Month: July 2017

Geoffrey Gurrumul Yunupingu, RIP

Age 46, a Torres Strait Islander, here are various obituaries.

What I am hearing about Republican tax reform

“The goal is a plan that reduces tax rates as much as possible, allows unprecedented capital expensing [for businesses], places a priority on permanence, and creates a system that encourages American companies to bring back jobs and profits trapped overseas,” it said.

No Border Adjustment Tax, even Ryan says that, lower rates for small business than for big business, full investment expensing, and an emphasis on permanence (how can they possibly manage that one?). Will there be a “skinny” version of this bill too?

Here is one article, plus I’ve been trawling Twitter, presumably more details are on the way or maybe not.

What I’ve been reading

1. Yiyun Li, Dear Friend, from My Life I Write to You in Your Life. One of the few books that have a perfect title. These are a cross between short stories, ruminations, and essays. Yiyun Li is from China, yet she refuses to write in Chinese or to have her work published in Chinese. At times you wonder what is really in here, but her voice and vision stick with you.

2. Yaroslav Trofimov, The Siege of Mecca: The 1979 Uprising at Islam’s Holy Shrine. Compulsively readable, and also excellent background on both the Gulf region and the Saudi-Iran conflict.

3. William R. Cline, The Right Balance for Banks: Theory and Evidence on Optimal Capital Requirements. Not for the unconverted, but a good guide for anyone with a prior interest. Capital requirements should be higher, but it is wrong to think the American economy currently has “too much finance.”

4. Regulating Wall Street: Choice Act vs. Dodd-Frank, published by NYU, with many notable contributors including multiple essays by Lawrence J. White. Balanced, judicious, the best look so far at pending reforms to banking and finance.

5. Slavoj Žižek, The Fragile Absolute: Or Why is the Christian Legacy Worth Fighting For? A lot of this book is only so-so, but the Preface — “A Glance into the Archives of Islam” — counts as one of the better works I’ve read this year, even though it comes in at only 27 pp. It covers Hagar and Sarah, how Muslim and Christian understandings of the Abraham story differ, and the intellectual sources of institutional problems with Islam and political order. That’s the secret to reading SZ, not to let yourself get distracted by the bad stuff or empty pages. Amongst those who do not revere him, he remains underrated.

Arrived in my pile is the exhaustive and comprehensive Edward N. Wolff, A Century of Wealth in America. This is likely to prove an important work for many researchers.

What also appears valuable, but I cannot read right now, is Kevin R. Brine and Mary Poovey, Finance in America: An Unfinished Story.

Betting markets inside corporations

There is a new paper in the JPE on this, with encouraging results:

A Pari-Mutuel-Like Mechanism for Information Aggregation: A Field Test inside Intel

Benjamin Gillen, Charles Plott & Matthew Shum

Journal of Political Economy, August 2017, Pages 1075-1099Abstract:

A new information aggregation mechanism (IAM), developed via laboratory experimental methods, is implemented inside Intel Corporation in a long-running field test. The IAM, incorporating features of pari-mutuel betting, is uniquely designed to collect and quantize as probability distributions dispersed, subjectively held information. IAM participants’ incentives support timely information revelation and the emergence of consensus beliefs over future outcomes. Empirical tests demonstrate the robustness of experimental results and the IAM’s practical usefulness in addressing real-world problems. The IAM’s predictive distributions forecasting sales are very accurate, especially for short horizons and direct sales channels, often proving more accurate than Intel’s internal forecast.

Hat tip goes to the excellent Kevin Lewis. Here are earlier, ungated versions.

Occupational Licensing Video

Here’s the video of the Heritage session on occupational licensing. All the talks were good; short and to the point. Maureen Ohlhausen, Acting Chairman of the Federal Trade Commission leads off, Paul Larkin discusses some of the legal issues and legislation, my comments begin around 28:20 followed by Dexter Price who talks about his personal experience trying to get a DC license–he is more than qualified for his job in property management but DC requires that in order to manage property he needs a very expensive and time consuming realtor’s license even though he has no interest in buying and selling property.

Thursday assorted links

1. Roombas are mapping your home, and they will sell that information to the highest bidder.

2. Registration link for Sept. 6 Conversation with Larry Summers.

3. China markets in everything Bob Dylan potato chips.

4. Is Baltimore the coolest city on the east coast?

5. Why aren’t businesses more interested in IQ tests?

6. More on India, China, and Bhutan (NYT).

Those new manufacturing sector jobs

Since 2008, Ford has been continually expanding its Asia Pacific odor laboratory in Nanjing, China. Today, the team consists of 18 ‘super smellers’, who conduct about 300 odor tests each year on materials and components that go into its Asia Pacific vehicles.

…Every year Ford runs an application process to select its team of super smellers in China. Would-be testers can come from any department within the company and are asked to judge material samples in 16 jars. They are judged on their smelling ability and consistency, but must also meet other requirements to qualify for a spot on the prestigious panel.

“You can’t smoke or have allergies and sinus issues,” says Mike Feng, a Ford smell tester for four years. “Wearing perfume, leather jackets or nail polish is also not allowed, and you shouldn’t use strongly scented shampoo to ensure your senses aren’t compromised.”

Ford’s super smellers must requalify annually to maintain their position on the panel and must be available to attend regular odor tests throughout the year. A small group of six panelists form the smell jury for each test and an average of their scores is given to each material sample.

“I’ve always been able to smell things before other people,” adds Feng. “My colleagues say that I can smell what the canteen is serving for lunch before anyone else.”

Here is the full story, via John Chilton.

Will robots really boost productivity all that much?

That is the topic of my latest Bloomberg column, here is one bit:

…consider the general logic of labor substitution. Machines and software are often very good at “making stuff” and, increasingly, at delivering well-defined services, such as when Alexa arranges a package for you. But machines are not effective at persuading, at developing advertising campaigns, at branding products or corporations, or at greeting you at the door in a charming manner, as is done so often in restaurants, even if you order on an iPad. Those activities will remain the province of human beings for a long time to come.

How much is this shift of labor into marketing a step forward? To be sure, a lot of commercial persuasion is useful. Marketing informs consumers about new products and their properties, or convinces them that one product is better for them than another. It was marketing that got me to stop watching baseball and switch to the more exciting NBA. Sometimes the very existence of an ad — even apart from any direct informational value — makes a product more enjoyable. If a particular basketball sneaker is associated with LeBron James, through an endorsement and TV commercials, some people will enjoy wearing that sneaker more.

That all said, a lot of marketing is a zero- or negative-sum game. Each business tries to pull customers away from the other brands, and while the final matching of customers to products is usually closely attuned to what people want, more is spent on these business battles than is ideal for social efficiency. My bank might make me feel better about being a customer there, but its services just aren’t much superior to those of the nearest competitor, if at all. Maybe Coke really is better than Pepsi, or vice versa, but it’s not that much better — and billions are spent trying to persuade consumers to make one switch or the other.

I don’t take the Galbraithian view, but still consumers only enjoy extra marketing so much. I conclude with this:

Don’t be surprised if you see a lot of robots in daily life, and in news stories, but not huge productivity gains in the published statistics. That’s exactly the American economy right now.

Do read the whole thing.

A good sentence fragment

Nothing in Arrow predicts higher expenditures. In fact, it predicts fewer expenditures because markets will partially breakdown (not exist)

That is from Jeremy Horpedahl on Twitter.

Wednesday assorted links

1. Tweet storm on what actually happened with the health care vote.

2. Vanity Fair on the changes at the NYT.

3. Joshua Wright tweetstorm on hipster antitrust and why it will and indeed should fail.

4. Inability to pass a drug test (NYT).

5. Cleveland Browns wide receiver to pursue Ph.d in economics.

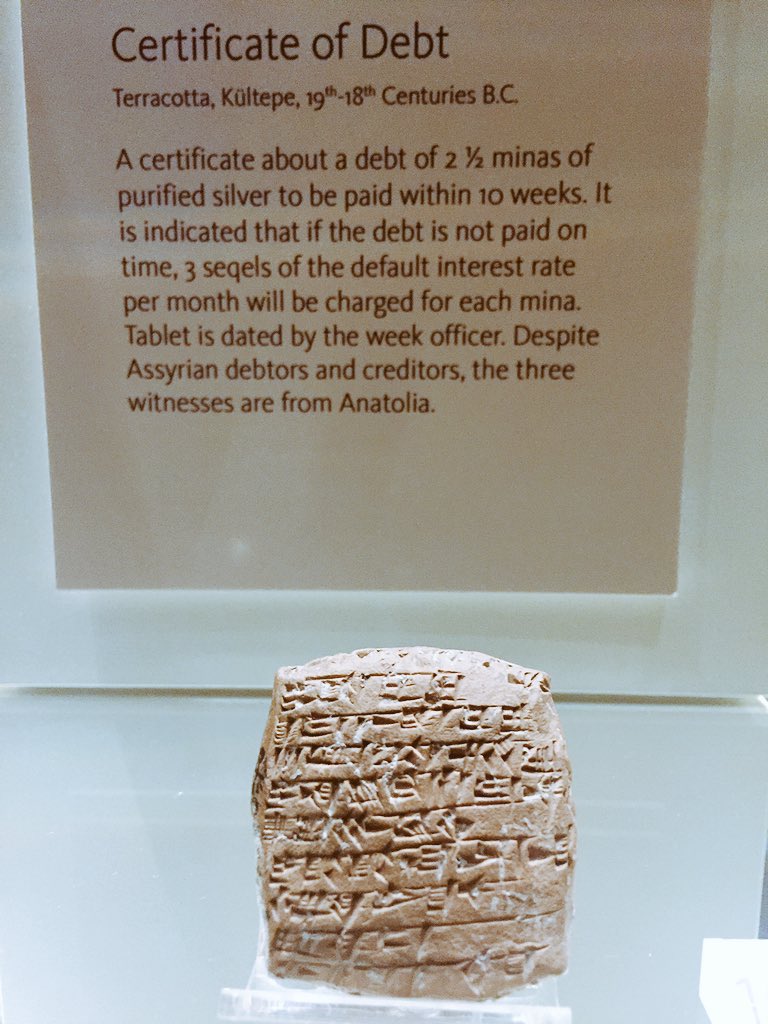

A Four Thousand Year Old Bond

From the Museum of Anatolian Civilizations in Turkey via a post on twitter from Isobel Finkel.

Why has regional income convergence in the U.S. declined?

1. “For over a century, incomes across states converged at a rate of 1.8% per year…The convergence rate from 1990 to 2010 was less than half the historic norm, and in the period leading up to the Great Recession there was virtually no convergence at all.”

2. After subtracting housing costs, janitors in NYC now earn less than they do in the Deep South. This was not the case for most of American history.

3. For NYC janitors, housing costs measure at 52% of their income.

4. Income differences across states are increasingly capitalized into housing prices.

5. “…income convergence declined the most in areas with [land] supply constraints.”

6. “Had [cross-state] convergence continued apace through 2010…the increase in hourly wage inequality from 1980 to 2010 would have been 8% smaller.”

That is from a new NBER working paper, “Why has Regional Income Convergence in the US Declined?”, by Peter Ganong and Daniel W. Shoag. Here are earlier ungated versions.

Note that this paper contains “…the first national panel measure of land use regulations in the US.”

Are American corporate profits really so high?

Notice that if a U.S. corporation earns a profit from affiliate operations abroad, the profit will be added to the numerator of CPATAX/GDP, but the costs will not be added to the denominator, as they should be in a “profit margin” analysis. Those costs, the compensation that the U.S. corporation pays to the entire foreign value-added chain–the workers, supervisors, suppliers, contractors, advertisers, and so on–are not part of U.S. GDP. They are a part of the GDP of other countries. Additionally, the profit that accrues to the U.S. corporation will not be added to the denominator, as it should be–again, it was not earned from operations inside the United States. In effect, nothing will be added to the denominator, even though profit was added to the numerator.

General Motors (GM) operates numerous plants in China. Suppose that one of these plants produces and sells one extra car. The profit will be added to CPATAX–a U.S. resident corporation, through its foreign affiliate, has earned money. But the wages and salaries paid to the workers and supervisors at the plant, and the compensation paid to the domestic suppliers, advertisers, contractors, and so on, will not be added to GDP, because the activities did not take place inside the United States. They took place in China, and therefore they belong to Chinese GDP. So, in effect, CPATAX/GDP will increase as if the sale entailed a 100% profit margin–actually, an infinite profit margin. Positive profit on a revenue of zero.

Here is much more, with many visuals and further details at the link, including a treatment of how to measure corporate profits accurately.

For the pointer, I thank @IronEconomist.

Football sentences to ponder

Question What are the neuropathological and clinical features of a case series of deceased players of American football neuropathologically diagnosed as having chronic traumatic encephalopathy (CTE)?

Findings In a convenience sample of 202 deceased players of American football from a brain donation program, CTE was neuropathologically diagnosed in 177 players across all levels of play (87%), including 110 of 111 former National Football League players (99%).

Here is the research paper, via Peter Metrinko. Here is NYT coverage of the result.