Month: February 2021

How much do we value Covid safety?

The grand experiment of blocking the middle seat on airplanes has proved what we have known all along about air travel: More people care about a cheap fare than comfort, or even pandemic safety.

Delta announced on Monday that it was extending its middle-seat block for one more month, to the end of April. Delta, the last U.S. airline to block all middle seats in coach, will consider further extensions based on Covid-19 transmission and vaccination rates.

So far, Delta thinks it’s earning goodwill and confidence with customers, particularly business travelers, who aren’t traveling now but will come back. Some who’ve flown during the pandemic have been willing to pay Delta more for more space onboard. Most have been price-sensitive leisure travelers willing to sit shoulder-to-shoulder for cheap fares—on airlines not blocking middle seats…

The bottom line for Delta during the pandemic has been bigger losses than rival airlines selling all their seats. Delta was the most profitable U.S. airline in the final six months of 2019. That flipped during the pandemic. In the last six months of 2020, Delta had the biggest losses, with a net loss of more than $6 billion, greater than United and Southwest combined.

Mr. Lentsch says Delta can’t keep blocking middle seats forever.

Here is more from the WSJ. I do get there is an externality here, so people are not paying enough for those more spacious Delta seats, as they do not take their higher risk to others into sufficient account. Still, a lot of the risk here is private, and I feel the public health community in the United States has not been willing to look such data in the face squarely enough. Is the public policy problem about minimizing “lives lost,” or maximizing “welfare,” or giving people “what they want”? Or some combination of those? Who exactly has been good at thinking through those trade-offs?

Have the pandemic population flows been into the relatively strict Vermont and California, or to the relatively open Florida and Texas?

To what extent is the real externality a kind of degradation of the public sphere, and the spread of stress and mental health problems, rather than the health of others per se?

Worth a ponder.

Thursday assorted links

1. Is China waiting on vaccinations until it can make everyone happy at once?

2. Will India ban crypto altogether?

3. First shot considerably reducing risk in Israel, paper here.

4. Has semiglutide solved much of the weight loss problem? That would truly end the great stagnation.

5. Some good results for toczilizumab against Covid.

6. Cowen’s 17th law: almost all things have origins earlier than you thought, including Covid-19 (WSJ).

7. Fiscal stimulus around the world.

8. Scott Sumner on the The Great Forgetting.

Good and important links today, self-recommended.

What are the most important statistical ideas of the past 50 years?

We argue that the most important statistical ideas of the past half century are: counterfactual causal inference, bootstrapping and simulation-based inference, overparameterized models and regularization, multilevel models, generic computation algorithms, adaptive decision analysis, robust inference, and exploratory data analysis. We discuss common features of these ideas, how they relate to modern computing and big data, and how they might be developed and extended in future decades. The goal of this article is to provoke thought and discussion regarding the larger themes of research in statistics and data science.

Sentences to ponder

Nearly 60 percent of the people facing charges related to the Capitol riot showed signs of prior money troubles, including bankruptcies, notices of eviction or foreclosure, bad debts, or unpaid taxes over the past two decades, according to a Washington Post analysis of public records for 125 defendants with sufficient information to detail their financial histories.

The group’s bankruptcy rate — 18 percent — was nearly twice as high as that of the American public, The Post found. A quarter of them had been sued for money owed to a creditor. And 1 in 5 of them faced losing their home at one point, according to court filings.

Here is more from The Washington Post. You will notice that the very poorest people don’t have a lot of those problems.

Full employment and the output gap

I’ve never accepted the standard story about “being at full employment” vs. “having unemployed resources” around, though often I write in that framework for reasons of intelligibility. That said, I do not reject this story in ways that make current debate participants very happy, or would create the potential for a policy free lunch.

I take a finance perspective on the output gap. If you are at what others call “full employment,” you can indeed do better, or at least try to do better. Start 300 companies that aim to be the next Stripe, Facebook, SpaceX — whatever. In the short run, you will create jobs, people at jobs will work harder, and so on. Employment, output, and also tax revenue will rise. You can pat yourself on the back and say you were not at full employment.

The thing is, you have accepted a higher level of risk. Many of those companies are likely to fail. And since they were started by humans consuming a broadly common set of cultural and media inputs, those risks will to some extent be correlated as well. Of course it might pay off big time as well.

You can always move “beyond full employment” by accepting more risk. Alternatively, you could deploy some common sense and suggest that no single point on the risk-return frontier corresponds to “full employment.”

And should you be happy about moving beyond full employment? Was the ex ante level of risk too low, too high, or just right? Depends! Even if you think ordinary Americans are too complacent, it does not follow the same is true for the marginal entrepreneurs.

In this setting, failure does not have to mean the gambles were bad ex ante, nor does success validate the initial fervor, as maybe everyone just got lucky.

Addendum: Don’t get too encouraged by what I am saying. The Lucas Supply curve is still pretty weak, as we have known for decades (only on Twitter is this not known). Bad nominal shocks do destroy jobs, but as time passes there is still no reason to think that “mere inflation” does more than a small amount to bring them back. No matter where you are on this risk-return curve.

Wednesday assorted links

1. “SARS-CoV-2 infection is effectively treated and prevented by EIDD-2801” (a Fast Grants project, has potential). And a nanobodies approach with promise, also Fast Grants.

2. My talk to Interintellect Salon on Malthus and the Malthusian trilemma, I liked it and the group.

3. Is the coelacanth overrated?

4. Papers on Smith, Hume, liberalism, and esotericism.

5. California state government now running a $25 billion surplus. How much more aid do they need again?

6. ” After controlling for demographic characteristics, we found no differences in subjective well-being between childfree individuals and parents, not-yet-parents, or childless individuals.” Also no difference in observed personality traits.

My Conversation with Brian Armstrong

He is the co-founder and CEO of Coinbase, here is the video, audio, and transcript. Here is part of the CWTeam summary:

Brian joined Tyler to discuss how he prevents Coinbase from being run by its lawyers, the value of having a mission statement, what a world with many more crypto billionaires would look like, why the volatility of cryptocurrencies like Bitcoin is more feature than bug, the potential for scalability in Ethereum 2.0, his best guess on the real identity of Satoshi, the biggest obstacle facing new charter cities, the meta rules he’d institute for new Martian colony, the importance of bridging the gap between academics and entrepreneurs, the future of crypto regulation, the benefits of stablecoin for the unbanked, his strongest and weakest interpersonal skill, what he hopes to learn from composing electronic music, and more.

And an excerpt:

COWEN: Recently, you cited an estimate that if bitcoin were priced at $200,000, that about half the world’s billionaires would be from crypto. How is that world different? What does it look like? How does it feel different from the world we have?

ARMSTRONG: That’s a big question. I guess the most honest answer is, I don’t know for sure. One thought I’ve had, though, is that if there are more people who generate a lot of wealth with crypto — which I think is already happening, and it will probably keep happening. Most of the people who bought crypto early on — they’re believers in the power of technology to change the world. They’re interested in the ethos of crypto in many cases, and I suspect that they would allocate their capital towards more things in that vein.

You could almost have this — I don’t know if you’d call it a renaissance or a golden age or something, of people who are technology believers. They want to see a better future coming from science and technology, and they’re going to use their capital for good in that direction. That could be one outcome.

There is much more at the link, interesting throughout.

Canada Needs a New Vaccination Strategy

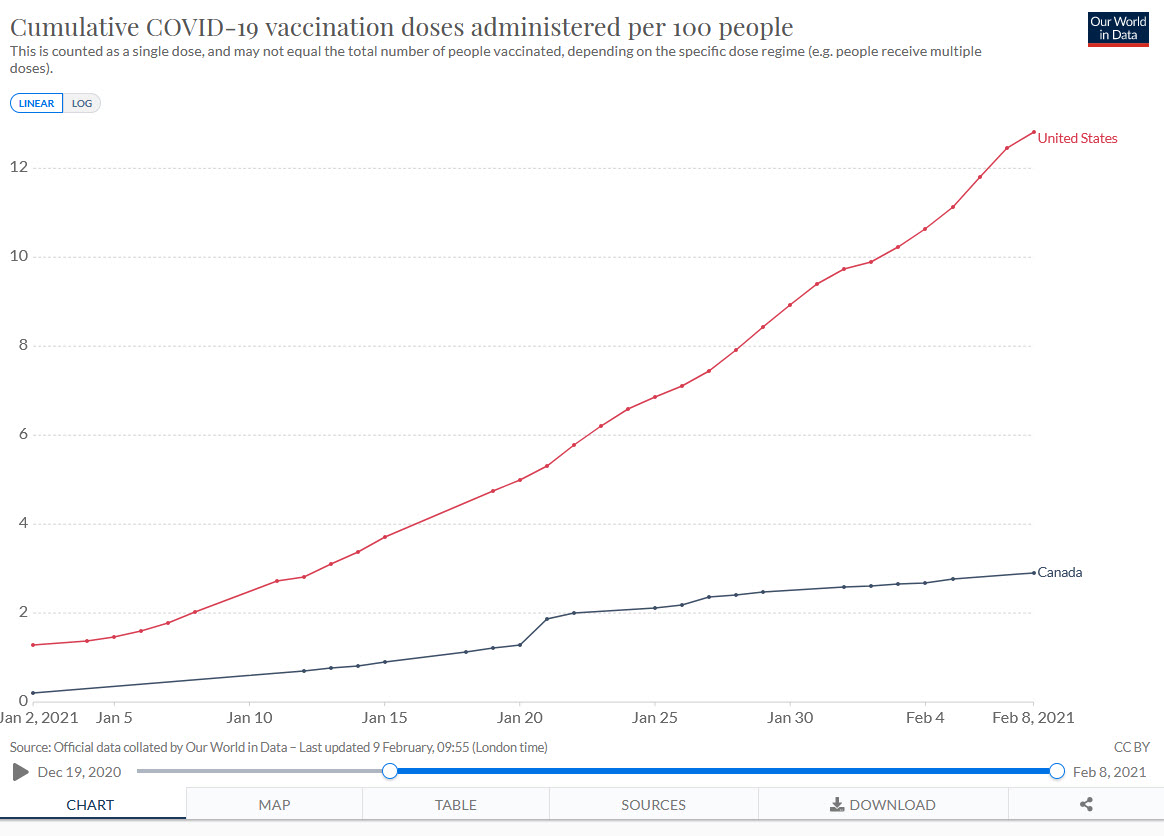

The US vaccination rollout has been deadly slow, inefficient, and chaotic. It has also been one of the best in the world. Canada, for example, is far behind the US on vaccination.

The Canadian deficit is mostly because they don’t have enough vaccine. Canada bought doses but they didn’t invest in capacity and a deal with China fell through. As a result, Canada won’t be getting lots of vaccine until March or April. Operation Warp Speed invested billions in the Modern vaccine and in early purchases of the Pfizer vaccine and thus got first dibs. The Americans are also not allowing vaccine to be exported to Canada. (We could at least give them access to our AstraZeneca factory!).

Regardless of blame, this puts Canada in a precarious situation. Death rates aren’t as high as in the United States but with new variants exploding, Canada is running a big risk. To get Canadians vaccinated more quickly–including my mother–Canada needs to find ways to stretch their vaccine supply–that means First Doses First, half dosing, intradermal delivery and other dose stretching strategies should be considered.

Many other countries are in a much more worse position than either the United States or Canada.

The Rot is Deep

It’s not just the FDA, or the CDC, or Trump. The rot is deep.

Defense News: Imagine that, for years, the U.S. intelligence community warns about a specific national security threat that could come to pass. One day, it finally does. International observers sound the alarm. The press picks up the scent. Within two weeks, the threat breaches U.S. defenses, and two weeks after that, Americans begin to die. But it takes six months for the U.S. Army to agree to fill the capability gap with a counter-weapon of its own design, and more than a year after the first American casualties, the Army rolls it out.

This, in fact, just happened. It’s the timeline of the Army’s response to the COVID-19 pandemic, an unambiguous threat to life and livelihoods.

It took a full year for the service to design, approve and distribute a face mask — called a Combat Cloth Face Covering, or CCFC — for its soldiers, an effort that required an additional $43.5 million in contracts to provide temporary solutions. That comes out to about $45 per mask, if you assume every active-duty, National Guard and Reserve soldier received one. A pack of 20 N95 masks at Home Depot costs about $20.

And yet, the Army congratulated itself on the “expedited” timeline, compared to the 18- to 24-month procurement cycle such an effort would normally take.

“The system worked as designed,” tweeted a former Marine.

And that is precisely the problem.

The ascendancy of Clubhouse

That is the topic of my latest Bloomberg column, here is one excerpt:

If you don’t already know, Clubhouse is a year-old social media service consisting of virtual “rooms” where people can talk to each other — by voice. That may not sound impressive, but many users swear by it, seeing it as a communications platform that could help restore peaceful discourse and civility rather than exacerbate tensions. I think of Clubhouse, which I joined last summer, as somewhere between talk radio and a dinner party.

Back in the 20th century, famed communications theorist Walter J. Ong suggested that oral cultures are more aggregative, more redundant, more conservative, and more openly questioning and dialogic. Given the social turmoil and polarization that the U.S. is going through, that all sounds pretty good.

To me, a lot of Clubhouse sounds like elders chatting around a traditional campfire, with many of the younger people listening in (noting that “elder” here is defined more by status than by age). Extra points go to those who are genuine, engaging and good at thinking out loud and leading a group. There is a subtle but definite set of hierarchies, though to the benefit of the conversation.

And:

One of the great strengths of Clubhouse is its celebrity-friendliness. If you are a major tech executive, why not speak in a Clubhouse session rather than to a journalist? The assembled crowd will spread your message, and can vouch for what you said and its context. It would not surprise me if Clubhouse soon becomes the major conduit for news about tech and tech executives, perhaps for Hollywood stars too. The one group that seems most out of place on Clubhouse are the journalists, who possess no special status and are discouraged.

There is much more at the link.

Tuesday assorted links

1. How adenovirus vaccines are made.

2. Third issue of Works in Progress.

4. Cass Sunstein to work on immigration law for the DHS in the Biden administration.

5. Interview with the excellent Youyang Gu (Emergent Ventures winner, btw).

6. Why are Covid cases falling so sharply in so many countries? (I had to click through twice to read the whole thread.)

7. Do looks matter for an academic career in economics? Yes, and a lot. Lookism of course remains the great vice, and arguably it is worst among many of those who fight against other “isms.”

One Shot if You Have Been Infected

Here’s noted microbiologist Florian Krammer:

This is now the third paper to find a very very good immune response after one shot of mRNA vaccine in people who had a previous SARS-CoV-2 infection. Time to discuss policy changes, @DrNancyM_CDC@CDCDirector

Paper here.

In other words, as I wrote earlier, “for the 25 million to 100 million Americans who have already been infected by COVID it may be better for them personally to delay the second dose….[thus] a significant fraction of second doses have little to no value.”

It’s good that people like Krammer are signaling that it’s time for policy change. Still, I am frustrated. None of this is unexpected or surprising. It’s just that some people (n.b. I am not referring to Krammer in particular) do not have the training or the mindset to make cost-benefit decisions under uncertainty. That’s ok in ordinary times but during a war, pandemic or takeover fight it’s deadly.

Decentralized Finance and Innovation

Decentralized finance to date seems mostly to be about speculatively trading one cryptocurrency for another. I see little real investment. But in my post on Elrond, I also wrote, “The DeX’s or decentralized exchanges have shown that automated market makers can perform the services of market order books used by the traditional exchanges like the NYSE at lower cost while being easily accessible from anywhere in the world and operating 24/7/365. Thus, every exchange in the world is vulnerable to a DeX.”

One of the reasons that I think DeFi has a big future is that there is much more innovation in the space than in traditional finance. Decentralization is really not a big deal for consumers–it’s even a negative in some respects–but it’s a huge factor for producing innovation.

As an illustration the excellent Bartley Madden (note my biases!) has an interesting idea for reformulating order books on size rather than time.

- One patented concept is that at a specified limit price, priority is based, not on the time when the order was received, but on order size, which incentivizes placing larger orders.

- Additional issued patent claims concern variable prices on limit orders depending on the number of shares traded and other technical details for new ways to facilitate the matching of institutional orders with large retail orders.

- The reason this platform would actually build liquidity is because of the preference given to the largest orders. In operation, a slight price advantage is achieved by the larger investors while the counterparty smaller investors achieve a very quick fill of their entire order.

Or consider the Budish, Crampton, Shim idea for batch auctions to avoid resource waste (rent-seeking) from high-frequency trading. Are these good ideas? I don’t know. But what I do know is that there is little chance that either will be adopted by a major exchange–the transactions costs, including bureaucracy, fear and complacency (why rock the boat?) make it very difficult to innovate. But these ideas could be implemented very quickly by a DeX.

DeFi illustrates “the perennial gale of creative destruction,” and right now we are in the creative phase. New ideas about how to exchange assets are being rapidly deployed and destroyed but a few will prove robust and then watch out. The destruction phase has yet to be begin. Wall Street is unprepared for the onslaught.

Addendum: See also Tyler’s post Will the Future be Decentralized?

Monopsony it ain’t

Remember the proposals for a $15 federal minimum wage?

Employment would be reduced by 1.4 million workers, or 0.9 percent, according to CBO’s average estimate…

That is from the new CBO report.

Who first noticed the tech was ready for human genome sequencing? (that was then, this is now)

Perkin Elmer’s last purchase had been a Cambridge, Massachusetts, company called PerSeptive Biosystems, a protein-analysis enterprise started by Lebanese-born wunderkind Noubar Afeyan seven years earlier, when the ink was still wet on his Ph.D. from MIT. Afeyan had sold his company to Perkin Elmer for almost $400 million. The deal had yet to be finalized, and formally speaking Afeyan wasn’t yet a Perkin Elmer employee. But he was at the meeting in Foster City, too. Like Lipe and Barrett, he shared White’s vision of “moving up the food chain” and getting into the genetic information business. But like them, he didn’t really have a clear idea how that was to be done.

It was Afeyan, the newcomer, who first said the words. The head of the multicapillary-machine production team was winding up a presentation on the instrument’s design and capacity. There were twenty-odd people around the table, discussing such matters as pricing, costs, and marketing strategy. This was the first time Afeyan had heard that the project even existed. He was taking some notes and idly doing some calculations. “You know, with enough of these machines, we could sequence the whole human genome,” he remarked. A few people chuckled at the notion, and the discussion returned to serious topics. But now Hunkapiller was hunched over his yellow pad, scribbling. After a minute he looked up. “He’s right,” he said. “Who’s right?” asked White. “Noubar. With two hundred machines, we could sequence the human genome in three years.” Most people in the room hardly knew Noubar Afeyan, but they knew Michael Hunkapiller. He would not interrupt a serious discussion except for something even more serious.

That is from James Shreeve’s The Genome War, here is more detail from the NYT in 1999, and for the pointer I thank Patrick Collison. Of course that is the same Afeyan Noubar who co-founded Moderna and now chairs it, here is my earlier CWT with him.