Month: November 2017

Supply and Demand

Enrico Moretti tells it like it is:

Over the past two years, San Francisco County added 38,000 jobs, reaching its highest employment level ever. Yet only 4,500 new housing units were permitted. For all those new families knocking on San Francisco doors, new units are available for less than 12 percent of them. The numbers for Silicon Valley are even worse. This is why the rents skyrocket.

The problem is largely self-inflicted: the region has some of the country’s slowest, most political and cumbersome housing approval processes and most stringent land-use restrictions.

…One way to think about it is that the enormous increase in wealth generated by the tech boom is largely captured by homeowners in the urban core who bought before the boom.

…The second negative consequence of the region’s restrictive housing policies in the urban core is environmental degradation on the periphery. Good environmental stewardship suggests that we should build more in the urban core near transit and jobs and less on the fringes. Yet because of cities’ strict housing regulations, we build more on farmland on the region’s outskirts and less in the city center where demand is higher.

It’s economics 101 not rocket science but few people have an interest in denying the truths of rocket science.

China degree of the day

Competitive video game tournaments enjoy a huge following in China, and now, 18-year-old Feng is among 60 students enrolled in the country’s first-ever college program specializing in esports.

Last year was a landmark year in the world of esports. In September, “esports and management” was added to the Ministry of Education’s list of permitted college majors. Three months later, the Communication University of China, Nanguang College, in Nanjing announced the launch of its own esports-related degree: Art and Technology (Esports Analysis), a four-year undergraduate program teaching event organizing, data analysis, gaming psychology, video content production, and esports team coaching. According to the school, graduates can expect to carve out careers in China’s booming esports industry as tournament organizers, online show producers, commentators, strategy analysts, and club managers.

Here is the full story, from the consistently interesting Sixth Tone. And note:

Staffordshire University in the U.K. will offer an undergraduate esports program starting in September 2018, while a number of U.S. colleges now provide esports scholarships for talented gamers.

Just don’t tax their tuition waivers!

Should tuition waivers be taxed?

My overall opinion here is the same as with taxes on private university endowments: no. The federal government needs to stick to a budget, and broadening the tax base in this way would only postpone that needed development. At some margins, “starving the beast” is a good idea, even if it doesn’t always work.

That said, some tuition waivers should be taxed, in particular those that accrue to faculty members when their children attend the same college or university. That is simply a benefit to the well-off and well-educated, and it would not seem to fit the canons of optimal tax theory. If you wish, let the government make it easier to borrow money to go to school. In the meantime, treat this as in-kind pay to faculty and tax it.

What about tuition waivers that universities offer independently to deserving students, often graduate students? Even apart from the public choice considerations, I don’t see why the efficiency case for taxing these is so strong.

Let’s say I can either self-educate at great effort (but perhaps little upfront expense), or I can invest a lot of resources convincing someone I am worth taking under their wing and tutoring, for free. I will reflect glory on my tutor for many years to come. In equilibrium, the rates of return to these two strategies should roughly equilibrate.

Now, if I self-educate, few would say I should be taxed on the benefit I give to myself from all the reading and learning. It would be odd, to say the least, to call it “self in-kind compensation.” (On top of that, it would bankrupt me in particular.) Similarly, if I persuade someone to stuff book knowledge into my ears for free, why should I then be taxed? Haven’t I done more or less the same thing, just using an intermediary and applying the effort at a slightly different stage of the education process? Unlike the faculty member enrolling his or her children, it is not a surreptitious way of delivering in-kind income to somebody. Rather, the tuition waiver is helping someone make an investment more cheaply. What if I sit down and patiently explain to you why “buy and hold low cost diversified funds” are a better investment option? Should you be taxed on receiving that wisdom? Again, I say no, noting that you will be taxed on any later financial payoff from that wisdom. We needn’t count the input as a taxable form of income.

Similarly, when it comes to education, if the tuition waiver helps you earn more, you will be taxed on that income later on too.

Alternatively, you might think there are too many graduate students in the system, a kind of Malthusian crowding when it comes to queuing for jobs. That might describe the world even for a lot of STEM jobs (NYT). Nonetheless, even if a legal/tax solution is required (debatable), taxing tuition waivers as in-kind income seems like the wrong approach. That change falls most heavily on the graduate students judged by the school to be most qualified. Those are also the people most likely to be future innovators. Instead, a paring back of more general tuition and tax subsidies would fall on the graduate students more evenly and I suspect more efficiently.

Maybe I’ll write a separate post on the most likely incidence of taxing tuition waivers as in-kind income — it’s a tricky problem, a good test of your micro mettle.

Claims about Saudi

In a style of government which is unique to the kingdom, they announced the arrests first and then they announced the creation of the committee which had ordered them. This is how the young prince acts, a man who some Middle East experts persist in referring to as a Western-style reformer. He acts with total disregard to habeas corpus, due process and the rule of law. In his eyes, those arrested are guilty before they are proven guilty.

This committee is McCarthyite in its powers and scope. The first thing to note in the decree which set it up, is that it puts itself above and beyond the law. The decree states that the committee (which bin Salman chairs) is “exempt from laws, regulations, instructions, orders and decisions while the committee shall perform the following tasks: … the investigation issuance of arrest warrants, travel ban, disclosure and freezing of accounts and portfolios, tracking of funds, assets, and preventing their remittance or transfer by persons and entities who ever they might be. The committee has the right to take any precautionary measures it sees, until they are referred to the investigating authorities or judicial bodies.”

In other words, the prince can do anything he likes to anyone, seizing their assets in and outside the kingdom. Let’s just remind ourselves of what he now controls. The prince heads all three of Saudi Arabia’s armies; he heads Aramco, the world’s biggest oil company; he heads the committee in charge of all economic affairs which is just about to launch the biggest privatisation the kingdom has seen; and he now controls all of Saudi’s media chains.

This was apparent from the list of businessmen arrested. ART, MBC and Rotana Media group dominate the Arab media. These Saudi media corporations account for most of what is put out on air in the Middle East, apart from the news output of Qatari-owned Al Jazeera.

Their respective owners, Saleh Kamel, Walid al-Ibrahim and Prince Waleed bin Talal are behind bars. Presumably too their wealth has been confiscated. Forbes prices bin Talal, chairman of the Kingdom Holding Corporation, at $18bn. He owns sizeable shares in numerous companies, including Newscorp, Citigroup, 21st Century Fox and Twitter. These shares too are under new management. The head of STC, the biggest mobile operator in Saudi, was also arrested.

If previous moves bin Salman took constituted a power grab, Saturday’s moves were a wealth grab.

Quite apart from the political dangers of stripping so many very rich Saudis of their wealth, this is a bizarre way to encourage foreigners to invest in the kingdom.

Here is the full piece by David Hearst, interesting to me but I don’t feel I can evaluate it. Via Bruno.

Jason Furman on the House tax reform plan

Find the slides here, 44 pp., very useful. I found (what seems to be) #36 most interesting, namely to the extent interest deductibility remains, many corporations will face a negative marginal rate under the new reforms.

I do think Jason could have offered more praise to how the plan limits various inefficient deductions, a long sought-after goal.

Hat tip goes to Greg Mankiw.

Sunday assorted links

1. Street food markets in North Korea.

2. If you would like to read a dystopian scenario about Google-Facebook-Amazon.

4. Arbitrage! (Walmart vs. Amazon)

5. The Courbet culture that is Swiss: “Our little canton can be a model for how to conduct an investigation.”

Have the Saudis created a coup-proof society?

You might wish to read James T. Quinlavin from 1999 (pdf), who also covers Syria and Iraq, here is one bit:

While observers have pointed to the apparent fragility of this balance for decades, the longevity of the balancing act is both a tribute to the Saudi rulers and evidence that their tools are more effective than generally recognized.

Ibn Saud’s personal conquest of Arabia, supported by a community of trust of about sixty men willing to fight against the odds, began with the recapture of the family seat in Riyadh. From there Ibn Saud went on to conquer the Nejd, the traditional heartland of Arabia, relying on both war and marriage to personalize his alliances and conquests. Marriage, even to bereaved relatives of defeated opponents, provided Ibn Saud an effective means of monitoring his enemies. The tribes of the Nejd made up the human core of Saudi Arabia, while Ibn Saud’s numerous progeny comprised the dynasty’s human core. Today the al-Sauds rule from a base within a family group that is not monolithic. Bonds of personal loyalty rather than of an “abstract notion of citizenship” extend from the family to the tribal groups. Only nontribal Saudis define their relation to the Saudi rulers in the latter terms.

Here is another:

To varying degrees, Saudi Arabia, Iraq, and Syria have come to concentrate key capabilities of offense and defense in parallel military forces. The total military power of the state is reduced, however, when these forces are not made available when needed.

Ahmed Al Omran on Twitter, a former WSJ correspondent, is monitoring current developments. If you are wondering, Saudi stocks have rebounded.

Should we tax the endowments of wealthy universities?

This NYT story has some background detail:

The House Republican tax plan released on Thursday includes a 1.4 percent tax on the investment income of private colleges and universities with at least 500 students and assets of $100,000 or more per full-time student. It would not apply to public colleges.

The endowments are currently untaxed, as they are considered part of the nonprofit mission of the colleges. The new tax, if it passed, would bring in an estimated $3 billion from 2018 to 2027, one of many new revenue sources Congress is considering to pay for broad tax cuts.

Note that this would apply to about 140 schools, and also that private foundations already pay tax on their investment income. Greg Mankiw writes:

If my rough calculations are correct, the tax would cost schools like Harvard between $1,000 and $2,000 per student every year.

I am opposed to this change, mostly because I don’t like to see the government deciding to go after a new source of wealth for its tax base. The focal point of non-interference ceases to be focal, and excesses and politicization too often follow. Slippery slope!

But if you are otherwise not so keen on this Brennan-Buchanan argument, what exactly are the grounds for opposing this? It taxes the relatively wealthy, and it taxes income from wealth. It taxes finance. I haven’t heard anyone oppose the tax on the investment income of private foundations, other than diehard anti-tax types. That tax has hardly vanquished the private foundation form. On top of all that, university endowments seem to have long time horizons, and to play the g > r game pretty well. As early as 1958, Paul Samuelson taught us we can transfer resources out of g > r games at no real cost.

So, you’ll hear a lot of caterwauling on this one, but the only good arguments against it are the libertarian ones. Broadening the base isn’t always good. Don’t be suckered by the “give up education for tax cuts for millionaires” non-rigorous rhetoric you will hear. With or without those tax cuts, you still have to ask yourself whether this tax hike is a sensible way of paying off our huge and growing debt.

I wonder if there are people who think a corporate income tax falls mainly on capital, but that this levy would fall mainly on students. Actually…I don’t wonder.

*Thor: Ragnarok* a brief review, no real spoilers

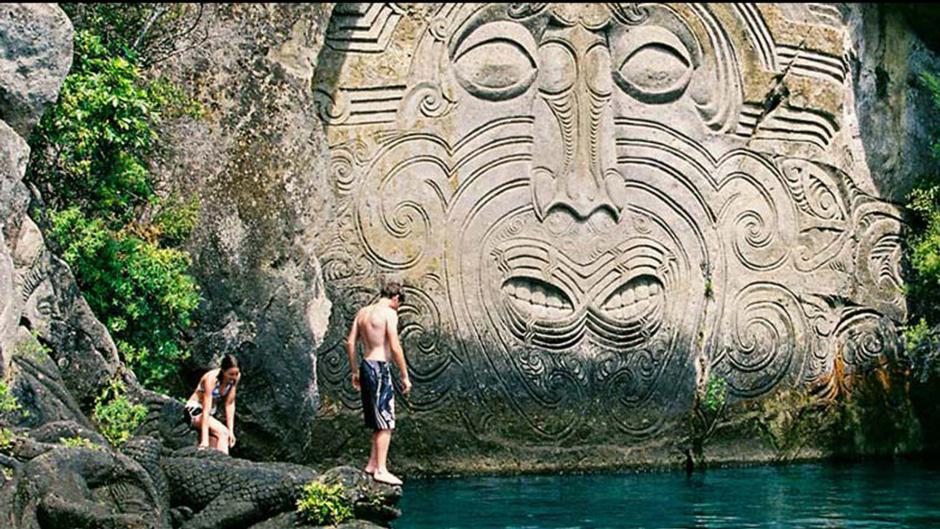

They have licensed another Led Zeppelin song, there is a new Morgan Freeman figure, and befitting the director the film is drenched in Maori design and themes and to some extent Maori humor.

“Being Maori,” Waititi [the director] said, “it’s extremely important to me to have native presence on any film. (link here)

Korg had a Maori accent, not surprisingly because the director himself played Korg; he is also Jewish from the maternal side. You can spot indigenous Australian and Maori actors throughout the movie. The spaceships are named after classic Australian Holden car brands. Democracy is not on the agenda, however, and the warrior ethic is more South Pacific than Nordic. Don’t get me started on the Ponaturi, Maori goblins of a sort. I’d love to hear an expert on East Bay legends analyze this story.

One of the most fun and interesting movies of the year, although the mainstream American reviews seem oblivious to these broader connections. Sadly, I didn’t have the knowledge to pick up on all the Marvel Easter Eggs.

Appear before the judge on your birthday

Using all French court decisions from 2002–2014 with 6 million decisions, we estimate significant impact on sentence lengths, but mainly for those defendants present at trial—equivalent to 3.5 days reduction. The average sentence length is 95 days. Focusing on the three-month threshold (the median sentence length), defendants are 1.6% less likely to be sentenced above this threshold on their birthday. Including controls for gender, crime, age, and nationality, the effect is 1.1% and remains statistically significant at the 5% level. Disaggregating the components of the sentence length reveals the impact is greatest on probation sentences–defined as the prison sentence people get in case of violation of their probation. Notably, individuals with drug offenses—but not violent offenses—benefit from this judicial leniency. They are 5% less likely to have sentences above three-months if sentenced on their birthday and appearing at trial.

For the United States, the birthday effect shows up only for the “days” component of the sentence, not for the “months” component.

That is all from a paper by Daniel L. Chen and Arnaud Philippe, via Robert Dur.

SALT fact of the day

In 2014 nearly 90% of the benefits of the state and local deduction as a whole flowed to those with incomes over $100,000.

So limiting the value of this deduction is obviously a good idea, right? No one is suggesting that this “tax hike” will ruin blue state coastal economies? Everyone is on board? Good, glad to hear that.

That is from The Economist.

Saturday assorted links

Medicaid, asthma, and ADHD caseloads

There is a new NBER working paper on these topics, by Anna Chorniy, Janet Currie, and Lyudmyla Sonchak, here is the abstract:

In the U.S., nearly 11% of school-age children have been diagnosed with ADHD, and approximately 10% of children suffer from asthma. In the last decade, the number of children diagnosed with these conditions has inexplicably been on the rise. This paper proposes a novel explanation of this trend. First, the increase is concentrated in the Medicaid caseload nationwide. Second, nearly 80% of states transitioned their Medicaid programs from fee-for-service (FFS) reimbursement to managed care (MMC) by 2016. Using Medicaid claims from South Carolina, we show that this change contributed to the increase in asthma and ADHD caseloads. Empirically, we rely on exogenous variation in MMC enrollment due a change in the “default” Medicaid plan from FFS or MMC, and an increase in the availability of MMC. We find that the transition from FFS to MMC explains most of the rise in the number of Medicaid children being treated for ADHD and asthma. These results can be explained by the incentives created by the risk adjustment and quality control systems in MMC.

The economics of medical diagnoses remain a drastically understudied area.

Friday assorted links

1. Volatility crashed in October.

2. The Faroe Islands by Google Sheep View.

3. The economics of elephants in Laos, and more here.

4. Can neuroeconomics explain “penny wise, pound foolish”? Paper here.

6. By 2030, will religious Catholics be a minority in Brazil?

7. Does Bitcoin use as much energy each year as does Nigeria?

Transcript of my Conversation with Brink Lindsey and Steve Teles

Due to popular demand, we are releasing a transcript of the Conversation with Lindsey and Teles.

We talk about liberaltarianism, how bad is crony capitalism really, whether government affects the distribution of wealth much, universities as part of the problem, whether IP law is too lax or too tough, why Steve didn’t do better in high school, the British system of government, Charles Murray, the Federalist Society, Karl Marx, Thailand, the Coase Theorem, and Star Trek, among other topics. Here is one bit:

COWEN: What’s the most important idea in the book that you understand better than he [Brink Lindsey] does?

TELES: Well, so there is a division of labor here. Brink did a lot more work on the cases than I did, although we talked about them all and I did a lot more work on the political analysis. We draw a lot on great, really seminal article by Rick Hall at University of Michigan called “Lobbying as Legislative Subsidy.” And I think that idea is dramatically under appreciated. The idea that what lobbyists are essentially doing is providing information, that information is scarce, it is a source of power. And one thing that we add is, if the state isn’t providing information itself, it essentially has to get it from outside. And when they get it from outside, it imports the overall inequality and information gathering and processing that’s in civil society. And that can be a very strong source of inequality in policy outcomes. I think Brink understands that, but this is my wheelhouse so I think probably if you were gonna push me, I’d say I understood it better that he did.

And this:

LINDSEY: One can see the whole sort of second wave feminist movement since the 60s as an anti rent-seeking movement, that white men were accumulating a lot of rents because of the way society was structured, that they were the breadwinner and there was a sexual division of labor, and they received higher pay than they would have otherwise because they were assumed to be the breadwinner, and women were just sort of kept out of the workforce in direct competition with men in many roles. The last half century has been an ongoing anti rent-seeking campaign and the dissipation of those rents especially by less skilled white men has been a cause of a great deal of angst and frustration and political acting out in recent years.

Here is a link to the podcast version of the chat, plus further explanation of my interview method for the two. Better yet, you can order their new book The Captured Economy: How the Powerful Enrich Themselves, Slow Down Growth, and Increase Inequality.