Month: March 2017

Monday assorted links

1. How to wiretap Trump Tower.

2. Economist Dorothy Rice passes away (NYT). And The Economist on feminist economics.

3. Underrated explanations for understanding the rise of Trump (NYT):

Historians will long ponder the factors behind Mr. Trump’s unlikely rise to the presidency. Most analyses cite his advocacy for the economically disaffected, his rejection or embrace of one form of identity politics or another, or his preternatural ability to connect with “Middle America.”

But another factor deserves attention: a bipartisan approach to national security focused on terrorism that has distorted America’s understanding of its interests.

4. The real story of Japan’s Bond Girl (NYT).

5. Atlantic Business on The Complacent Class: “[The Complacent Class] provides an open invitation for the reader to think deeply.” And Arnold Kling reviews Complacent Class: ” There is a lot to the book. You should read it. Even though it is getting a lot of coverage, don’t just assume that you can pick up its contents by osmosis. But prepare to disagree with him at times.” And a review by Dalibor Rohac.

I am doing a Reddit AMA at 2 p.m.

Here is the link, all are welcome…

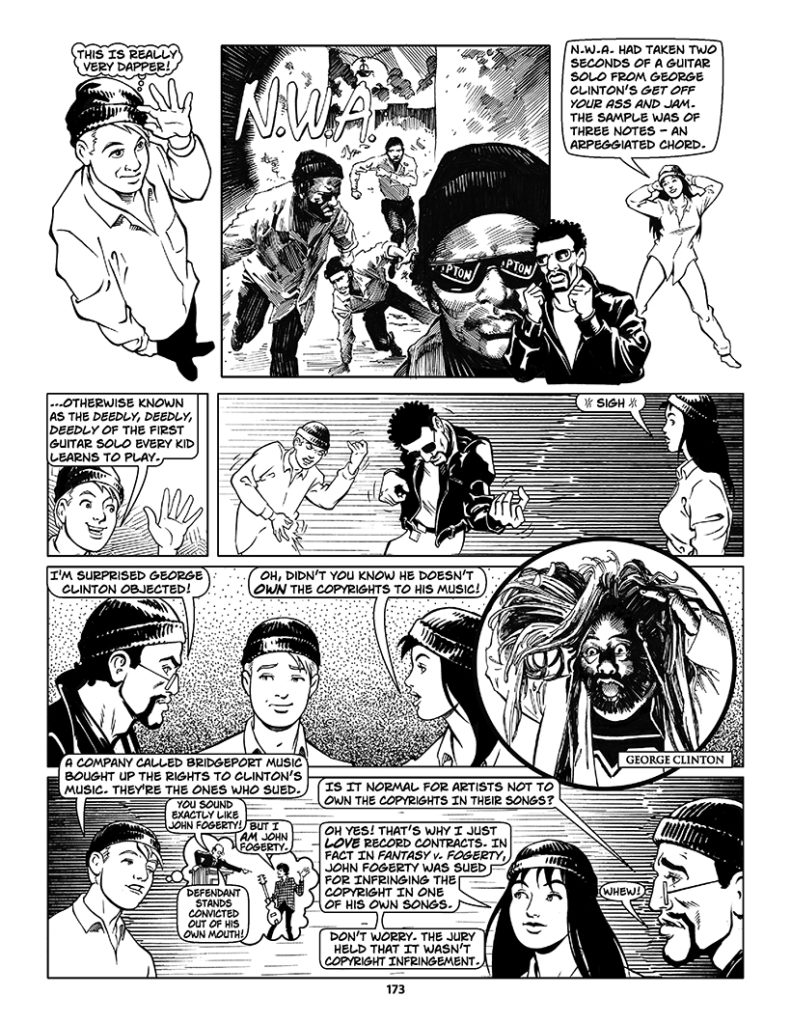

Theft! A History of Music

Theft! A History of Music is a graphic novel by James Boyle, Jennifer Jenkins and the late Keith Aoki. It’s about musical borrowing and the laws that have attempted to regulate musical borrowing and inter-mixing over the past 2000 years.

The history in this book runs from Plato to Blurred Lines and beyond. You will read about the Holy Roman Empire’s attempts to standardize religious music with the first great musical technology (notation) and the inevitable backfire of that attempt. You will read about troubadours and church composers, swapping tunes (and remarkably profane lyrics), changing both religion and music in the process. You will see diatribes against jazz for corrupting musical culture, against rock and roll for breaching the color-line. You will learn about the lawsuits that, surprisingly, shaped rap. You will read the story of some of music’s iconoclasts—from Handel and Beethoven to Robert Johnson, Chuck Berry, Little Richard, Ray Charles, the British Invasion and Public Enemy.

Theft! is informative and quite fun. I enjoyed it a lot. You can buy a paperback or get a free download. Here’s one page:

Should we tax robots?

That idea was suggested recently by Bill Gates, though I think you can debate with what degree of literalness. It’s worth a ponder in any case, and here is a recent Noah Smith column on the idea, and here is Summers in the FT, WaPo link here. And here is Izabella Kaminska.

Put aside the revenue-raising issue (which will require some taxes on capital, most likely, including on robots): if we have taken in optimal revenue, is there a separate and additional argument for an additional robot tax? In this context, I would consider “robots” to be capital that is especially substitutable for human labor.

Presumably the claim is that there is either a distributional or an “externalities from a happy human being” reason to slow the rate at which capital is substituted for labor. But if we accept that assumption, should we tax robots or subsidize wage labor?

One reason not to tax the robots is that employers might substitute away from robots and toward natural resources rather than toward domestic human labor. Maybe that doesn’t sound intuitive, but think of paying the energy costs to outsource to another nation and transport the outputs back home.

But the main issue is probably one of incidence. A general problem with a wage subsidy is that sometimes much of its value its captured by employers. For instance if the subsidy takes an EITC form, employers could pay less to their workers, but perhaps many eager workers still would seek the job to capture the somewhat higher net total wage, namely the employer portion plus the benefit. If enough workers are keen to get the pay, employers can claw back much of the EITC boost and still get the work force they need.

Now consider the incidence of a tax on robots. If the elasticity of the demand for robots is high, there will be a big shift away from robots and toward labor (and land and other resources). It is at least possible that workers capture more of the gains this way than from the direct subsidy to their wages. On the downside, the employer fares less well under this scheme.

So it depends on how labor and robot elasticities relate to each other. I don’t know what relationship between the parameter values is likely, but typically in these scenarios just about any result is possible. The robot tax would seem to do best when the elasticity of demand for robots is high, but the corresponding elasticity of demand for labor is low (and differentials in supply elasticities do not offset this). As robots and labor become more substitutable, that difference in demand elasticities is likely to diminish. So if you are going to do this, maybe it is necessary to do it soon, precisely when it does not seem needed.

Your call, but that is the basic set-up of the problem.

Derek Thompson’s *The Hit Makers*

What makes one song, TV show, or consumer product a hit, and the other not? Derek’s new book is probably the very best exploration of this question. Perhaps not surprisingly, I interpret much of his answer in terms of complacency: people want something that appears a bit different, but actually is deeply conservative and keeps them running in place (my take, not exactly his). In any case, what is the right blend of new and old to captivate an audience?

Here is one good review of the book. You can buy it here.

Global trade Danish shipping company fact of the day

Maersk had found that a single container could require stamps and approvals from as many as 30 people, including customs, tax officials and health authorities.

While the containers themselves can be loaded on a ship in a matter of minutes, a container can be held up in port for days because a piece of paper goes missing, while the goods inside spoil. The cost of moving and keeping track of all this paperwork often equals the cost of physically moving the container around the world.

That is by Nathaniel Popper and Steve Lohr, mostly about blockchains, via Ángel Cabrera.

Sunday assorted links

1. Allison Stanger’s open letter to Milan Kundera.

2. Duke Ellington plays the Beatles on the Ed Sullivan Show.

3. U.S. health care expenditures are fairly well explained by U.S. consumption behavior.

4. Some background on the FISA warrant process.

5. Finance economist Stephen Ross has passed away.

6. Interview with Die Welt [auf deutsch].

Payola and satellite radio

In the last two weeks I’ve heard the new George Harrison box set mentioned so often on channel 26 Sirius satellite radio — accompanied by the playing of Harrison songs — that I’ve concluded some form of payola is going on. In its early days, satellite radio was critical of the mainstream radio stations for this practice, but now it’s jumped on board. And you know what — no one cares! Even on the internet, there is hardly anyone complaining. Hard to believe, I know, but that is maybe one indirect advantage of the current political polarization.

And why should you complain about satellite radio payola? Without payola, the stations choose songs (directly or indirectly, through dj instructions) to pull in the marginal subscriber. With payola, payments from IP holders become a separate influence on program content. Those payments are most likely to come from IP holders whose products show a high elasticity of demand with respect to advertising. In other words, the influence of producer surplus rises, relative to consumer surplus.

Intuitively, that seems to me “music that a lot of listeners already are familiar with, even if they don’t know that a new boxed set just has been released” is how that category translates into satellite radio circa 2017. Or, in other words, George Harrison.

Perhaps the most underrated George Harrison song is “You.”

Addendum: Interestingly, payola in earlier parts of the 20th century seemed to favor music for the young, black music, and new, previously undiscovered artists. It’s worth thinking through why this has changed. For 1950-2000, there is no “marginal subscriber to radio” the way there is for satellite radio, rather most listeners are in the relevant network. Furthermore, today’s satellite radio listeners are I believe considerably older and somewhat wealthier than the typical radio listener, either now or earlier. When more or less everyone was on the “free radio network,” the high elasticity of profits with respect to advertising was for the artists who otherwise wouldn’t get much exposure. In contrast, today it is for “golden oldies,” where the taste for the product already is there but information about availability may be lacking.

Autor, Dorn, and Hanson respond on the China trade shock

Messrs Autor, Dorn and Hanson went so far as to publish a scathing eight-page technical response to Mr. Rothwell. “The main methodological critique provided by Rothwell is unfounded,” they wrote. “The critique provided does not follow from his own logic.”

Here is the full WSJ coverage of the dispute, by Bob Davis.

Mumbai Razes Apartment Building, I Raise Questions

A story in The Times of India unwittingly illustrates the problems of construction in Mumbai. It is headlined, 11-storey illegal building near tracks finally razed. Many newspapers carried the story and all of the ones that I read took a righteous tone. ‘Finally this illegal monstrosity has been demolished’, they said. The authors appeared to regret only that the city had taken so long to act.

A story in The Times of India unwittingly illustrates the problems of construction in Mumbai. It is headlined, 11-storey illegal building near tracks finally razed. Many newspapers carried the story and all of the ones that I read took a righteous tone. ‘Finally this illegal monstrosity has been demolished’, they said. The authors appeared to regret only that the city had taken so long to act.

The building was not illegally constructed on public property or park land nor on a historical landmark. There were no safety claims, as far as I could find, although people worried about the safety of the demolition job given the nearness to the railroad. The photo at right shows a before and after picture. The after does not look better to me than the before.

Not everyone was pleased. The locals, presumably mostly residents (or perhaps hired thugs), tried to stop the demolition:

The BMC began demolition of the structure in June 2016, but owing to severe resistance from locals and no adequate police protection, the work had to be stopped abruptly.

The demolition resumed in August 2016 with the help of around 80 labourers. Though locals again threatened the labourers, the BMC continued the work amid police protection.

Eventually, however, the building was razed to the ground. But here is where it gets interesting. Amazingly, this is not the first time a building on this site has been demolished. According to another report this is in fact the third demolition. Now either the developer is an idiot or it must be so costly to construct a building legally that it’s worth the very real risk of demolition to construct it illegally.

I understand the frustration that people feel when the law is flouted but the real question stories like this raise is, What kind of law makes it so expensive to construct new apartment buildings in a city that by some measures is the most unaffordable in the entire world?

Saturday assorted links

1. Hamilton, Canada legalizes street hockey once again.

2. When will Amazon ship to the moon?

3. New Zealand offers free holiday to people who agree to do job interviews there.

4. $200 AI device to judge whether your tennis balls are in or out.

5. My podcast with The Art of Manliness. And my interview with Harvard Business Review.

6. Spanish Uber for priests. And John Cochrane on what economics really should be for.

The culture that is England, affirmative action edition

Oxford University has launched a summer school aimed at white British boys, in an effort to increase its intake of working class students.

It is the first time the university has ever specifically targeted this demographic, which is one of the most underrepresented groups in higher education.

Under a new partnership with the Sutton Trust, a social mobility charity, male students from rural and coastal communities will be recruited for summer schools hosted at Oxford University.

…Research by the Sutton Trust charity shows that white British boys who are eligible for free school meals – a key measure of poverty – achieve the lowest GCSE grades of any major ethnic group, with only a quarter (24%) gaining at least five C grades including English and maths.

This compares to around a third (32%) of white British girls on free school meals who achieve this benchmark, making them the lowest performing major female ethnic group.

Here is further information, via the excellent Jeff H.

Friday assorted links

1. Robert Laszlewski argues against selling health insurance across state lines. Basically new competition with narrow mandate plans can pick apart the previous pooling equilibrium.

2. My OnPoint podcast/interview. And me on YahooFinance.

3. How children are being shaped by their know-it-all voice assistants.

4. Are NFL coaches too predictable for their own good?

5. Virginia is the first state passing a law to allow robots to deliver directly to your front door.

6. Russ Roberts on what economists do and do not know.

7. The new smart condom that tracks data on your speed and velocity.

Komodo Dragon Blood!

The Economist covers some important new research out of George Mason University on the search for new antibiotics:

MYTHOLOGY is rich with tales of dragons and the magical properties their innards possess. One of the most valuable bits was their blood. Supposedly capable of curing respiratory and digestive disorders, it was widely sought. A new study has provided a factual twist on these fictional medicines. Barney Bishop and Monique van Hoek, at George Mason University in Virginia, report in The Journal of Proteome Research that the blood of the Komodo dragon, the largest living lizard on the planet, is loaded with compounds that could be used as antibiotics.

Komodo dragons, which are native to parts of Indonesia, ambush large animals like water buffalo and deer with a bite to the throat. If their prey does not fall immediately, the dragons rarely continue the fight. Instead, they back away and let the mix of mild venom and dozens of pathogenic bacteria found in their saliva finish the job. They track their prey until it succumbs, whereupon they can feast without a struggle. Intriguingly, though, Komodo dragons appear to be resistant to bites inflicted by other dragons.

Most animals—not just Komodo dragons—carry simple proteins known as antimicrobial peptides (AMPs) as general-purpose weapons against infection. But if the AMPs of Komodo dragons are potent enough to let them shrug off otherwise-fatal bites from their fellow animals, they are probably especially robust. And that could make them a promising source of chemicals upon which to base new antibiotics.

*Deep Thinking*

The author is Gary Kasparov and the subtitle is Where Machine Intelligence Ends and Human Creativity Begins. I am honored to have had the chance to write a blurb for this book. It is everything I wanted from this author and title, and it also contains the inside scoop — with some truly interesting and deep revelations — about the match with Deep Blue.

Self-recommending, and interesting throughout!