Month: September 2020

Does Demand for New Currencies Increase in a Recession?

Every time there is a recession we hear more about barter and new currencies, especially so-called “local” currencies. An inceased interest in barter and new currencies suggests a theory of recessions, the lack of liquidity theory:

Bloomberg: “In times of crisis like the one we are jumping into, the main issue is lack of liquidity, even when there is work to be done, people to do it, and demand for it,” says Paolo Dini, an associate professorial research fellow at the London School of Economics and one of the world’s foremost experts on complementary currencies. “It’s often a cash flow problem. Therefore, any device or instrument that saves liquidity helps.”

I wrote about this several years ago but on closer inspection it’s not obvious that interest in barter or new currencies increases much in a recession or that these new currencies are helpful. Here’s my previous post (with a new graph) and no indent.

Nick Rowe explains that the essence of New Keynesian/Monetarist theories of recessions is the excess demand for money (Paul Krugman’s classic babysitting coop story has the same lesson). Here’s Rowe:

The unemployed hairdresser wants her nails done. The unemployed manicurist wants a massage. The unemployed masseuse wants a haircut. If a 3-way barter deal were easy to arrange, they would do it, and would not be unemployed. There is a mutually advantageous exchange that is not happening. Keynesian unemployment assumes a short-run equilibrium with haircuts, massages, and manicures lying on the sidewalk going to waste. Why don’t they pick them up? It’s not that the unemployed don’t know where to buy what they want to buy.

If barter were easy, this couldn’t happen. All three would agree to the mutually-improving 3-way barter deal. Even sticky prices couldn’t stop this happening. If all three women have set their prices 10% too high, their relative prices are still exactly right for the barter deal. Each sells her overpriced services in exchange for the other’s overpriced services….

The unemployed hairdresser is more than willing to give up her labour in exchange for a manicure, at the set prices, but is not willing to give up her money in exchange for a manicure. Same for the other two unemployed women. That’s why they are unemployed. They won’t spend their money.

Keynesian unemployment makes sense in a monetary exchange economy…it makes no sense whatsoever in a barter economy, or where money is inessential.

Rowe’s explanation put me in mind of a test. Barter is a solution to Keynesian unemployment but not to “RBC unemployment” which, since it is based on real factors, would also occur in a barter economy. So does barter increase during recessions?

There was a huge increase in barter and exchange associations during the Great Depression with hundreds of spontaneously formed groups across the country such as California’s Unemployed Exchange Association (U.X.A.). These barter groups covered perhaps as many as a million workers at their peak.

In addition, I include with barter the growth of alternative currencies or local currencies such as Ithaca Hours or LETS systems. The monetization of non-traditional assets can alleviate demand shocks which is one reason why it’s good to have flexibility in the definition of and free entry into the field of money (a theme taken up by Cowen and Kroszner in Explorations in New Monetary Economics and also in the free banking literature.)

During the Great Depression there was a marked increase in alternative currencies or scrip, now called depression scrip. In fact, Irving Fisher wrote a now forgotten book called Stamp Scrip. Consider this passage and note how similar it is to Nick’s explanation:

If proof were needed that overproduction is not the cause of the depression, barter is the proof – or some of the proof. It shows goods not over-produced but dead-locked for want of a circulating transfer-belt called “money.”

Many a dealer sits down in puzzled exasperation, as he sees about him a market wanting his goods, and well stocked with other goods which he wants and with able-bodied and willing workers, but without work and therefore without buying power. Says A, “I could use some of B’s goods; but I have no cash to pay for them until someone with cash walks in here!” Says B, “I could buy some of C’s goods, but I’ve no cash to do it with till someone with cash walks in here.” Says the job hunter, “I’d gladly take my wages in trade if I could work them out with A and B and C who among them sell the entire range of what my family must eat and wear and burn for fuel – but neither A nor B nor C has need of me – much less could the three of them divide me up.” Then D comes on the scene, and says, “I could use that man! – if he’d really take his pay in trade; but he says he can’t play a trombone and that’s all I’ve got for him.”

“Very well,” cries Chic or Marie, “A’s boy is looking for a trombone and that solves the whole problem, and solves it without the use of a dollar.

In the real life of the twentieth century, the handicaps to barter on a large scale are practically insurmountable….

Therefore Chic or somebody organizes an Exchange Association… in the real life of this depression, and culminating apparently in 1933, precisely what I have just described has been taking place.

What about today (2011)? Unfortunately, the IRS doesn’t keep statistics on barter (although barterers are supposed to report the value of barter exchanges). Google Trends shows an increase in searches for barter in 2008-2009 but the increase is small. Some reports say that barter is up but these are isolated (see also the 2020 Bloomberg piece), I don’t see the systematic increase we saw during the Great Depression. I find this somewhat surprising as the internet and barter algorithms have made barter easier.

In terms of alternative currencies, the best data that I can find shows that the growth of alternative currencies in the United States is small, sporadic and not obviously increasing with the recession. (Alternative currencies are better known in Germany and Argentina perhaps because of the lingering influence of Heinrich Rittershausen and Silvio Gesell).

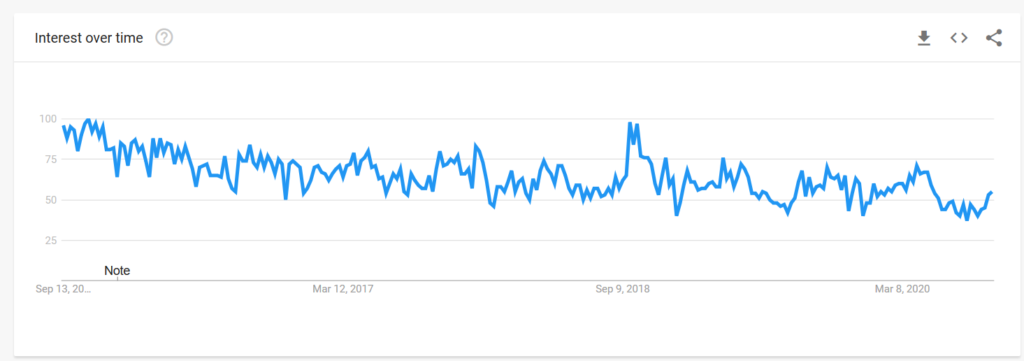

Below is a similar graph for 2017-2020. Again not much increase in recent times.

In sum, the increase in barter and scrip during the Great Depression is supportive of the excess demand for cash explanation of that recession, even if these movements didn’t grow large enough, fast enough to solve the Great Depression. Today there seems to be less interest in barter and alternative currencies than expected, or at least than I expected, given an AD shock and the size of this recession. I don’t draw strong conclusions from this but look forward to further research on unemployment, recessions and barter.

What I’ve been reading

1. Stephen Hough, Rough Ideas: Reflections on Music and More. Scattered tidbits, about half of them very interesting, most of the rest at least decently good, mostly for fans of classical music and piano music. Should you develop the habit of warming up? Why don’t they always have a piano in the “green room”? How many recordings should you sample before trying to play a piece? What kinds of relationships do pianists develop with their page turners? That sort of thing. I read the whole thing.

2. Jeremy England, Every Life is on Fire: How Thermodynamics Explains the Origins of Living Things. A fun and readable popular science book on why life may be likely to evolve from inanimate matter: “Living things…make copies of themselves, harvest and consume fuel, and accurately predict the surrounding environment.” Who could be against that?

3. Dov H. Levin, Meddling in the Ballot Box: The Causes and Effects of Partisan Electoral Interventions. “A fifth significant way in which the U.S. aided Adenauer’s reelection was achieved by Dulles publicly threatening, in an American press conference which took place two days before the elections, “disastrous effects” for Germany if Adenauer was not reelected.” A non-partisan, academic work, “This study is the first book-length study of partisan electoral interventions as a discrete, stand-alone phenomenon.” From 1946-2000, there were 81 discrete U.S. interventions in foreign elections, and 36 by the USSR/Russia, noting that outright conquest did not count in that data base.

4. John Kampfner, Why the Germans Do it Better: Notes from a Grown-Up Country (UK Amazon link, not yet in the USA). You should dismiss the title altogether, which is intended to provoke British people. In fact the author spends plenty of time on what is wrong with Germany, ranging from an incoherent foreign policy to the weaknesses of Frankfurt as a financial center. In any case, this is an excellent book trying to lay out and explain recent German politics and economics. It is more conventional wisdom than daring hypothesis, but the conventional wisdom is very often correct and how many people really know the conventional wisdom about Naomi Seibt anyway? Recommended, the best recent look at what is still one of the world’s most important countries.

5. David Carpenter, Henry III: 1207-1258. “No King of England came to the throne in a more desperate situation than Henry III.” The Magna Carta had just been instituted, Henry was just nine years old, and England was ruled by a triumvirate, with a very real chance that the French throne would swallow up England. This is one of those “has a lot of unfamiliar names that are hard to keep track of” books, but don’t blame Carpenter for that. In terms of scholarly contribution it stands amongst the very top books of the year. And yes there was already a Wales back then. They also started building Westminster Abbey under Henry’s reign. Here are some of the origins of state capacity libertarianism, volume II is yet to come.

6. Elena Ferrante, The Lying Life of Adults. The last quarter of the book closes strong, so my final assessment is enthusiastic, even if it isn’t in the exalted league of her Neapolitan quadrology. It will probably be better upon a rereading, which I will do.

Not your grandpa’s South Asia libertarianism

I did an Ask Me Anything for the South Asian chapter of Students for Liberty, based on their reading of my book Big Business: Love Letter to an American Anti-Hero.

By far the two most popular topics for questions were a) social media, and b) sexual harassment. Understandable, given South Asian circumstances, but not necessarily what you would hear in the United States, especially from an SfL group.

I think most Western libertarians and classical liberals still do not understand how much South Asia is going to redefine their discourse.

Monday assorted links

1. Might changes in proton density, spurred by solar wind, predict earthquakes? If true, this would really be something.

2. Violates Godwin’s Law right upfront anyway speak for yourself! I genuinely find such hostile intentions difficult to understand.

3. Will a growth drug undermine “dwarf pride”? (NYT).

4. Robin Hanson on how and why remote work will matter.

5. Economics of the energy transition. Some subtle and underpromoted points in this one.

6. Why we can’t have good things: I am not sure how much public health experts are to blame for the problems in this article about why we don’t have home testing. The FDA won’t approve it? Do something about that! (Where is the outcry, other than from Paul Romer?) The American people aren’t ready for it? Well, are they ready for the alternatives you are proposing? Overall I found this NYT piece a depressing sign of American and perhaps also public health malaise.

7. Using banned cell phones for prison extortion by calling loved ones back home, excellent NYT piece, amazing investigative journalism.

*Tenet* — a review (no real spoilers)

Although liquid securities markets play no role in the plot, this is nonetheless a movie where the value of information is repeatedly very high.

You can think of the movie as constructing a world so that a high value for information is ruling all of the time. And how strange such a world would have to look.

Most plots are about effort, character, moral fortitude, luck, or preexisting conditions (“are they really meant for each other?”). It is about time we had a film about information, even though the final world that is built is stranger than you might have expected.

“We must go now.”

But in fact, in the real world, you hardly ever need to “go now.” You can go just a little bit later, and it won’t matter much.

But this is not the speed premium, rather the game-theoretic concept is that of last mover advantage, the opposite of Schelling’s first mover advantage. Few of us are intuitively ready to take that concept literally and to order our understanding of a movie around it.

If you have studied Steven Bram’s book Biblical Games (and his other writings), this film will flow naturally for you — otherwise not!

Unlike most slacker films, this movie takes a decided stance on Newcomb’s Paradox, though to reveal that would be a total spoiler.

The movie also has genuine innovations in its chase and fight scenes, a rarity and indeed near-impossibility these days.

The soundtrack is excellent, and might at least some of the music be palindromic?

As for inspirations, you might consider Raiders of the Lost Ark, most other Nolan movies, the Book of Exodus, the Sator Square, James Bond, Frank Tipler and Pierre Teilhard de Chardin, and most of all Buster Keaton’s Sherlock, Jr.

To be clear, I don’t love most of Nolan’s films, and Inception bored me, so I wasn’t expecting much from Tenet. I walked away happy.

Should I now be rooting for a sequel? Or would that be a prequel?

Kudos to Alex for renting out the theater, he is the real Protagonist is this one.

Diminished choice in your neighborhood supermarket

Americans are spending more, yet increasingly they are being offered fewer choices, both online and in person, slowing a years-long trend toward innovations that put “good for you” and “environmentally friendly” spins on established and much-loved products.

The winnowing — what one expert calls a “Sovietish” reduction of choice — is also solidifying eating patterns, for good or for ill. With customers’ selections reinforced by online advertising, repeat ordering and other algorithms, the food system is becoming bifurcated as consumers who have expressed enthusiasm for healthful or artisanal foods are offered more of the same, while those with a penchant for highly processed comfort foods are inundated with opportunities to restock.

There is a gender effect as well:

He says more men are claiming to be the primary shopper during the pandemic, and “they do buy different things and buy differently.” Men, Baum says, tend to favor efficiency: shopping club stores for bulk purchases, convenience stores and online. They report making fewer, larger, quicker trips for a narrower range of items.

This part surprised me, though I wonder if they have done a full data check:

This “narrower range” is not just a brick-and-mortar constriction. As the pandemic accelerates the shift to online shopping, the number of packaged food products available to purchase on the Internet fell 21 percent globally from January to May, according to Euromonitor International, a London-based market research company. It found that nine out of the 10 biggest countries by retail sales saw a drop in the number of unique SKUs available online.

Here is more from Laura Reiley, note this also is another reason why actual rates of price inflation are somewhat higher than what we are measuring.

New results on the housing boom and bust

We build a model of the US economy with multiple aggregate shocks that generate fluctuations in equilibrium house prices. Through counterfactual experiments, we study the housing boom-bust around the Great Recession, with three main results. First, the main driver of movements in house prices and rents was a shift in beliefs, not a change in credit conditions. Second, the boom-bust in house prices explains half of the corresponding swings in nondurable expenditures through a wealth effect. Third, a large-scale debt forgiveness program would have done little to temper the collapse of house prices and expenditures but would have dramatically reduced foreclosures and induced a small, but persistent, increase in consumption during the recovery.

That is from a recently published article by Greg Kaplan, Kurt Mitman, and Giovanni L. Violante in the Journal of Political Economy. Here are some less gated versions.

Sunday assorted links

1. John Cleese on PC and wokeness. I think the first comment is satire rather than serious, but one can’t be entirely sure these days. The best-known Monty Python episodes these days are entirely acceptable, but some of the now lesser-known works are pretty…out there.

2. “Meanwhile, for-profit companies charge schools thousands of dollars for the training, making the active shooter drill industry worth an estimated $2.7 billion — “all in pursuit of a practice that, to date, is not evidence-based,” according to the researchers.” Link here.

3. Ross Douthat on how many lives a more competent president would have saved (NYT).

4. Why don’t coaches/manangers adjust more? A parable from the NBA, but with much broader applicability. Note that sometimes the star player is the problem too.

NPR plays overrated vs. underrated with Banerjee and Duflo

Cardiff Garcia led the charge, along with Stacey Vanek Smith, here is one excerpt:

GARCIA: Overrated or underrated – being married to an economist.

BANERJEE: Underrated.

(LAUGHTER)

BANERJEE: Excellent.

DUFLO: Underrated, of course.

SMITH: (Laughter). What about overrated/underrated – dating an economist?

BANERJEE: I mean, if you’re married to one (laughter) overrated.

SMITH: I mean, did you guys, like, split checks? Or, like, how did that work? Did you run into any economic quandaries early on?

BANERJEE: We were pretty flexible. We’re not really money people, so we didn’t – never spent a minute thinking about it.

Here is the full program. For the pointer I thank Michelle Dawson.

Is this a reason why sex has been declining?

Even pre-pandemic that is, for an illustration let’s turn to Washington Post’s Date Lab:

Sam says his ideal partner would share 80 percent of his political views (100 percent “would be boring,” he says), and over the nearly three-hour conversation, they discovered where their 20 percent gap in politics lay: former South Bend, Ind., mayor Pete Buttigieg. When Elli asked him who his preferred candidate was during the 2020 Democratic primaries, she said, “Please don’t say Pete.” (He said Pete.) Sam, on the other hand, says that Elli thought Buttigieg “was a Republican.” Ultimately, it was a difference that both of them could stomach.

Good for them! They are now set to have an in-person date.

The future of distance work arbitrage! (those new Rwandan service sector jobs)

In the central African country of Rwanda, single mothers employed at a Japanese eatery have found a new source of income after their jobs took a hit from the novel coronavirus pandemic: babysitting Japanese kids online.

Despite the seven-hour time difference, the cross-cultural service sees women play and sing with children 12,000 kilometers away in Japan via the videoconferencing app Zoom. The mothers will sometimes stream themselves shopping, chopping vegetables and cooking, to the delight of the kids’ parents as well.

The service is provided twice a day for an hour each in a mix of local languages, English, and Japanese.

“There’s a groove that you can’t experience in neighborhood eurythmic classes,” said Toyochika Kamekawa, 36, from Takahama in Fukui Prefecture. His 2-year-old son regularly takes part in the online sessions and sings songs he has been taught, accompanying himself on his toy drum.

The initiative was started up by Rwanda resident Mio Yamada, 38, who hires single mothers to work at her Japanese restaurant in the capital city of Kigali, and her acquaintance Yushi Nakashima, 30.

Yamada, who studied Swahili at university and now has three sons, moved to Rwanda with her husband in 2016 and opened her restaurant the following year.

And:

“I think my son will come to some realization (about the economic disparity between countries) when he’s older and compares his allowance with the sitters’ wages.”

And:

Some of the songs performed by the sitters touch on these darker themes. In one that foreshadows the conflict, the lyrics implore a child to stop crying with the words that when the war begins, they will be given milk from a cow that isn’t sad.

Here is the full story, via Air Genius Gary Leff.

Saturday assorted links

1. Bidet sales: the current countercyclical asset. It’s not just suburban real estate, Big Tech, and food service delivery.

3. 1955 University of Chicago Ph.D. price theory exam, chaired by Milton Friedman. Can you guess who got the best grade? How well would you do?

4. ““Nothing says white privilege like trying to orchestrate your own cancellation,” tweeted Sofia Quintero, a writer and activist from the Bronx.” Link here.

Are School Reopening Decisions Related to Union Influence?

Yes, in short. Here is a new paper from Corey Deangelis and Christos Makridis:

The COVID-19 pandemic led to widespread school closures affecting millions of K-12 students in the United States in the spring of 2020. Groups representing teachers have pushed to reopen public schools virtually in the fall because of concerns about the health risks associated with reopening in person. In theory, stronger teachers’ unions may more successfully influence public school districts to reopen without in-person instruction. Using data on the reopening decisions of 835 public school districts in the United States, we find that school districts in locations with stronger teachers’ unions are less likely to reopen in person even after we control semi-parametrically for differences in local demographic characteristics. These results are robust to four measures of union strength, various potential confounding characteristics, and a further disaggregation to the county level. We also do not find evidence to suggest that measures of COVID-19 risk are correlated with school reopening decisions.

And please do note that last sentence again:

We also do not find evidence to suggest that measures of COVID-19 risk are correlated with school reopening decisions (emphasis added).

Via the excellent Kevin Lewis.

Dark matter, second waves and epidemiological modelling

Here is a new paper from , , and :

Background Recent reports based on conventional SEIR models suggest that the next wave of the COVID-19 pandemic in the UK could overwhelm health services, with fatalities that far exceed the first wave. These models suggest non-pharmaceutical interventions would have limited impact without intermittent national lockdowns and consequent economic and health impacts. We used Bayesian model comparison to revisit these conclusions, when allowing for heterogeneity of exposure, susceptibility, and viral transmission. Methods We used dynamic causal modelling to estimate the parameters of epidemiological models and, crucially, the evidence for alternative models of the same data. We compared SEIR models of immune status that were equipped with latent factors generating data; namely, location, symptom, and testing status. We analysed daily cases and deaths from the US, UK, Brazil, Italy, France, Spain, Mexico, Belgium, Germany, and Canada over the period 25-Jan-20 to 15-Jun-20. These data were used to estimate the composition of each country’s population in terms of the proportions of people (i) not exposed to the virus, (ii) not susceptible to infection when exposed, and (iii) not infectious when susceptible to infection. Findings Bayesian model comparison found overwhelming evidence for heterogeneity of exposure, susceptibility, and transmission. Furthermore, both lockdown and the build-up of population immunity contributed to viral transmission in all but one country. Small variations in heterogeneity were sufficient to explain the large differences in mortality rates across countries. The best model of UK data predicts a second surge of fatalities will be much less than the first peak (31 vs. 998 deaths per day. 95% CI: 24-37)–substantially less than conventional model predictions. The size of the second wave depends sensitively upon the loss of immunity and the efficacy of find-test-trace-isolate-support (FTTIS) programmes. Interpretation A dynamic causal model that incorporates heterogeneity of exposure, susceptibility and transmission suggests that the next wave of the SARS-CoV-2 pandemic will be much smaller than conventional models predict, with less economic and health disruption. This heterogeneity means that seroprevalence underestimates effective herd immunity and, crucially, the potential of public health programmes.

This would appear to be one of the very best treatments so far, though I would stress I have not seen anyone with a good understanding of the potential rotation (or not) of super-spreaders, especially as winter comes and also as offices reopen. In that regard, at the very least, modeling a second wave is difficult.

Via Yaakov Saxon, who once came up with a scheme so clever I personally sent him money for nothing.

Covid-19 in Kenya

Let’s hope this is true!:

Policy makers in Africa need robust estimates of the current and future spread of SARS-CoV-2. Data suitable for this purpose are scant. We used national surveillance PCR test, serological survey and mobility data to develop and fit a county-specific transmission model for Kenya. We estimate that the SARS-CoV-2 pandemic peaked before the end of July 2020 in the major urban counties, with 34 – 41% of residents infected, and will peak elsewhere in the country within 2-3 months. Despite this penetration, reported severe cases and deaths are low. Our analysis suggests the COVID-19 disease burden in Kenya may be far less than initially feared. A similar scenario across sub-Saharan Africa would have implications for balancing the consequences of restrictions with those of COVID-19.

Here is the full paper.