The future of Europe?

Every time I go to Europe I wonder what kind of future the place has:

1. The average American consumes 77 percent more than the average citizen of EU-15, read here.

2. Germany has recently failed in its attempt to reform the country’s antiquated store closing laws. German shops, with some exceptions, cannot stay open later than eight at night or on Sundays or major holidays. The German public strongly opposes these laws, but the small shop lobby dominates.

3. A recent survey in France suggests that 70 percent of French schoolchildren aspire to become bureaucrats rather than captains of industry. (See the IHT, June 9, “Divided We Graumble,” by Roger Cohen, p.2.)

4. The beauty of European cities typically stems from 1920 or earlier, when much of Europe was economically freer than the United States. How would U.S./Europe comparisons feel to us if all of Europe had been built after the second World War? How many people would then think that the “European way of life” is superior.

5. Guido Tabellini (FT, June 3) tells us that Europeans consume more leisure because they find it harder to get good jobs, not because of a cultural preference for the finer things in life.

6. The major European economies face serious demographic problems and have a hard time pushing much above a one percent growth rate. Americans call it a recession when our rate of growth falls to a mere two percent.

Hey, wait a minute:

American investment in the European Union is at an all-time high. So how bad can things be?

This is what makes economics an interesting science. My best guess is that it is easier than ever before to free-ride on the productivity and ingenuity of your neighbors. This is a great benefit of globalization, but it also makes it too easy for economies to postpone needed reforms.

That being said, here are further grounds for hope.

Crowds are wiser than you think

I’m reading James Surowiecki’s The Wisdom of Crowds – so far, it’s very good! Steve Sailer posted the following comment on the book:

…he doesn’t really explain why pseudo-markets like the Iowa Election Market tend to be more accurate than traditional predictive tools like the Gallup Poll, although the answer is obvious: because they piggyback off traditional sources of information like Gallup. For example, participants in the IEM look at not just the Gallup Poll but a dozen others. Without these pollsters spending large amounts of money to generate information, however, the market players would be pretty clueless. Similarly, if the crowd takes the average of the 11pm weather forecasts of the weatherguys on Channels 2, 4, and 7, they may well beat the best individual forecast, but that doesn’t mean the crowd could beat the professional weathermen — unless the pros first tell them what they think the weather is going to be.

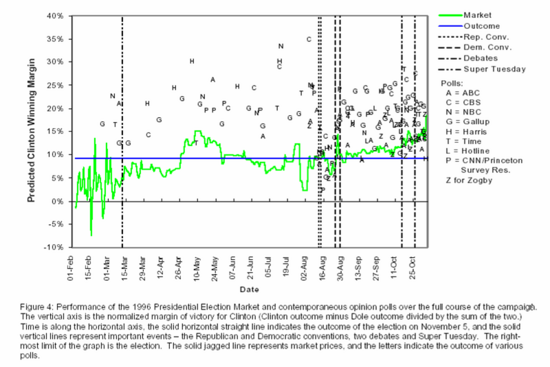

Clearly, there is some truth to this – Hayek said markets are “marvelous” he didn’t say “miraculous.” But a lot more goes on in information markets than averaging. The green line in the figure below (click to expand) shows the Iowa market prediction for the 1996 Presidential election. The blue line is what actually occured. The spots are various polls. Now notice that from February through August every single poll overpredicted Clinton’s victory and every single poll, with but one exception, was above the market prediction. This means that the market prediction could not possibly be an average of the polls.

Surowiecki gives a number of other examples where the wisdom of the crowds cannot be explained by averaging of expert opinion even though averaging is an important reason why crowds can be wise.

Global warming links

Courtesy of Jane Galt. The upshot of her post is that the problem is very very hard to solve.

I thought that The Day After Tomorrow, which I saw in Poland, had more bad cliches than perhaps any other movie I have seen, ever. The bad science is actually one of the least ridiculous things about the movie.

Did you know that the film had the widest “day-and-date” release in movie history? (See June 7-13 Variety, p.12.) It topped 108 markets at the same time, in early June. It failed to earn the number one spot in Greece and Serbia, however. Can you guess why?

How many words can your dog understand?

If it is a collie, perhaps up to 200 words.

The researchers found that Rico knows the names of dozens of play toys and can find the one called for by his owner. That is a vocabulary size about the same as apes, dolphins and parrots trained to understand words, the researchers say.

Since dogs-as-we-know-them co-evolved with humans, I don’t find this surprising. More generally, we underrate the intelligence of many animals. But even I found this part hard to believe:

Rico can even take the next step, figuring out what a new word means.

The researchers put several known toys in a room along with one that Rico had not seen before. From a different room, Rico’s owner asked him to fetch a toy, using a name for the toy the dog had never heard.

The border collie, a breed known primarily for its herding ability, was able to go to the room with the toys and, seven times out of 10, bring back the one he had not seen before. The dog seemingly understood that because he knew the names of all the other toys, the new one must be the one with the unfamiliar name.

Here are some of the words that Rico understands. Keep in mind that this dog understands only German, the text is translated. Note also that most “tricks” (remember Hans the horse?) still represent some form of communication with the animal.

Here is another summary report. And yes, the work is published in the highly respected journal Science, in case you were wondering.

On a related note, I just read (and recommend) this book on how animals talk to each other.

A basket for weaker currencies?

Mr [Barry] Eichengreen spells out…an ingenious plan…he proposes the creation of a market for lending and borrowing in a synthetic unit of account, a weighted basket of emerging-market currencies. Such bonds would be popular with investors, since the currency would be more stable than the sum of its parts and, at first at least, carry attractive yields. Importantly, such a market, if it could be established, would eventually let emerging-market economies tap foreign capital without currency mismatches. This is because those, such as the World Bank, that issued such bonds would be keen to reduce their exposure to the basket by lending to the countries in that basket in their own currencies.

The idea is to prevent a mismatch between assets and liabilities:

…some countries’ financial fragility results simply from their need for foreign investment. In the most susceptible countries, firms and banks borrow heavily in dollars, while lending in local currencies. If the value of the local currency wobbles, this mismatch between domestic assets and foreign liabilities is cruelly exposed.

Why are the assets and liabilities of emerging markets so ill matched?…International investors are very choosy about currencies. Most consider only bonds denominated in dollars, yen, euros, pounds or Swiss francs. This select club of international currencies is locked in for deep historical and structural reasons. Thus, poor countries that want to borrow abroad must bear currency mismatches through no fault of their own.

I have no problem with trying the idea, but what can we expect?

First, it remains a puzzle why lenders are reluctant to denominate international loans in anything but the five major currencies (dollar, Euro, yen, sterling, and Swiss franc). So it is hard to know whether another unit of account could join this exclusive club. Perhaps investors would find the basket hard to evaluate or simply unwieldy. They might not want the basket any more than they would lend in Brazilian real, which is the original source of the problem.

Second, say that the basket did become widely used and relatively stable. Underdeveloped countries would then have their liabilities in a stable unit of account but their assets would still fluctuate in value. We would return to a version of the original problem. Now one might hope that the basket-denominated debts would be swapped back into the local currency. But I don’t see any particular reason why such swaps would increase in ease.

Third, if the basket becomes more liquid than its underlying components, the system may be vulnerable to arbitrage and speculation opportunities. Whether these would be stabilizing remains an open question. In essence the price of the basket would tell you where the underlying components are headed. We would have a new version of the “stale pricing” problem.

The Eichengreen proposal represents an old dream, and one that I have been taken with myself: improve risk-sharing simply by creating a new nominal value. This may sound like economic alchemy, but hey, it worked with stock index futures. That being said, in this arena the number of failures far outweighs the number of successes.

Here is one summary of the plan. Here is a useful summary by Eichengreen and Haussman.

Thanks to Chris Danford for the pointer.

Has the Riemann hypothesis been solved?

Maybe. Of course there have been false alarms before. The Riemann hypothesis, often considered the greatest unsolved problem in mathematics, concerns whether the distribution of prime numbers has a particular order.

Here is one summary of the problem; here is another, with some more technical links.

You can check out the would-be proof yourself.

Zimbabwe

Zimbabwe continues its short march into barbarism. Here’s is a quote from land minister John Nkomo – sadly reminiscient of early twentieth century history.

Ultimately, all land shall be resettled as state property. It will now be the state which will enable the utilization of the land for national prosperity.

Of course, he was quoted in the government controlled newspaper. And get this, it’s not good enough that the government take the land:

Mr. Nkomo urged farmers to volunteer their land to the state rather than wait for an order, saying, “The state should not be made to waste time and money on acquisitions.”

The people of Zimbabwe are starving because of land “redistribution” could a better example of Robert Lucas’s dictum be found?

Immigration and 9/11

One of the few bright notes since 9/11 is that there has been no backlash against immigrants. Consider, for example, that there were 25 percent more immigrants to the United States in 2002 than in 2000 (see Table 1). Nor has there been an immigration backlash against Muslims – there were 19 percent more immigrants, for example, from Iran in 2002 than 2000 (see Table 2). Even more surprising, despite heightened examination, 20 percent fewer aliens were expelled from the United States in 2002 than in 2000 (see Table 43).

China facts

1. Chinese per capita income in 2003 is roughly seven times higher than in 1978.

2. In 2002, in purchasing power parity terms, China accounted for twelve percent of global gdp.

3. The figure drops to only four percent, if we calculate real gdp by exchange rates rather than purchasing power parity.

4. In 1952, Communist China claimed to comprise five percent of global gdp.

2. China accounted for one-third of world economic product in 1820. The figure is from work by Angus Maddison.

These facts are drawn from Tuesday’s Financial Times, an Op-Ed entitled “China is Not Racing Ahead, Just Catching Up.”

Addendum: Bruce Bartlett refers me to Maddison’s data.

Are casinos good for the economy?

People who live near casinos are going broke faster than people who don’t, a new study found.

The growth rate of personal bankruptcies in counties with casinos was more than double that of similar counties without them during the 1990s, according to the study by Creighton University.

On the other hand, the rate of business bankruptcies was significantly lower in counties with casinos, the study showed.

Here are the exact numbers:

The study compared roughly 250 counties across the country with commercial or tribal casinos with non-casino counties with similar demographics. It found the cumulative growth rate on personal bankruptcies in casino counties to be more than 100 percent higher than the non-casino counties between 1990 and 1999.

It also found business bankruptcy rates in casino counties to be 35.4 percent lower than non-casino counties.

Here is one brief summary. Here is the original research.

The more surprising and puzzling result is that business bankruptcy rates are lower when gambling is present, even after adjusting for the quality of the county’s economy. Note that tribal casinos are most frequent in poorer regions. These regions may have fewer local businesses altogether, and thus perhaps those casinos induce personal rather than business bankruptcy. The businesses are owned by outsiders in any case. And if they are chains, perhaps they go bankrupt at lower rates.

I’m all for legalizing (zoned) gambling. The real question is whether we should tax gambling at higher rates than other economic activities.

Addendum: Jeff Smith points my attention to the following NBER paper, of direct interest.

How Colombia solves its traffic problems

Drive as fast as possible. Be aggressive too:

Traffic experts had previously been puzzled as to how Bogotá, with 7 million inhabitants and more than a million private cars, is so jam-free. The answer now seems that Bogotáns are simply more aggressive than their counterparts in London, New York and other huge metropolises.

But why the dare-devil style? Olmos and Muñoz point out that, before improvements to Bogotá’s public-transport and cycling infrastructure, and restrictions on the use of private cars, the city was routinely gridlocked. Perhaps formerly frustrated motorists are now revelling in the open road.

Still, freedom comes at a price, say the researchers: one in six Colombians who die a violent death meet their end in a traffic accident.

I’ve long suspected that something like this would prove true. If you can’t afford to synchronize your lights, just let drivers run them at will. The results also may explain why traffic in Mexico City flows at all.

Here is the original research. Here is an earlier MR post on Colombia.

Robert Lucas on Distribution versus Production

Here’s the conclusion to, The Industrial Revolution – Past and Future, a recent paper by Nobel Prize winner Robert Lucas.

Of the tendencies that are harmful to sound economics, the most seductive, and in my opinion the most poisonous, is to focus on questions of distribution. In this very minute, a child is being born to an American family and another child, equally valued by God, is being born to a family in India. The resources of all kinds that will be at the disposal of this new American will be on the order of 15 times the resources available to his Indian brother. This seems to us a terrible wrong, justifying direct corrective action, and perhaps some actions of this kind can and should be taken. But of the vast increase in the well-being of hundreds of millions of people that has occurred in the 200-year course of the industrial revolution to date, virtually none of it can be attributed to the direct redistribution of resources from rich to poor. The potential for improving the lives of poor people by finding different ways of distributing current production is nothing compared to the apparently limitless potential of increasing production.

Hat tip to Mahalanobis, now a great group blog.

Abolish the FCC

Declan McCullogh is correct.

It’s time to abolish the Federal Communications Commission.

The reason is simple. The venerable FCC, created in 1934, is no longer necessary.

Its justification for existence was weak 70 years ago, but advances in technology since then have eliminated whatever arguments remained. Central planning didn’t work for the Soviet Union, and it’s not working for us. The FCC is now an agency that does more harm than good.

Consider some examples of bureaucratic malfeasance that the FCC, with the complicity of the U.S. Congress, has committed. The FCC rejected long-distance telephone service competition in 1968, banned Americans from buying their own non-Bell telephones in 1956, dragged its feet in the 1970s when considering whether video telephones would be allowed and did not grant modern cellular telephone licenses until 1981–about four decades after Bell Labs invented the technology. Along the way, the FCC has preserved monopolistic practices that would have otherwise been illegal under antitrust law.

These technologically backward decisions have cost Americans tens of billions of dollars….

Read it all here.

The next killer app, or who needs books?

The picture definition on Japanese camera-phones is now so high that people can stand in a shop, surreptitiously photograph the pages of a magazine and then later read their ill-gotten literature from the screens of their mobile phones.

Japan’s booksellers have risen as one to demand that the Government criminalises this practice…

…the thefts have become more ambitious. Students, for example, are finding that entire textbooks can be photographed and read later at palm-sized convenience.

The publishing industry is suffering badly from the advance of mobile phones in Japan. Where once the train carriages were full of people reading comics or newspapers, passengers now concentrate solely on the screens of their phones. Mobile phone operators say that text-message volumes correspond almost exactly with the commuter rush-hour peaks and troughs.

The latest phones come equipped with a tuner that can — fuzzily — pick up television broadcasts, and several operators have introduced phones with navigation software that shows the user as a moving red blip on an ultra-detailed street atlas of Japan.

That’s from The Times, June 5, 2004, p.2W, no link available. Here is some background information. Here is a related article. Here is a more general article on the illegal downloading of books.

To be continued…

Polish memories

1. Hearing Poles say they love America, but America does not love them.

2. Hearing a Krakow taxi driver praise Ronald Reagan.

3. Staying in a “Jewish hotel” that can’t get kosher food right and hires Poles to stage Klezmer music for German tourists.

4. Seeing the Basilica in Krakow, arguably the most beautiful church in Europe. Which is saying something. Here are some images, but they don’t come close to the real thing.

5. Visiting Auschwitz and Birkenau. Words fail, but everyone should make this trip if they can.