Category: Economics

Markets in everything, Japan edition (again)

You could devote an entire blog to this category:

Japanese toy company People has released a new age alarm clock

that supposedly helps kids wake up by turning them into Ultraman. It’s

called the Okiro! Asa Ichiban Taiyou Senshi – Charenjaa Kitto (Wake up!

First Sun Warrior of the Morning

– challenger kit) and was manufactured for the Japanese Ministry of

Education “early to bed early to rise” program. The $38 kit comes with

the extravagant eye shield and helmet; a series of talismans and

message cards (no doubt world-saving secret missions); and a 27-day

program that will involve your child taking orders from "the commander."The commander wakes the child up at 6 a.m., and prompts players to put

on the helmet and hit a "roger" button to acknowledge their

wakefulness. Then, they are ordered to count to 10 in five different

languages: English, Japanese, German, Swahili and Malagasy. At that

point, the player is "allowed to take off the equipment and start the

day"…

Here is the full story (with illustrations) and thanks to Yana and Caleb for the pointer. What if you can’t count to ten in Malagasy? What happens to the rest of your day? Keep this link in mind or maybe try How to Get a Date in Malagasy.

China/Syria Fact of the Day

I have been talking with GMU President Alan Merten, who is also in Kunming via Syria. In Syria, Alan was surprised when he was asked to meet with President Bashar al-Assad. Even more surprising, the President wanted to talk about entrepreneurship, GMU, and how Syria can benefit from better economics.

Later, talking with the Finance minister, Merten learned one of the key drivers of this new openness. The Finance minister explained that he was meeting with a counterpart in the Chinese government. "What can we do," the Syrian Finance minister asked, "to increase Chinese investment?" "Well," the Chinese minister replied, "before we invest in Syria you most open your markets, cut your subsidies, and reduce regulation…"

Markets in everything: lives for sale

He says he’s not the first person to put his life on the

block.Australian philosophy student Nicael Holt, 24, offered his

life to the highest bidder last year to protest mass

consumerism.American John Freyer started All My Life For Sale

(www.allmylifeforsale.com) in 2001 and sold everything he owned

on eBay, later visiting the people who bought his things.Adam Burtle, a 20-year-old U.S. university student, offered

his soul for sale on eBay in 2001, with bidding hitting $400

before eBay called it off. Burtle admitted he was a bored geek.

Here is the story. The current seller is Ian Usher, a lovelorn Australian:

From Sunday, June 22 for one week, Usher’s life is up for

sale on eBay with the package including his $420,000

(US$397,000) three-bedroom house in Perth, Western Australia, a

trial for his job at a rug store, his car, motorbike, clothes

and even friends.

Here is a previous MR post on an Australian life for sale.

Is microfinance the new subprime?

Ryan Hahn asks:

In the case of microfinance, however, it seems to me the problem of limited liability is rearing its ugly head. Poor borrowers generally have little or no collateral, so they usually have little reason to avoid a strategic default.

It is a common myth that microfinance loans have no collateral. I sooner worry that the process of collateralization is too thorough. Remember that microfinance loans are made to small groups of five to ten people, typically neighbors. If you don’t pay up, your associate has to. The reality is that the person left holding the bag — who knows you well — will come seize your TV set or in some cases the process is a bit less pleasant. Part of the efficiency of microfinance is simply the separation of the lending and the "thug" functions. Banks can lend to high-risk individual borrowers without themselves resorting to the illegal intimidation practices of the village moneylender. The dynamics of cooperative behavior in the village are not always pretty but overall it works better than the moneylender; if nothing else the person seizing the collateral knows that next time around he or she may be the non-payer. For more detail, see my Wilson Quarterly article with Karol Boudreaux.

High commodity prices

Guillermo Calvo writes:

Incentives to stockpile commodities stem from the combination of low

central bank interest rates (especially in the US) and the growth in

sovereign wealth funds. The latter, in my view, is the crucial factor.

Sovereign wealth funds have been created partly with the intent of

switching the composition of government wealth from highly liquid but

low-return assets to more risky but much more profitable investment

projects. Thus, their attempt to get rid of excess liquidity resembles

the econ 101 exercise in which the student is asked to trace the

effects of a portfolio switch away from money and into capital. The answer is – of course – higher prices.

The piece is interesting throughout, hat tip to Mark Thoma.

Pay For It: Radical Water Privatization for Poor Countries

Here is my piece for Forbes.com on the privatization of residential water supply in the Third World. Excerpt:

And no, I don’t mean a water

concession with a price regulated by the government, I mean true

laissez faire in water supply. No price regulation, no rate of return

regulation, no government ownership of assets, no political pressure to

keep prices low. Water companies should be allowed to maximize their

profits, and because supplying water is nearly always a monopoly, they

should be allowed to make monopoly profits. I know the idea sounds

crazy–to an economist, water supply is a classic "natural"

monopoly–but on closer inspection the other alternatives might be

worse.

And more:

If complete deregulation

is too radical for you, consider the interesting compromise proposed by

the economist Jeffrey Sachs, currently heading the Earth Institute at Columbia University.

He suggests that the private company be allowed to charge high prices,

but only under the condition that it allocates a minimum amount of

water for everyone, either for free or at a much lower price. Basic

water needs would be met, and the company still might make a profit.That said, I’m less worried about high prices than Sachs. Let’s say

the new water prices were so high as to capture all the benefits that

buyers would receive from the new supply of water. We can expect much

lower rates of diarrhea and other diseases, if only because the water

supplier can charge more for cleaner and safer water. The resulting

decline in disease means that children will die less frequently and

adults will be healthier and more energetic. Those long-term social

benefits are of enormous help to poor communities, even if high prices

take away many of the initial, upfront benefits of the new water

supply. In other words, we should consider radical privatization

precisely because water is a public good and because clean water is so

important for long-run economic growth.

Read the whole thing.

More Sex is Safer Sex

In More Sex is Safer Sex Steven Landsburg famously argued (based on work by Michael Kremer) that if more people, especially more sexually conservative people, had sex the AIDS epidemic could be reduced. Landsburg wrote:

Imagine a country where almost all women are monogamous, while all men

demand two female partners per year. Under those circumstances, a few

prostitutes end up servicing all the men. Before long, the prostitutes

are infected; they pass the disease on to the men; the men bring it

home to their monogamous wives. But if each of those monogamous wives

were willing to take on one extramarital partner, the market for

prostitution would die out, and the virus, unable to spread fast enough

to maintain itself, might well die out along with it.

In The Wisdom of Whores (see also my earlier post) Elizabeth Pisani says that such a country exists, it’s Thailand, and the results of more sex was safer sex – exactly as Landsburg argued. Here’s Pisani’s story:

Thailand used to fit the the classic ‘virtuous girls, philandering boys’ model. At the start of the 1990s, 57 percent of twenty-one-year-old men in Northern Thailand trooped off to the brothel to do their philandering. More than half the sex workers who soaked up their excess energy were HIV-infected….

Then…the Thai economy boomed. Girls were getting better educations than ever before…Educated girls were waiting longer before getting married, but not before having sex. By the end of the 1990s, 45 percent of girls aged 15-21 in northern Thailand admitted to having sex with boyfriends before marriage, compared to less than a tenth of that in a nationwide survey in 1993.

…So at the end of the decade, we have a lot more premarital sex and not all that much condom use with girlfriends. But now that these young, cash-strapped guys can have sex without paying, they’ve stopped handing over cash for sex. By the end of the 1990s, only 7 percent of young men were paying for sex, and HIV prevalence in sex workers had come down too.

….In short, more women having premarital sex equals less HIV.

Pisani cites neither Landsburg nor Kremer so I believe her account is independent. Note that Pisani also credits Thailand’s successful condom program.

Fly to Japan and ease your environmental conscience

Remember the question about the environmental impact of flying? Air Genius Gary Leff puts it nicely:

If you’re pulling inventory out of a low fare bucket, the strong

expectation is that there’s little effect at the margin on your buying

the ticket because the airline expects to operate a flight that doesn’t

come close to filling up.If you’re pulling inventory out of a high fare bucket, for coach

fares at the extreme end if you’re traveling on a Y fare, you can

pretty much expect that the flight will be close to sold out and that

the airline is willing to risk displacing another passenger in the

short term in exchange for your higher fare… or at least that the

ticket cost is high enough to potentially influence behavior on the

part of the airline…Reality is even a little bit more complicated than that. Cargo has

to come into play, too. Regardless of what you pay and what fare class

you’re booking in, your travel on United between San Francisco and

Nagoya, Japan is going to have almost no effect whatsoever on United’s

decision-making. They’ve got a very large contract with Toyota and they

fill up their 747 with cargo and the flight goes out with very low load

factors yet is still profitable for them to operate.

Getting a frequent flyer seat also means that your environmental impact is likely very small. I am pleased, of course, that I often have Gary booking my seats for me, all in the interests of a cleaner Earth. The bottom line is that if you get a good deal on price, you should feel doubly good about it.

The Price of Everything

Here is Ezra Pound’s Usura Canto, here is a link to Russell Roberts’s The Price of Everything: A Parable of Possibility and Prosperity, available for pre-order. Can you guess which one has the better economics? In fact Russ’s book is the best attempt to teach economics through fiction that the world has seen to date.

Here is Russ’s summary of the book. Here is Arnold Kling on the book.

Who is the happiest-looking economist?

A group of researchers showed photographs, taken from economists’ home pages, to the public and the winner was Edmund Phelps; here is the paper. Will Wilkinson, source of the tip, summarizes further (with photos) and offers this quotation:

…advice for young academics is: if you seek happiness, become a macro-economist and research happiness; a Nobel Prize does not make you happier; if you want to be popular with the ladies, take lessons from Edmund Phelps, Bruno Frey and Richard Easterlin; if you are looking for the ability to age like a red wine, Joseph Stiglitz and Jean Tirole have the trick, but not Richard Easterlin.

I thought that Milton Friedman usually looked very happy though he was not included in the poll.

The environmental cost of flying

Minderbender, a loyal MM reader, asks:

How should we think about the environmental costs of commercial flying?

It seems as though the average cost is high, but the marginal cost is

quite low. When I fly across the country, it doesn’t cause any extra

flights, it just makes the one I’m on slightly heavier. Yes, the

increased revenues might give the airline an incentive to increase the

number of flights, but this effect seems very weak – much lower than

the average cost of my flight (the consumption of fuel divided by the

number of passengers). Maybe I’m just miscalculating?

I think about this every time I fly. A simple model of route expansion is that higher demand increases the number of total flights by some probability. For the system as a whole, the decisive flying unit has to come somewhere and there is no reason why, on average, it can’t be you. In other words, at least in stochastic terms you can’t escape the blame.

A second simple model of route expansion is that gates and other airport facilities are scarce and underpriced relative to demand. When demand goes up, supply is not very elastic and mostly they raise price rather than increasing output. Those who feel very guilty should prefer this second model.

The more they cut back on flights, as they have been doing, the more likely the first model is true. The second model is most likely true if you are flying into regulated foreign markets although I believe the Europeans are now opening up for U.S. carriers.

You might ask comparable questions about eating meat and killing cows. If you’re worried about your net impact, eat animals from countries with very privileged, monopolized and highly regulated, supply-inelastic livestock sectors.

Best economics paper of 1958

Leonardo Monasterio asks:

Which paper/book should we celebrate its 50th year? Obviously, my vote goes to the paper that started the cliometric revolution:

The Economics of Slavery in the Ante Bellum South

Alfred H. Conrad, John R. Meyer

The Journal of Political Economy, Vol. 66, No. 2 (Apr., 1958), pp. 95-130

Is there any other contestant?

The two obvious competitors are Modigliani and Miller on financial irrelevance (AER) and Paul Samuelson on the overlapping generations model (JPE). I’m inclined to put M-M first and Conrad and Meyer second. Am I missing anything? Don’t one or two of Schelling’s famous game theory articles date from this year as well?

Postwar American economics was splendid. WWII meant that many thinkers (Friedman, Samuelson, Schelling, others) had real world experience with tackling big problems. At the same time these people were just getting their hands on quantitative thinking and some more technical tools, yet the profession still valued breadth to some degree.

As goes New Zealand, so goes the world?

The land of the long white cloud has enjoyed a 10-year economic boom

driven by exports of milk, butter and cheese, a population riding a

housing market boom and tourists eager to sample the landscapes

depicted in Hollywood films such as The Lord of the Rings.But

New Zealand is on the cusp of a downturn and risks seizing the dubious

honour from the US of becoming the world’s first developed nation to

sink into recession, as measured by two consecutive quarters of

negative gross domestic product growth.GDP numbers for the January-March quarter due this month are forecast

to show a contraction of at least 0.3 per cent. TD Securities and other

economic forecasters are predicting a 0.2 per cent decline for the

April-June quarter.

Here is more information. Elsewhere in the Commonwealth, one UK supplier is now charging $14-15 a gallon ($18 for a UK gallon) for gas, he wants to make sure his customers can always get the product.

Krugman gets a Rotten Tomato

Paul Krugman is attacking Milton Friedman (again) for rotten tomatoes. Here’s Krugman in 2007:

These are anxious days at the lunch table. For all you know, there

may be E. coli on your spinach, salmonella in your peanut butter and

melamine in your pet’s food and, because it was in the feed, in your

chicken sandwich.Who’s responsible for the new fear of eating?

Some blame globalization; some blame food-producing corporations; some

blame the Bush administration. But I blame Milton Friedman.…Without question, America’s food safety system has degenerated over the past six years.

and here he is today repeating himself:

Lately, however, there always

seems to be at least one food-safety crisis in the headlines – tainted

spinach, poisonous peanut butter and, currently, the attack of the

killer tomatoes.How did America find itself back in The Jungle?

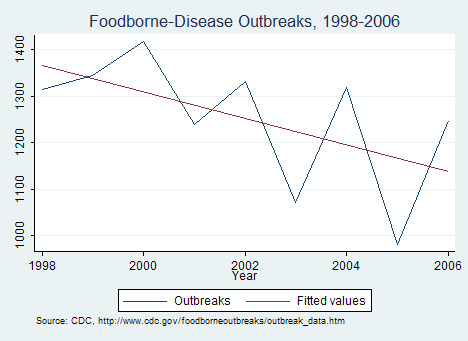

I was curious so I collected data from the Center for Disease Control on Foodborne Disease Outbreaks from 1998-2006. The data only go back to 1998 because in that year the CDC changed its surveillance system creating a discontinuity but note that we are covering a chunk of the Clinton years and are well within the time frame over which Krugman says the safety system has degenerated. Here’s the result:

What we see is a lot of variability from year to year but a net downward trend. You can also look at cases per year which are more variable but also show a net downward trend. No evidence whatsoever that we are back "in The Jungle."

Becker, Spence, Phelps, and Scholes

On the global economy and the recent downturn. The pointer is to www.bookforum.com.