Results for “south africa” 264 found

Economic development in an “Average is Over” world

Here is my new paper on that topic (pdf, new link here), commissioned by the Asian Development Bank (but not yet approved or refereed by them). The key question is what kind of development path will follow, given the realities of premature deindustrialization in emerging economies today. Here is one bit from the paper:

…trickle-down growth from price discrimination and the erosion of intellectual property rents becomes more important as a source of economic improvement. I call this mechanism “cell phones instead of automobile factories.” Many economic ideas are subject to non-rivalrous use, as they can be deployed by many people once they exist. That phenomenon may sound separate from the substitution of capital for labor outlined above, but that is part of the same broader process. If the wealthier nations use smart software to displace imports from the developing world, poorer nations will benefit from the software in other ways, including a trickle-down of goods and services.

The cell phone (and by extension the smart phone) is a paradigmatic example of trickle-down consumption. The technologies behind the cell phone were invented across a variety of nations, none of them poor (although China contributed to the finishing process), and yet cell phones are extremely prominent in poor and lesser developed nations. Internationally, cell phones and smart phones have brought significant benefits and often at relatively low cost. In the poorer parts of Asia, cell and smart phones are available for much lower prices than in the West. Part of that is the result of price discrimination, such as when Samsung sets deliberately lower prices for most of Africa and the poorer parts of Asia. In other cases the poorer countries buy a somewhat lower quality product, but one still effective for many of their needs. The Blackberry was not long ago state of the art in the United States, but now it sells primarily in poorer countries, including Indonesia, Vietnam, and South Asia, in addition to parts of Africa, and of course it sells to these regions at lower prices.

And this:

Or in other words, rather than Indonesia or Cambodia exporting manufactures to buy imported goods, an alternative development path is that some of those imports trickle down and enter poorer countries at especially low prices. Poorer economies can’t get constant cost goods and services for any cheaper than they are available in wealthier countries and in fact they may have to pay more because of shipping costs, poor institutions, and less efficient retail systems. If the wealthy nations produce more cement, the trickle down benefits from that activity may be slight. But for declining cost commodities, it is a different story entirely.

The more the economies of the wealthy countries are focused on increasing returns to scale sectors, the more important this version of trickle-down growth will become. And for the last few decades, many of the most important innovations in the wealthy countries have been shifting into increasing returns to scale sectors, most notably in the tech world. The tech world is geographically clustered, and centered in Silicon Valley, which are both classic signs of an increasing returns to scale sector. Some of the outputs are given away for free (Google, Facebook), and others show high degrees of market concentration, with a single dominant supplier providing a network good (eBay, Facebook, Instagram, Twitter). When it comes to the hardware behind the tech sector, there is an emphasis on new models, upgrades, and differential pricing plans, again all signs of increasing returns to scale.

In the limiting case, if everything in the economy looks and acts like the tech sector, this source of growth could be quite significant indeed. In other words, a world where “software eats the world,” to borrow Marc Andreessen’s phrase, is a world where the developing nations end up doing pretty well, even if the traditional export-oriented path to convergence has gone away.

Most forms of economic growth are fundamentally imbalanced (Hirschman 1958), but in this “cell phones scenario” we see a new form of imbalance. The new imbalance would be based on increasing returns to scale goods, which would trickle down to poorer countries, vs. constant and increasing cost goods, which would not trickle down. Developing nations thus would be very well supplied with (cheaper versions of) increasing returns to scale goods, but have relatively stagnant supplies of constant and decreasing returns to scale goods.

Comments of course are welcome. The paper also includes some brief discussions of how the main arguments might apply to China, India, the Philippines, and Central Asia, in line with its ADB origins.

The internationalization of Italy?

Two days ago I reported on how Italian food was the big winner from culinary globalization. How are things going in Italy itself?:

Annual spending by Italian families on restaurants and cafes shrank nearly 2% between 2007 and 2014, Eurostat’s latest data show, while consumption of ethnic foods such as Chinese or North African has nearly doubled during that period.

The Masuellis—with a back-of-the-envelope way of running their business—can’t get bank loans to modernize their restaurant. They had to sell a property to fund the restaurant in 2011 and 2012, and have also reached into their own pockets to pay salaries and taxes at times.

Mr. Masuelli considered firing some of his five employees, but the rigid labor laws meant the cost of dismissing them was too high. At the same time, new health and safety regulations have eaten into profit.

More broadly there is this:

Officer Pang is a top supervisor in one of China’s biggest police departments, in the southern metropolis of Guangzhou. But for two weeks, he and three other Chinese police officers are in Italy with strict orders: to protect Chinese tourists.

Of course it is only four officers, but isn’t that what they said at first about RoboCop? I also enjoyed this paragraph:

“It’s our duty to make Chinese fall in love with Rome and Italy,” said Alessandro Zucconi, the president of the Young Hoteliers Federation in Rome, who agreed that “misunderstandings” sometimes occur between the two cultures. “They are not like the Germans, who mostly come knowing our culture and literature better than we do.”

Developing…

The political legacy of American slavery

Forthcoming, Journal of Politics, from Avidit Acharya, Matthew Blackwell, and Maya Sen:

We show that contemporary differences in political attitudes across counties in the American South in part trace their origins to slavery’s prevalence more than 150 years ago. Whites who currently live in Southern counties that had high shares of slaves in 1860 are more likely to identify as a Republican, oppose affirmative action, and express racial resentment and colder feelings toward blacks. These results cannot be explained by existing theories, including the theory of contemporary racial threat. To explain these results, we offer evidence for a new theory involving the historical persistence of political and racial attitudes. Following the Civil War, Southern whites faced political and economic incentives to reinforce existing racist norms and institutions to maintain control over the newly free African-American population. This amplified local differences in racially conservative political attitudes, which in turn have been passed down locally across generations. Our results challenge the interpretation of a vast literature on racial attitudes in the American South.

The past still matters…

*The American Slave Coast*

I very much liked this lengthy but highly readable book by Ned and Constance Sublette, subtitled A History of the Slave-Breeding Industry, and that subtitle does indeed reflect the emphasis. Here are a few of the things I learned from it:

1. Barbados took in more African slaves than did the entire United States; Alex had a related post on the size of American importation.

2. President James Polk speculated in slaves, based on inside information he obtained from being President and shaping policy toward slaves and slave importation.

3. In the South there were slave “breeding farms,” where the number of women and children far outnumbered the number of men.

4. The price of a slave peaked in his or her late teens. There was another price spike upwards at about age eight, when child mortality declined.

5. Much of the University of Virginia was built by slaves; is anyone calling for those buildings to be torn down?

6. Quite possibly the sugar plantations model, including for slave deployment, stems from São Tomé, starting in the late 15th century.

7. George Mason wanted to cut off the African slave trade into Virginia, although the authors suggest many people supported this view because they wished to increase the value of the stock of slaves already in the state. I could not tell whether this was Mason’s motive or not.

8. The Anglo-American settlers of Louisiana were primarily from Kentucky.

9. In the time of slavery, the South was generally considered to be less anti-Semitic toward Jews than the North.

Recommended, here is the Amazon link. And here is Jason Kottke on the book. And here is a good Malcolm Harris review.

W.E.B. Du Bois on Woodrow Wilson

It is worth reading what one of the African-American civil rights leaders, and a brilliant man, thought of Woodrow Wilson at the time of his candidacy:

As to Mr. Wilson, there are, one must confess, disquieting facts; he was born in Virginia, and he was long president of a college which did not admit Negro students…On the whole, we do not believe that Woodrow Wilson admires Negroes…Notwithstanding such possible preferences, Woodrow Wilson is a cultivated scholar and he has brains…We have, therefore, a conviction that Mr. Wilson will treat black men and their interests with farsighted fairness. He will not be our friend, but he will not belong to the gang of which Tillman, Vardaman, Hoke Smith and Blease are the brilliant expositors. He will not advance the cause of an oligarchy in the South, he will not seek further means of “jim crow” insult, he will not dismiss black men wholesale from office, and he will remember that the Negro…has a right to be heard and considered, and if he becomes President by the grace of the black man’s vote, his Democratic successors may be more willing to pay the black man’s price of decent travel, free labor, votes and education.

That is from pp.187-188 of August Meier, Negro Thought in America 1880-1915: Racial Ideologies in the Age of Booker T. Washington. You can see that Du Bois did not “have it in” for Wilson.

And here is a letter from September 1913, from Dubois to Wilson, after Wilson had been in office for but half a year:

Sir, you have now been President of the United States for six months and what is the result? It is no exaggeration to say that every enemy of the Negro race is greatly encouraged; that every man who dreams of making the Negro race a group of menials and pariahs is alert and hopeful. Vardaman, Tillman, Hoke Smith, Cole Blease, and Burleson are evidently assuming that their theory of the place and destiny of the Negro race is the theory of your administration, They and others are assuming this because not a single act and not a single word of yours since election has given anyone reason to infer that you have the slightest interest in the colored people or desire to alleviate their intolerable position, A dozen worthy Negro officials have been removed from office, and you have nominated but one black man for office, and he such a contemptible cur, that his very nomination was an insult to every Negro in the land.

To this negative appearance of indifference has been added positive action on the part of your advisers, with or without your knowledge, which constitutes the gravest attack on the liberties of our people since emancipation, Public segregation of civil servants in government employ, necessarily involving personal insult and humiliation, has for the first time in history been made the policy of the United States government.

By the way, I’ve also learned that Du Bois, despite his Marxist sympathies, studied economics with Taussig at Harvard, had well-worked out views on Mill and Ricardo, and once wrote a paper defending the economics of the gold standard. He also studied with Gustav Schmoller at what was then the University of Berlin, now Humboldt University.

What’s wrong with this picture?

The New York Times covers a controversy about a Texas history textbook:

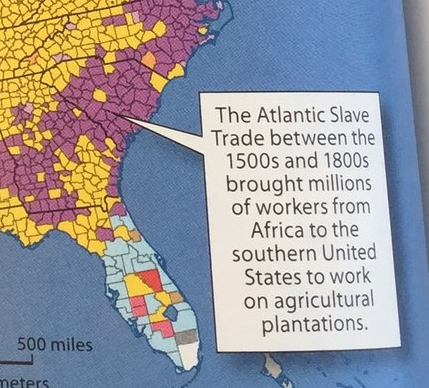

Coby Burren, 15, a freshman at a suburban high school south of here, was reading the textbook in his geography class last week when a map of the United States caught his attention. On Page 126, a caption in a section about immigration referred to Africans brought to American plantations between the 1500s and 1800s as “workers” rather than slaves.

The black lives matter movement is upset that slaves are referred to as workers.

I am upset that the caption is factually incorrect even if rewritten not to use the word worker. In particular, it is not true that millions of slaves were brought from Africa to the southern United States. In fact, less than half a million came to the United States.

Here is Henry Louis Gates Jr:

The most comprehensive analysis of shipping records over the course of the slave trade is the Trans-Atlantic Slave Trade Database, edited by professors David Eltis and David Richardson. (While the editors are careful to say that all of their figures are estimates, I believe that they are the best estimates that we have, the proverbial “gold standard” in the field of the study of the slave trade.) Between 1525 and 1866, in the entire history of the slave trade to the New World, according to the Trans-Atlantic Slave Trade Database, 12.5 million Africans were shipped to the New World. 10.7 million survived the dreaded Middle Passage, disembarking in North America, the Caribbean and South America.

And how many of these 10.7 million Africans were shipped directly to North America? Only about 388,000. That’s right: a tiny percentage.

Here is the primary database for what we know about the Atlantic Slave Trade which lists 305,326 slaves brought to the USA. Gates goes on to note that some 60-70 thousand slaves initially brought to the Caribbean ended up in the United States so he estimates that perhaps 450,000 African slaves in total were brought to the U.S. over the course of the slave trade.

If you want to understand the slave trade it’s important to understand that the vast majority of the slaves taken from Africa were shipped to the Caribbean and South America. If you want to understand slavery in America it’s important to understand that most slaves in the United States were born into slavery. Also, as Gates notes, it’s a rather striking and amazing fact that “most of the 42 million members of the African-American community descend from this tiny group of less than half a million Africans.”

Regardless of whether you think that slaves are workers or not the textbook failed its students by getting the facts wrong. In a better culture, that failure would make for a controversy and a story in the New York Times.

Hat tip: Arthur Charpentier on twitter.

A very good sentence

We care about African animals and British people, but ignore African people and British animals.

That is from Andrew Pearson, via Ben Southwood. And here is an interesting WaPo Lindsey Bever article about the economics of hunting big game.

The economics of population imbalance

That is the topic of my latest column for The Upshot at The New York Times, here is an excerpt:

Unfortunately, regions with rapidly growing populations, like Africa and South Asia, often have lower living standards. In our likely global future, these regions will have more people than they can comfortably support, while many countries in the West and in East Asia will have too few young people for prosperous economies.

As an economist, I see an obvious solution: Relatively underpopulated and highly developed countries could profitably take in young Africans and South Asians — and both sides would gain. Yet it’s far from clear that all nations that could benefit from this policy would entertain it, partly because of persistent racial and cultural bias. There is also the legitimate question of how quickly immigrants can adjust to new environments, especially if they are arriving with weak educational backgrounds as the job market demands ever-stronger skills.

…If you’re not convinced that a declining population is a problem, consider Japan. In terms of real gross domestic product per hour worked, Japan has continued to have good performance, but it has a fundamental problem: The working-age population has been declining since about 1997. And Japan’s overall population has been growing older, so with fewer workers supporting so many retirees, national savings will dwindle and resources will be diverted from urgent tasks like revitalizing companies and otherwise invigorating the economy. Japan has already gone from being a miracle exporter to a country that runs steady trade deficits. Perhaps there is simply no narrowly economic recipe to keep its economy growing; Edward Hugh made this argument in his recent ebook, “The A B E of Economics.”

I am extremely pessimistic that we will manage to achieve any more than a small amount of workable population transfers. Furthermore potential underpopulation is one of the most serious and underrated problems today, as Robin Hanson argued a few years ago.

There is also this bit, the first sentence of which may remind you of Steve Sailer:

France, Israel and Singapore are three countries where population issues are being discussed quite frankly; all have explicit public policies to encourage more births. And more countries will probably go down this route. Encouraging people to have more children, and generally bidding for human talent, may characterize the economic policies of the future, just as cities and states today bid for football stadiums and factories.

By the way, recent reports indicate that the relaxation of China’s one-child policy have led to many fewer births than were expected. And this new paper (pdf) indicate that immigrant inflows raise the birth rates of native women by making child care more affordable.

How much have white Americans benefited from slavery and its legacy?

Many people are talking about the Ta-Nehisi Coates essay on reparations. Ezra Klein has a summary of the argument, which runs as follows:

What Coates shows is that white America has, for hundreds of years, used deadly force, racist laws, biased courts and housing segregation to wrest the power of compound interest for itself. The word he keeps coming back to is “plunder.” White America built its wealth by stealing the work of African-Americans and then, when that became illegal, it added to its wealth by plundering from the work and young assets of African-Americans. And then, crucially, it let compound interest work its magic.

I would suggest that most living white Americans would be wealthier had this nation not enslaved African-Americans and thus most whites have lost from slavery too, albeit much much less than blacks have lost. For instance it is generally recognized that freer and fairer polities tend to be wealthier for most of their citizens. (We may disagree about what “fair” means for many issues, but slavery and its legacy are obviously unfair.)

More specifically, many American whites benefited from hiring African-American labor at discrimination-laden discounted market prices, but many others lost out because it was more costly to trade with African-Americans. That meant fewer good customers, fewer eligible employees, fewer possible business partners, fewer innovators, and so on, all because of slavery and subsequent discrimination. The wealth-destroying effects are surely much larger here, even counting whites alone. And the longer the time horizon, the more likely the dynamic benefits from trade will outweigh the short-run benefits from discriminating against some class of others.

Empirically, I do not think whites in slavery-heavy regions have had especially impressive per capita incomes. And a lot of the economic catch-up of the American South came only when the region abandoned Jim Crow.

We also can look at how many white Americans have had ancestors who, at least for a while, had zero or near-zero net wealth. The returns from slavery may have been compounding for some heirs of Mississippi plantation owners, but not for most of us. My father, when he was thirty, had just gone bankrupt from an unsuccessful attempt to manage a New Jersey pet store. In what sense was he, or later I, reaping compound returns from a legacy of slavery? We go back to the point that overall he probably would have had a better chance in the wealthier and fairer non-discriminating society, even if you can pinpoint some mechanisms through which he might have benefited, such as facing less competition from potential African-American pet store entrepreneurs.

The economic incidence of slavery is a tricky matter (most of what Squarely Rooted argues here is wrong). A lot of whites in the slave trade bought slaves at the going market price and earned the going market rate of return. Of course these same whites were reluctant to free the slaves they had bought and that meant terrible lives for the victims. But the gains of those whites are not mirror images of the losses of the slaves. Thus in some regards slavery was a massive collective action problem with a relatively small number of beneficiaries. Those benefiting would include individuals who first saw the gains from seizing slaves from Africa, and individuals who were good at spotting undervalued slaves and buying them up and exploiting them. That’s a fair number of people but it is far from comprising the overwhelming majority of society in 1840, much less 1940 or 2014, once we consider possible wealth transmission to their heirs.

There is still a moral case for reparations even if most American whites have lost from slavery rather than benefited. (Although I doubt if the America public would see the matter that way, which is one reason why the reparations movement probably isn’t going anywhere.) Nonetheless on the economics of the issue I would suggest a very different analysis than what I am seeing from many of the commentators. And this analysis makes slavery out to be all the more destructive, and reparations to be all the more unlikely.

Addendum: It is amazing how many of you cannot read and digest a simple sentence such as “There is still a moral case for reparations even if most American whites have lost from slavery rather than benefited.” Which by the way is far to the “left” of where the current debate stands in American politics and indeed in most other parts of the world.

Why emerging markets should look within

That is the title of my latest New York Times column, here is one excerpt:

In recent weeks, Argentina, Turkey, Ukraine and Thailand have endured plunging currencies, capital flight and political disruptions in varying combinations. While they have all been affected by global economic tides, these nations are facing crises because of problems in their national governance. And if we look elsewhere around the world, we find that governance has been re-emerging as a major factor behind success or failure in many emerging nations.

It’s not that macroeconomic quandaries have gone away in all of those countries. There are still many such issues: how to deal with current account deficits, for example, or how to face the consequences of tighter monetary policy in the United States. But these concerns were foreseeable, and some countries have been meeting them, if imperfectly, while others are letting these problems push them over the precipice. In this context, good governance means directing political energies at strengthening the economy rather than trying to cement power and keep down the opposition.

This new world contrasts with two earlier waves of change. The first started in the 1990s, when a rising China bought and invested in raw materials at an unheard-of pace. That flow of purchasing power was so strong that it brought better times to other emerging nations, including many in South America and Africa, regardless of whether the individual countries had good governance in place.

The second major wave was the recent global recession, which damaged the commercial prospects of many nations. For instance, in the first quarter of 2009, the gross domestic product of Singapore fell at an annualized rate of 8.9 percent. That wasn’t because Singapore had bad economic policy, but because exports were hit by a global downturn beyond the country’s control.

The two waves have had such noticeable effects that we’ve become unaccustomed to evaluating political fundamentals in individual nations. But these waves, though not quite over, have slowed.

Some of the likely losers are Argentina, Thailand, Turkey, and Ukraine. Chile, Malaysia, and Mexico are likely to come out of the turmoil in OK shape, to cite some examples on the other side. As for China…?

Do read the whole thing.

Assorted links

1. Plane eating in Ghana. Yum.

2. The future of jobs and work, a Ryan Avent survey from The Economist. And will a computer hire you?

3. What motivates young musicians to try to be great?

4. Why we like to watch rich people; the people writing these answers are mostly into total denial.

5. The “world’s biggest music store” — HMV in London — is no more.

From the comments, on seasonal business cycles

ohwilleke reports:

While “Christmas” is new, the notion of a consumption splurge after the fall harvest, followed by a lean late winter-early spring season (Lent/Ramadan) before the spring harvest is deeply rooted in pre-modern agricultural reality. When you have an abundance of perishable goods it makes sense to consume them before they go bad, and then to string out the more limited supply of durable foodstuffs when fresh foodstuffs are scarce. In the same way, summer vacation is rooted in the need to free up children for agricultural labor at times of peak demand. As noted above, spring weddings supply a consumption boost after the Spring Harvest and also are timed to minimize the likelihood of critical parts of a first pregnancy taking place during the lean late winter-early spring (although these days it has more to do with the end of the school year).

Only with cheap and fast trans-hemispheric shipping (together with a lack of significant piracy for most of that trade), and advances in food preservation and refrigeration in the last half century or so, have those agricultural considerations become irrelevant (although, of course, excess and lean times should fall at different parts of the year in the Southern hemisphere and in places like Southern India, the Sahel, and the tropics of Asia, African and South America that have different seasons).

Japan and China use end of year bonuses (often as 6-12% of annual compensation) as a significant part of annual compensation as a way to share rather than leveraging macroeconomic risk for firms and the economy as a whole. In good years, when there is more supply, lots of people get big bonuses; in bad years, scarcity is widespread. The main virtue of this approach is that it makes firms more robust and puts them under less pressure to engage in cyclic layoffs but making labor costs look more like equity and less like debt. This too was well suited to an agricultural tradition rooted in sharecropping or the equivalent that was once widespread in all feudal economies as well as in neo-feudal economies in places like the American South. This isn’t a strategy limited to the orient. It is also the quintessential Wall Street economy model utilized by major financial firms like investment banks and the large law firms that serve them.

The pressure from the “real economy” – both the goods and services supply side and the labor demand side – to have punctuated consumption is much weaker now than it once was, particularly in economies or sectors of economies without the strong annual bonus tradition. The largest sectors of the modern economy that are both strongly cyclic in terms of business cycles and very seasonal within each year, are construction and real estate – and these cycles also drive a fair amount of durable goods consumption. Both construction and real estate are weakest in the winter. Agriculture’s share of the economy is now much more stable from a consumer’s perspective and much smaller as a percentage of the total economy. Real estate handles cyclic shifts by being largely commission based. Construction relies on highly fragmented project specific team building through networks of general contractors and subcontractors rather than integrated firms (a pattern also common in the film industry and theater industry).

Bottom line: The finance oriented macroeconomic models obsessed with interest rates, inflation, GDP growth rates, unemployment rates and size of the public finance sector are ill suited to analyzing optimal seasonal business cycle patterns. A more fruitful analysis looks at the roots of current seasonal patterns in economic history and at the way that the “real economy” has changed with technology to see if those patterns still make sense, perhaps for new reasons.

You will find ohwilleke’s blog here.

Automation, inequality and geopolitics

Joss Delage wrote me with a question, here is part of it:

Here’s what I’m curious about: assuming things turn out as described in your book, what do you think are the geopolitical ramifications? More specifically, do you envision some countries specializing to attract the top earners, and if so which and how?

I don’t cover geopolitical questions in Average is Over, but here are a few observations:

1. I see elites, working in a coalition with elderly voters, as able to control the political agenda enough to prevent most developed economies from flipping into purely destructive economic policies. So I expect the leading wealthy nations to maintain relatively strong positions in the world. (The book by the way does explicitly predict that U.S. government will get bigger and that social welfare spending will rise, contrary to what some reviewers have suggested.) This will be hardest, however, for the relatively pure democracies, such as the Westminster systems.

2. Some small nations, most notably Monaco and Luxembourg and Singapore, have the option of “specializing” in the higher earners and keeping in only a minimum of stagnant wage earners. A mix of immigration policies and land prices will enforce this choice. Commuting will rise in importance, where possible. But such outcomes will not describe a very large share of the world.

3. One class of vulnerable nations will be current exporters who rely on low wages to be competitive. Automation in the wealthy nations will disrupt their business models. The current Indian model of “doing most things internally” — which is by no means ideal — will be relied on increasingly. Export-led surpluses will not be available to drive growth, as the wealthier nations become the export leaders by increasingly wide margins. Given the rise of smart software and robots too, labor costs will not hold them back.

4. African nations and other poor nations, such as those in southeast Asia, also will not have the option of “last generation” export-led growth, pockets of resource wealth aside. Many of these nations will specialize in lower middle class earners. Free-riding upon global technologies will be important, as with cell phones today. Many more technologies will spread in this fashion, with the aid of price discrimination. We might see billionaires adopting particular regions or groups and transferring technologies to them at relatively low cost. “Wealth without wealth generation” will describe many locales.

5. One key question is whether software-led growth will lower or raise the relative price of most natural resources. There will be much more production! One possible scenario is that manufacturing growth will rise more rapidly than natural resource production will be eased. Countries with the higher-priced natural resources will then be geopolitical winners. And in that case high energy prices become quite a burden on lower middle income earners, who switch out of cars and into bicycles, mass transit, and the like. Yet it remains possible that smart software will do more for energy production, or for copper production, than it will for manufacturing production.

6. In talks (but not in the book) I have suggested that food production is the best candidate for “what will be most difficult to augment” in an age of smart software. Food production seems harder to “wall off” and it seems more embedded in local culture (for better or worse, usually for worse) than factory production. See our MRU video on conditional convergence, which considers the work of Dani Rodrik in this regard. It would mean that the price run-up for Midwestern farm land in the United States may not be a bubble.

Let’s say smart software, robots, and artificial intelligence really do pay off. What other geopolitical predictions would this imply?

What is the rate of return on killing black rhinos? (auction markets in everything)

The Dallas Safari Club said Friday it aims to raise up to a million dollars for endangered black rhinoceroses by auctioning off a permit to kill one in Namibia. The move has raised the ire of wildlife preservation organizations, who question the move’s ethics.

Ben Carter, executive director of the Dallas Safari Club, told Agence France Presse the Namibian government “selected” his hunting club to auction a black rhino hunting permit for use in one of its national parks. Namibia has an annual quota to kill up to five black rhinos out of the southern African nation’s herd population of 1,795 animals.

“First and foremost, this is about saving the black rhino,” Carter said.

The permit is expected “to sell for at least $250,000, possibly up to $1 million,” and will be auctioned off at the Club’s annual convention from Jan. 9-12 next year. The Conservation Trust Fund for Namibia’s Black Rhino will receive 100 percent of the sale price, the Club said.

There is more here, courtesy of the excellent Mark Thorson.

Private Schools in Developing Countries

Tina Rosenberg has an excellent piece on private schooling in developing countries at the NYTimes blog:

In the United States, private school is generally a privilege of the rich. But in poorer nations, particularly in Africa and South Asia, families of all social classes send their children to private school….

BRAC used to be an acronym for Bangladesh Rural Advancement Committee, but now the letters stand alone. It was founded in 1972 to provide relief after Bangladesh’s war of liberation. Although you’ve probably never heard of it, BRAC is the largest nongovernmental organization in the world, with some 100,000 employees, and it services reach 110 million people.

…And since 1985, it has run schools… BRAC has more than 1.25 million children in its schools in Bangladesh and six other countries, and it is expanding.

BRAC students, in fact, do better than their public-school counterparts….BRAC students are more likely to complete fifth grade — in 2004, 94 percent did, as opposed to 67 percent of public school students. (The BRAC number is now about 99 percent.) On government tests, BRAC students do about 10 percent better than public school students — impressive, given that their population is the most marginalized. (emphasis added).

In my own work on private schools in India I also found suggestive evidence that private schools–mostly very small, urban slum schools–produced better outcomes than their public counterparts (paper (pdf), video).