Month: September 2017

How to alleviate the problem of identity and credit hacks?

Here is one proposal:

What if I told you that the credit rating companies already had a system to verify identities before opening new accounts — but, because this would be a minor inconvenience, and a drag on their profits, they only allow this status to last for 90 days for any given account unless a police report can be filed, and furthermore, while they may claim that they’ll do this, it’s not actually a legal requirement? From a Krebs on Security piece from 2015 (as ever, Krebs is two years ahead of the zeitgeist):

“With a fraud alert on your credit file, lenders or service providers should not grant credit in your name without first contacting you to obtain your approval — by phone or whatever other method you specify when you apply for the fraud alert … Fraud alerts only last for 90 days, although you can renew them as often as you like. More importantly, while lenders and service providers are supposed to seek and obtain your approval before granting credit in your name if you have a fraud alert on your file, they’re not legally required to do this.”

That’s right: a solution to the ongoing insane catastrophe which is the American credit system already exists. The infrastructure and process for it is already in place. But thanks to regulatory capture, an inability to understand the scale of data hacks that modern technology enables, or sheer incompetence, it only exists on a case-by-case, opt-in, short-term solution.

Obviously everybody should have this verification — “two-factor authentication,” if you will — turned on and kept on. This would not be a panacea, of course. Security hipsters will loudly protest that phones and email are terrible second authentication factors that no one should even consider using. Phone and email are not ideal, but the point is, universalizing this existing solution would hugely improve matters for a relatively trivial cost.

That is from Jon Evans. I still would like to know what is the social cost of identity theft. Furthermore, what is the cost of identity theft as a ratio of the cost of some people simply not paying borrowed money back?

Everyone is all a-flutter on this issue, and attacking Equifax, but I am looking for more reliable information before voicing an opinion.

*The Color of Money*

The author is Mehrsa Baradaran, and the subtitle is Black Banks and the Racial Wealth Gap. Here is one excerpt:

Not only were black bankers stuck in a perpetual money pit, but they were often cast as the villains when thing went wrong. That their loans went primarily to the black middle class and were out of reach of the majority of blacks sometimes made black banks the targets of criticism. Abram Harris was one of these critics. Harris was the first nationally renowned black economist and the first to do a comprehensive study of black banks, called The Negro as Capitalist (1936). Harris headed the Howard economics department from 1936 to 1945, when he became the first black economist at the University of Chicago. He was recruited there by Frank Knight…Harris had held Marxist sympathies while at Howard, but with his move to Chicago, his economic philosophy became more traditional.

Here is Wikipedia on Harris. As for Baradaran, I found this to be “two books in one.” First, it was an OK and useful but not original look at the evolution of the racial wealth gap. Second, it was a very interesting but interspersed history of black banking in America. Overall recommended. Here is the book’s home page.

Monday assorted links

2. Median income is not rising in Washington, D.C.

3. China markets in everything.

4. How to read a chocolate bar label.

5. Should we make it harder for an American president to launch nuclear weapons?

6. Vermont will be experimenting with paying for health care results: “Making lump sum payments, instead of paying for each X-ray or checkup, changes the financial incentives for doctors.”

Buffett Wins Bet

NYPost: The Oracle of Omaha once again has proven that Wall Street’s pricey investments are often a lousy deal. Warren Buffett made a $1 million bet at end of 2007 with hedge fund manager Ted Seides of Protégé Partners. Buffett wagered that a low-cost S&P 500 index fund would perform better than a group of Protégé’s hedge funds.

Buffett’s index investment bet is so far ahead that Seides concedes the match, although it doesn’t officially end until Dec. 31.

The problem for Seides is his five funds through the middle of this year have been only able to gain 2.2% a year since 2008, compared with more than 7% a year for the S&P 500 — a huge difference. That means Seides’ $1 million hedge fund investments have only earned $220,000 [through 2016] in the same period that Buffett’s low-fee investment gained $854,000.

I am shocked that Seides put his money on five funds-of-funds, thus piling fees on fees. It was a loser bet. Mark Perry at Carpe Diem has more of the stats.

In one way, this is another win for index fund investing but there is still an anomaly. The S&P trounced the hedge funds but it still lost to an investment in Berkshire Hathaway! (see addendum) Admittedly the race was pretty close at times but after ten years Berkshire was up 91.5% and the S&P 500 up 69.1%.

Addendum: An astute reader with access to a Bloomberg terminal points out that an investment in the S&P 500 pays dividends while famously Berkshire Hathaway does not. Moreover, when you compare total returns the S&P 500 is up 110.7% over this period and Berkshire is up 91.8% so indexing over this period even beats Buffett!

Why I am opposed to Netflix streaming

Reed Hastings, the Netflix CEO who co-founded the company long before “streaming” entered the popular lexicon, was born during a fairly remarkable year for film. 1960 was the year Alfred Hitchcock’s Psycho astounded and terrified audiences, influencing a half-century of horror to come. It was a year of outstanding comedies (Billy Wilder’s The Apartment), outstanding epics (Stanley Kubrick’s Spartacus) and outstandingly creepy thrillers (Michael Powell’s Peeping Tom—a close cousin of Psycho).

But in the vast world of Netflix streaming, 1960 doesn’t exist. There’s one movie from 1961 available to watch (the original Parent Trap) and one selection from 1959 (Compulsion), but not a single film from 1960. It’s like it never happened. There aren’t any movies from 1963 either. Or 1968, 1955 or 1948. There are no Hitchcock films on Netflix. No classics from Sergio Leone or François Truffaut. When Debbie Reynolds died last Christmas week, grieving fans had to turn to Amazon Video for Singin’ in the Rain and Susan Slept Here. You could fill a large film studies textbook with what’s not available on Netflix.

Netflix’s selection of classic cinema is abominable—and it seems to shrink more every year or so. As of this month, the streaming platform offers just 43 movies made before 1970, and fewer than 25 from the pre-1950 era (several of which are World War II documentaries). It’s the sort of classics selection you’d expect to find in a decrepit video store in 1993, not on a leading entertainment platform that serves some 100 million global subscribers.

The bottom line is that streaming rights are expensive, whereas for shipping around DVDs the company can simply buy a disc. Alternatively, you could say that the law for tangible media — such as discs — is less infested with special interests than the law for digital rights? What does that say about our future?

Here is the article, via Ted Gioia.

What I’ve been reading

1. Peter Sloterdijk, Selected Exaggerations: Conversations and Interviews, 1993-2012. No, he’s not a fraud, and this volume is probably the best introduction to his thought. Is there an extended argument here? I am not sure, but I did enjoy this bit:

The existential philosophers have greatly overstated homelessness. In fact, people sit in their apartments with their delusions and cushion themselves as best they can.

But why does he have to follow up with?:

Living means continuously updating the immune system — and that is precisely what foam theory can help us show more clearly than before.

In the German-speaking world he passes for one of the most important world thinkers.

2. Declan Kiberd, After Ireland: Writing the Nation from Beckett to the Present. A very high quality and original look at how Irish literature reflects the nation’s development, though it assumes a fair knowledge of the works being discussed.

3. Fred Hersch, Good Things Happen Slowly: A Life in and Out of Jazz. How someone from a previous generation a) became a star jazz pianist, b) discovered gay liberation, and c) woke from a coma to resume a miraculous career.

4. Stephen Greenblatt, The Rise and Fall of Adam and Eve. In general I am a Greenblatt fan, and not persuaded by the critics of his popularizations, but this book is not doing it for me. For the Hebrew Bible I prefer to read densely argued Straussians.

5. William Ian Miller, The Anatomy of Disgust. Miller’s books from the 1990s remain an underrated source of “stuff for smart people.” His book on disgust could be the best in that series, for me this is a reread and yes it did hold up.

A Technology Story in Three Headlines

Sunday assorted links

A City on the Hill

The Redeemed Christian Church of Nigeria has built its own private city.

A 25-megawatt power plant with gas piped in from the Nigerian capital serves the 5,000 private homes on site, 500 of them built by the church’s construction company. New housing estates are springing up every few months where thick palm forests grew just a few years ago. Education is provided, from creche to university level. The Redemption Camp health centre has an emergency unit and a maternity ward.

On Holiness Avenue, a branch of Tantaliser’s fast food chain does a brisk trade. There is an on-site post office, a supermarket, a dozen banks, furniture makers and mechanics’ workshops. An aerodrome and a polytechnic are in the works.

…“If you wait for the government, it won’t get done,” says Olubiyi. So the camp relies on the government for very little – it builds its own roads, collects its own rubbish, and organises its own sewerage systems. And being well out of Lagos, like the other megachurches’ camps, means that it has little to do with municipal authorities. Government officials can check that the church is complying with regulations, but they are expected to report to the camp’s relevant office. Sometimes, according to the head of the power plant, the government sends the technicians running its own stations to learn from them.

There is a police station on site, which occasionally deals with a death or the disappearance of a child, but the camp’s security is mostly provided by its small army of private guards in blue uniforms. They direct traffic, deal with crowd control, and stop children who haven’t paid for the wristband from going into Emmanuel Park – home to the aforementioned ferris wheel.

As in Gurgaon, India, where the government fails opportunities are opened for entrepreneurs who think big.

Why men are not earning more

“And it all starts at age 25,” Mr. Guvenen said. The decline in lifetime earnings is largely a result of lower incomes at younger ages rather than at older ages, he said, and “that was very surprising to us.”

Most younger men ended up with less because they started out earning less than their counterparts in previous years, and saw little growth in their early years. They entered the work force with lower wages and never caught up.

That is from a very good NYT piece by Patricia Cohen. And note that in spite of all the recent very good economic news, for men the basic story really hasn’t changed, namely that of stagnation as a class.

I wonder sometimes if a Malthusian/Marxian story might be at work here. At relevant margins, perhaps it is always easier to talk/pay a woman to do a quality hour’s additional work than to talk/pay a man to do the same. And so as the demand for such additional hours opens up, the gains go to women, not men. That is at least for the lower income brackets, and perhaps the very most for younger earners. In other words, especially at young ages, women might be serving as a kind of “reserve army of the underemployed.”

Peer review is younger than you think

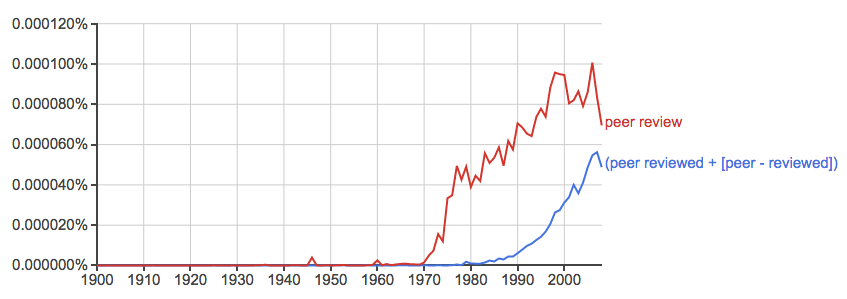

Via Ben Schmidt, the term becomes common only in the 1970s:

I’d like to see a detailed look at actual journal practices, but my personal sense is that editorial review was the norm until fairly recently, not review by a team of outside referees. In 1956, for instance, the American Historical Review asked for only one submission copy, and it seems the same was true as late as 1970. I doubt they made the photocopies themselves. Schmidt seems to suggest that the practices of government funders nudged the academic professions into more formal peer review with multiple referee reports.

Further research is needed (how about we ask some really old people?), at least if peer review decides it is worthy of publication. Frankly I suspect such work would stand a better chance under editorial review.

In the meantime, here is a tweet from the I didn’t know she was on Twitter Judy Chevalier:

I have just produced a 28-page “responses to reviewer and editor questions” for a 39-page paper.

I’d rather have another paper from Judy.

By the way, scientific papers are getting less readable.

Why do Swedes support their far-right parties?

This is from a job market paper at Stockholm University, by Sirus Dehdari:

This paper studies the effects of economic distress on support for far-right parties. Using Swedish election data, I show that shocks to unemployment risk among unskilled native-born workers account for 5 to 7 percent of the increased vote share for the Swedish far-right party Sweden Democrats. In areas with an influx of unskilled immigrants equal to a one standard deviation larger than the average influx, the effect of the unemployment risk shock to unskilled native-born workers is exacerbated by almost 140 percent. These findings are in line with theories suggesting that voters attribute their impaired economic status to immigration. Furthermore, I find no effects on voting for other anti-EU and anti-globalization parties, challenging the notion that economic distress increases anti-globalization sentiment. Using detailed survey data, I present suggestive evidence of how increased salience of political issues related to immigration channels economic distress into support for far-right parties, consistent with theories on political opportunity structure and salience of sociocultural political issues.

Here is Dehdari’s cv, all via Matt Yglesias.

There is a hot hand after all

This paper, “The Hot-Hand Fallacy: Cognitive Mistakes or Equilibrium Adjustments? Evidence from Major League Baseball,” delivers on both the theory and the empirics:

We test for a “hot hand” (i.e., short-term predictability in performance) in Major League Baseball using panel data. We find strong evidence for its existence in all 10 statistical categories we consider. The magnitudes are significant; being “hot” corresponds to between one-half and one standard deviation in the distribution of player abilities. Our results are in notable contrast to the majority of the hot-hand literature, which has generally found either no hot hand or a very weak hot hand in sports, often employing basketball shooting data. We argue that this difference is attributable to endogenous defensive responses: basketball presents sufficient opportunity for transferring defensive resources to equate shooting probabilities across players, whereas baseball does not. We then develop a method to test whether baseball teams do respond appropriately to hot opponents. Our results suggest teams respond in a manner consistent with drawing correct inference about the magnitude of the hot hand except for a tendency to overreact to very recent performance (i.e., the last five attempts).

That is from Brett Green and Jeffrey Zwiebel, via Rolf Degen. Here are ungated versions.

Saturday assorted links

1. Should Amish use smart phones? (NYT)

2. Versatile people are more likely to be self-employed.

3. Is giving money to poor people now considered morally questionable?

4. The long death of Product 19.

5. The Ig Noble economics prize goes to a study of the effect of saltwater-crocodiles on problem gamblers.

I find it remarkable that cement is exported at all

Below are the 15 countries that exported the highest dollar value worth of cement during 2016:

- China: US$692.4 million (7.6% of total cement exports)

- Thailand: $612.2 million (6.8%)

- United Arab Emirates: $544.4 million (6%)

- Turkey: $494.8 million (5.5%)

- Germany: $486.3 million (5.4%)

- Spain: $477.3 million (5.3%)

- Vietnam: $403 million (4.4%)

- Japan: $391.3 million (4.3%)

- Canada: $368.7 million (4.1%)

- India: $267 million (2.9%)

- Greece: $248.6 million (2.7%)

- Senegal: $209 million (2.3%)

- United States: $205.9 million (2.3%)

- Pakistan: $185.6 million (2%)

- South Korea: $162.9 million (1.8%)

Here is the link.