Category: Medicine

Competition Compounded

ArsTechnica: Turing Pharmaceuticals, the company that last month raised the price of the decades-old drug Daraprim from $13.50 a pill to $750, now has a competitor.

Imprimis Pharmaceuticals, Inc., a specialty pharmaceutical company based in San Diego, announced today that it has made an alternative to Daraprim that costs about a buck a pill—or $99 for a 100-pill supply.

Good news. Competition is working. But I was puzzled. In Generic Drug Regulation and Pharmaceutical Price-Jacking, I argued that competition was slow because the FDA makes it expensive and time consuming to get a generic drug approved for sale in the United States. Was I wrong about the difficulty of generic entry? No.

The drug that Imprimis Pharmaceuticals is selling is not FDA-approved. A bit of background is in order. Even today some drugs need to be tailor-made. A patient, for example, might not be able to swallow a pill so a licensed pharmacist may create for a specific, individual patient a small batch of the drug in liquid form. A pharmacy that does this kind of work is called a compounding pharmacy.

Compounding pharmacies have a long and tendentious history with the FDA. The FDA has always claimed that a new drug is a new drug, even one created only for a specific individual. Thus, the FDA has always said that it has the right to regulate compounding pharmacies just like manufacturers of new drugs. In practice, however, the FDA allowed the industry to proceed with little regulation.

In the 1990s some compounding pharmacies began to create large batches, especially of drugs in short supply, as a way of avoiding the FDA process. The FDA worried about quality control, however, and it re-evaluated its traditional hands off approach. A political battle then ensued in which Congress and the Supreme Court also had their say. In 2012, fungal meningitis outbreaks caused by poor quality control at the New England Compounding Center brought these issue to public attention and resulted in greater regulation of compounding pharmacies, albeit with clearer regulations on when a compounding pharmacy may sell large quantities.

Imprimis Pharmaceuticals did not apply for approval to sell a generic version of Daraprim. As I argued earlier, that would take years and cost millions of dollars. Instead, it is doing an old-style end-run of the FDA process by offering its alternative under the compounding pharmacy laws. That means that it can only sell to order, on a patient by patient, prescription by prescription basis. Since Daraprim is not widely used this may work. Indeed, I hope this end run works but my reading of the act is that compounders can only supply drugs in large quantities if they are on the FDA’s shortage list. Perhaps the FDA will look the other way, however, in order to send Turing and similar firms a message.

Division of labor markets in everything is science broken after all?

There is a growing industry where publication consultants will work with authors, research groups or even institutions to help get their work published, or help submit their dissertation/thesis. This help can range from proof reading, data collection, analysis (including statistics), helping with the literature review and identifying suitable journals/conferences.

That is from a new PubMed paper, via Neuroskeptic.

Personalized Medicine and the FDA

In my post A New FDA for the Age of Personalized, Molecular Medicine I wrote:

Each patient is a unique, dynamic system and at the molecular level diseases are heterogeneous even when symptoms are not. In just the last few years we have expanded breast cancer into first four and now ten different types of cancer and the subdivision is likely to continue as knowledge expands. Match heterogeneous patients against heterogeneous diseases and the result is a high dimension system that cannot be well navigated with expensive, randomized controlled trials. As a result, the FDA ends up throwing out many drugs that could do good.

The Manhattan Institute has today taken out a full-page ad in the New York Times calling for a discussion about how to integrate personalized medicine with the FDA. The ad reads in part:

A new era in science and medicine calls for a new approach at the federal Food and Drug Administration, which determines whether any new treatment is safe and effective.

Every American has a stake in this change – because everyone will be a patient someday.

Congress should lay the foundation for a 21st century FDA by creating an external advisory network drawing on the expertise of the scientific and patient communities to assist the FDA in setting standards for how biomarkers can be better integrated into the drug development process.

This is a call for collaboration on an unprecedented scale to help the FDA chart a safe path for advancing biomarkers from discovery in a lab to your doctor’s office. We echo previous recommendations made by the President’s Council of Advisors on Science and Technology, the National Institutes of Health, a report from the National Research Council – and senior staff at the FDA itself.

The ad is signed by former FDA commissioner Andrew von Eschenbach, Peter Huber, (whose excellent book The Cure in the Code lays out the science and policy of biomarkers), Eric Topol, and myself among others.

See Project FDA for more.

*The Invention of Science*

That is the new, magisterial and explicitly Whiggish book by David Wootton, with the subtitle A New History of Scientific Revolution.

I wish there were a single word for the designator “deep, clear, and quite well written, though it will not snag the attention of the casual reader of popular science books because it requires knowledge of the extant literature on the history of science.” Here is one excerpt, less specific than most of the book:

My argument so far is that the seventeenth-century mathematization of the world was long in preparation. Perspective painting, ballistics and fortification, cartography and navigation prepared the ground for Galileo, Descartes and Newton. The new metaphysics of the seventeenth century, which treated space as abstract and infinite, and location and movement as relative, was grounded in the new mathematical sciences of the fifteenth and sixteenth centuries, and if we want to trace the beginnings of the Scientific Revolution we will need to go back to the fourteenth and fifteenth centuries, to double-entry bookkeeping, to Alberti and Regiomontanus. The Scientific Revolution was, first and foremost, a revolt by the mathematicians against the authority of the philosophers.

769 pp., recommended — for some of you.

I had to order my copy from UK, in the US it comes out in December and can be pre-ordered.

The self-tracking pill

Some morning in the future, you take a pill — maybe something for depression or cholesterol. You take it every morning.

Buried inside the pill is a sand-sized grain, one millimeter square and a third of a millimeter thick, made from copper, magnesium, and silicon. When the pill reaches your stomach, your stomach acids form a circuit with the copper and magnesium, powering up a microchip. Soon, the entire contraption will dissolve, but in the five minutes before that happens, the chip taps out a steady rhythm of electrical pulses, barely audible over the body’s background hum.

The signal travels as far as a patch stuck to your skin near the navel, which verifies the signal, then transmits it wirelessly to your smartphone, which passes it along to your doctor. There’s now a verifiable record that the pill reached your stomach.

This is the vision of Proteus, a new drug-device accepted for review by the Food and Drug Administration last month. The company says it’s the first in a new generation of smart drugs, a new source of data for patients and doctors alike. But bioethicists worry that the same data could be used to control patients, infringing on the intensely personal right to refuse medication and giving insurers new power over patients’ lives. As the device moves closer to market, it raises a serious question: Is tracking medicine worth the risk?

That is from Russell Brandom.

Economist Heidi Williams has won a MacArthur fellowship

The award announcement includes a description of her work (with further links), basically she does health care economics at MIT. In particular she considers when IP restrictions might hinder rather than support further innovation. Here is her home page, she also has interesting papers on prizes. Here is her research statement (pdf), interesting throughout, a very good selection from the committee.

Elsewhere, Matthew Desmond works on eviction as a cause and not just a symptom of poverty.

*Mate*, by Tucker Max and Geoffrey Miller

I’ve found Geoffrey Miller’s earlier books quite interesting, even if I didn’t always agree with them. A few years ago, however, he had a um…Twitter mishap…and since then I’ve been wondering what would emerge from that process.

His new book is…different. Think of it as a guide to dating and mating for males, but unlike the pick-up artists he (with Max) focuses on the separating rather than the pooling equilibrium. That is, he advises men to actually be better men, and not just to send clever signals, and so the subtitle is Become the Man Women Want. Hard to argue with that, right?

The advice covers such recommendations as “Focus on the women who seem interested in you.” (p.257) and “Hang out with Intelligent People” (p.127), among other maxims. Didn’t Nietzsche come up with a few of those? Or was it Norman Vincent Peale?

Be aware that “She’s been dealing with creepy douchebags for a long time”; that’s a subheader (p.35).

Is it true that “Most guys have sexually repulsive feet, and women notice.”? (p.206) MR readers are not always the ones to ask.

At first I thought I’ve never seen a market product so cleverly designed to segregate the actual buyers from those who will find it of value, but it has lots of five-star reviews on Amazon. Sadly enough, maybe America really needs this book.

Addendum: Here is Robin Hanson’s review.

Generic Drug Regulation and Pharmaceutical Price-Jacking

The drug Daraprim was increased in price from $13.60 to $750 creating social outrage. I’ve been busy but a few points are worth mentioning. The drug is not under patent so this isn’t a case of IP protectionism. The story as I read it is that Martin Shkreli, the controversial CEO of Turing pharmaceuticals, noticed that there was only one producer of Daraprim in the United States and, knowing that it’s costly to obtain even an abbreviated FDA approval to sell a generic drug, saw that he could greatly increase the price.

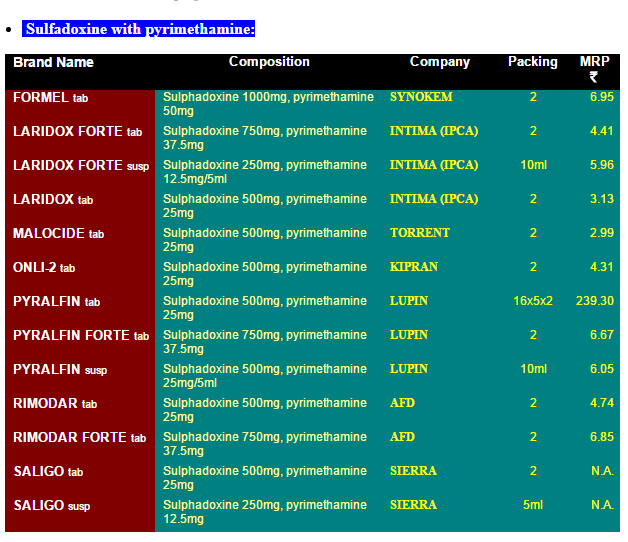

It’s easy to see that this issue is almost entirely about the difficulty of obtaining generic drug approval in the United States because there are many suppliers in India and prices are incredibly cheap. The prices in this list are in India rupees. 7 rupees is about 10 cents so the list is telling us that a single pill costs about 5 cents in India compared to $750 in the United States!

It is true that there are real issues with the quality of Indian generics. But Pyrimethamine is also widely available in Europe. I’ve long argued for reciprocity, if a drug is approved in Europe it ought to be approved here. In this case, the logic is absurdly strong. The drug is already approved here! All that we would be doing is allowing import of any generic approved as such in Europe to be sold in the United States.

Note that this is not a case of reimportation of a patented pharmaceutical for which there are real questions about the effect on innovation.

Allowing importation of any generic approved for sale in Europe would also solve the issue of so-called closed distribution.

There is no reason why the United States cannot have as vigorous a market in generic pharmaceuticals as does India.

Hat tip: Gordon Hanson.

Are pharmaceutical drug prices too high?

Hillary Clinton has proposed a new plan to bring down prescription drug prices, but so far the reception is cool. Here is one comment:

But when I ran it by some health economists and other health policy experts, several strongly disliked the idea because it misunderstands the diversity of companies in the pharmaceutical industry. They say it would create perverse incentives that could raise instead of lower the costs of developing new drugs.

“This is an astonishingly naïve approach,” said Amitabh Chandra, a professor of public policy at Harvard University, in an email. He argues that the plan could encourage wasteful research spending without necessarily doing much about the prices charged for medications.

That is from Margot Sanger-Katz at the NYT, not the Heritage Foundation.

I would stress a different point, and this concerns pharmaceutical prices more generally, not just the Clinton plan. Higher prices induce more innovation, and those innovations benefit patients in many countries. Note that connection is true even if you think most innovations come from universities or the NIH rather than being hatched Big Pharma. There is still a pot at the end of the rainbow for the significant innovators in this process.

OK, so how much does innovation go down if prices go down?

Here is an earlier post by Alex on Frank Lichtenberg’s estimation: “Thus, price controls or other restrictions that reduce prices are almost certainly a bad idea.”

Here is another earlier post by Alex, citing Megan, noting that Apple spends three cents of every dollar on R&D, and other inconvenient facts and that was from 2009.

If the advocate of lower drug prices does not have clear quantitative evidence for a conclusion of “lowering drug prices will not harm innovation very much,” commit the analysis to the flames, for it harbors nothing but sophistry and illusion. And while agnosticism about elasticities might weaken the argument for keeping prices high, that’s not an argument for lowering prices, that is an argument for agnosticism.

This same point applies to most commentaries on TPP I might add, and intellectual property analysis. Write it on the bathroom wall: “Without an elasticity, there is no answer.” And scream it from the rooftops while you are at it.

China question of the day

Visits to medical institutions, hospital visits, and primary medical facilities are growing at 2.98%, 5.40%, and 1.56% respectively.

That is from Christopher Balding, read the whole post. And that is for an aging population and in a setting where the demand for health care is for structural reasons growing rapidly. Furthermore the use of traditional Chinese medicine is declining rapidly, fifteen percent this year from Balding’s citation.

Now let’s say the Chinese economy is about fifty percent services, though the exact number can be debated. And we know that manufacturing PMI is down seven months in a row.

What is your estimate of the overall rate of economic growth in China? The overall rate of growth six months or a year from now?

In the middle of this post you will find Scott Sumner on China’s growth.

Here is Krugman’s excellent post on how large China spillovers will be. I say watch for who is exposed to the sudden weekend ten to fifteen percent devaluation. Lots of other EM currencies have gone down by about that amount, why should China be so different or immune? The Chinese government isn’t going to spend trillions of dollars on fighting a losing battle in the currency wars, they are simply waiting for the right time for this to happen. Don’t be caught off-guard.

The incidence of the ACA mandates

Here is Mark Pauly, with Adam Leive and Scott Harrington (NBER), this is part of the abstract:

We find that the average financial burden will increase for all income levels once insured. Subsidy-eligible persons with incomes below 250 percent of the poverty threshold likely experience welfare improvements that offset the higher financial burden, depending on assumptions about risk aversion and the value of additional consumption of medical care. However, even under the most optimistic assumptions, close to half of the formerly uninsured (especially those with higher incomes) experience both higher financial burden and lower estimated welfare; indicating a positive “price of responsibility” for complying with the individual mandate. The percentage of the sample with estimated welfare increases is close to matching observed take-up rates by the previously uninsured in the exchanges.

I’ve read so many blog posts taking victory laps on Obamacare, but surely something is wrong when our most scientific study of the question rather effortlessly coughs up phrases such as “but most uninsured will lose” and also “Average welfare for the uninsured population would be estimated to decline after the ACA if all members of that population obtained coverage.” The simple point is that people still have to pay some part of the cost for this health insurance and a) they were getting some health care to begin with, and b) the value of the policy to them is often worth less than its subsidized price.

You will note that unlike say the calculation of the multiplier in macroeconomics, the exercises in this paper are relatively straightforward. They also show that people exhibit a fairly high degree of economic rationality when it comes to who signs up and who does not.

It has become clearer what has happened: members of various upper classes have achieved some notion of “universal [near universal] coverage,” while insulating their own medical care from most of the costs of this advance. Those costs largely have been placed on the welfare of…the other members of the previously uninsured. So we’ve moved from being a country which doesn’t care so much about its uninsured to being…a country which doesn’t care so much about its (previously) uninsured. I guess countries just don’t change that rapidly, do they?

I fully understand that Obamacare has survived the ravages of the Republican Party, and it was barely attacked in the recent series of debates, and thus it is permanently ensconced, and that no better politically feasible alternative has been proposed. At this point, the best thing to do is to improve it from within. Still, there are good reasons why it will never be so incredibly popular.

Data on deductibles

Kaiser, a health policy research group that conducts a yearly survey of employer health benefits, calculates that deductibles have risen more than six times faster than workers’ earnings since 2010.

I would stress two points. First, the value of benefits is in some regards eroding, so those who wish to cite benefits as an answer to wage stagnation will encounter some push back from reality.

Second, I don’t see this factor cited often as a possible contributing force to the moderation of health care cost inflation in recent years. But perhaps it plays some role.

The NYT Reed Abelson article is here.

There is no great dental stagnation

Digital pedometers and Swiss health insurance, a match made in heaven

Swiss health insurers could demand higher premiums from customers who live sedentary lifestyles under plans to monitor people’s health through wearable digital fitness devices.

CSS, one of Switzerland’s biggest health insurers, said on Saturday it had received a “very positive” response so far to its pilot project, launched in July, which is monitoring its customers’ daily movements.

The MyStep project, developed in conjunction with the University of St Gallen and the Federal Institute of Technology (ETH) Zurich, is using digital pedometers to track the number of steps taken by 2,000 volunteers until the end of the year, synchronizing that data with an online portal on the CSS website.

But don’t worry, that is just the pilot program:

Fitness wristbands such as Fitbit are just the beginning of a revolution in healthcare, believes Ohnemus.

“Eventually we will be implanted with a nano-chip which will constantly monitor us and transmit the data to a control centre,” he said.

Obesity in Switzerland now costs the health service eight billion francs a year, according to figures from the Federal Office of Public Health, rising from 2.7 billion in 2002.

There is more here, and for the pointer I thank Axacatl Maqueda.

Japan Liberalizes Regenerative Medicine

Japan is liberalizing its approval process for regenerative medicine:

…Regenerative medicines in Japan can now get conditional marketing approval based on results from mid-stage, or Phase II, human trials that demonstrate safety and probable efficacy. Once lagging behind the United States and the European Union on approval times, there is now an approximately three-year trajectory for approvals, according to Frost’s Kumar. That compares with seven to 10 years before.

…Around the world, companies have also faced setbacks while pushing such treatments. In the U.S., Geron Corp., which started the first nation-approved trial of human embryonic stem cells, ended the program in 2011, citing research costs and regulatory complexities.

…While scientists globally have worked for years in this field, treatments have been slow to come to market. But there is hope in Japan that without the political red tape, promising therapies will emerge faster and there will be speedier rewards.

Japan is liberalizing because with their aging population treatments for diseases like Alzheimer’s and Parkinson’s disease are in high demand. Under the new system, a firm with a gene or regenerative therapy (e.g. stem cells) can get conditional approval with a small trial. Conditional approval means that the firm will be able to sell its procedure while continuing to gather data on efficacy for a period of up to seven years. At the end of the seven year period, the firm must either apply for final marketing approval or withdraw the product. The system is thus similar to what Bart Madden proposed for pharmaceuticals in Free to Choose Medicine.

Due to its size and lack of price controls, the US pharmaceutical market is the most lucrative pharmaceutical market in the world. Unfortunately, this also means that the US FDA has an outsize influence on total world investment. The Japanese market is large enough, however, that a liberalized approval process if combined with a liberalized payment model could increase total world R&D.

Breakthroughs made in Japan will be available for the entire world so we should all applaud this important liberalization.

Hat tip: Michael Mandel.