agricultural productivity and of Hitler as a non-nationalist who saw race as the primary category of human existence. It’s not easy to write an original and readable book on the Holocaust these days, but Snyder seems to have done it. You can read some reviews here.

India (China) fact of the day

In nominal terms — the most appropriate measure when judging an economy’s global impact — India’s output is one-fifth that of China’s. India makes up a mere 2.5 per cent of global GDP against a hefty 13.5 per cent for China. If China grew at 5 per cent annually, it would add an Indian-sized economy to its already hefty output in less than four years. Saying India can match this is like saying a mouse can pull a tractor.

Auction markets in everything

Elephants, giraffes, lemurs, and even a cockroach at the Oakland Zoo have been exploring their creative sides to produce colorful paintings that will be auctioned for charity.

The painting sessions were conducted by zoo keepers who used only positive-reinforcement, including plenty of treats, as they worked with the animals, zoo spokeswoman Nicky Mora said.

Elephants were helped to hold paintbrushes in their trunks and giraffes in their mouths and produced their artwork one stroke at a time. Goats, lemurs, and meerkats had their hooves, paws or claws dabbed with nontoxic, water-based paint and ran over a blank sheet of poster board while chasing a treat.

Thirty-two of the works will be auctioned on eBay starting Thursday.

Andy, a Madagascar hissing cockroach, scurried around a canvas and the result was a piece in purple, green and yellow tones.

Maggie, a Nigerian dwarf goat, had her hooves dipped in blue, green and yellow paint and the keeper coaxed her with snacks to walk on a canvas.

I recall once reading that de Kooning was quite impressed by the paintings of an elephant. There is more here.

Assorted Thursday links

1. Data on refugee and asylum admissions (pdf); by the way America admitted many more people in 1990 than now.

2. The economics of organized crime in Italy (pdf).

3. Greg Mankiw on the Jeb Bush tax plan. And Krugman on the same. And the Tax Policy Center.

4. Further Scott Sumner bullishness on China. And Thomas Piketty on immigration to Europe.

5. A list with Israel Kirzner on it. And a list with Veronique de Rugy on it — fifty most influential, from Politico.

6. Was it degrading for the Chinese to hire “programming cheerleaders”?