Month: October 2021

Do inflation expectations matter for inflation?

Many people (NYT) are talking about the new paper by Jeremy Rudd on exactly this topic — Rudd is skeptical that they matter very much. So I went to read the paper, and I have to say I am baffled. It didn’t change my priors at all. I didn’t see new empirical estimates, or new theoretical arguments, and furthermore I didn’t see the most relevant factors discussed much. I did see a lot of pokes at Friedman, Phelps, and Lucas (and there is also an introductory assertion that, even given enough time, markets with flexible prices do not clear. Then he goes on to deny that the theory of household choice is sufficient to derive downward-sloping demand…why do that???).

I would start by looking at the clearest cases where inflationary expectations do matter. If inflation rates become quite high (say above forty percent?), many people switch to alternate currencies. Or in hyperinflations the velocity of money, after some point, accelerates very dramatically, thereby fueling the inflation further. So inflation expectations really do matter, as supported by both theory and evidence. Contrary to Rudd, the theoretical case is there, though the question of magnitude at lower inflation rates is largely an open one. But let’s not slip from “open” to “we are justified in thinking they don’t matter very much at all.”

You can even put aside velocity and the demand for money and the theory for inflation expectations mattering still is there. For instance, if I look at the simple and fairly general menu costs models, suppliers know they won’t be changing their prices very often. So they form an expectation of inflation when deciding where to put the price right now, knowing that level will have to be “close enough” for some time to come. That’s a very simple theoretical mechanism! No, that is not a priori but it carries a lot of force and Rudd does not consider it.

If I ask “which papers do I, as outsider, already know in this area?” I hit upon Michael F. Bryan, et.al. “The inflation expectations of firms: What do they look like, are they accurate, and do they matter?”, 2015, not so ancient and from the Atlanta Fed. There is lots of careful estimation in this paper, and here is part of the abstract:

Next we show that, during our three-year sample, firm inflation expectations appear to be unbiased predictors of their year-ahead observed (perceived) inflation. We also show that firms know what they don’t know—that the accuracy of firm inflation expectations is significantly and negatively related to their uncertainty about future inflation. And lastly, we demonstrate, by way of a cross-sectional Phillips curve, that firm inflation expectations are a useful addition to a policymaker’s information set. We show that firms’ inflation perceptions depend (importantly) on their expectations for inflation and their perception of firm-level slack.

That doesn’t prove that inflation expectations matter a great deal, but it is certainly consistent with them mattering, as theory would lead us to expect. It seems to go much further than Judd, and it is not cited by Judd.

Or how about the NBER survey by Olivier Coibion, et.al.: “Empirical evidence suggests that inflation expectations of households and firms affect their actions but the underlying mechanisms remain unclear, especially for firms.” There is a whole section of the paper “Do inflation expectations affect economic decisions/”, with the answer mostly being “yes,” in part with the caveat that inflationary expectations are hard to measure precisely.

That all is consistent with my rather basic understanding of the matter. Again, this paper is not cited by Rudd. It’s not that I think a contribution has to cite every paper out there, but when you play the “no estimation of my own, just going to poke holes in various claims, and focusing from people decades ago…”…a reader such as I is going to want to see you cite and rebut the main recent attempts to establish relevance for inflationary expectations.

And here is commentary from Joseph Gagnon. Here is commentary from Ricardo Reis, some good points though I think he overstates the indeterminacy issue.

Most of all, I don’t feel I have a horse in this race. I am very comfortable with the idea that we, as economists, have a poor understanding of regime shifts, including shifts in inflation regimes. But when I am told that, as a result of agnosticism, I should infer inflationary expectations are not very relevant…then I feel someone has jumped the gun.

Ringo says

“The other side of that is – I was telling someone the other day – if Paul hadn’t been in the band, we’d probably have made two albums because we were lazy boogers.

“But Paul’s a workaholic. John and I would be sitting in the garden taking in the color green from the tree, and the phone would ring, and we would know, ‘Hey lads, you want to come in? Let’s go in the studio!’

“So I’ve told Paul this, he knows this story, we made three times more music than we ever would without him because he’s the workaholic and he loves to get going. Once we got there, we loved it, of course, but, ‘Oh no, not again!'”

There you go, that is a very simple and correct theory of The Beatles. I don’t care if you like “I am the Walrus” more than “Penny Lane.”

And via Bill Benzon, here is the new The Journal of Beatles Studies. And here is my earlier post Paul McCartney as Management Study.

Friday assorted links

1. How did 30,000 Haitians get to Texas?

2. “I am here.” “Missing man in Turkey accidentally joins his own search party before realising he was the person they were looking for.”

3. LaBoissiere podcast chatted with me. And Noah interviews Jason Crawford about Roots of Progress (written).

6. More on the new results on inflation expectations and their possible irrelevance (NYT).

Molnupiravir against Covid

Molnupiravir against Covid (Bloomberg). It might cut the death rate in half, the market has been boosting the Merck share price. And more here: “…molnupiravir works by introducing genetic errors that garble the coronavirus’s genetic code. That means it may be more resistant to mutation, and may even work on other coronaviruses or RNA viruses.” And StatNews here.

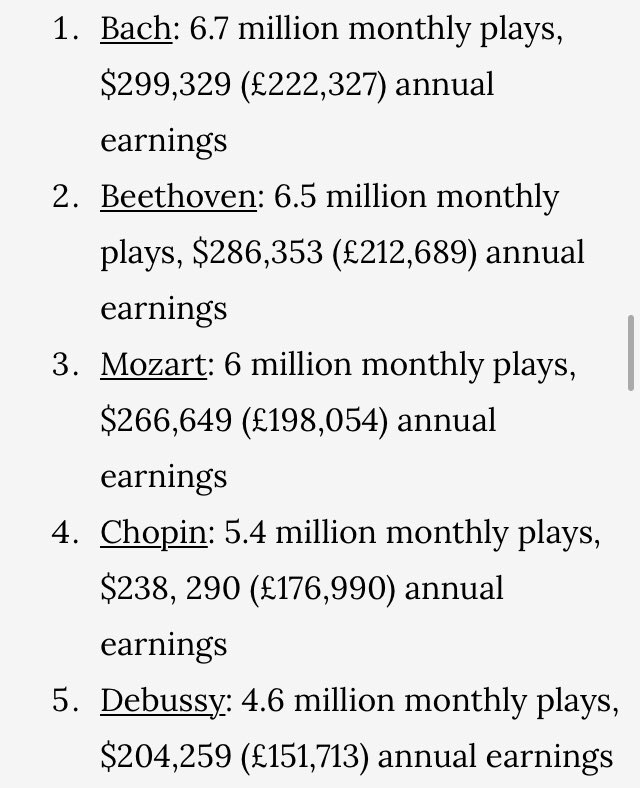

How Much Would Bach Make on Spotify?

Bach gets 6.7 million streams a month which pay .0037 per stream or about $25,000 a month or nearly 300k a year. (That is the total payment, however, composer royalties would be lower but he could also sell some T-shirts.) Not superstar earnings but much more than they earned in their lifetimes even after adjusting for inflation.

In other news, an AI working with a group of musicologists is about to release a newly completed Beethoven’s tenth symphony.

Hat tip: Ted Gioia.

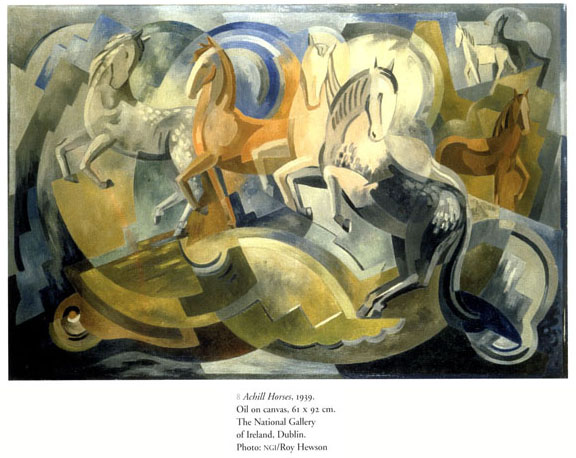

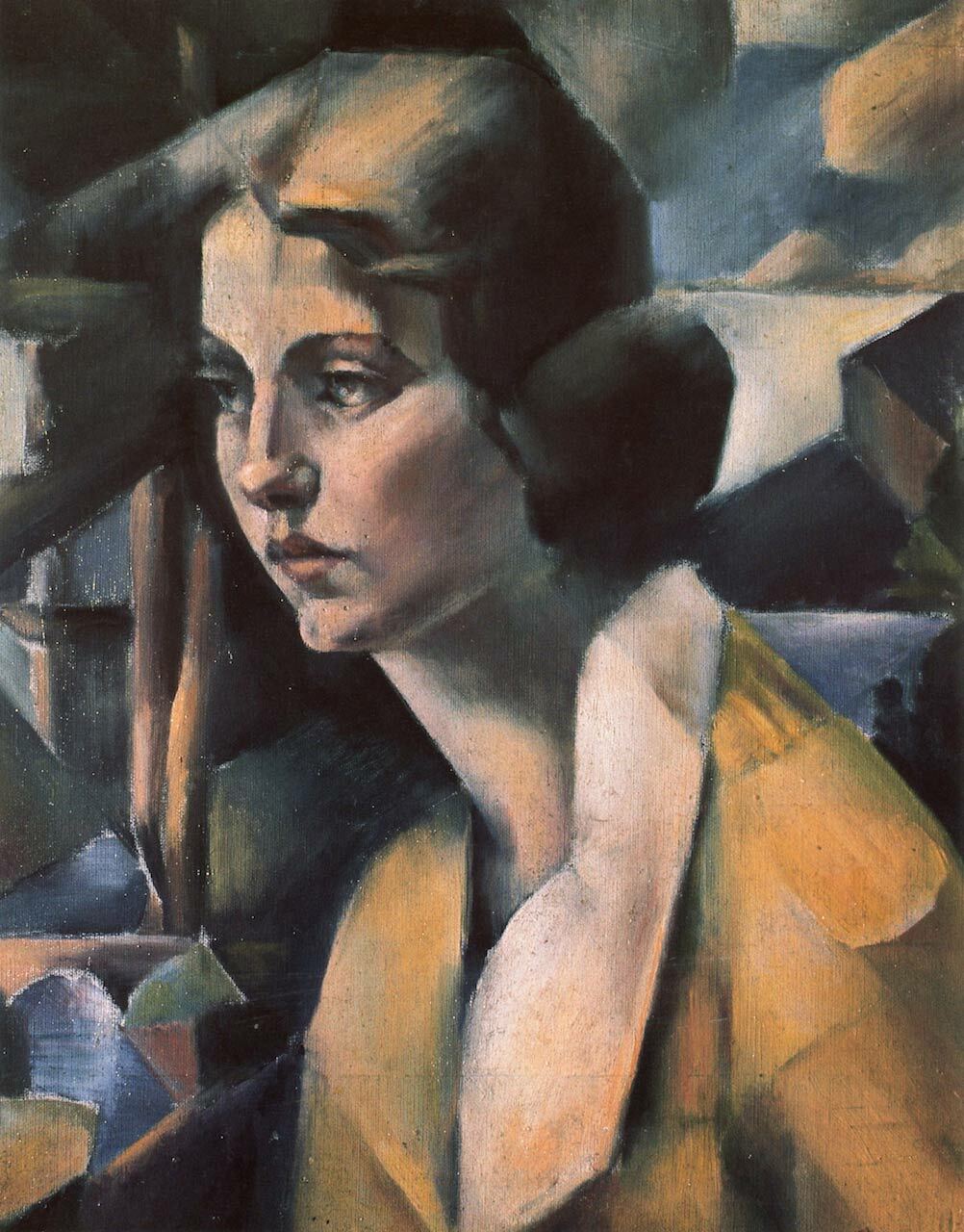

Who are the best Irish artists?, part III, Mainie Jellett

Mainie Jellett, 1897-1944, born in Dublin to a well-to-do Protestant family of Huguenot origin. She studied with William Orpen in Dublin and then moved to England, where she developed an attractive figurative style. But soon thereafter her work turned abstract when she studied Cubism in Paris in the early 1920s. She was part of what might be the most significant (and rapid) revolution in the history of art, although the Irish branch of that revolution usually receives little attention. She and Evie Hone led the introduction of modern art to Ireland, and arguably still represent the peak of that tradition. “Like James Joyce, who had ‘not become modern to the extent that he ceased to be Irish’, Jellett made modernism Irish.” (source)

She blended cubism on top of Christian devotional ideas and also structures and images from the Book of Kells and other medieval Celtic sources. At its best, her work is just perfect — you would not wish for the curves or angles or colors to go any other way. Here is a classic Jellett image, also drawing on some Chinese influences:

Here is her painting “Abstract Crucifixion”:

For a point of contrast, see her homage to Fra Angelico. Her Anglo-Irish background led to some hostility, and her deliberate invocation of specifically Catholic images is sometimes interpreted as a project for Irish cultural reconciliation.

Here is a less typical but still fine representational work:

I can’t bring myself to call her the greatest Irish artist ever, as perhaps she is not tops in breadth or multiplicity of perspectives, but she was one of the very best and I do not tire of viewing her work. She is the equal of many of the better-known modernist artists from other countries and she excelled also in watercolors and sketches. Her life was cut tragically short by pancreatic cancer.