Month: September 2015

Damned if they do, damned if they don’t

The Syrian-Lebanese have a long history in Haiti, and in fact they account for most of Haiti’s very wealthiest families. They are also sometimes resented by the other Haitians for their extreme commercial success. Here is one illustrative but not fully objective account from Wikipedia:

Since the early twentieth century there was a Syrian community in Haiti. This consisted of roughly 500 people, mainly engaged in trade and many of them were Syrian Americans. The entire business community of Syrians, however, tended to sell their products to the United States. Over time, the importance of these merchant foreigners grew, reaching positions in the political order of the country. It is of enormous importance to the country, that surpassing most of the Haitians in government (one that was formed by the social elite of Haiti, against a poor majority), caused major uprisings against the Syrians and the idea widespread among Haitians was that they should be deported. Therefore, the Syrian American club sent a letter to the U.S. State Department of Washington D.C., explaining the reasons why the island was purchased for trade with the U.S. and asked for help and advice from the U.S. Federal Government. At that time the Syrians had also addressed the majority of imports of goods to Haiti, both in the field of provisions as in beverages. Syrian traders also were, at present, the only foreign traders willing to work under native conditions than other groups of traders that were rejected. So, they sold wholesale. However, these traders were occupied all trades with the country, which made them gain rejection of a significant part of the population. Thus, the Haitian government launched a new political program that limited the Syrian trade in the country.

Of course Haiti could take in more “Syrian-Lebanese” too, but this would be unpopular in some circles because…the previously Syrian-Lebanese have been…too successful.

*Foolproof: Why Safety Can Be Dangerous and How Danger Makes Us Safe*

The new Greg Ip book is coming out soon, I just bought my copy…

The Costs of Occupational Licensing

On Labor Day let’s all read the excellent White House report on occupational licensing:

…the current licensing regime in the United States also creates substantial costs, and often the requirements for obtaining a license are not in sync with the skills needed for the job. There is evidence that licensing requirements raise the price of goods and services, restrict employment opportunities, and make it more difficult for workers to take their skills across State lines. Too often, policymakers do not carefully weigh these costs and benefits when making decisions about whether or how to regulate a profession through licensing. In some cases, alternative forms of occupational regulation, such as State certification, may offer a better balance between consumer protections and flexibility for workers.

The unknown Anacostia

I am known for giving house guests, especially if they are from abroad, strange tours of random parts of the United States. Yesterday it was a mix of Northeast D.C. and Anacostia.

Maketto on H St. offers Cambodian and Taiwanese cuisine in hip surroundings. The Dolcezza factory near Union Market serves gelato without freezing it, so it is superior to the other branches, and Righteous Cheese is the best shop of its kind in town. St. Elizabeth’s Hospital, in Anacostia, was the first federally supported mental hospital, dating from the 1850s; John Wilkes Booth spent time there. The architecture looks like something from Shutter Island or a Stephen King novel, and if you are clever you can talk your way in through the front gate. The Frederick Douglass House is the standard Anacostia site, worth more than one visit. The Big Chair originally was an advertisement for a furniture company, but has evolved into an Anacostia landmark and it was renovated in 2006. It since has fallen from the biggest chair in the world to no better than number three. At The Big Chair Coffee and Grill, reopened by African immigrants I might add, drinks are remarkably cheap.

Overall Anacostia is improving at a rapid clip, with lots of new town home construction and even some shops. In terms of greenery and views, it is one of the nicest parts of town and someday it will be very expensive indeed.

Monday assorted links

1. I could show this guy how to pick out a really bad county. Nonetheless I applaud the reporter for admitting his mistake. Maybe he was a former chess player.

2. Enjoy whiskey in zero gravity (there is no great stagnation).

3. What have asylum seekers invented for us?

4. The Court is no longer so Supreme (truth in advertising?).

The Frechet Probability Bounds — Super Wonky!

I recently ran across a problem using the Frechet probability bounds. The bounds weren’t immediately obvious to me and Google didn’t enlighten so I wrote an intuitive explanation. Super wonkiness to follow. You have been warned.

Suppose that we have two events A and B which occur with probability P(A) and P(B). We are interested in saying something about the joint event P(A∩B), the probability that both events occur, but we don’t know anything about whether the events are correlated or independent. Can we nevertheless say something about the joint event P(A∩B)? We can. The Frechet bounds or inequalities tell us:

max[0,P(A)+P(B)-1] ≤ P(A∩B) ≤ min[P(A),P(B)]

In words, the probability of the joint event can’t be smaller than max[0,P(A)+P(B)-1] or bigger than min[P(A),P(B)]. Let’s give an intuitive explanation.

The events themselves are not important only the probabilities so let’s use an intuitive model for the events. Let x be a random number distributed between 0 and 1 with each number equally likely (i.e. a uniform distribution). Suppose that the event A occurs whenever x is in some region between a and b. For example, we might say that event A occurs if x is between .4 and .6 and event B occurs if x is between .1 and .7. Notice also that since any number between 0 and 1 is equally likely the probability that event A occurs is just the width of the A region, b-a. In this case, for example, P(A)=.6-.4=.2 and similarly P(B)=.7-.1=.6.

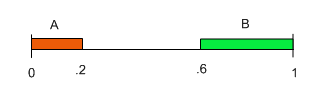

Now suppose that a demon arranges the events A and B to minimize the probability that both events occur. What is the smallest the demon could make P(A∩B)? To minimize the probability that both A and B occur we can think of the demon as placing the two events “as far apart” as possible. For example, the demon will begin one event at 0 and define it as the region moving right until the width is equal to P(A) and the other event the demon will begin at 1 and move left until the width is equal to P(B). If P(A)=.2 and P(B)=.4, for example, then the demon will define the events so that A∈[0,.2] and B∈[.6,1]. Here’s a picture. Notice that by beginning one event at 0 and the other at 1 the demon minimizes the overlap which is the probabiity that both events occur.

In this case, the events don’t overlap at all and so the demon has ensured that the probability of P(A∩B)=0.

In this case, the events don’t overlap at all and so the demon has ensured that the probability of P(A∩B)=0.

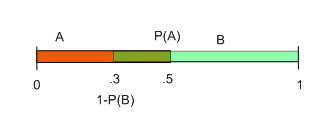

But what if the two events must overlap? Suppose for example that P(A)=.5 and P(B)=.7 then the demon’s logic of minimization leads to the following picture:

We can see from the picture that the overlap is the region between .3 and .5 which we know has probability .5-.3=0.2. Thus we have discovered that if P(A)=.5 and P(B)=.7 then the joint probability has to be at least .2, i.e. .2≤P(A∩B).

We can see from the picture that the overlap is the region between .3 and .5 which we know has probability .5-.3=0.2. Thus we have discovered that if P(A)=.5 and P(B)=.7 then the joint probability has to be at least .2, i.e. .2≤P(A∩B).

Now let’s generalize. The probability of any event occuring is the length of its region b-a but since the demon always begins the event A at 0 then the probability of P(A) is simply b the rightmost point of the A region. Thus, on the diagram the rightmost point of the A region is labelled P(A) (.5 in this case). Also since the demon always begins the B region at 1, P(B)=1-a′ where a′ is the leftmost point of the B region so rearranging we have that the leftmost point a′=1-P(B) as shown in the picture at .3. Thus, we can read immediately from the figure that the overlap region has length P(A)-(1-P(B)). Notice that if P(A)<1-P(B) then there is no overlap and the difference is a negative number. Rearranging slightly, the length of the overlap region is P(A)+P(B)-1. So now we have two cases, either there is no overlap at all in which case P(A∩B)=0 or there is overlap and P(A∩B)=P(A)+P(B)-1. So putting it all together we have proven that:

max[0,P(A)+P(B)-1] ≤ P(A∩B)

The Frechet bounds also say:

P(A∩B) ≤ min[P(A),P(B)]

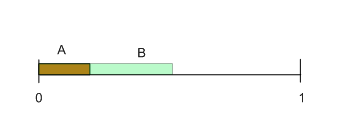

This is much easier to show. If minimization is accomplished by minimizing the overlap then maximization is accomplished by maximizing the overlap. To maximize the joint probability the demon starts both regions at the same point, say at the 0 point, so the picture looks like this:

The joint probability is then the region of overlap. But the regions can’t overlap by more than the smallest of the two regions! In this case the A region is smaller than the B region and since the regions start at 0 we have P(A∩B)≤P(A). Generalizing we have that:

The joint probability is then the region of overlap. But the regions can’t overlap by more than the smallest of the two regions! In this case the A region is smaller than the B region and since the regions start at 0 we have P(A∩B)≤P(A). Generalizing we have that:

P(A∩B) ≤ min[P(A),P(B)]

Thus we have proven the Frechet bounds:

max[0,P(A)+P(B)-1] ≤ P(A∩B) ≤ min[P(A),P(B)]

Addendum: Here is Heckman on the theory of Frechet Bounds and Heckman and Smith and Heckman, Smith and Clements with applications.

Online lending is overrated

So the industry turned instead to the wholesale markets. Hedge funds and investment banks have proved a much easier sell. Not surprising, perhaps, when average rates on a Lending Club loan are between 7.5 per cent and 25 per cent and bond fund returns are closer to 2 per cent. Institutions now make up about four-fifths of many US operators’ funding. That allows some of the largest marketplace lenders to grow at more than 100 per cent a year. But it also makes them look a lot less like financial innovators — and more like finance companies of yore.

The FT piece by Jonathan Ford is interesting throughout, for instance he emphasizes that new business in these markets is drummed up only slowly and the sector depends on origination fees of one kind or another. One possible outcome is that these online lenders will be bought out by banks. Yet:

The snag is that banks trade on just 10 to 12 times earnings. Even after recent share price falls, that is far below the valuations that listed marketplace lenders enjoy.

Stay tuned, but the great stagnation for finance is in my view likely to continue…

China and the Great Depression of the 1930s

I learned a good deal reading Ramon H. Myers’s essay “The World Depression and the Chinese Economy 1930-6” in Ian Brown’s The Economies of Africa and Asia in the Inter-war Depression. Here are a few of his points:

1. In the 1920s, per capita growth in China was probably around 0.33 percent a year, one percent a year in absolute terms. I would add the notion that the country already was on an explosive growth path does not seem borne out by these estimates.

2. The Chinese financial system at the time was quite free-wheeling and money flowed into China to facilitate the country’s 1915-1930 growth.

3. By the late 1920s, China’s exports were only about 2 to 3 percent of gdp.

4. The Japanese seized Manchuria 1931-32, and the region had been accounting for a significant portion of China’s industrial growth.

5. The loss of Manchuria excepted, Chinese internal growth rose about 11.6 percent a year across 1930-36. It seems the country just wasn’t hit that hard by the global Great Depression.

6. There was sustained deflation during 1931-1935; some of this ties in to complex developments in the silver market, as China was on a silver standard. Yet economic activity still expanded. Silver flowed out of the country, but there was a big boost in credit and “inside money.”

7. As an aside, had I mentioned that the Nanjing government only firmly controlled two provinces of the country as of 1935, with “minimal control” in eight others?

8. Shanghai grew throughout most of the 1930s, with exceptions for the Japanese attack and the Yangtse flood of 1931.

Myers’s conclusion that the Great Depression did not hit China so hard has been challenged (pdf), but so far his account is the most convincing I have found. China during the Great Depression remains an understudied topic.

A very good sentence

First, central banks don’t spend $150 billion every three weeks, or about $200 billion a month, to support a currency that is close to appropriately valued.

That is from Christopher Balding. Here is more:

Second, if you look at a list of major currencies and their move against the dollar over the past year, China is the extreme outlier in that the RMB has only dropped 2% compared to most currencies which have lost 10-30%. If China is even on the low end of a fall relative to the US dollar, it would need to drop at least 10% and a middle of the pack fall would require it to drop about 20%.

Ladies and gentlemen, lay your bets…

Robert Whaley speaks

On my iPhone are 55 albums by Bob Dylan, 16 albums by Leonard Cohen and 34 albums by Steve Earle. That’s all I listen to. It’s the storytelling in their lyrics. Dylan’s album “Tempest” is one of his best. The title song is a haunting 14-minute song about the sinking of the Titanic. I have every one of his albums except the last one where he interprets Frank Sinatra. That was out of line. He must have needed money. And I actually bumped into Steve Earle at the airport and introduced myself. My wife was just disgusted that I’d go and bother him, but he was very receptive. No, I did not tell him I developed the volatility indices.

Here is the rest of the interview.

Malek Jandali

Jamali was born in Germany on Christmas Day but raised in Homs, Syria. He studied piano at the Arab Institute of Music in Damascus and later in Moscow with Victor Bunin. In 1995 he won a scholarship to attend the North Carolina School of the Arts, and received a Master’s from the University of North Carolina in 2004. He has had an active career as a pianist and composer and has lived much of his time in Atlanta, now being a U.S. citizen. Many of his pieces combine Middle Eastern musical modes with traditional Western harmonies.

He was honored with the GUSI Peace Prize in 2013 for his efforts on behalf of peace and humanitarian causes, most of all helping to raise money for Syrian children. Not long ago, he received a “Great Immigrant” award from the Carnegie Corporation.

Here is one short video of his music, the visuals are good too. Here is an article about Jandali. Here is his Wikipedia page.

After performing at the White House in 2011, and also playing at a protest, and speaking out against the Syrian regime, Jandali’s parents were severely beaten and their home in Syria was ransacked, it is believed by Syrian security forces.

Eventually his parents fled Syria, and now they are relocated in Roswell. That was possible because Jandali is an American citizen. Otherwise…?

Currently it can take up to two years to process a refugee application from Syria, and of course most people do not have much chance of success through this route.

What China says about China

Chinese Finance Minister Lou Jiwei told his Group of 20 counterparts that the country’s economy is likely to face tough conditions for up to 10 years, sources familiar with the G-20 meeting said Sunday.

Following the two-day gathering through Saturday, the Chinese government said Lou told the finance chiefs that the next five years would be painful for the Chinese economy, and would include a difficult process of structural adjustment.

I don’t see why he would say that if growth were still in the five to seven percent range.

The Nikkei article is here, hat tip to the essential Nerys Avery.

Sunday assorted links

2. Polar bears against Putin?.

4. A very good new survey article on neighborhood effects, by Leventhal, Dupéré, and Shuey, academic gate for Wiley. A nice complement to the recent work by Chetty and other economists.

Sentences to ponder, The Strong Situation Hypothesis

This position can be seen as a variation on the theme of the “strong situation hypothesis” (Cooper and Withey, 2009). This hypothesis, based on the work of Mischel (1977), proposes that personality differences are especially like to be outwardly expressed in “weak” situations offering no clear situational clues and a wide range of possibilities as to how to behave. Conversely, individual differences are expected to have less room for expression in “strong” situations where the choice of behavioral outcomes is severely limited and where everyone is bound to behave in a similar way.

…Thus, individual risks could play a magnified role in highly disadvantaged neighborhood contexts.

That is from Tama Leventhal, Véronique Dupéré, and Elizabeth A. Shuey, “Children in Neighborhoods,” In Handbook of Child Psychology and Development Science, edited by Marc H. Bornstein and Tama Leventhal. New York: Wiley, 2015, p.520, academically gated link here, an excellent and consistently interesting survey piece complementing the recent economic studies by Chetty and others.

Ungated Cooper and Withey is here (pdf), also worth your time. Here is a related Wikipedia entry, perhaps not as clear as it might be.

Saturday assorted links

1. “I am not a story“– Galen Strawson.

2. At the margin. And communications training needed for Chinese central banker.

3. Chimp > drone.

4. Greg Mankiw on a carbon tax.

5. Review of Dani Rodrik’s new book on Economic Rules.

6. Markets in everything: “Hillary Clinton’s risky, extreme right-wing scheme to privatize the State Department’s email.” Didn’t she recently come out against so many federal contractors at the expense of federal employees?