Month: June 2021

Wednesday assorted links

1. Todd Kashdan criticizing his own work.

2. “The American Economic Journal: Microeconomics (one of the very top journals that isn’t part of the holy Top-5, hallowed be thy names) managed to go an entire year without accepting a paper!” (out of 415 submissions).

3. How the NIH behaves during an emergency.

4. Increase of women in personnel management.

5. There is no Argentine bola great stagnation.

6. Speculative.

7. Sheilagh Ogilvie does Five Books on the Industrial Revolution.

Two Vaccine Updates

First, in an article on new vaccine boosters in USA today there is this revealing statement:

Any revised Moderna vaccine would include a lower dose than the original, Moore said. The company went with a high dose in its initial vaccine to guarantee effectiveness, but she said the company is confident the dose can come down, reducing side effects without compromising protection.

Arrgh! Why wait for a new vaccine??? Fractional dosing now!

The same article also notes:

One of Moderna’s co-founders, MIT professor Robert Langer, is known for his research on microneedles, tiny Band-Aid-like patches that can deliver medications without the pain of a shot. Moderna has said nothing about delivery plans, but it’s conceivable the company might try to combine the two technologies to provide a booster that doesn’t require an injection.

The skin is highly immunologically active so you can give lower doses with a microneedle patch. The microneedles are sometimes made from sugar and don’t hurt. Microneedle delivery, however, can cause scars but I say apply the patch where the sun don’t shine and let’s go!

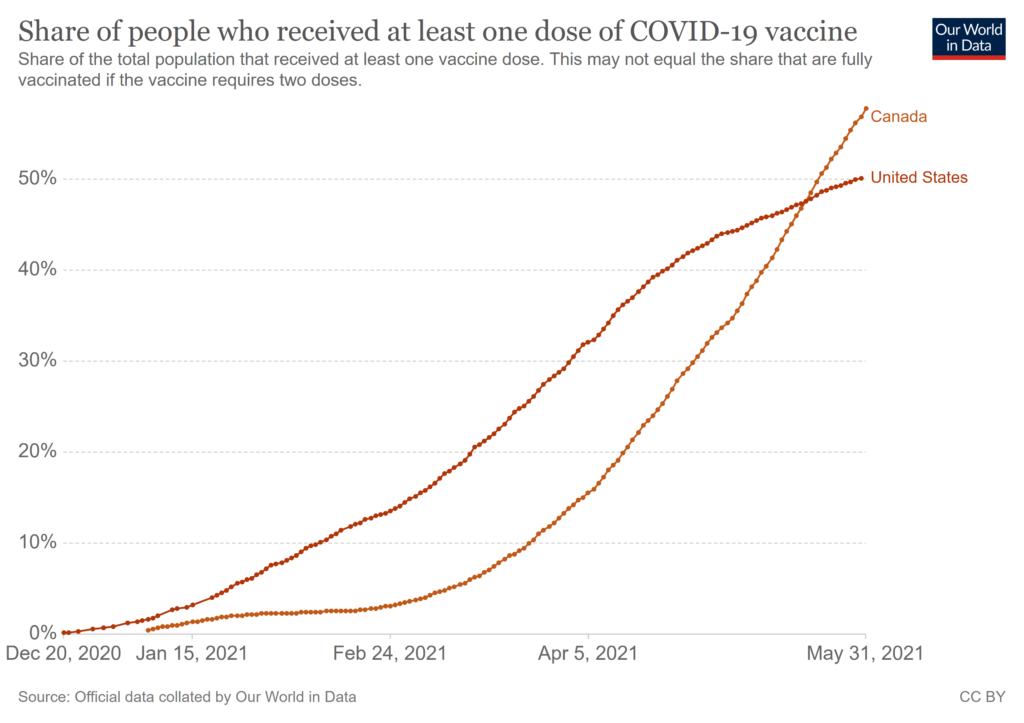

Second, Canada’s NACI has now endorsed mix and match for the AZ and Pfizer and Moderna vaccines. First Doses First has put Canada in very good shape (now ahead of the US in percent of the population with at least one dose) and this was always part of the FDF plan–delay second doses to get out more first doses and then, when supplies increase, give second doses, possibly with a better vaccine.

Do individuals make more rational decisions when the stakes are higher?

Often yes, but this is a shibboleth of economics that doesn’t always fit the facts, as has been illustrated starkly by our behaviors during the pandemic. Many people have taken too much risk, or been too risk-averse, even with high stakes on the line. Here is one excerpt from my recent Bloomberg column:

You might wonder why we are getting these big, important decisions so wrong. I have at least two hypotheses. One is that anxiety causes people to make worse decisions. Facing the danger of a deadly pandemic, for example, the higher stakes might induce me to shift into denial, if only to protect my sanity and peace of mind. I might make worse decisions than if I were simply trying to avoid the common cold, for which the stakes are far lower.

My other hypothesis involves identity and the desire for belonging. It is no accident that red states in the U.S. are under-vaccinated relative to blue states; vaccine skepticism is in part an identity marker for Trump supporters. People tend to see big decisions as more important in shaping their identity than small ones. In essence, the significance of a decision induces all kinds of surrounding social forces to “infect” that decision with partisan influences, and that decision in turn becomes a truly credible signal of what we believe.

For most economic decisions, people do still make better choices when the stakes are higher — but this isn’t a universal principle. Are you so sure, for example, that decisions about who to marry are made more rationally than those about which TV show to watch? Maybe they are, but it’s not entirely obvious.

Note that it is now much easier to make good small stakes decisions, largely because of the internet:

An accompanying change is that low-stakes decisions are easier than ever, due largely to the internet, with one crucial caveat: The decision-maker must be relatively rational. Several decades ago, if you wanted to figure out the best paper towels to buy, you might have asked around and then collated a lot of information yourself. These days it is easy enough to search the internet for the answer. Or consider the example of credit-card rewards, which are far easier to collect, manipulate and use because of the internet.

The danger of course is that the sum of all these smaller triumphs convinces people that they are rational about big dilemmas too — despite the fact that they choose rather poorly on some of them. We are not used to a world where we are worse at big decisions than the small ones. But it has been hurtling our way for some while now.

Recommended. I also cite this: “Bryan Caplan, a colleague who studies human rationality, has put the individual Covid response in only the second percentile of “my initially mediocre expectations.””

Olaf Stapledon movie coming!?

From Iceland? Narrated by Tilda Swinton?

Via Jeet Heer, and Ilya Novak. Is it any good?

The age of reason is fifth grade?

Finally, the proportion of equilibrium play increases significantly until fifth grade and stabilizes afterward, suggesting that the contribution of age to equilibrium play vanishes early in life.

Here is more from Isabelle Brocas and Juan D. Carrillo, forthcoming in the JPE.

Tuesday assorted links

1. The resilience of the U.S. corporate bond market. And who needs a flying car?

2. Famous economists’ grave sites.

3. “Measured intelligence did not predict increased mate appeal in either study, whereas perceived intelligence and funniness did.” Speculative.

4. Blockchain-based smart contract for Kenyan crop insurance (speculative).

5. David Beckworth podcast with Mark Carney, mostly macro.

6. Winning probabilities of horses with fast-sounding names are overstated.

7. How they used to dance, starring Doris Day.

More on Individualism and Benevolence

This paper investigates the role of individualism in charitable giving. Individualistic societies are those that value individual fulfillment, personal responsibility, and relationships with those outside one’s in-group. Though critics suggest individualism undermines virtues such as generosity, we consider contrary mechanisms first developed in the tradition of classical political economy, especially the “doux commerce” hypothesis (Hirschman 1982), which posits that self-interested pursuit of gains through trade has broader, usually positive, effects on the attitudes and behavior (Matson 2020). Originating in French Enlightenment–era works—especially Montesquieu (1777a, XX.2)—and later found in Mandeville (1988 [1714]), Smith (1982 [1759]), and Hume (1994 [1742]), these arguments fell out of favor within mainstream economics for much of the twentieth century (Boettke 1997). But interest in these works has reemerged alongside growing interest in endogenous preferences (Bowles 1998) and the cultural dimensions of economic activity and as experimental evidence identifying success in trade as a cause of prosocial conduct has accumulated (Smith and Wilson 2019).

…To test our hypotheses, we use evidence from a large cross-section of countries and several measures of individualism, including Hofstede’s (2001) individualism-collectivism index, the index of survival versus self-expression from the World Values Survey (WVS) (Inglehart and Oyserman 2004), and measures of generalized tolerance. Each represents a quantitative measure of culture, or what David Hume referred to as national character (Sent and Kroese 2020). Our empirical results show that individualism is indeed associated with charitable giving, as is economic freedom. The results support the argument of classical liberals thatcommercial society and the social and cultural institutions that support it are sources of the common good.

From Cai, Caskey, Cowen, Murtazashvili, Murtazashvili and Salahodjaev. See my previous post(s) on this topic.

U.S. Largest Industries, 1890

1. Transportation

2. Agriculture and Related Industries

3. Food, Beverages, and Tobacco Products

4. Metal, Metal Products, and Machinery

5. Textiles, Textile Products, and Clothing

6. Mining and Quarrying

7. Banking

8. Wood, Lumber, and Their Products

9. Leather and Allied Products

10. Slaughtering and Meat Packing

That is from the new and excellent An Illustrated Business History of the United States, by Richard Vague. How many of you really know everything that is in here? In that same year Buffalo was the tenth largest U.S. city. And the most valuable import around that time (1891-1900) was sugar, with coffee #2 and “Hides and skins” #3.

The fly swatter had not yet been invented.

Just remember: picture books are usually better than regular books.

Is the second-cheapest wine a rip-off?

The standard economic analysis of product-line pricing by Mussa and Rosen (1978) implies that higher-quality varieties command higher absolute mark-ups. It is widely claimed that this property does not apply to wine lists. Restaurateurs are believed to overprice the second-cheapest wine to exploit naïve diners embarrassed to choose the cheapest option. This paper investigates which view is correct. We find that the mark-up on the second cheapest wine is significantly below that on the four next more expensive wines. It is an urban myth that the second-cheapest wine is an especially bad buy. Percentage mark-ups are highest on mid-range wines. This is consistent with the profit-maximising pricing of a vertically differentiated product line with no behavioral elements, although other factors may contribute to the price pattern.

That is from a new paper by David de Meza and Vikram Pathania, via The Browser (which is worth paying for).