Month: February 2021

Thursday assorted links

My Conversation with Patricia Fara

The last chat was with Brian Armstrong about bitcoin, this one started with Isaac Newton and bit coins (really). Here is the audio, video, and transcript. Here is the CWTeam summary:

Patricia Fara is a historian of science at Cambridge University and well-known for her writings on women in science. Her forthcoming book, Life After Gravity: Isaac Newton’s London Career, details the life of the titan of the so-called Scientific Revolution after his famous (though perhaps mythological) discovery under the apple tree. Her work emphasizes science as a long, continuous process composed of incremental contributions–in which women throughout history have taken a crucial part–rather than the sole province of a few monolithic innovators.

Patricia joined Tyler to discuss why Newton left Cambridge to run The Royal Mint, why he was so productive during the Great Plague, why the “Scientific Revolution” should instead be understand as a gradual process, what the Antikythera device tells us about science in the ancient world, the influence of Erasmus Darwin on his grandson, why more people should know Dorothy Hodgkin, how George Eliot inspired her to commit unhistoric acts, why she opposes any kind of sex-segregated schooling, her early experience in a startup, what modern students of science can learn from studying Renaissance art, the reasons she considers Madame Lavoisier to be the greatest female science illustrator, the unusual work habit brought to her attention by house guests, the book of caricatures she’d like to write next, and more

And here is one excerpt:

COWEN: Let’s start with Isaac Newton. How was it that he died rich?

FARA: He earned his money from several different ways. When he went down to London, he had far more than he ever did as a Cambridge professor because he was running the London Mint. He got a fat salary for that. He also got a premium, a reward for every single gold coin that was minted.

He invested in global trading companies like the East India Company, for example, that were sending guns and textiles out to Africa and then shipping enslaved peoples over to the Americas.

He also invested in other stock market companies. There was this famous occasion — it’s the anniversary this year of what’s called the South Sea Bubble — when he invested a small fortune in a new company, the South Sea Company, and he watched the levels rise, and he stayed in there, and he sold when the stocks had gone up. He made a small fortune, but then he made the classic beginner’s error. He invested in again at a higher price, and he watched the value crash.

So he did lose several million in today’s currency on that particular venture. But in general, when he died, he was an extremely rich man, and you can tell that — the inventory of his possessions runs to a vellum scroll that’s 17 feet long.

COWEN: What was it that he collected so obsessively to have all these possessions?

FARA: Well, a lot of it was equipment for catering. He’s got this reputation for being very antisocial, but he had hundreds of plates and sets of cutlery and things like that. He also had that ultimate Georgian luxury: he owned two silver chamber pots.

He spent money on having a good number of portraits of himself painted that he would send out to other people as bribes or as rewards for their allegiance to him. He had furniture. He had decorations. He had a carriage. He had a sedan chair tucked in the stables. He had lots of servants.

On Newton’s time at The Royal Mint

COWEN: Now, as you know, Newton spends what, over 30 years working at the Mint?

FARA: Yes.

COWEN: What’s your model of why he did this? How much was it for income? Did he think he was done with major contributions, say, to physics and optics? How do you think about that decision in his life?

FARA: I think he was very frustrated with being at Cambridge. He applied for several positions there, which he didn’t get. In theological terms, he was rather at odds with everybody else at Cambridge because he was a very, very devout believer in God, but he didn’t adhere to the traditional, to the orthodox Anglican theological belief in the Trinity, so that was difficult for him.

He’d been trying to leave Cambridge for some time, and he had a very close friend, Charles Montagu, the Earl of Halifax, who was Chancellor of the Exchequer, very influential man. He managed to find Newton this very prestigious job at the Mint that paid a good salary. The minute Newton heard about it, he downed tools at Cambridge, rushed down to London, and he moved and started a new life within a few months.

…COWEN: What do you think about Newton’s basic idea on silver recoinage — bring in all the silver coins, melt them down, reissue at a lower value? Was he right about that or not? Or do you side with John Locke?

Recommended, interesting throughout.

Potential yet still thwarted Filipino nurse vaccine barter markets in everything?

The Philippines will let thousands of its health care workers, mostly nurses, take up jobs in Britain and Germany if the two countries agree to donate coronavirus vaccines, a senior official said on Tuesday.

Britain’s health ministry said it was not interested in such a deal and its priority was to use shots domestically, but added it would share surplus vaccine internationally in the future.

The Philippines, which has among Asia’s highest number of coronavirus cases, has relaxed a ban on deploying its health care workers overseas, but still limits the number of medical professionals leaving the country to 5,000 a year.

Alice Visperas, director of the labor ministry’s international affairs bureau, said the Philippines was open to lifting the cap in exchange for vaccines from Britain and Germany, which it would use to inoculate outbound workers and hundreds of thousands of Filipino repatriates.

Here is the full story, via Marvin Vista.

Wednesday assorted links

1. Robin Hanson: Is Status-Seeking A Context-Neglecting-Value?

2. UFO skeptic West has not in fact debunked those videos.

3. More on the new UK science funding agency.

4. Story of Novavax (WSJ). And new efficacy data for Chinese vaccines.

5. Response to Julia Galef and Herbert Simon on the value of travel.

6. “The huge parachute used by NASA’s Perseverance rover to land on Mars contained a secret message, thanks to a puzzle lover on the spacecraft team. Systems engineer Ian Clark used a binary code to spell out “Dare Mighty Things” in the orange and white strips of the 70-foot (21-meter) parachute. He also included the GPS coordinates for the mission’s headquarters at the Jet Propulsion Laboratory in Pasadena, California.” Link here.

7. New radical computer science program in Limerick, Ireland.

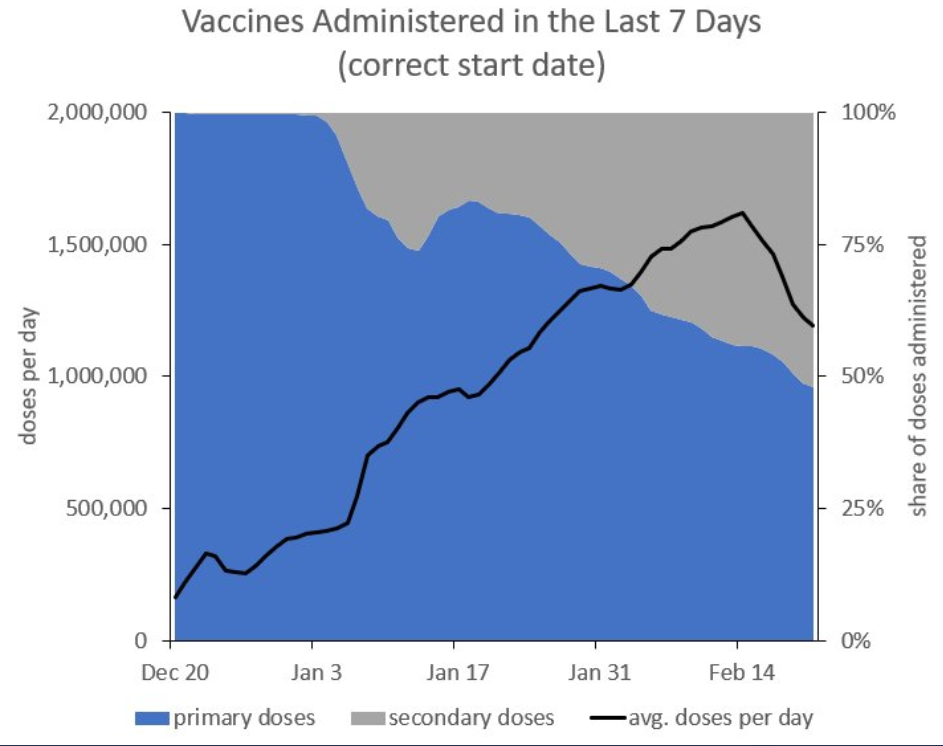

A Majority of Doses are Now Second Doses

As of Feb. 18 (last day of full data) we gave out 817,708 second doses and just 702,426 first doses. In other words, a majority of doses are now second doses. As Daniel Bier writes this means that we are boosting some people from ~85% to ~95% protected when we could be vaccinating more first timers and getting them from 0% protected to ~85% protected.

If we followed the British rule and delayed the booster to 12 weeks, we could immediately more than *double* the number of people going from 0% protected to to ~85% protected. More first-doses would be great for the newly protected and more people at ~85% protection would also reduce transmission so there would be fewer new infections and less threat to the non-vaccinated.

The opportunity cost of not delaying the booster is measured in lives lost.

Duke is a Trademark Bully!

Duke University has gone to incredibly and absurd lengths to contest other people’s trademark applications. For example, Duke opposed the following marks by filing with the Trademark Trial and Appeal Board :

- “The Dude Diet” for a diet-related website

- “Kuke” for electronic products

- “Goluke” for clothing

- “Le Duc” for food and drink services

they have even tried to claim they own “devil” and filed oppositions against:

- “Werdo” with this scribbled image of a devil for shirts and hats

- “Devils Nightmare” for beer

- “Devil’s Garden” for alcoholic beverages

- “Pretty Devil” for slot machines

It gets worse, Duke claims the letter D and the word blue with filed oppositions against:

- “Beach’d” for beach bags and cosmetic bags

- “D’Grill” for barbecue smokers and grills

- “DLove” for advertising and other services

- “True Blue” for auto parts

- “Stay Blue” for denim clothing

- “Blue Ball Chiller” for alcoholic beverages

- “Blue Solutions” for various goods and services related to car rentals and car sharing.

None of this is remotely consistent with trademark law which doesn’t convey an ownership right but is merely meant to help consumers purchase the products they intend to purchase. Yet, many of Duke’s oppositions have been successful since it’s often easier for the group asking for a trademark to simply give up and change their mark. Duke bullies far more than do other similar universities.

All of this is from an excellent paper, Mark of the Devil: The University as Brand Bully by James Boyle and Jennifer Jenkins both of whom are professors at the Duke University of Law! Bully for them!

Texas utilities should have had more dynamic pricing

But there was also a missed opportunity on the demand side. Texas has retail choice for electricity, but the overwhelming majority of Texas customers face electricity prices that are too static, too inflexible, and don’t respond to market conditions. Economists have been advocating dynamic prices for decades, but adoption has been slow.

Case in point. While wholesale prices in the Texas market climbed last week to $9,000/MWh, the overwhelming majority of electricity customers in Texas continued to pay retail prices close to $120/MWh, barely 1/100th of the true marginal cost.

Not seeing these high prices, Texas consumers had little incentive to conserve. You had a feast or famine — with millions of consumers at an all-you-can-eat buffet — while millions of others faced tragic blackouts and, essentially, an infinite price.

If everyone instead had turned their thermostats to a chilly, but manageable, 65°, this could have really helped the state manage the emergency. As Severin Borenstein pointed out after the California power outages last August, even modest adjustments to the thermostat can save a lot of electricity.

Dynamic pricing allows customers to pay lower prices throughout 99% of the year, in exchange for facing much higher prices when supply is tight. Numerous studies have documented that dynamic pricing yields substantial demand reductions (here, here, here, and here).

You may have read about households who paid enormous electricity bills last week. 29,000 out of Texas’ 11+ million customers buy their electricity from Griddy, a retailer that charges customers wholesale prices for a monthly fee of $9.99/month. This is a very extreme version of dynamic pricing. The evidence shows that you don’t need such extreme price changes to encourage conservation. Moreover, it is straightforward to incorporate hedging into retail contracts to protect customers from these outcomes.

With 28GW of forced outages in Texas last week, it is unlikely that dynamic prices alone could have closed the gap between demand and supply. But dynamic pricing is the fastest and cheapest way to build flexibility into the market, and can play an important role moving forward.

Here is more from Lucas Davis. Via Jonathan Carmel.

“Beeple is an artist”

Beeple is an artist.

He makes digital art—pixels on screens depicting bizarre, hilarious, disturbing, and sometimes grotesque images. He smashes together pop culture, technology, and postapocalyptic terror into blistering commentaries on the way we live. A recent frame depicted Donald Trump wearing a leather mask and stripper’s pasties, taking a whip to the coronavirus bug (title: “Trump Dominating Covid”). On the day Jeff Bezos announced he was kicking himself upstairs, Beeple imagined the Amazon founder as a massive, threatening octopus emerging from the ocean as military helicopters circled above (“Release the Bezos”).

Beeple has 1.8 million Instagram followers. His work has been shown at two Super Bowl halftime shows and at least one Justin Bieber concert, but he has no gallery representation or foothold in the traditional art world.

And yet in December the first extensive auction of his art grossed $3.5 million in a single weekend.

Here is the full Esquire article, do check out the accompanying images. The reproduced image is for sale here for one dollar. Here is the home page of Beeple. Here are more images.

Tuesday assorted links

1. Thwarted markets in everything: “Indianapolis Colts WR Michael Pittman Jr. says he won’t give up No. 11 to Carson Wentz.”

2. Siddhartha Mukherjee on heterogeneities in relative pandemic performance, revisiting a now-neglected topic (New Yorker).

3. North Dakota legislative house passes an anti-mask mandate bill.

4. Experiencing the Spanish flu lowered social trust. And more than 200 monoliths now.

5. Is Robert Gordon emerging from his previous stagnationist position?

6. Will/should the U.S. create a “strategic monkey reserve”? (NYT)

7. Spotify is going hi fi in selected markets. Civilization has returned (I hope).

The AstraZeneca Vaccine Works Well

A new study looking at essentially the entirety of the Scottish population finds that both the Pfizer and AstraZeneca vaccine work very well at preventing hospitalizations from the first dose.

UK policy for use of vaccines against COVID-19 involves an offer of a first dose followed by a second dose 12 weeks later. To our knowledge, this is the first study of COVID-19 vaccine effect against hospitalisation for an entire nation after a single dose of vaccine. We found that a single dose of BNT162b2 COVID-19 vaccine was associated with a vaccine effect (VE) of 85% (95% CI 76 to 91) for COVID-19 hospitalisation 28-34 days post-vaccination. A single dose of ChAdOx1 vaccine was associated with a vaccine effect 94% (95% CI 73 to 99) at 28-34 days post-vaccination. VEs increased over time with a peak at 28-34 days post-vaccination for both vaccines. Comparable VEs were seen in those aged ≥80 years for prevention of COVID-19 hospitalisation with a high combined VE of 81% (95% CI 65 to 90) at 28-34 days post-vaccination.

Arne Akbar, president of the British Society for Immunology, noted “…overall these new findings should provide reassurance around the UK’s decision to offer the two doses of the vaccine 12 weeks apart.”

Another important point is that the AstraZeneca vaccine actually shows a higher effectiveness than the Pfizer vaccine. The study wasn’t designed to compare the vaccines and the populations getting the vaccines aren’t random samples. Nevertheless, the AstraZeneca vaccine appears to work well and it was actually given to a greater proportion of elderly patients.

The new results from Scotland support the UK, EU, and WHO decisions to authorize the AstraZeneca vaccine. If the US had authorized the AstraZeneca vaccine in late December at the same time as did the UK, millions more Americans could have been vaccinated saving many lives.

Where is the FDA’s cost-benefit calculation?

Cool, green Britannia

Over the summer of 2020, as coronavirus cases fell and life in Britain felt briefly normal, something very abnormal was happening to the country’s electricity supply. No coal was burned to generate any portion of it for a period of more than two months, something that had not happened since 1882. Britain’s four remaining coal-burning power plants are zombies, all but dead. Within a couple of years they will be closed and Britain will probably never burn coal for electricity again.

The elimination of power stations that burn coal has helped Britain cut its carbon emissions faster than any other rich country since 1990 (see charts). They are down by 44%, according to data collected by the Department for Business, Energy and Industrial Strategy (BEIS) during a period when the economy grew by two-thirds. Germany’s emissions, in contrast, are down by 29%; coal is still burned to generate some 24% of its electricity. Britain has made cuts to its emissions 1.8 times larger than the EU average since 1990. In America, emissions over the same period are up slightly.

Here is the full article from The Economist. I’ll say it again, whether it is AI, the Oxford/Astrazeneca vaccine, the speed of the current vaccination program, this switch to greener energy, the reemergence of Oxbridge, the new Dominic Cummings-inspired DARPA-like science funding plan, or London being the world’s best city — current Great Britain remains grossly underrated.

Clementine Jacoby, Emergent Ventures winner

More than 2 million people are imprisoned in the U.S., among them hundreds of thousands who experts say don’t pose a public-safety threat and could be released. One problem: the data that could trigger those releases get backlogged, because they’re often spread out among different departments. That’s why in 2019, Clementine Jacoby, a software engineer, launched Recidiviz, a nonprofit that has worked with more than 30 states to log into one system key data points—such as whether an incarcerated person has served most of their sentence or has shown progress by completing a treatment program, or more recently, how well equipped a correction facility is to handle a COVID-19 outbreak. It then uses an algorithm to recommend certain prisoners for release. “Our hope is that the people who are succeeding get off early,” Jacoby says, “and that frees up attention for officers to spend time with the people who actually need it.” Of course, no algorithm is perfect, and algorithms alone won’t solve the issues of the criminal-justice system. But so far, Recidiviz has seen early signs of success. To date, the nonprofit has helped identify as appropriate for release nearly 44,000 inmates in 34 states, including North Dakota, which last spring saw its prison population drop by 20%.

That is from the Time100 Next. The initial grant helped Clementine quit her job to do Recidivez full-time.

The new world of digital art on the blockchain

In the 10 years since Chris Torres created Nyan Cat, an animated flying cat with a Pop-Tart body leaving a rainbow trail, the meme has been viewed and shared across the web hundreds of millions of times.

On Thursday, he put a one-of-a-kind version of it up for sale on Foundation, a website for buying and selling digital goods. In the final hour of the auction, there was a bidding war. Nyan Cat was sold to a user identified only by a cryptocurrency wallet number. The price? Roughly $580,000.

Mr. Torres was left breathless. “I feel like I’ve opened the floodgates,” he said in an interview on Friday.

The sale was a new high point in a fast-growing market for ownership rights to digital art, ephemera and media called NFTs, or “nonfungible tokens.” The buyers are usually not acquiring copyrights, trademarks or even the sole ownership of whatever it is they purchase. They’re buying bragging rights and the knowledge that their copy is the “authentic” one.

Other digital tokens recently sold include a clip of LeBron James blocking a shot in a Lakers basketball game that went for $100,000 in January and a Twitter post by Mark Cuban, the investor and Dallas Mavericks owner, that went for $952. This month, the actress Lindsay Lohan sold an image of her face for over $17,000 and, in a nod to cryptocurrencies like Bitcoin, declared, “I believe in a world which is financially decentralized.” It was quickly resold for $57,000.

Blockchains of course are being used to designate which copy is the authentic one. Is it such a big step from photography to this? Here is more from Erin Griffith at the NYT.

Addendum: The next step presumably is to introduce some price discrimination. Yes, there can be a “most authentic” original copy. But after that, how about some intermediate categories? “Well, this is the almost-original copy, defined on the “brother blockchain” here is another, somewhat closed related copy, defined on the “cousin blockchain,”” just as Japanese prints had different editions, etc.

Monday assorted links

1. When it came to actual human affairs, John Rawls was in fact a mediocre, ordinary thinker at best. Yes TJ is a deep and wonderful book. But when he wrote on anything concrete, would it today even make the better half of Twitter?

2. Call for papers on Smith and Hume. And Ian Anderson of Jethro Tull writes a guide to Indian food.

3. How some Texans ended up with huge electricity bills. And was deregulation at fault? (NYT) And a good thread on what happened.

4. Are Canadians covering up their Covid cases out of shame? (NYT)

5. My Bloomberg column on the four basic truths of macroeconomics.

Hungary’s Vaccine Approval Rule

AP: Hungarian health authorities were the first in the EU to approve the Sinopharm jab for emergency use on Jan. 29. That came after a government decree streamlined Hungary’s vaccine approval process by allowing any vaccine administered to at least 1 million people worldwide to be used without undergoing review by the country’s medicines regulator.

The country expects to receive 5 million total doses of the Sinopharm vaccine over the next four months, enough to treat 2.5 million people in the country of nearly 10 million.

Authorize any vaccine already used by at least 1 million people is a type of reciprocity or peer-review rule in which you speed up approval in your country based on data from another country. As with all such rules, it’s imperfect–new and extensive use will reveal common, serious side effects and many uncommon ones as well but extensive use is not a guarantee of safety or efficacy. Nevertheless, when time is of the essence the 1 million+ rule is a smart rule.

Hat tip: Bart Madden.