Future Nobel Prize winners

Steve Levitt found this list on a blackboard at University of Chicago. I’m still predicting (as opposed to expecting) Eugene Fama and Richard Thaler for this year’s prize. Laugh at me when I am wrong, this coming Monday.

Prediction markets for the flu

In many asset markets the very phenomenon of market trading appears to increase volatility. Richard Roll did some empirical studies of exogenously determined market closings (occasionally various exchanges have closed for brief periods for purely technical reasons, such as catching up on paperwork or upgrading systems). Price volatility was higher across periods when markets where open than when markets where shut. In essence you draw inferences from watching other people trade, other people draw inferences from your inferences, and so on. The “dialogue” embedded in the market makes the price bounce around, even when it hones in on a better mean forecast.

Note further that most meta-rational people should not trade (economists refer to no-trade theorems). When you trade, you should always ask why you think you know more than the person you are trading with. Not every trader in the market as a whole can meta-rationally conclude that she knows more than the other traders. Yes you might trade for liquidity to put your kids through college, but I suspect that most trading in prediction markets is or would be opinion-based. It is especially prone to hubris and irrationality, which again contributes to volatility.

Here is the paradox. We need volume for the price to tell of much about market conditions. But volume is based on irrationality to large extent. Most people — the uninformed — should simply park their money about forget about active trading. And the remaining informed cannot so easily trade against each other.

Prediction markets may be least well-suited for predicting terrorist attacks. Tracking an excessively volatile price could create worry and perhaps sometimes panic. What will happen each time the market price spikes for a nuclear bomb going off in a major American city?

The very virtue of prediction markets now becomes their cost. If you hear rumors, in the absence of prediction markets, you can ignore them and pretend they are not true. With asset markets, however, your forecast moves into equality with that of the market, otherwise you would trade. It is precisely this “forcing quality” that makes prediction markets so useful, but also so potent. Price movements are materially and psychologically harder to ignore. The very feature of prediction markets that mobilizes information also mobilizes coordinated social reactions to the embodied information, and not always for the better.

So the prediction market skeptics have a valid point in some contexts, but this does not detract from the benefits of prediction markets more generally.

I welcome the Ubermensch

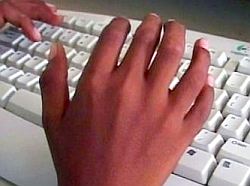

There is a great scene in the movie Gattaca of a piano recital. (As I remember it). As we listen to the beautiful and complex music the camera slowly pans in on the pianist’s fast-moving fingers until we see why the music is so amazing, the pianist has six fingers on each hand. Was the music written for the pianist or was the pianist written for the music? Even though Gattaca is often understood as a dystopia the movie is great at showing the promise of genetic engineering.

In India, genetic mutation has done what we are close to doing with genetic engineering. Devender Harne has six fingers on each hand and six toes on one foot and seven on the other. He says the extra fingers let him work faster than other children.

If you think the photo has been Photoshopped, it hasn’t. See here for the full story and video. Thanks to J-Walk Blog for the link.

My favorite things Tennessee

Music: Who is really from Tennessee? Putting the Sun Records and Nashville crowds aside and focusing on birth, you have Lester Flatt, Dolly Parton, Tina Turner, and Aretha Franklin. Honorable mention to Chet Atkins and Isaac Hayes. Add in Bessie Smith and yes I enjoy Justin Timberlake too. Brownie McGee and Sleepy John Estes round out the blues representation. A strong category, and if you count "recorded in Tennessee," it hits the stratosphere.

Elvis Presley song: (Marie’s the Name) His Latest Flame.

Author: James Agee, Let us Now Praise Famous Men. Tennessee Williams does not fit, despite his name. There is not much to choose from here.

Film, set in: Here is a list, but I don’t much like Nashville or The Coal Miner’s Daughter. How about the final scene of Goldfinger?

Director: Quentin Tarantino. He is overrated but Reservoir Dogs is a classic.

Artist: Robert Ryman, here is one image, and no need to write and tell me this is ridiculous. Red Grooms is an alternative pick. There is William Edmondson, if you wish to go the "Outsider" route.

Comments are open…

Artistic achievement late in life

…After 1660, with the monarchy restored, Milton’s political dreams lay in ruins under the double blow of the collapse of the Puritan Republic and the failure of said republic to uphold freedom while it lasted. Milton retired to private life and returned to his true vocation, the writing of poetry. He had gone blind while serving as secretary to Cromwell, and now sat composing his poems in his head, and dictating each day to his daughters the portion that he had composed. It was in this retirement that he produced his three long poems, Paradise Lost, Paradise Regained, and Samson Agonistes. He died 8 November 1674.

Milton was born in 1608. Here is my previous post on age and achievement; read the comments on Coase and Stigler.

The tricky problem of sticky wages

Rick Hartenstein is the Pharmacy Director at Ochsner Clinic Foundation in New Orleans. He writes me with a question:

An article in our local paper this morning discussed the phenomenon of sign-on bonuses at fast food restaurants. Since this will almost certainly drive up wages in the area, and hospitals are highly dependent upon low wage jobs, I was wondering what you would advise our Human Resources VP to do. I am an almost daily reader of MR and really appreciated the blogs during the hurricane (I was here at the hospital for 8 days). Any other observations on wages and prices for us? One thing is sure – the areas of the city that housed the majority of lower wage workers are obliterated. We have massive vacancies in these types of jobs as do other employers.

My response was as follows:

The rise in wages is a good sign because it means that employers are trying to draw workers back to New Orleans. If employers were packing up and leaving then wages would be falling so there is some hope. For the hospital Human Resources VP I would suggest that the situation is probably temporary so rather than higher wages he or she may want to follow the lead of the restaurants and offer "signing bonuses" and/or bonuses to be paid after say 6 months on the job. The reason for this is that it may be very difficult to reduce wages later on – reducing wages typically causes a lot of discontent. Furthermore, if you keep the wages of older employees constant but, as wages fall, offer newer employees lower wages you will have two people doing the same job being paid different wages. That is not good for morale either. In addition, to signing bonuses the hospital might want to think about what it can offer in terms of relocation services, housing, transportation and so forth. Again, these would be useful temporary measures to draw workers to the hospital without creating a permanent expectation of higher future wages.

Comments are open if you have other suggestions for Rick.

Six reasons why I don’t like IS-LM analysis

1. It suggests that you can shift one curve without the other moving as well. In other words, it assumes that excess demands in the goods market are independent from excess demands in the money market.

2. The IS curve — which involves investment demand — uses the real rate of interest, r. The LM curve — which involves money demand — uses the nominal rate of interest, i. These two curves are then put on the same graph. I have been told many times this can be done without contradiction; at best this is true only in the shortest of runs, when prices are not changing.

3. Everything in the model is flows, but stocks matter too. No person in the model considers his or her intertemporal budget position. You don’t have to believe in Barro’s Ricardian debt-equivalence theorem to be worried by this.

4. Coordination problems — which should be at the center of macro — are obscured by the aggregate apparatus.

5. The IS curve, drawn from investment demand, uses the long-term rate of interest. The LM curve, drawn from money demand, uses short-term rates of interest. Yet the relative movements of short and long rates remain a significant puzzle and do not follow the predicted relationship.

6. You see the curves — which remind you of supply and demand curves — and you wish to start manipulating them in the same manner. See #1.

My (significant) concession: The model does fairly well predicting many economic phenomena in the short run. But you could do better reading Arthur Marget on sophisticated versions of the quantity theory of money. I hope to explore this point in more detail soon.

The future of the book trade?

With its snazzy new "Great Ideas" series released this month, Penguin Books hopes to provide an economical remedy for time-pressed readers in search of intellectual sustenance.

Each of the paperbacks costs $8.95 and offers readers a sampling of the world’s great non-fiction. For example, the Gibbon book is a slim 92-page selection called The Christians and the Fall of Rome. It presents Gibbon as sort of an intellectual tapas to be savored in one sitting.

Here is the full story. Like it or not, I see the non-fiction sector as heading toward shorter and shorter books. Can you do one hundred pages on monetary policy? Get this:

Because "we want readers to be able to get close to the text," the books do not have introductions or prefaces, Penguin publisher Kathryn Court says. "It’s daunting. There are so many books and so little time."

Practice exam questions for macroeconomics

I hope my macro class has a good handle on these:

1. Which aspect of the macroeconomy does real business cycle theory find most difficult to explain? Why? What is the most convincing attempt to "save" RBC in the area you outline? Does it work?

2. Let us say that the seasonal business cycles literature taught us something about traditional business cycles. What might the policy implications be? You could spin out several different scenarios, but focus on the most plausible one.

3. Assume that the expectations theory of the term structure of interest rates were correct. Would this strengthen the case for monetary or for fiscal policy, and why?

4. Write your own exam question and answer it. You will be graded on the quality of the question as well as your answer. The submission of "Write your own exam question and answer it" would give you, for a philosophy class, an "A+", but for macroeconomics, a "C minus".

Spam is No Free Lunch

Department of Yikes

Two teams of federal and university scientists announced today that they had resurrected the 1918 influenza virus, the cause of one of history’s most deadly epidemics, and had found that unlike the viruses that caused more recent flu pandemics of 1957 and 1968, the 1918 virus was actually a bird flu that jumped directly to humans.

The work, being published in the journals Nature and Science, involved getting the complete genetic sequence of the 1918 virus, using techniques of molecular biology to synthesize it, and then using it to infect mice and human lung cells in a specially equipped, secure lab at the Centers for Disease Control and Prevention in Atlanta.

The findings, the scientists say, reveal a small number of genetic changes that may explain why the virus was so lethal. The work also confirms the legitimacy of worries about the bird flu viruses that are now emerging in Asia.

The new studies find that today’s bird flu viruses share some of the crucial genetic changes that occurred in the 1918 flu. The scientists suspect that with the 1918 flu, changes in just 25 to 30 out of about 4,400 amino acids in the viral proteins turned the virus into a killer. The bird flus, known as H5N1 viruses, have a few, but not all of those changes.

Here is the full story, which contains many other points of interest, including whether the sequencing should have been done in the first place. In case you forgot, 1918 was the flu pandemic which killed 50 to 100 million people, and don’t think we are so much better protected in 2005. Today I started writing my piece on what we should do about avian flu.

Books too sad to blog about

The Year of Magical Thinking, by Joan Didion.

Why has the Heritage Foundation been successful?

Following up on our earlier discussion of think tanks, Bruce Bartlett offers some analysis.

Who said economics doesn’t get you the girls?

Click here. Thanks to AdamSmithee for the pointer.

When do creators do their best work?

Randall Jarrell similarly observed that "[Wallace] Stevens did what no other American poet has ever done, what few poets have ever done: wrote some of his best and newest and strangest poems during the last year or two of a very long life."

In contrast:

[Jean-Luc] Godard has directed scores of movies in a career that continues today in its fifth decade, but there is a strong critical consensus that his most important single work is his first full-length movie, Breathless, which he made in 1960 at the age of 30.

Those two passages are from David W. Galenson’s forthcoming Old Masters and Young Geniuses: The Two Life Cycles of Artistic Creativity. Here is a related working paper. Here are many other interesting papers.

My question: Which economists have done extremely important work after the age of 50? Have done their best work after 50? After 40? Comments are open, I welcome your suggestions but it is not easy…