Month: June 2019

Friday assorted links

1. “The first rule of promoting cohesion is: Don’t talk about cohesion.”

2. Consumer protection law vs. antitrust for tech companies.

3. The English word that hasn’t changed in sound or meaning in 8000 years.

4. Glen Weyl, Lucas Geiger, & Kaliya Young on identity verification.

5. The Poet says professional athletes should have their own doctors.

6. Paul Krugman on rent control (NYT, 2000).

Rent control returns to New York

The bills announced on Tuesday night by the Democratic leaders of the State Senate and the Assembly would abolish rules that let building owners deregulate apartments and close loopholes that permit them to raise rents.

The legislation would directly impact almost one million rent-regulated apartments in New York City, which account for more than 40 percent of the city’s rental stock, and allow other municipalities statewide beyond New York City and its suburbs to adopt their own regulations…

The rent regulation package, which is expected to be approved before the end of the week, is perhaps the most resonant symbol of the change in power in Albany since Democrats took complete control in November.

Republicans had dominated the State Senate for most of the last century and formed a close alliance with the New York City real estate industry, which donated heavily to Republican senators.

The elections in November not only brought Democrats to power in the State Senate, but also saw the rise of progressive lawmakers who fiercely opposed real estate interests.

Here is the full NYT story. Perhaps someday I will write a book or essay called The Great Forgetting…

Beware of persistence studies

A large literature on persistence finds that many modern outcomes strongly reflect characteristics of the same places in the distant past. However, alongside unusually high t statistics, these regressions display severe spatial auto-correlation in residuals, and the purpose of this paper is to examine whether these two properties might be connected. We start by running artificial regressions where both variables are spatial noise and find that, even for modest ranges of spatial correlation between points, t statistics become severely inflated leading to significance levels that are in error by several orders of magnitude. We analyse 27 persistence studies in leading journals and find that in most cases if we replace the main explanatory variable with spatial noise the fit of the regression commonly improves; and if we replace the dependent variable with spatial noise, the persistence variable can still explain it at high significance levels. We can predict in advance which persistence results might be the outcome of fitting spatial noise from the degree of spatial au-tocorrelation in their residuals measured by a standard Moran statistic. Our findings suggest that the results of persistence studies, and of spatial regressions more generally, might be treated with some caution in the absence of reported Moran statistics and noise simulations.

That is from a new paper by Morgan Kelly, and here is a look at the studies he considers, via Morton Jerven.

Thursday assorted links

It would be a mistake to split up Facebook

Slate has published an adaptation from my recent book *Big Business: A Love Letter to an American Anti-Hero*, here is one excerpt:

Advocates of splitting up the big tech companies have a utopian vision of what will replace them. Whether you like it or not, we now live in a world where every possible idea (and video) will be put out there in some fashion or another. Don’t confuse your discomfort with reality with your assessment of big tech companies as individual agents. We’re probably better off having major, well-capitalized companies as guardians and gatekeepers of online channels, however imperfect their records, as the relevant alternatives would probably be less able to fend off abuse of their platforms and thus we would all fare worse.

Imagine, for instance, that instead of the current Facebook we had seven smaller companies all performing comparable social networking services, perhaps with some form of interconnectability or data portability. The negative sides of social media, which are indeed real, probably would be worse and harder to control.

It is unlikely that such a setting would result in greater consumer privacy and protection. Instead, we would have more weakly capitalized entities, with less talent on staff and weaker A.I. technologies to take down objectionable material. Probably some of those companies would be more tolerant of irresponsible user behavior as a competitive lure. Fake accounts would proliferate, and social networking sites such as 4chan—often a cesspool of racism and rhetoric that goes beyond the merely offensive—would comprise a larger and more central part of the market.

As for privacy, these smaller Facebook replacements would be more susceptible to hacks, foreign surveillance and infiltration, and external manipulation—the real dangers to our privacy and well-being.

There is much more at the link.

Hong Kong in the broader history of liberty

That is my other Bloomberg column for this week, here is one excerpt:

Still, actual life in Hong Kong seemed to be pretty free, especially compared to the available alternatives, which included the totalitarian state that was Mao’s China. Yet as the British lease on Hong Kong approached expiration, an even deeper problem with a non-democratic Hong Kong became evident: Because there was no legitimate alternative sovereign to protest, the British simply handed the territory over to China. (Compare Hong Kong’s experience to that of Taiwan, which did evolve into a free democratic state and remains independent.) Hong Kong was bartered away like a piece of colonial merchandise. Everyone learned the hard way that democracy really does matter.

Hong Kong still ranks near or at the top of several indices of economic freedom. But that may be a sign these indices have lost touch with the nature of liberty. In Hong Kong, the notion of a credible commitment to the future ceased to have meaning some time ago. Not only is there the specter of Chinese intervention, but there is also a broader understanding that the rules of the game can change at any time, including of course when it comes to extradition procedures. Meanwhile, many Hong Kong residents know their behavior is being monitored and graded, and they know the role of the Chinese government will only grow.

Thus is revealed a deeper lesson still: Freedom is not merely the ability to buy and sell goods at minimum regulation and a low tax rate, variables that are readily picked up by economic freedom indices. Freedom is also about the narratives people live by and the kind of future they imagine for themselves. Both of these are greatly affected by the legitimacy and durability of their political institutions.

The piece also offers a brief discussion of the Bruce Lee movie “Enter the Dragon.”

Should we let graduate students in private universities form unions?

That is the topic of my latest Bloomberg column and my answer is no, here is one excerpt:

One core reason to have unions is to boost the real wages of needy workers. But graduate students are not employees in the traditional sense. They are receiving training, often on very favorable terms. Typically a university is investing large sums of money to make those students employable and successful, usually on the academic market; the University of Chicago says it invests more than $500,000 per doctoral student. If those students demanded and received higher wages for their teaching, the university would not necessarily increase its investment in them at all; it could simply reallocate existing funds. Thus it is misleading to think there is a real bargaining situation here.

Think of a university as an investor in these students, and toward that end it must choose between boosting their academic quality through better training, or paying them higher stipends and teaching wages to ease their immediate financial concerns. The incentive for the university, which cares about its broader and longer-term reputation, is to invest in the quality of those students but pay them smaller amounts (though enough to live on). In contrast, the incentive for a graduate student union would be to push for higher wages, given that the other university investments are less visible and hard to monitor.

At the margin, society is better off if the focus is on the training, which enhances productivity in the long term, rather than on higher wages and stipends for students in the short term.

And:

In general, when considering this issue, ask yourself a question: When it comes to bringing about change, do today’s universities have too many veto points or too few?

Some researchers have pointed out that graduate student unions don’t seem to have harmed the public universities that allow them (such unions, which are permissible in many states, would not be affected by the federal government’s decision). The evidence may be compelling in the short run, but the real costs are likely to come later — by slowing down or even preventing beneficial changes to the U.S. system of higher education. Furthermore, state labor laws dramatically limit what public employees can negotiate for. Unionized graduate students at private universities unions would not face similar restrictions.

Recommended, do read the whole thing.

What should I ask Masha Gessen?

I will be doing a Conversations with Tyler with her, no associated public event. What should I ask her? As always, I thank you all for your wisdom and counsel.

Wednesday assorted links

1. China fact of the day: “Prefectures that experienced a more severe export slowdown witnessed a significant increase in incidents of labor strikes.”

2. Raising children with voice assistants. And Canada bans the keeping of whales and dolphins in captivity.

3. Why this professor does not retire at age eighty. A good piece, not to be taken entirely uncritically, of relevance to more people than just professors.

4. Dose of Gwern.

5. Airfares are getting cheaper.

6. Rachel Glennerster podcast on how to invest in the developing world. Has a transcript too.

SlateStarCodex and Caplan on ‘Why Are the Prices So D*mn High?’

SlateStarCodex, whose 2017 post on the cost disease was one of the motivations for our investigation, says Why Are the Prices so D*mn High (now available in print, ePub, and PDF) is “the best thing I’ve heard all year. It restores my faith in humanity.” I wouldn’t go that far.

SSC does have some lingering doubts and points to certain areas where the data isn’t clear and where we could have been clearer. I think this is inevitable. A lot has happened in the post World War II era. In dealing with very long run trends so much else is going on that answers will never be conclusive. It’s hard to see the signal in the noise. I think of the Baumol effect as something analogous to global warming. The tides come and go but the sea level is slowly rising.

In contrast, my friend Bryan Caplan is not happy. Bryan’s basic point is to argue, ‘look around at all the stupid ways in which the government prevents health care and education prices from falling. Of course, government is the explanation for higher prices.’ In point of fact, I agree with many of Bryan’s points. Bryan says, for example, that immigration would lower health care prices. Indeed it would. (Aside: it does seem odd for Bryan to argue that if K-12 education were privately funded schools would not continue their insane practice of requiring primary school teachers to have B.A.s when in fact, as Bryan knows, credentialism has occurred throughout the economy)

The problem with Bryan’s critiques is that they miss what we are trying to explain which is why some prices have risen while others have fallen. Immigration would indeed lower health care prices but it would also lower the price of automobiles leaving the net difference unexplained. Bryan, the armchair economist, has a simple syllogism, regulation increases prices, education is regulated, therefore regulation explains higher education prices. The problem is that most industries are regulated. Think about the regulations that govern the manufacture of automobiles. Why do all modern automobiles look the same? As Car and Driver puts it:

In our hyperregulated modern world, the government dictates nearly every aspect of car design, from the size and color of the exterior lighting elements to how sharp the creases stamped into sheet metal can be.

(See Jeffrey Tucker for more). And that’s just design regulation. There are also environmental regulations (e.g. ethanol, catalytic converters, CAFE etc.), engine regulations, made in America regulations, not to mention all the regulations on the inputs like steel and coal. The government even regulates how cars can be sold, preventing Tesla from selling direct to the public! When you put all these regulations together it’s not at all obvious that there is more regulation in education than in auto manufacturing. Indeed, since the major increase in regulation since the 1970s has been in environmental regulation, which impacts manufacturing more than services, it seems plausible that regulation has increased more for auto manufacturing.

As an empirical economist, I am interested in testable hypotheses. A testable hypothesis is that the industries with the biggest increases in regulation have seen the biggest increases in prices over time. Yet, when we test that hypothesis as best we can it appears to be false. Remember, this does not mean that regulation doesn’t increase prices! It can and probably does it’s just that regulation is not the explanation for the differences in prices we see across industries. (Note also that Bryan argues that you don’t need increasing regulation to explain increasing prices, which is true, but I still need a testable hypotheses not an unfalsifiable claim.)

So by all means let’s deregulate, but don’t expect 70+ year price trends to reverse until robots and AI start improving productivity in services faster than in manufacturing.

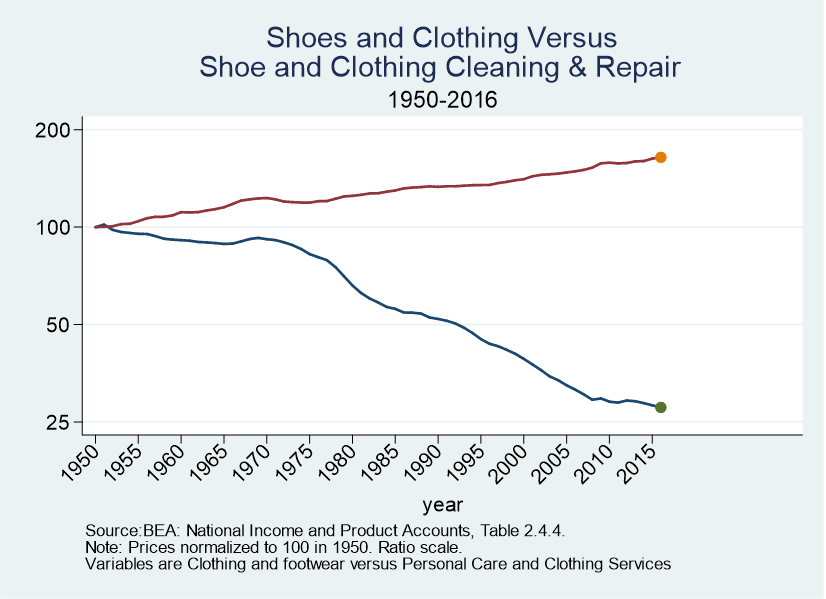

Let me close with this. What I found most convincing about the Baumol effect is consilience. Here, for example, are two figures which did not make the book. The first shows car prices versus car repair prices. The second shows shoe and clothing prices versus shoe repair, tailors, dry cleaners and hair styling. In both cases, the goods price is way down and the service price is up. The Baumol effect offers a unifying account of trends such as this across many different industries. Other theories tend to be ad hoc, false, or unfalsifiable.

Addendum: Other posts in this series.

Jungle Bird, NYC

That is my brother’s new restaurant in Chelsea, southeast Asian food, it has made the Approval Matrix and after three weeks is already a big hit. Billed as a cocktail bar, but the food is truly excellent, and this is not just familial favoritism. Get the dumplings, the turmeric chicken salad (actually a perfectly musty, stinky Malaysian dish — a highlight), and the betel leaves when they have them. Jungle Bird serves some of the best southeast Asian food in Manhattan, and yet the chef grew up in New Jersey, fancy that.

You are creating a genetic profile for your entire family…

…if you give away a genetic profile for yourself. Elizabeth Joh (NYT) writes:

You may decide that the police should use your DNA profile without qualification and may even post your information online with that purpose in mind. But your DNA is also shared in part with your relatives. When you consent to genetic sleuthing, you are also exposing your siblings, parents, cousins, relatives you’ve never met and even future generations of your family.

Unless you are going to gain something very specific, I generally recommend that people should not give away their genetic information.

RIP, Martin Feldstein

In addition to being a great economist, Marty was an institution builder. He was the early driving force behind the rise of the NBER, he led the development of empirical public finance as a respected field, and also very early on he pushed health care economics, both through his leadership at the NBER and through his own work and mentorship. He always was reaching out to help others, and Larry Summers, Jim Poterba, David Cutler, Raj Chetty, and Jason Furman were some of those he mentored. The economics of art museums was yet another topic he had a real interest in, and stimulated research in.

Marty also was one of my oral examiners at Harvard, and he asked only excellent questions. I thank him for judging my answers to be good enough.

Does trade reform promote economic growth?

Do trade reforms that significantly reduce import barriers lead to faster economic growth? In the two decades since Rodríguez and Rodrik’s (2000) critical survey of empirical work on this question, new research has tried to overcome the various methodological problems that have plagued previous attempts to provide a convincing answer. This paper examines three strands of recent work on this issue: cross-country regressions focusing on within-country growth, synthetic control methods on specific reform episodes, and empirical country studies looking at the channels through which lower trade barriers may increase productivity. A consistent finding is that trade reforms have a positive impact on economic growth, on average, although the effect is heterogeneous across countries. Overall, these research findings should temper some of the previous agnosticism about the empirical link between trade reform and economic performance.

That is the abstract to the new NBER working paper from Douglas Irwin, self-recommending.

My question about Haifa

When visiting Israel, I spent two days in Haifa, Israel’s third largest city at about 279,000. It seemed to me oddly empty, in a fractal sort of way. The supermarkets had very little on their shelves. There weren’t many supermarkets, or for that matter many restaurants. No part of town seemed to be truly densely populated. There was neither a center nor a thriving set of edge cities, not that I could see. There weren’t even many parts of town.

Nothing even remotely resembling a real bookstore, not outside of the university at least. So what gives? What is the proper theory of Haifa?