Month: June 2021

Structural unemployment for me but not for thee (a continuing series!)

Paul Krugman cries “Uncle!”, apparently seconded by Peter Diamond, and the continuing deserved elevation of Marianna Kudlyak. She is a truly great and important economist.

A simple and stupid one variable theory of this year’s NBA playoffs (so far)

It is typically worth trying on such theories for size, no matter what their defects.

It is hard to avoid noticing that last year’s finalists — Miami and the Lakers — both exited this year in the first round, and ignominiously. Injuries and fatigue were part of the reason why.

The teams that are doing best — Phoenix, New Jersey, and Atlanta — had minimal or zero playoff responsibilities last time around. Usually of course playoff performance is positively correlated from one year to the next.

We will see if this theory has predictive value moving forward. In any case, it does seem the league has discovered the margin where player fatigue truly is a binding variable.

Addendum: ESPN provides the data on injuries to stars.

Tuesday assorted links

1. National Geographic. And amazing how unfunny is Woke TikTok (NYT). How many Woke comedians could fill a mid-sized arena?

2. Cicadas swarming around Washington are showing up on weather radar.

3. Bitcoin en El Salvador? (in Spanish) What is their real strategy here?

4. An argument that high inflation is indeed coming.

5. Ross is right (NYT). And aphantasia and hyperphantasia (NYT). Here is a rebuttal to Ross if you would like to read it, I think it is weak.

Better Crowdfunding

In 1998, I designed the “dominant assurance contract” (DAC) mechanism for producing public goods privately. In my latest paper, just published in GEB written with the excellent Tim Cason and Robertas Zubrickas we test the theory in the lab and…it works! Kickstarter hadn’t yet been created when I first wrote but the DAC mechanism can now be easily explained as a Kickstarter contract with refund bonuses. On Kickstarter and other crowdfunding sites you contribute to a project and if a contribution threshold isn’t reached you get your money back. The Kickstarter contract is useful but it’s still easy for a good project to fail because there are many equilibria with non-funding. For example, if I think that you won’t contribute then I may decide not to contribute and if I don’t contribute then you may decide not to contribute. Neither of us can do better by contributing, given the other person is not-contributing, and so non-contributing is a Nash equilibrium (see my talk at the Foresight Institute for more details). Now introduce refund bonuses which pay out only if the threshold is not reached. Now if I think that you won’t contribute then I want to contribute, to earn the refund bonus, and the same is true for you. Indeed, the only equilibria in the crowdfunding game with refund bonuses have the project being funded. Thus, a nice feature of the refund bonus game is that in equilibrium the refund bonuses are never paid!

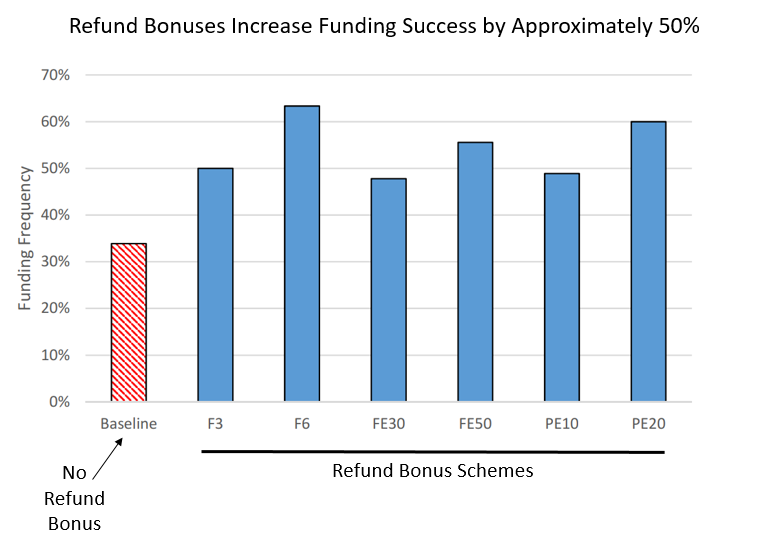

To test the theory we (mostly Tim and Robertas!) created an environment very similar to that faced by people on Kickstarter. Namely, there are multiple projects to choose from, each with different private payouts and each project has a contribution threshold and some projects offer refund bonuses. We test a variety of different types of refund bonuses including fixed (e.g. $10) and proportional e.g. (20% of your contribution) and also early refund bonuses (a refund bonus if the contribution threshold is not reached and you agreed to contribute in the first half of the funding period) or for contributions at any point in the game. Our research leads to three important conclusions.

First, without refund bonuses only ~30% of socially valuable projects succeed (perhaps coincidentally almost the exact same as on Kickstarter). But with refund bonuses the success rate increases by about 50% to 50- 60% and it doesn’t much matter much what type of refund bonuses are used!

Second, early refund bonuses have some useful properties. A key to the mechanism is that it quickly makes many contributors pivotal. At the beginning of the game it’s in no single individual’s interest to fund the public good but as others contribute there comes a time when the contribution necessary to push the total funding over the threshold is less than the value of the public good to the individual–thus, for purely self-interested reasons, a potential contributor can benefit by pushing funding just over the threshold. We say such contributors are pivotal. Early refund bonuses make contributors pivotal sooner and we think this gives people time to recognize that pushing funding over the threshold is in their interest. In addition, when more people contribute early this sends a signal of social cooperativeness which also appears important to fund public goods.

Third, refund bonuses pay for themselves! In theory, refund bonuses are never paid but in practice, as we have seen, some socially valuable projects fail even with refund bonuses. Nevertheless, for reasonable markups it’s still in an entrepreneur’s interest to use refund bonuses because the greater success rate more than pays for having to pay modest refund bonuses when a project fails.

We think refund bonuses can substantially improve crowdfunding and we hope to partner with a crowdfunding site to run a field experiment. Contact me if interested!

Read the whole thing.

Why are the less educated in democracies especially anti-science?

This is not exactly what I was hoping to hear, but at this point along the road you know none of the stories are going to be pretty:

…less educated citizens in democracies are considerably less trustful of science than their counterparts in non-democracies. Further analyses suggest that, instead of being the result of stronger religiosity or lower science literacy, the increase in skepticism in democracies is mainly driven by a shift in the mode of legitimation, which reduces states’ ability and willingness to act as key public advocates for science. These findings help shed light on the institutional sources of “science-bashing” behaviors in many long-standing democracies.

In particular:

…democracies are significantly less likely to make references to science in their constitutions, and award a smaller share of high state honors to scientists.

Lower democratic trust in government, as found in democracies, also translates into lower trust in science, at least among the less educated citizens. An autocratic regime is more likely to invoke modernization and science as a form of attempted legitimization.

For poorly educated individuals, the countries where trust in science is highest are Kuwait, China, Kazakhstan, Spain, Tanzania, Gambia, Tajikistan, Myanmar, UAE, and Uzbekistan, three of those being former Soviet Union. For college degree and above, the countries where trust in science is highest are Philippines, India, Belgium, Denmark, Norway, Ireland, Finland, Spain, Tajikistan, and Czech Republic.

Sad!

Here is the full paper by Jiang and Wan, via the excellent Kevin Lewis.

John Stuart Mill on the Californian Constitution

From 1850:

The Californians have not been solely occupied with “the diggings.” They have found time also to construct a set of institutions…It is worthy of remark how instantaneously any body of American emigrants, as soon as they have formed a settlement, proceed to make a constitution; though European authorities of no small account in their own estimation, are never tired of assuring us that constitutions cannot be made. But while these sages are stoutly denying the possibility of motion, the Americans, one after another, like Diogenes, rise up and walk; and not one stumble has occurred to mar the completeness of the practical confutation. Whatever other faults have been found with the Anglo-American constitutions, no one has yet said that they will not work; a fate so often denounced against all constitutions except those which, like the British, “are not made but grow,” or, it should rather be said, come together by the fortuitous concourse of clashing forces.

Mill in particular praised that the California Constitution gave women the right to own their own property. From the Toronto edition of the Collected Works, vol.XXV.

Solve for the football culture equilibrium that is Mexican

Many fans shrug off accusations of homophobia and insist the chant is just a joke. “We do not scream at the goalkeeper because of his sexual preference, we don’t even care about it,” a YouTube commenter on a 2016 public-service video denouncing the chant wrote. “We shout to create chaos, because it is part of the atmosphere of a stadium in Mexico.”

For some, the chant merely illustrates wider homophobia in society.

Here is the proposal of an American academic:

“Convince fans that it brings bad luck to their own team,” Doyle said, “and this nonsense will stop.”

Now that’s a plan. The actual (new) rule is to stop play if the chants become too extreme:

Nearly two years ago, FIFA approved a disciplinary code that allows referees to end matches if fans use chants or display behavior deemed to be homophobic or racist. However, because of COVID-19, Mexico’s national team has played few games in front of fans since the rules were adopted.

But when the team returns to the field May 29 to face Iceland in Arlington, Texas, Yon de Luisa, the Mexican federation’s president, said the new code will be strictly enforced.

If you are feeling just a bit generous in interpretation:

There is vigorous debate over whether the chant is offensive since the offending word is said to have many meanings in Spanish, one of which is a derogatory slur used to demean gay men.

Some countries should be just a bit more woke!

Monday assorted links

1. How inevitable is the concept of numbers?

2. Learning about disadvantage leads to perceptions of incompetence.

3. The decline and indeed collapse of the ACLU (NYT).

5. A journey to puffin island: “Puffins beat their wings up to 400 times per minute, and are vocal when on land but are silent when flying over water.”

6. The import of home field advantage in soccer.

Fractional Dosing Study in Brazil

Fiocruz, the Brazilian public health institute, will test half doses of the AstraZeneca vaccine. Not much information available yet. From a Google Translate article.

BANDNews: Fiocruz, in partnership with the government of Espírito Santo, is going to carry out a study with the application of half a dose of the Astrazeneca vaccine to the entire population of the municipality of Viana, in Greater Vitória.

The city has about 35 thousand inhabitants.

The immunization will take place on Sunday, June 13, and residents will be able to choose whether they want to participate in the study.

According to the state secretary of Health, Nésio Fernandes, there is already evidence of the effectiveness of the application of half a dose of the vaccine in immunization against Covid-19.

If the experience is successful, it will be possible to double the number of people vaccinated in the country with the immunizing agent produced by Fiocruz.

See my previous posts on fractional dosing for why this is very important.

Hat tip: Cisco Costa.

Some points about corporate tax

Written from the British context:

Should the system be changed to one where companies are taxed on all the profits they make from their sales in the country?

There are a few downsides to this.

First of all it would be very hard for one country to switch to such a system without getting the rest of the world to do it too. If we did it unilaterally it would open up more differences between national tax regimes and so create, rather than reduce tax avoidance loopholes.

It is also far from clear the UK would gain from such a change. We might gain from some of the big US-based multinationals paying more tax here, but we have plenty of multinationals of our own and they would generally end up paying less here. The biggest losers could well be poorer developing countries, especially those reliant on extractive industries such as mining. If they could only tax companies based on their sales to their residents in that country that would bring in a lot less than taxing them on the share of the economic value of the products generated in that country. The UK itself still generates between 8 and 9 percent of Government revenues from corporation tax, which is pretty respectable internationally, despite being a very open economy exposed to competition.

There is also an economic question as to who ultimately bears the burden of taxes on a company – is it the shareholders, the customers, or the workers, and if the workers, is it the highly-paid top management or the people at the bottom? The answer is not certain, but it does seem likely that a shift to sales-based tax would be at the expense of the customers. In other words, by taxing internet-based suppliers more, we could be more heavily taxing ourselves.

But the strongest argument against is fairness. If a product is invented / developed / mined / refined / built and potentially even marketed and sold all round the world entirely from country X, making use of staff educated in country X, who use country X’s health care system and transport network, often with tax breaks from country X to encourage its growth, and maybe even wage subsidies from country X for its employees, who deserves to be able to tax the company’s profits? Is it country X, or every country that has someone in it who buys a product from the company? Of course if a country wants to tax sales it can, and sales taxes such as VAT are a perfectly reasonable and sensible part of a country’s tax mix; though in the EU, this is governed to a considerable extent by EU rules.

There are many further detailed points at the link. And do note this:

There is a perceived issue with the internet making it easier than ever for companies to ‘sell into’ a country with little or no presence in that country, and therefore offering little or no taxable base for the government of that country to tax the profits of. Sales taxes can be part of the answer to this.

But of course a sales tax does not appear to consumers to be a free lunch, and so it is not as politically popular as a sales-based hike in corporate rates. And so we arrive at the current mess of a situation: “We want tax equity, but you can’t possibly expect us to do that in a way that is transparent!”

Denver bleg

Where should I eat in Denver? Doesn’t have to be fancy, of course. I thank you all in advance for the suggestions.

Tax incidence on competing two-sided platforms

That is a paper by Paul Belleflamme and Eric Toulemonde, from a few years ago:

We analyze the effects of various taxes on competing two-sided platforms. First, we consider nondiscriminating taxes. We show that specific taxes are entirely passed to the agents on the side on which they are levied; other agents and platforms are left unaffected. Transaction taxes hurt agents on both sides and benefit platforms. Ad valorem taxes are the only tax instrument that allows the tax authority to capture part of the platforms’ profits. Second, regarding asymmetric taxes, we show that agents on the untaxed side benefit from the tax. At least one platform, possibly the taxed one, benefits from the tax.

This may all turn out to matter more if the new multinational corporate tax regime comes into existence. Of course you can vary the assumptions further yet, and get additional and differing results, but please keep in mind: the tax you impose is not the incidence you get.

Trade Wars Are Hard to Win, Part LXXIV

Bloomberg: The surge of cheap panels from China dealt a crushing blow to U.S. manufacturers — and Solyndra wasn’t the only casualty. After three other U.S. solar manufacturers sought bankruptcy protection, Obama in 2012 slapped duties as high as 249% on the imports. Manufacturers responded by moving operations out of China, but they didn’t head to the U.S. Instead, large manufacturers skirted the U.S. tariffs by building facilities to assemble solar cells and modules across Southeast Asia.

Making matters worse, China retaliated by imposing its own duties of up to 57% on imports of U.S.-made polysilicon — tariffs that crippled U.S. producers of the conductive material used in solar panels.

…Before the Chinese tariffs, U.S.-made polysilicon had been shipped to the country and used to produce ingots, the next stage of solar cell manufacturing. But the tariffs made American polysilicon too expensive, Wang said, and the U.S. went from making 50% of the world’s polysilicon in 2007 to less than 5% today.

Tariffs on imports of solar panels were imposed by both the Obama and Trump presidencies and neither succeeded. We would have done better by letting the Chinese subsidize their solar industry and thus our solar energy system and more likely keeping our input suppliers.

Hat tip: Scott Lincicome.

Structural adjustment for thee but not allowed for me

The economy has not bounced back to prepandemic employment levels, even as G.D.P. effectively has.

Some blame unemployment benefits for keeping workers at home, while others claim that it is the virus still holding back customers and therefore employers from adding jobs. Yet there is a third factor that is likely the labor market’s primary challenge: We are undergoing an enormous reallocation of people and jobs. People need time to find their new position in the labor market.

The early hope among policymakers and economists was that the pandemic aid offered to businesses and families would mean that once we recovered from the pandemic, workers would simply return to their old jobs, sending millions back to work each month and closing the employment gap quickly.

The problem is that old jobs are long gone for the vast majority of those who remain unemployed.

That is from Betsey Stevenson (NYT), and I am not taking issue with her arguments. Note that if you look about the debate over 2021 more broadly, pretty much everyone agrees there might be too much AD rather than too little. And yet these matching problems are still around? Hmm….once you are in a mess, supply-side labor adjustment problems just cannot be fixed so easily by nominal demand and nominal demand only. See my earlier recent post on this point, namely that business cycle recoveries tend to look the same on the labor side for supply-side reasons. During recoveries a lot of people just don’t want to go back to work or even look for a job! That was true in the last recession as well, read this paper, or this research. People hate the idea if you call them ZMP, but it’s right there in the numbers…how can someone be MP > 0 if they won’t even show up for an interview?

You might notice, by the way, I am not a huge fan of the NAIRU concept and you won’t see me cite it very often (occasionally it is useful shorthand for a less controversial concept.) The following notion, however, is well-defined: “What the rate of unemployment would be if there were no major negative shocks for a decade and people had seven, eight, or even more years to search for the right job match.” Yes that is indeed a well-defined number, and that number is pretty low. I’m just not sure that is very “natural.” What would John Gray say? The Marquis de Sade?

The new proposal on corporate tax synchronization

The G-7 nations have coordinated (NYT, FT here) to announce a minimum corporate tax rate of 15%. Even if seen through, that doesn’t mean all rates must be at 15% or higher, rather if a rate is at 5% another country (the home base country? the countries where the customers are?) gets to tack on another 10% to make the total take 15%. That limits the incentive to post very low rates in the first place, by checking the gains from tax haven strategies.

One perennial question is whether the 15% rate is defined over gross or net income. You don’t want to tax gross income, especially if the business under consideration actually is making a loss. In any case, you basically end up taxing business income acquisition per se.

If it is net income you are taxing at minimum 15%, you haven’t done as much to limit tax arbitrage as you thought at first. Especially if the multinational and its subsidiaries engage at arm’s length transactions with shadow pricing, etc. Net income is a major object of the actual manipulations, and would become all the more so under this new plan, assuming it is applied to net income. Won’t countries wanting to play the tax haven game end up with very lax definitions of “net income”? (Or for that matter gross income?) Or does that get regulated as well?

I don’t think this whole plan should make “the Left” happy. David Fickling wrote for Bloomberg:

The more likely outcome of the current round of reform will be a continuation of the decline in corporate rates that we’ve seen for four decades. Even amid the push to prevent tax-base erosion in recent years, 24 of the 37 members of the Organization for Economic Cooperation and Development have cut their corporate tax rates since 2008, while just seven have raised them. Statutory corporate tax rates have trended downward by about 5% a decade since 1980 to the current situation, where the average sits at around 24%. Nations that want to compete with lower-taxed jurisdictions may find the pull of 15% irresistible.

And then:

The risk now is that 15% becomes not just a minimum, but an anchor for maximum tax rates as well.

In other words, the tax haven tax competition game is redone with a 15% floor, but the agreement also pinpoints a corporate tax rate that is “good enough” and would come to be seen as “best possible treatment.” Neither of those are forcing moves which would require countries to drop their rates to 15% in the resulting equilibrium, but yes I agree with Fickling that there might be a good deal of clustering right at or near 15%, accelerated by this plan of course.

Note also that, under the plan, the 100 largest corporations would have to pay tax in proportion to where they sell their goods and services, even if they are not formally located in those countries (will there be a literal notch right at “company #100”?). Ireland loses big on that provision, as in essence more corporate tax revenue would be routed to larger countries such as France and Germany. In how serious a manner would companies have to keep track of their customers? (What happened to privacy law here? Or did they never really care much about privacy to begin with!? What are crypto companies supposed to do about this?)

Biden wants to raise the U.S. corporate tax rate to 28 percent, and Ireland, one of the major supposed villains in this game, has a rate of 12.5%. So fifteen percent just isn’t that outrageously high, even if companies do end up having the pay that actual rate (though see above about gross vs. net income, and what other “outs” will there be?).

The European digital taxes may be scrapped as well (with the details under negotiation and no one wanting to “move first”), which would ease a wee bit of the burden on the major tech companies from the broader change.

Here are various observations from Soumaya Keynes.

Is the underlying view that the U.S. Congress is supposed to approve this without further renegotiations? How about the other countries?