Category: Current Affairs

Simple truths about Greece

Greece will have to bring its current account deficit down to zero at some point.

This can happen in two ways: either Greece exports more or spends less. Adjusting the current account by spending less would require an additional fall in GDP of 25 per cent, given that in Greece only one in four US dollars of spending cuts goes abroad. This is clearly not a pretty picture. But adjusting by raising exports would require they increase by 50 per cent, not an easy feat. Achieving it through tourism alone would require the industry to triple in size – an unlikely prospect.

And this:

Here’s the bad news for Greece: in our sample of 128 countries, it had the biggest gap between its current recorded level of income and the knowledge content of its exports. Greece owes its income to borrowed foreign spending it cannot pay back. It produces no machines, no electronics and no chemicals. Of every 10 US dollars of worldwide trade in information technology, it accounts for one cent.

This problem cannot be addressed by fiscal Keynesian stimulus, by bland trade facilitation or by paying lip-service to structural adjustment as the November International Monetary Fund agreement implicitly assumes.

China facts of the day

Office rents in Beijing have soared over the past two years, making it more expensive to lease prime work space in China’s capital than in New York, according to an industry survey.

A boom in demand and limited supply of high-quality space catapulted Beijing to fifth place in a list of the world’s priciest office locations that was compiled by Cushman & Wakefield, a commercial property services firm.

Hong Kong retained the top spot, followed by London, Tokyo and Moscow. New York was sixth, just behind Beijing.

Prime office rents in Beijing’s central business district rose 75 per cent last year, the fastest globally, and up from a 48 per cent increase in 2010, according to the survey.

Here is a bit more.

The negotiations over refunding Greece

Here is one very effective understatement:

The two sides were “quite far apart” over projected cuts of 25 per cent in private sector wages, 35 per cent in supplementary pensions and the immediate closure of about 100 state-controlled organisations with thousands of job losses, a Greek official said.

Coase may yet kick in, but it looks pretty tough to me. Here is a good post on what it means if there is no public lender haircut.

The cultures that is Italy

Responsible for one of the most stupid shipping accidents of all time, not to mention the death of thirty or so passengers, Schettino was nevertheless greeted in his home town of Meta di Sorrento (on the south side of the bay of Naples) by a crowd waving banners in his favor and complaining, priest included, that the man’s bad press was the result of a general prejudice against their community. “Every Italian,” Giacomo Leopardi dryly remarked in 1826 “is more or less equally honored and dishonored.”

Here is more, interesting throughout.

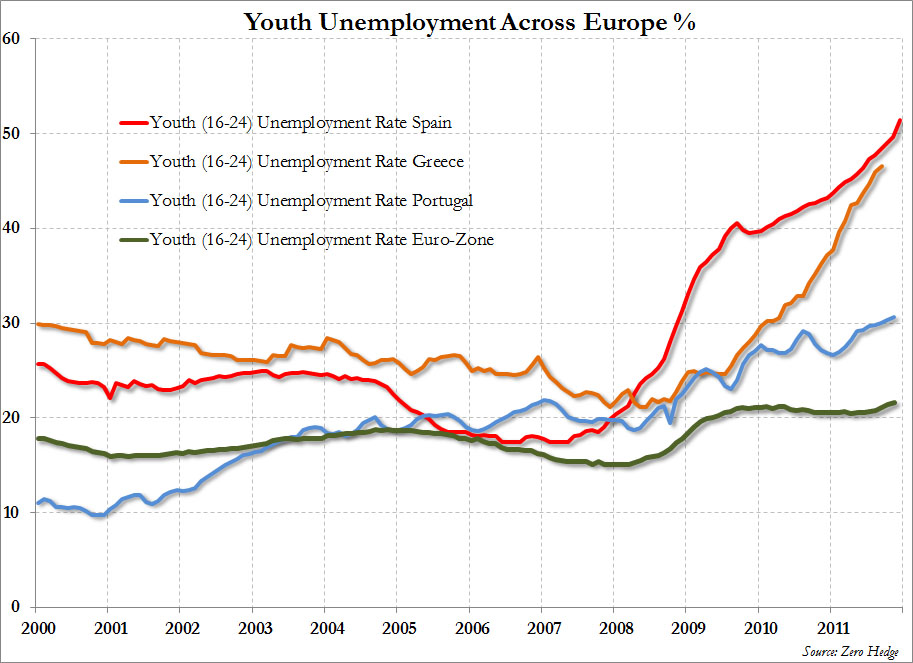

Youth unemployment across Europe

Here is more, hat tip goes to Greg Ip.

Addendum: Do read the excellent comment by Peter Whiteford, for instance:

The unemployment ratio – that is, the number of unemployed people over the population rather than the labor force is arguably a more consistent indicator across countries.

This shows that while in Greece for example, the unemployment rate for youth was around 46% the unemployment ratio was around 10% – nearly half of those in the labour force were unemployed, but only a little over 20% of all the people in the age group were in the labour force.

In Praise of Private Equity

Excellent piece by Reihan Salam on private equity and how Bain fit into the larger picture of a dynamic economy.

The difficult truth that virtually no politician is prepared to acknowledge is that the road to job creation runs through job destruction.

…Chad Syverson, an economist at the University of Chicago’s Booth School of Business, found that what separates top firms from bottom firms is, typically, a large difference in productivity, with the top ones producing almost twice as much with the same measured input. This creates an almost irresistible temptation for investors. If Firm X, languishing at the 10th percentile in terms of productivity, could somehow be overhauled to match the productivity levels achieved by Firm A, at the 90th percentile, the potential for profit would be huge. Note, however, that halving “measured input” in order to double productivity will often mean shedding the weakest performers and giving those who remain the tools they need to do their jobs better and faster. Private equity does exactly this.

What Mitt Romney discovered was that American corporations sometimes had to be dragged, wailing and whining, into a state of efficiency. As a management consultant at Bain & Company, Romney had studied successful firms and then told other firms how to replicate their strategies. But those firms had come of age in the fat years of American corporate dominance, when many believed that the Japanese could do little more than manufacture cheap toys and textiles, and many were reluctant to accept his newfangled advice. It eventually became clear that if Romney and his cohort were going to remake American business, they’d have to raise money to make their own investments. Spurred by the senior partners at Bain & Company, Romney and his merry band of consultants established Bain Capital.

I wish Romney were as eloquent in his defense as is Salam.

Can Greece now leave the eurozone?

Meg Greene writes:

I have long thought that the troika would cut Greece loose and let it default and exit the eurozone once eurozone banks had been sufficiently firewalled. Perhaps this aggressive proposal by Germany is one of the unintended consequences of the ECB’s three year long term refinancing operation (LTRO). If eurozone banks have as much access to cheap, three-year ECB funding as their collateral allows, perhaps Germany and the troika have decided that eurozone banks can survive a Greek default. Greece is clearly insolvent and must leave the eurozone to eventually return to growth. The German proposal may have accelerated the inevitable.

I recall someone on Twitter noting that if Greek leaders turned fiscal sovereignty over to Brussels, the relevant parties would end up hanged for treason, or something like that. I’ll predict against that outcome. Angus adds comment. The general point here is that apparent progress also makes it easier for parts of the Eurozone to unravel. In this context what counts as “good news” or “bad news” can be quite tricky.

Cell phone taxes and the tragedy of the anticommons

Why are cell phone taxes so high? In the United States we tax cell phones more than beer. The usual explanations for high taxes, negative externalities and low elasticity of demand don’t seem to apply to cell phones. Our colleagues Thomas Stratmann and Matt Mitchell offer an answer based in political economy.

…no single politician does choose to tax them that much. Instead, the high taxes that we pay on our cell phones are the sum of lots of little taxes imposed by several different political entities. Consider, for example, the tax bill of a typical New Yorker. It includes a federal USF fee, four state taxes, five city taxes, and a local 9-1-1 fee. Each of these is relatively small, but when you add it all up, the combined rate is over 22 percent.

…The mobile service tax base appears to suffer from a tragedy of the anticommons…numerous overlapping tax authorities seek to obtain revenues through wireless-service taxation, and this may lead to overexploitation of the tax base.

…We use state-level data from three years to examine the possible economic, demographic, and political factors that might explain the variation in these rates. We find that wireless tax rates increase with the number of overlapping tax bases.

Hat tip: Neighborhood Effects.

The pending Greek default

A few of you have asked what I make of the pending Greek default. I would prefer to call it the “Greek resolution,” since I am not sure it matters much whether there is a formal legal default. You hear some “CDS settlements will go crazy” stories but right now they are just that, stories. And there may yet be an agreement for Greece, although no agreement will stop their money supply from shrinking sixteen percent a year (or more). In any case, I see two significant events on the way:

1. Other countries will start asking more vocally why they are not getting some form of the Greek deal. Ireland in particular is picking up all of its bank debt, or what if Monti wants some real debt relief, asked for quietly but firmly under the table? Since he is making serious efforts to deliver on responsible policy reform, and he is quite credible internationally and with investors, this in some ways makes him a more dangerous player in the game. (Such a rebalancing of power in the bargaining game is a neglected aspect of putting in those technocrats.) These scenarios start looking ugly quickly.

2. After Greece the market will likely focus on Portugal. It is one thing to say “Greece is an exception,” much tougher to hold the general Eurozone line with “Greece and Portugal, they are the exceptions.”

It boils down to what kind of focality the Greek resolution will have. Since theories of focality are not very precise or predictable, this is a tough one to call. I’ll stick with my longer-run view that the Eurocrisis can be solved if a) the 17 countries act in a roughly unified way, and b) Italy shows reasonable prospects of growing at about two percent a year or more.

In other words, I’m still a pessimist.

Repugnant

Betting markets in everything

From the Irish:

You can also bet on which cliché Obama will use first in Tuesday’s State of the Union Address…

The long list is here. Favored is “We have more work to do” while “Life is a box of chocolates” comes in at only 250-1.

For the pointer I thank A.

I expect your comments on this post will be awful, try to prove me wrong

Karl Smith asks:

I am specifically going to ask Yglesias, Drum, Cowen, Ozimek and Barro (Josh) to chime in on this. Anyone else feel free as well, but I would like to hear from these guys.

I don’t care if Mitt Romney pays negative taxes, cheated on his mistress with her daughter, fired his Grandmother while at Bain, and lied to kids to get the GOP nomination, etc.

What are the significant differences that you think we could actually see come to pass from a Romney Presidency versus an Obama Presidency?

I am generally a better-the-devil-you-know kind of guy, but I am pretty open here. So, let me here it.

Kevin Drum offers a specific answer. I have not invested much energy in following Romney or the other Republican candidates, so this is a rough, impressionistic response. Here are a few points:

1. I expect Romney to claim he has repealed ACA, but in fact he will change five aspects of the law and cement the rest of it in place, albeit in a less progressive manner and with lower Medicaid expenditures. (Outright repeal actually would not be easy, not to mention filibuster issues.) He knows he doesn’t have any other “right-wing health care plan” in his back pocket, won’t be willing to restore the status quo ex ante, and he will be willing to take the “Tea Party knock on the chin” very early on in his term, hoping to repair the fence later. Ultimately letting the issue fester doesn’t help him, and he is smart enough to realize that.

2. The Republican Party will split very quickly. For instance, will AEI support or oppose Romney in an early action like this? I don’t know, but I see massive carnage. Democrats may end up happier than they expect.

3. Romney will use conservative judge nominations, corporate tax cuts, Dodd-Frank repeal (does anyone understand it anyway?), and estate tax repeal to try to keep the base in line. Democrats may end up less happy than they expect.

4. Medicare won’t be touched, not fundamentally. There is some chance that a “twenty years from now” plan is passed (remember Waxman-Markey?), yet without any secure mechanism for commitment to make the actual cuts.

5. I worry if Obama wins on a platform of envy and anti-rich sentiment; such ideas rarely translate well into policy. If Obama loses, future Democrats will continue the cash goodies they deliver to constituents but fold on a lot of regulatory issues (don’t want to appear “anti-business”), and they will pay greater lip service to Deficit Commission recommendations and the like, while insisting that the governing Republicans take the heat for an actual budget deal. It is a much better outcome if Obama is re-elected from a promise to govern as a moderate and a fiscal conservative. So far I don’t see that as the Democratic strategy, so I am more worried about an Obama re-election than I used to be.

As noted, those are very rough predictions and I don’t have much faith in them, but they are my best guesses.

What else can Karl Smith get me to do?

Toy markets in everything

As another swipe at the West, Iranians will soon be able to buy toy versions of the US spy drone that it captured in December, Iranian media reported.

Models of the bat-wing RQ-170 Sentinel – which Iran’s military displayed on TV after it was downed near the Afghan border – will be mass produced in a variety of colours, reports said.

Here is more, mostly on the cultural war against Barbie dolls in Iran.

Why the European downgrades matter

Perhaps more importantly, and at the risk of repeating myself, the downgrades increase the dependence of the big banks on finance from the European Central Bank – and for the economic recovery of the eurozone, that’s a very bad thing.

The less that banks are able to raise funds in a normal commercial way, the more they’re dependent on a central bank, the more reluctant they are to lend to the wider economy – and given the massive dependence of the eurozone economy on finance provided by banks, that leads to a reduction of economic activity, a reinforcement of recessionary conditions…

..the downgraded Italian and French governments would be seen to be less financially capable of bailing out Italian and French banks in a crisis, so other creditors would be shouldering more risk…

So even if the downgrades don’t lead to default by a nation or a bank, they make it much harder for the banks – and in a way the whole eurozone – to get off life support.

…That creates a damaging negative feedback loop (less lending means asset price falls, more bankruptcies, bigger losses for banks, and even less lending by capital-constrained banks) which makes it all the harder for the eurozone to break free of its cycle of decline.

And, as I said in my earlier note, the downgrades also make it harder for the eurozone to establish a proper circuit breaker – in the form of a giant bailout fund – to protect other sovereign creditors in the event that today’s impasse in Greek debt talks lead to a Greek default.

Here is a useful and only slightly overstated summary of where things stand:

The entire eurozone banking system can be seen to have been nationalised – or at least the funding of banks has been nationalised, even if their ownership hasn’t been transferred to taxpayers.

Addendum: Here are some comments from RBS.

Arab Spring and the stability of monarchy

Victor Menaldo has a new paper:

This paper helps explain the variation in political turmoil observed in the MENA during the Arab Spring. The region’s monarchies have been largely spared of violence while the “republics” have not. A theory about how a monarchy’s political culture solves a ruler’s credible commitment problem explains why this has been the case. Using a panel dataset of the MENA countries (1950-2006), I show that monarchs are less likely than non-monarchs to experience political instability, a result that holds across several measures. They are also more likely to respect the rule of law and property rights, and grow their economies. Through the use of an instrumental variable that proxies for a legacy of tribalism, the time that has elapsed since the Neolithic Revolution weighted by Land Quality, I show that this result runs from monarchy to political stability. The results are also robust to alternative political explanations and country fixed effects.

Here are his other papers.