Month: December 2015

Saturday assorted links

Denmark fact of the politically incorrect paper of the day

Using Danish matched employer-employee data, this paper estimates the relative productivity of men and women and finds that the gender “productivity gap” is 12 percent–seventy five percent of the 16 percent residual pay gap can be accounted for by productivity differences between men and women.

That is from the job market paper of Yana Gallen, a job market candidate from Northwestern.

High skilled migration and global innovation

Another argument against the brain drain hypothesis is that bringing talented workers to the “frontier” countries will boost the supply of global public goods. Rui Xu, in her job market paper from Stanford (pdf), considers exactly this effect. Here are her main results:

Science and engineering (S&E) workers are the fundamental inputs into scientific innovation and technology adoption. In the United States, more than 20% of the S&E workers are immigrants from developing countries. In this paper, I evaluate the impact of such brain drain from non-OECD (i.e., developing) countries using a multi-country endogenous growth model. The proposed framework introduces and quantifies a “frontier growth effect” of skilled migration: migrants from developing countries create more frontier knowledge in the U.S., and the non-rivalrous knowledge diffuses to all countries. In particular, each source country is able to adopt technology invented by migrants from other countries, a previously ignored externality of skilled migration. I quantify the model by matching both micro and macro moments, and then consider counterfactuals wherein U.S. immigration policy changes. My results suggest that a policy – which doubles the number of immigrants from every non-OECD country – would boost U.S. productivity growth by 0.1 percentage point per year, and improve average welfare in the U.S. by 3.3%. Such a policy can also benefit the source countries because of the “frontier growth effect”. Taking India as an example source country, I find that the same policy would lead to faster long-run growth and a 0.9% increase in average welfare in India. This welfare gain in India is largely the result of additional non-Indian migrants, indicating the significance of the previously overlooked externality.

In other words, the brain drain argument is overrated. You might also wish to sample our MRUniversity video on the brain drain argument.

Why older halls for symphony orchestras sound better than new ones?

According to Witold Rybczynski, it is partly a matter of size and shape. Older halls were more likely in a shoe-box shape, such as Musikvereinsaal (1870),the Concertgebouw (1888), and Symphony Hall (1900). The orchestra is at the narrow end of the hall, and “Sound is reflected to the listener from the two parallel walls (which are about sixty to eighty feet apart) as well as from the ceiling. Because the concertgoer is relatively close to the musicians, the atmosphere is intimate, visually as well as acoustically.”

The need for greater seating capacity, because of revenue, swells the halls to as large as 3,000 seats and renders these properties more difficult to achieve. Most of all, it is now difficult “to reflect bass notes from the side walls.”

Different halls also have different “reverberation” times, and thus the more that a hall is used for different kinds of music, the more the design of that hall reflects a compromise. In theory there should be different halls for playing Gorecki and Bach, so an all-purpose hall will sound ideal only rarely.

That is all from his new book Mysteries of the Mall and Other Essays, pp.188-192.

Friday assorted links

1. Can epigenetics influence sperm?

2. The Marc Andreessen productivity guide.

3. Russ Roberts chats with Mitch Weiss on the economics of the Broadway musical.

4. What it’s like to visit Cuba now, as an American.

5. Which kinds of books actually sell?

6. Music of Adele without overproduction, it is a shame what we are losing.

Level effects vs. growth rate effects

Here is an excellent blog post by John Cochrane on that topic, here are some scattered summary bits:

As it turns out, the difference between “growth” and “level” effects in growth theory and facts is not so strong. Many economists remember vaguely something from grad school about permanent “growth” effects being different and much larger than “level” effects. It turns out that the distinction is no longer so clear cut; “growth” is smaller and less permanent than you may have thought, and levels are bigger and longer lasting than you may have thought.

…But “temporary” “short-run” or “catch-up” growth can last for decades. And it can be highly significant for people’s well-being. From 2000 to 2014, China’s GDP per capita grew by a factor of 7, from $955 per person to $7,594 per person, 696%, 14.8% annual compound growth rate (my, compounding does a lot). And they’re still at 15% of the US level of GDP per person. There is a lot of “growth” left in this “level” effect!

…So where are we? There is no magic difference between permanent growth effects and one-time level increases. All we have are distortions that change the level of GDP per capita.

Do read the whole thing.

Did unconventional monetary policy give the economy some “below zero” properties?

Arsenios Skaperdas, in his job market paper (same link), says yes. I found this an ingenious method of investigation:

I examine the relationship between monetary policy and growth at the zero lower bound using industry data. I devise a simple inferential test of monetary policy’s industry effects. In the absence of the zero bound, and given previous Federal Reserve behavior, the federal funds rate would have troughed in the range of -2 to -5% since 2009. If unconventional policy failed to bridge this gap, this deficit should represent a very large contractionary monetary shock. I create a measure of historical industry interest rate sensitivity. Estimates from this measure imply that interest rate sensitive industries, such as construction, should have suffered a 4 to 10% decrease in revenues, since 2009, in comparison to insensitive industries. I do not find that this is the case. Furthermore, differences in cross-industry revenue growth rates, ranked by interest rate sensitivity, are similar to those seen in previous US economic recoveries. Finally, I quantify how much the results are due to unconventional monetary policy. I construct an implied stance of monetary policy, equivalent to an unbounded effective federal funds rate, directly from industry growth rates and macro variables. The evidence suggests that unconventional policy lowered the effective stance of policy below zero.

Skaperdas is from UC Santa Cruz, not always a strong placer in the job market, but I found this one of the more interesting papers of this year, so perhaps some of you should give him a look…

That was then, this is now

From the headlines:

The economy of Greece is in shambles. Internal rebellions have engulfed Libya, Syria, and Egypt, with outsiders and foreign warriors fanning the flames. Turkey fears it will become involved, as does Israel. Jordan is crowded with refugees. Iran is bellicose and threatening, while Iraq is in turmoil. AD 2031? Yes. But it was also the situation in 1177 BC, more than three thousand years ago,when Bronze Age Mediterranean civilizations collapsed one after the other, changing forever the course and the future of the Western world. It was a pivotal moment in history — a turning point for the ancient world.

That is from Eric H. Cline, 1177 B.C. The Year Civilization Collapsed, an interesting read.

Thursday assorted links

The year in recorded music, 2015

Here is some of what I listened to:

1. A big chunk of rap and R&B, centered around Kanye West, Frank Ocean, Kendrick Lamar, Drake, and D’Angelo, among others. Marvin Gaye is gone, but we’re actually living in a second golden age. Enjoy it.

2. Kamasi Washington’s The Epic was the jazz album I’ve enjoyed most.

3. The big box set of the year, which you might otherwise not think of buying, is Hulaland: The Golden Age of Hawaiian Music, excellent across all four discs and full of history.

4. From Syria, I’ll again recommend Dabke: Sounds of the Syrian Houran and Omar Souleyman, both highly worthwhile.

5. In classical music my picks would be Matthew Bengtson, Scriabin piano sonatas, volumes one and two. He’ll be playing Scriabin in Gaithersburg this Saturday night.

6. By the way, Rubber Soul came out fifty years ago today, which puts it closer to World War I than to 2015. My favorite song on the album is still “You Won’t See Me”, listen to the background vocals with headphones.

Is the gig economy taking over Washington, D.C.?

No, basically:

We first look at the number of District taxpayers who have paid self-employment taxes. The data show that the total number of people who pay self-employment taxes has increased in the District from 35,000 in 2006 to nearly 49,000 in 2014. This is a very steep increase (36 percent overall and nearly 4.5 percent annualized) even when compared to the relatively rapid increase in the District’s population and tax filers (tax filers grew at about 2 percent per year during the same period). But data show that the rapid increase in the number of filers who paid self-employment taxes occurred before 2010. In fact, since 2010, the share of tax filers who pay self-employment taxes has been stable at about 14 percent.

That is from a longer post, there is more at the link. Here is the broader (and excellent) blog on the law and economics of Washington, D.C., DistrictMeasured.com.

The optimal regulation of massage and prostitution

The job market paper of Amanda Nguyen, of UCLA, is on that topic, I found her results intriguing:

Despite its illegality, prostitution is a multi-billion dollar industry in the U.S. A growing share of this black market operates covertly behind massage parlor fronts. This paper examines how changes to licensing in the legal market for massage parlors can impact the total size and risk composition of the black market for prostitution, which operates either illegally through escorts or quasi-legally in massage parlors. These changes in market structure and risk consequently determine the net impact of prostitution on sexually transmitted diseases (STDs) and sexual violence. I track the impact of two policy changes in California that resulted in large variation in barriers to entry via massage licensing fees. Using a novel dataset scraped from Internet review websites, I find that lower barriers to entry for massage parlors makes the black market for prostitution larger, but also less risky. This is due to illegal prostitution buyers and suppliers switching to the quasi-legal sector, as well as quasi-legal sex workers facing a reduced wage premium for high-risk behavior. Consequently, the incidence of gonorrhea and rape falls in the general population. I also present evidence that growth in the quasi-legal sector imposes a negative competition externality on purely legal massage firms.

I don’t find the rape result intuitive, but I am seeing it pop up in a number of papers, so perhaps it should be taken seriously.

Japan fact(s) of the day

Yosuke Otsubo conservatively estimates that two-thirds of the rarest American clothing items, especially of the denim and workwear variety, remain in Japanese hands.

Levis from the 1930s can go for as much as 10k, and one collector in Chiba Prefecture owns about 3,000 pairs of jeans. A 1966 model can cost about $2000.

That is all from the new and interesting Ametora: How Japan Saved American Style, by W. David Marx. And here is New Yorker coverage of the book.

By the way, FTAlphaville is hiring!

Wednesday assorted links

1. Emperor Palpatine, the Death Star, and systematic risk (pdf).

2. New Hoover Institution book on inequality, open access, with many notables.

3. The role of drugs in the death rate spike for white women.

4. Robert Trivers documentary “biopic” is coming.

5. Bipolar predicts high educational achievement.

6. German walls that pee back at you.

7. Polyglot parrot combinatorial markets in everything. Or try this link.

A Dual-Track Drug Approval Process

In a post earlier this year I noted that Japan has significantly liberalized its approval process for regenerative medicine. Writing in Forbes, Bart Madden and Nobelist Vernon Smith outline a similar proposal for the United States.

Recently, Japanese legislation has implemented the core Free To Choose Medicine (FTCM) principles of allowing not-yet-approved drugs to be sold after safety and early efficacy has been demonstrated; in addition, observational data gathered for up to seven years from initial launch will be used to determine if formal drug approval is granted.

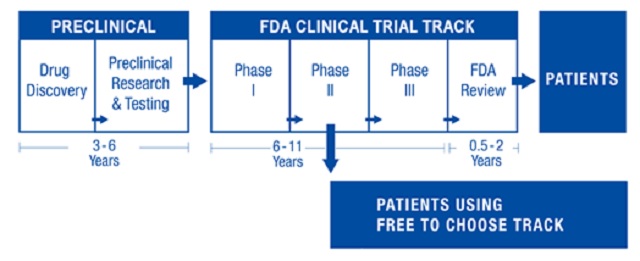

…FTCM legislation in the U.S. would create a dual track system (see figure below) that preserves the existing FDA clinical trial process while offering patients an alternative. Patients, advised by their doctors, would be able to contract with a drug developer to use not-yet-approved drugs after Phase I safety trials are successfully completed and one or more Phase II trials have demonstrated continued safety and initial efficacy. The resulting early access could make FTCM drugs available up to seven years before conventional FDA approval, which entails Phase III randomized control trials and a lengthy FDA review before the FDA makes an approval decision.

…The heart of the dual track system is the Tradeoff Evaluation Drug Database (TEDD) which would be available to the public through a government-supervised web portal. TEDD would contain all treatment results of FTCM drugs including patients’ health characteristics and relevant biomarkers, but no personal identification. This open access database would be a treasure-trove of information to aid drug developers in making better R&D decisions consistent with fast-paced learning and innovation.

…Today’s world of accelerating medical advancements is ushering in an age of personalized medicine in which patients’ unique genetic makeup and biomarkers will increasingly lead to customized therapies in which samples are inherently small. This calls for a fast-learning, adaptable FTCM environment for generating new data. In sharp contrast, the status quo FDA environment provides a yes/no approval decision based on statistical tests for an average patient, i.e., a one-size-fits-all drug approval process.

I hold the Bartley J. Madden Chair in Economics at the Mercatus Center so I am biased but this is an important proposal. Japan is leading the way and similar ideas are being discussed in Great Britain but as the most important pharmaceutical market in the world, the United States has an outsize influence on world drug development. We need to lower costs and speed new drugs to market.