Category: Current Affairs

Gallup fact of the day

The French election campaign continues

Sarkozy struck a strident new tone in a Sunday rally.

He threatened to pull France out of the Schengen open borders agreement and demanded the European Union adopt measures to fight cheap imports, warning that France might otherwise pass a unilateral “Buy French” law.

“I want a Europe that protects its citizens. I no longer want this savage competition,” he declared to a cheering crowd. “I have lost none of my will to act, my will to make things change, my belief in the genius of France.”

The story is here.

What would Nietzsche say?

Financial markets are already betting Greece will default again in the future. Grey market pricing for the new Greek bonds to be issued as part of the exchange ranged from 17 to 28 cents on the euro, a highly distressed level, according to indicative quotes seen by the FT.

The pricing equates to a yield on the new bonds of 17 to 21 per cent about where Greek yields stood in the autumn and far worse than the yield on debt issued by Portugal, which has also received a bailout.

Here is more.

Three on Launching

1. The excellent Reihan Salam writes, “Tabarrok’s Launching the Innovation Renaissance is my favorite manifesto in years. In a better world, it would be the roadmap for the U.S. center-right.” Small steps towards a much better world, Reihan!

2. A truly Straussian Straussian Reading of Launching the Innovation Renaissance.

3. I will be speaking at Inventing the Future: What’s Next for Patent Reform at AEI in Washington, DC on Wed. March 14, 12:30-2:00.

The hangover from a dishonest election

That is the Russian stock index. The decline may well be noise, but a fall of over 3 percent is nonetheless worth a ponder.

Apprenticeships v. College

In my post, College has been oversold, I discussed the 40% college dropout rate. In a piece in this week’s Chronicle of Higher Education, Tuning in to the Dropping Out, I reprise some of this material but also discuss high school dropouts and the importance of alternative education paths.

In the 21st century, an astounding 25 percent of American men do not graduate from high school. A big part of the problem is that the United States has paved a single road to knowledge, the road through the classroom. “Sit down, stay quiet, and absorb. Do this for 12 to 16 years,” we tell the students, “and all will be well.” Lots of students, however, crash before they reach the end of the road. Who can blame them? Sit-down learning is not for everyone, perhaps not even for most people. There are many roads to an education.

Consider those offered in Europe. In Germany, 97 percent of students graduate from high school, but only a third of these students go on to college. In the United States, we graduate fewer students from high school, but nearly two-thirds of those we graduate go to college. So are German students poorly educated? Not at all.

Instead of college, German students enter training and apprenticeship programs—many of which begin during high school. By the time they finish, they have had a far better practical education than most American students—equivalent to an American technical degree—and, as a result, they have an easier time entering the work force. Similarly, in Austria, Denmark, Finland, the Netherlands, Norway, and Switzerland, between 40 to 70 percent of students opt for an educational program that combines classroom and workplace learning.

…In the United States, “vocational” programs are often thought of as programs for at-risk students, but that’s because they are taught in high schools with little connection to real workplaces. European programs are typically rigorous because the training is paid for by employers who consider apprentices an important part of their current and future work force. Apprentices are therefore given high-skill technical training that combines theory with practice—and the students are paid! Moreover, instead of isolating teenagers in their own counterculture, apprentice programs introduce teenagers to the adult world and the skills, attitudes, and practices that make for a successful career.

For more see Launching the Innovation Renaissance and–showing the opportunity for consensus on this topic–a recent post on apprenticeships from the Shanker blog.

Sentences to ponder

And then, finally, there’s Peter Eavis’s conspiracy theory: if the Greek bond exchange goes really smoothly, and the sun rises in the morning and Italian bond yields stay below 5%, then maybe that’s the most worrying outcome of all. Because at that point Greece will have managed to wipe out, at a stroke, debt amounting to some 54% of GDP. You can see how Portugal and Ireland might be a little jealous. You don’t want to make sovereign default too easy — not least because it would do extremely nasty things to European banks’ balance sheets.

That is Felix Salmon, here is more, in recent times Felix has been the go-to guy for the Greece story: “…we’re going through the largest sovereign default in the history of the world, and surprisingly few people — including senior European policymakers and journalists who are covering it professionally — really seem to understand what’s going on.”

Is unemployment better than Canada?

Or do the Canadians simply do not want us?

They are a projected 335,000 job opportunities arising in British Columbia and Alberta between now and 2014, especially in construction. The biggest demand relates to carpenters, electricians, welders, plumbers, heavy equipment operators and millwrights.

Canada differs from many countries seeking workers abroad in that it encourages long term inward migration by specified groups and facilitates family settlement.

Most of all they are searching in Ireland, it seems.

China Fact of the Day: China Outsources to Europe

Spiegel: Great Wall this week became the first Chinese automobile manufacturer to open an automobile assembly plant inside the European Union…

…Bulgaria, the EU’s poorest country, is attractive as a labor market because it is an oasis of cheap wages and low taxes. Workers are considered well educated and the country is ideal as the site for a company like Great Wall to launch. Given that wages for factory workers have risen considerably in China in recent years, assembly sites abroad have become increasingly attractive for some manufacturers.

Expect to see a lot more of this in coming years.. As wealth and consumption increases, China will also begin to import more from developed countries, including more finished goods.

Investing in Greece: Only for the Filthy Rich

If a small company wants to sell shares to investors it must demonstrate to the SEC that the investors are “accredited,” basically wealthy, or otherwise it must go through a long and burdensome process to make an offering to the public. According to one account, Greece has considerably more peculiar requirements:

Antonopoulos and his partners spent hours collecting papers from tax offices, the Athens Chamber of Commerce and Industry, the municipal service where the company is based, the health inspector’s office, the fire department and banks. At the health department, they were told that all the shareholders of the company would have to provide chest X-rays, and, in the most surreal demand of all, stool samples.

Greek banks were not much better:

Once they climbed the crazy mountain of Greek bureaucracy and reached the summit, they faced the quagmire of the bank, where the issue of how to confirm the credit card details of customers ended in the bank demanding that the entire website be in Greek only, including the names of the products.

“They completely ignored us, however much we explained that our products are aimed at foreign markets and everything has to be written in English as well,” said Antonopoulos.

Take this with a grain of salt but the World Bank does rank Greece 135th in the world (186 countries ranked) in ease of starting a business.

Greek markets in everything

It’s being called the “negative salary”: Due to austerity measures in Greece, it’s being reported that up to 64,000 Greeks will go without pay this month, and some will have to pay for having a job. Numbers in austerity reports have usually reflected figures in the millions, since they reflect industry-wide cuts (i.e. a 537-million euro cut to health and pension funds). And plans of cutting minimum wage by up to 32% is all but a given in the country. Today’s “negative salary” deal—which could have government employees returning funds— reveals the real human impact of the austerity measures.

Here is more.

Congress gets two right

In a rare display of function, Congress extended the payroll tax cut and in the same deal they arranged to sell more spectrum, both good ideas and ones that I have argued for extensively. Frankly, I am pleased but surprised. Any inside knowledge on how this was accomplished?

Not from Atlas Shrugged

The Hill: Six House Democrats, led by Rep. Dennis Kucinich (D-Ohio), want to set up a “Reasonable Profits Board” to control gas profits.

The Democrats, worried about higher gas prices, want to set up a board that would apply a “windfall profit tax” as high as 100 percent on the sale of oil and gas, according to their legislation.

…The Gas Price Spike Act, H.R. 3784, would apply a windfall tax on the sale of oil and gas that ranges from 50 percent to 100 percent on all surplus earnings exceeding “a reasonable profit.” It would set up a Reasonable Profits Board made up of three presidential nominees that will serve three-year terms.

And here directly from the proposed bill:

(4) REASONABLE PROFIT.—The term ‘reasonable profit’ means the amount determined by the Reasonable Profits Board to be a reasonable profit on the sale.

Addendum: Here is Bryan Caplan’s classic, Atlas Shrugged and Public Choice: The Obvious Parallels and here is the award-winning Atlas Shrugged app.

Romney v. Romney

The joke going around last week was that a liberal, a conservative and a moderate walk into a bar. “Hi Mitt,” says the bartender. Here’s Mitt proving the point:

“This week, President Obama will release a budget that won’t take any meaningful steps toward solving our entitlement crisis,” Romney said in a statement e-mailed to reporters. “The president has failed to offer a single serious idea to save Social Security and is the only president in modern history to cut Medicare benefits for seniors.”

Hat tip on this one to Paul Krugman.

Innovation Nation v. Warfare-Welfare State (more)

The New York Times has a lengthy piece on the expansion of the welfare state:

The government safety net was created to keep Americans from abject poverty, but the poorest households no longer receive a majority of government benefits.

…Dozens of benefits programs provided an average of $6,583 for each man, woman and child in the county in 2009, a 69 percent increase from 2000 after adjusting for inflation.

…The recent recession increased dependence on government, and stronger economic growth would reduce demand for programs like unemployment benefits. But the long-term trend is clear. Over the next 25 years, as the population ages and medical costs climb, the budget office projects that benefits programs will grow faster than any other part of government, driving the federal debt to dangerous heights.

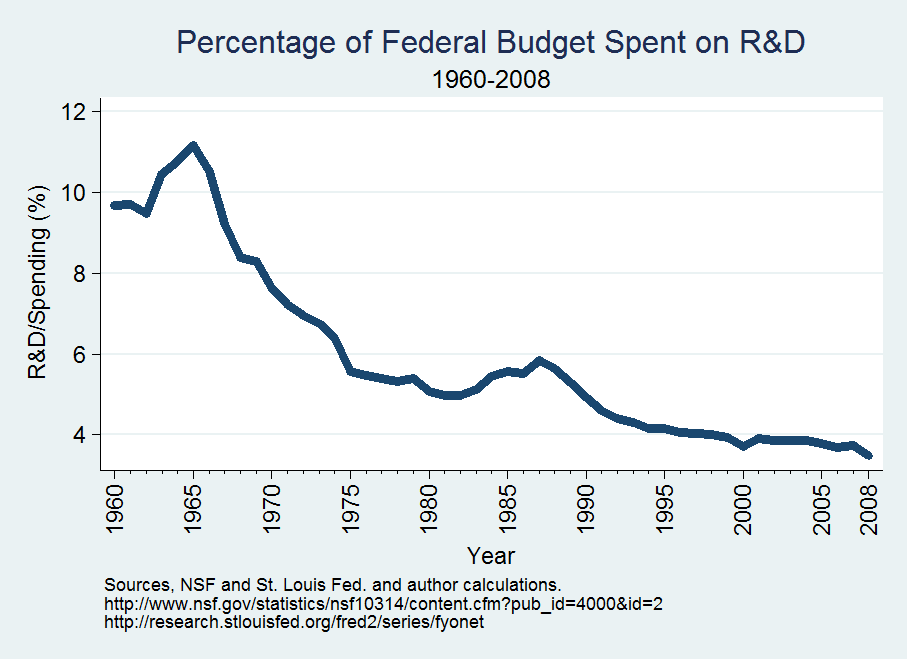

In Launching the Innovation Renaissance (and here) I argue that the warfare-welfare state is crowding out other areas of spending, even when such spending could be highly valuable.