Results for “"ben thompson"” 30 found

Monday assorted links

1. The pricing of Lego blocks and sets, more interesting than it sounds, though not to me. And hockey is too expensive for a growing number of Canadians (NYT).

2. Fixing the problems of credentials today.

3. Ben Thompson podcast with Dan Wang.

4. A new bibliography on the best books against socialism.

5. Erik Torenberg channels/integrates some of my remarks from interviews.

Net neutrality for me but not for thee?

To be perfectly clear, I would prefer that 8chan did not exist. At the same time, many of those arguing that 8chan should be erased from the Internet were insisting not too long ago that the U.S. needed to apply Title II regulation (i.e. net neutrality) to infrastructure companies to ensure they were not discriminating based on content. While Title II would not have applied to Cloudflare, it is worth keeping in mind that at some point or another nearly everyone reading this article has expressed concern about infrastructure companies making content decisions.

That is from the excellent Ben Thompson and yes you should pay for his tech email newsletter.

That was then, this is now

The data came from Facebook:

During Obama’s initial 2008 bid for office, his team had already embraced technology in a greater capacity than any before it, assembling massive email lists and other targeted initiatives that earned Obama historic fundraising tallies. But for 2012, campaign manager Jim Messina wanted to take things even further.

To get there, his staff needed to link what had previously been disjointed databases of voter information (collected by volunteers, pollsters, and other campaign workers) into a single, comprehensive pool unrivaled in detail and scope. Whereas most voter logs used by campaigns often list only names and telephone numbers, Obama’s advanced tool dove into specifics like age, race, district, and voting history: it allowed field workers to rank voters intelligently and not waste time chasing unlikely votes.

Here is the article from The Verge, via the excellent Ben Thompson. I recall similarly glowing coverage from The New York Times.

Libra and remittances

Dante Disparte, as interviewed by Ben Thompson ($$, but you should subscribe to Ben):

One example is the use case of international money transfers or remittances. Globally, the remittance cash flow is projected to be about $715 billion in 2019, and on average…you are seeing between seven and ten percent of transfer costs, and in some instances much higher than that in the teens. For a product and an outcome from the sender and receiver point of view, that is not only very slow, it often takes a few days to clear on the receiving end, it is [extremely expensive]. There are direct payment rails that are just technology powered that do a lot in terms of advancing efficiency, but pre-blockchain it would have been very, very hard to conceive of a network of international payments that could do that at near zero cost instantaneously while at the same time not sacrificing the type of ledgering and transaction information that would enable the world to begin to do that securely. So that would be one amazing use case that could put billions and billions of dollars back into the market by eliminating as many of these fees as possible, while at the same time putting billions of dollars into the hands of people around the world in real time.

Here is my current understanding of Libra/Calibra, at least within this particular context, noting again that my understanding may be wrong or incomplete. These transfers would not go through the current banking system as we know it, but rather through a blockchain with say 100 or so (quite legitimate) participants enforcing some kind of “proof of stake” standard. Some form of “proof of stake-equivalent of mining fees” would have to be paid, either explicitly or implicitly, and those arguably could be much lower than current remittance costs, noting that the actual operation of proof of stake in this setting remains to me murky. Still, it would largely avoid the current mining fees associated with Bitcoin. On net, one is trading in the current regulatory and clearing and Western Union branch costs for these future proof of stake costs. Do you think the Libra Association can run a proof of stake system for less say than $100 billion?

“But don’t you have to convert your Libras back into mainstream fiat currencies?” Well, maybe you might, but that is simply the cost of showing up at the relevant financial institutions and claiming redemption. Those costs also could be much lower than the current fees associated with remittances. What is sent through the blockchain network simply can be Libras, as I understand it, with varying assumptions on how much people will hold Libras rather than converting them.

To use a historical analogy, think of this as substituting “the transfer of paper claims to gold” for “claims to gold,” but in a one hundred percent reserves setting. It can be (and indeed was) much cheaper to send around the paper than the gold, and yet the paper still was a claim to the gold. The Libra is a kind of parallel, redeemable currency, legally not within standard banking systems, but still redeemable in terms of mainstream fiat currencies which are within standard banking systems. “Create a synthetic claim which can be traded more cheaply” would be my version of the ten-word slogan.

Another slightly wordier slogan might be: “let’s actually separate the means of payment from the medium of exchange by creating a new synthetic asset, because those two things actually should not be the exact same asset.”

Of course it still remains to be seen in which countries regulators will allow this to happen. How persuasive is the promise of one hundred percent reserves? I don’t mean to speak for Libra/Calibra here, but I believe they are suggesting (or implying?) that the proof of stake system for making and validating transfers could in essence enforce relevant regulations against money laundering, illegal transfers, and the like.

It is a quite separate (but possible) claim to believe that libras could serve as an effective medium of exchange at a retail level, and perhaps I will cover that in a separate post. That would mean that both the medium of exchange and means of payment should be new and different assets, a much stronger claim.

Here are my earlier questions about Libra, with responses.

Tuesday assorted links

1. James Hamilton on Libra. And Barry Eichengreen on Libra. And Ben Thompson on Libra.

2. African internet shutdowns are increasing.

4. I am not sure how I feel about this obituary of Norman Stone. And is “bizarrely” really the right word?

5. China’s favorite food delivery service is now worth more than its biggest internet search firm.

The Facebook cryptocurrency

Kroszner and I wrote about related possibilities in our 1994 book Explorations in the New Monetary Economics. Here is a not very informative WSJ article. Here is Ben Thompson speculating from his email newsletter:

This, then, is what I suspect is the overall motivation for Facebook’s efforts: having its own currency will allow for transactions on Facebook’s terms, not the credit card companies, which should, in turn, allow for both more kinds and more total transactions. Consider a Facebook currency on a theoretical level: if there were no fees attached to a transaction, micropayments suddenly become much more viable; peer-to-peer payments are simple — for both users and Facebook — as clicking a button; tipping models actually make sense.

None of these benefits are new to be sure, the question, though — and this is always the question generally, but with payments especially — is how you get from here-to-there. Remember, payments is a multi-sided network: users have to be one board, merchants need to be on board, and there has to be some sort of liquidity in the market. From a user perspective, how do you get them to buy into the network? Then consider merchants: how do you prevent them from taking money out of the market, killing liquidity?

In fact, Facebook is well-equipped on both fronts, particularly the merchant side: remember, merchants are the most likely culprits when it comes to killing liquidity in a market. They are going to transfer a cryptocurrency to fiat as soon as possible. Merchants, though, are also paying Facebook a lot of money for ads: that is, they are already putting money into the system. To that end, it is easy to see Facebook giving a discount to merchants willing to leave their money in the system and simply buy advertising using their Facebook tokens.

Users are trickier: certainly Facebook will push things like peer-to-peer payments to get users to connect up their bank accounts or debit cards to Facebook’s network, but I also suspect this is where the rumors about Facebook paying for ad-viewing comes in. This is not, in my estimation, some sort of genuine acknowledgment that user attention is worth compensating directly, but rather a plausible way to seed user accounts such that they are motivated to use Facebook’s currency; ideally, at least for Facebook, there will end up being lots of ways to use that currency.

…I don’t think that Facebook wants to impose any fees at all: thinks about it — what could possibly be more valuable to an advertising-based business than knowing exactly what customers are spending their money on?

You have to pay for Ben, but it is worth doing so, you can subscribe here.

Prophets of the Conversations with Tyler

From before the season started:

COWEN: The Milwaukee Bucks last year won, I believe, 44 games, and in the NBA, they were in the bottom third for the number of three-pointers attempted. Why should we think they might do better this year?

[Ben] THOMPSON: Because they had the worst coach in the league, by far, and he is gone, and now they have a new coach. They actually have the best shot profile in the entire league in the preseason, which is shooting threes or shooting shots at the rim. They are 89 percent or something like that.

They are going to have a great year. Giannis is going to win MVP. It’s going to be amazing, and we, being Bucks Twitter, is going to spend the whole time telling everyone that we were right and they were wrong.

That is from my Conversation with Ben Thompson. The Bucks are now 9-2, and two nights ago they beat the world champion Golden State Warriors.

The EU “link tax” has been resurrected

And here is commentary from Ben Thompson:

This is why the so-called “link tax” is doomed to failure — indeed, it has already failed every time it has been attempted. Google, which makes no direct revenue from Google News, will simply stop serving Google News to the EU, or dramatically curtail what it displays, and the only entities that will be harmed — other than EU consumers — are the publications that get traffic from Google News. Again, that is exactly what happened previously.

There is another way to understand the extent to which this proposal is a naked attempt to work against natural market forces: Google’s search engine respects a site’s robot.txt file, wherein a publisher can exclude their site from the company’s index. Were it truly the case that Google was profiting unfairly from the hard word of publishers, then publishers have a readily-accessible tool to make them stop. And yet they don’t, because the reality is that while publishers need Google (and Facebook), that need is not reciprocated. To that end, the only way to characterize money that might flow from Google and Facebook (or a €10-million-in-revenue-generating Stratechery) to publishers is as a redistribution tax, enforced by those that hold the guns.

Here is the full post, excellent as always.

Is Facebook causing anti-refugee attacks in Germany?

Here is the key result, as summarized by the NYT:

Wherever per-person Facebook use rose to one standard deviation above the national average, attacks on refugees increased by about 50 percent.

Here is the underlying Müller and Schwarz paper. They consider 3,335 attacks over a two-year period in Germany. But I say no, their conclusion has not been demonstrated. Where to start?

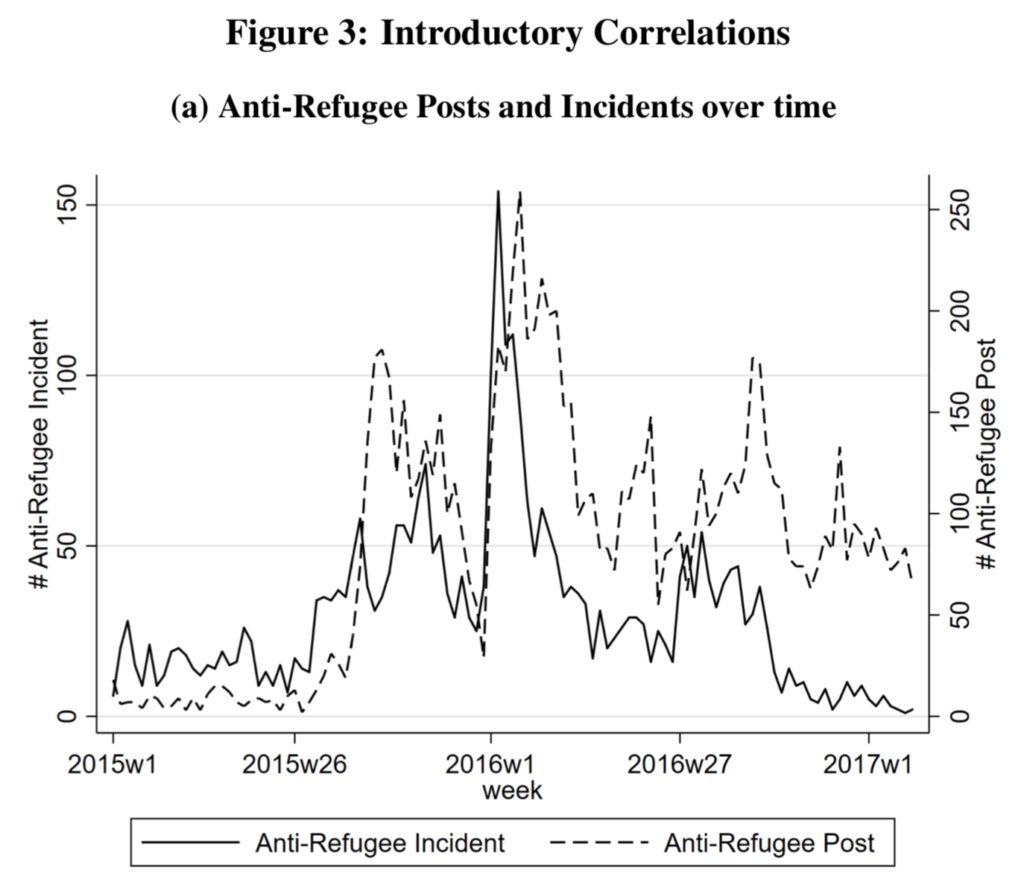

Here is one picture showing a key correlation:

That looks pretty strong, doesn’t it? Nein! That is not how propaganda works, as an extensive literature in sociology and political psychology will indicate. That is how it looks when you measure what is essentially the same variable — or its effects — two different ways. For instance, that very big spike in the middle of the distribution? As Ben Thompson has pointed out, it represents the New Year’s harassment attacks in Cologne. Maybe that caused both Facebook activity and other attacks to spike at the same time? Will you mock me if I resort to the “blog comment cliche” that correlation does not show causation?

That looks pretty strong, doesn’t it? Nein! That is not how propaganda works, as an extensive literature in sociology and political psychology will indicate. That is how it looks when you measure what is essentially the same variable — or its effects — two different ways. For instance, that very big spike in the middle of the distribution? As Ben Thompson has pointed out, it represents the New Year’s harassment attacks in Cologne. Maybe that caused both Facebook activity and other attacks to spike at the same time? Will you mock me if I resort to the “blog comment cliche” that correlation does not show causation?

To continue with the excellent Ben Thompson (he is worth paying for!), the identification method used in the paper is suspect, and he focuses on this quotation from the authors:

In our setting, the share of a municipality’s population that use the AfD Facebook page is an intuitive proxy for right-wing social media use; however, it is also correlated with differences in a host of observable municipality characteristics — most importantly the prevalence of right-wing ideology. We thus attempt to isolate the local component of social media usage that is uncorrelated with right-wing ideology by drawing on the number of users on the “Nutella Germany” page. With over 32 million likes, Nutella has one of the most popular Facebook pages in Germany and therefore provides a measure of general Facebook media use at the municipality level. While municipalities with high Nutella usage are more exposed to social media, they are not more likely to harbor right-wing attitudes.

The whole result rests on assumptions about Nutella? What if you used likes for Zwetschgenkuchen? Has a robustness test been done? Was a simple correlation not good or not illustrative enough? I’ll stick with the simple hypothesis that some municipalities have both more Facebook usage, due to high AfD membership, and also more attacks on refugees, and furthermore both of those variables rise in tense times. AfD is the German party with the strongest presence on Facebook, I am sorry to say.

You will note by the way that within Germany the Nutella page has only verifiable 21,915 individual interactions, including likes (32 million is the global number of Nutella likes…die Deutschen are not that nutty), and that is distributed across 4,466 municipal areas. (If you are confused, see p.12 in the paper, which I find difficult to follow and I suspect that represents the confusion of the authors.) That should make you more worried yet about the Nutella identification strategy. They never tell us what they would have without Nutella, a better tasting sandwich I would say.

I also would note the broader literature on propaganda once again. Consider the research of Markus Prior: “…evidence for a causal link between more partisan messages and changing attitudes or behaviors is mixed at best.” These Facebook results are simply far outside of what we normally suppose to be true about human responsiveness — so maybe the company is undercharging for its ads!

Ben adds:

I am bothered by the paper’s robustness section in two ways: first, every single robustness test confirmed the results. To me that does not suggest that the initial result must be correct; it suggests that the researchers didn’t push their data hard enough. There is always a test that fails, and that is a good thing: it shows the boundaries of what you have learned. Second, there were no robustness tests applied to one of the more compelling pieces of evidence, that Internet and Facebook outages were correlated with a reduction in violence against refugees. This is particularly unfortunate because in some ways this evidence works against the filter bubble narrative: after all, the idea is the filter bubbles change your reality over time, not that they suddenly inspire you to action out of the blue.

The authors do present natural experiments from Facebook and internet outages. They find that “…for a given level of anti-refugee sentiment, there are fewer attacks in municipalities with high Facebook usage during an internet outage than in municipalities with low Facebook usage without an outage.” (p.28). Again I find that confusing, but I note also that “internet outages themselves…do not have a consistent negative effect on the number of anti-refugee sentiments.” That is the simple story, and it appears to exonerate Facebook. pp.28-30 then present a number of interaction effects and variable multiplications, but I am not sure what to conclude from the whole mess. I’m still expecting internet outages to lower the number of attacks, but they don’t.

Even if internet or Facebook outages do have a predictive effect on attacks in some manner, it likely shows that Facebook is a communications medium used to organize gatherings and attacks (as the telephone once might have been), not, as the authors repeatedly suggest, that Facebook is somehow generating and whipping up and controlling racist sentiment over time. Again, compare such a possibility to the broader literature. There is good evidence that anti-semitic violence across German regions is fairly persistent, with pogroms during the Black Death predicting synagogue attacks during the Nazi time. And we are supposed to believe that racist feelings dwindle into passivity simply because the thugs cannot access Facebook for a few days or maybe a week? By the way, in their approach if there is an internet outrage, mobile devices do not in Germany pick up the slack.

I’d also like to revisit the NYT sentence, cited above, and repeated many times on Twitter:

Wherever per-person Facebook use rose to one standard deviation above the national average, attacks on refugees increased by about 50 percent.

That sounds horrible, but it is actually a claim about variation across municipalities, not a claim about the absolute importance of the internet. The authors also reported a very different and perhaps more relevant claim to the Times:

…this effect drove one-tenth of all anti-refugee violence.

I would have started the paper with that sentence, and then tried to estimate its robustness, without relying on Nutella.

As it stands right now, you shouldn’t be latching on to the reported results from this paper.

Thursday assorted links

1. What makes the hardest equations in physics so difficult?

2. Privacy in the new Toronto Quayside. And 30 minutes of Jordan Peterson.

3. Arving Panagariya on Indian textiles and job creation.

4. The passport culture that is Swiss (Dutch).

5. Ben Thompson on the economics and also motivations of Facebook.

6. The gender wage premium is higher for exporters. And Elena Ferrante to become columnist for The Guardian.

Thursday assorted links

1. “Audible’s new feature lets you skip right to the most erotic part of romance novels…“Take me to the good part” lets listeners jump to the juicy sections of 110 romance titles in the company’s collection. These include beloved tropes like a couple’s first meeting, their innuendo-heavy banter, a marriage proposal, and, of course, sex scenes.” Link here.

2. What Southeast Asia would look like if every proposed railway were built. And more information here.

3. Profile of Jay Powell: “He doesn’t drink much, plays golf and the guitar, and has an odd ability to repeat people’s sentences backward to them, a quirk former colleagues say is a reminder of his smarts — and how closely he listens.”

4. One of my favorite Ben Thompson pieces, this one on Tech goes to Washington.

5. Eugenics 2.0? How far are we?

My Fall 2017 Ph.d Industrial Organization reading list

It is long, and thus below the fold…

- Competition

Einav, Lira and Levin, Jonathan, “Empirical Industrial Organization: A Progress Report,” Journal of Economic Perspectives, (Spring 2010), 145-162.

Bresnahan, Timothy F. “Competition and Collusion in the American Automobile Industry: the 1955 Price War,” Journal of Industrial Economics, 1987, 35(4), 457-82.

Asker, John, “A Study of the Internal Organization of a Bidding Cartel,” American Economic Review, (June 2010), 724-762.

Bresnahan, Timothy and Reiss, Peter C. “Entry and Competition in Concentrated Markets,” Journal of Political Economy, (1991), 99(5), 977-1009.

Whinston, Michael D., “Antitrust Policy Toward Horizontal Mergers,” Handbook of Industrial Organization, vol.III, chapter 36, see also chapter 35 by John Sutton.

“Benefits of Competition and Indicators of Market Power,” Council of Economic Advisors, April 2016.

Klein, Benjamin and Leffler, Keith. “The Role of Market Forces in Assuring Contractual Performance.” Journal of Political Economy 89 (1981): 615-641.

Bogdan Genchev, and Julie Holland Mortimer. “Empirical Evidence on Conditional Pricing Practices.” NBER working paper 22313, June 2016.

Sproul, Michael. “Antitrust and Prices.” Journal of Political Economy (August 1993): 741-754.

McCutcheon, Barbara. “Do Meetings in Smoke-Filled Rooms Facilitate Collusion?” Journal of Political Economy (April 1997): 336-350.

Crandall, Robert and Winston, Clifford, “Does Antitrust Improve Consumer Welfare?: Assessing the Evidence,” Journal of Economic Perspectives (Fall 2003), 3-26, available at http://www.brookings.org/views/articles/2003crandallwinston.htm.

FTC, Bureau of Competition, website, http://www.ftc.gov/bc/index.shtml. Read about some current cases and also read the merger guidelines.

Parente, Stephen L. and Prescott, Edward. “Monopoly Rights: A Barrier to Riches.” American Economic Review 89, 5 (December 1999): 1216-1233.

Demsetz, Harold. “Why Regulate Utilities?” Journal of Law and Economics (April 1968): 347-359.

Armstrong, Mark and Sappington, David, “Recent Developments in the Theory of Regulation,” Handbook of Industrial Organization, chapter 27, also on-line.

Shleifer, Andrei. “State vs. Private Ownership.” Journal of Economic Perspectives (Fall 1998): 133-151.

Farrell, Joseph and Klemperer, Paul, “Coordination and Lock-In: Competition with Switching Costs and Network Effects,” Handbook of Industrial Organization, vol.III, chapter 31, also on-line.

Xavier Gabaix and David Laibson, “Shrouded Attributes, Consumer Myopia, and Information Suppression in Competitive Markets,” http://papers.ssrn.com/sol3/papers.cfm?abstract_id=728545.

Strictly optional: Ariel Pakes and dynamic computational approaches to modeling oligopoly: http://www.economics.harvard.edu/faculty/pakes/files/Pakes-Fershtman-8-2010.pdf

http://www.economics.harvard.edu/faculty/pakes/files/handbookIO9.pdf

2. Organization

Gibbons, Robert, “Four Formal(izable) Theories of the Firm,” on-line at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=596864.

“Make Versus Buy in Trucking: Asset Ownership, Job Design, and Information,” by George P. Baker and Thomas N. Hubbard, American Economic Review, (June 2003), 551-572.

Van den Steen, Eric, “Interpersonal Authority in a Theory of the Firm,” American Economic Review, 2010, 100:1, 466-490.

Miller, Merton, and commentators. “The Modigliani-Miller Propositions After Thirty Years,” and comments, Journal of Economic Perspectives (Fall 1988): 99-158.

Myers, Stewart. “Capital Structure.” Journal of Economic Perspectives (Spring 2001): 81-102.

Hansemann, Henry. “The Role of Non-Profit Enterprise.” Yale Law Journal (1980): 835-901.

Optional: Charness, Gary and Kuhn, Peter J. “Lab Labor: What Can Labor Economists Learn From the Lab?” NBER Working Paper, 15913, 2010, Lazear, Edward P. “Leadership: A Personnel Economics Approach,” NBER Working Paper 15918, 2010, Oyer, Paul and Schaefer, Scott, “Personnel Economics: Hiring and Incentives,” NBER Working Paper 15977, 2010.

Cowen, Tyler, Google lecture on prizes, on YouTube.

3. Production

American Economic Review Symposium, May 2010, starts with “Why do Firms in Developing Countries Have Low Productivity?” runs pp.620-633.

Nicholas Bloom, Raffaella Sadun, and John Van Reenen, “Recent Advances in the Empirics of Organizational Economics,” http://cep.lse.ac.uk/pubs/download/dp0970.pdf.

Nicholas Bloom, Raffaella Sadun, and John Van Reenen, the slides for “Americans do I.T. Better: US Multinationals and the Productivity Miracle,” http://www.people.hbs.edu/rsadun/ADITB/ADIBslides.pdf, the paper is here http://www.stanford.edu/~nbloom/ADIB.pdf but I recommend focusing on the slides.

Bloom, Nicholas, Raffaella Sadun, and John Van Reenen. “Management as a Technology?” National Bureau of Economic Research working paper 22327, June 2016.

Syerson, Chad “What Determines Productivity?” Journal of Economic Literature, June 2011, XLIX, 2, 326-365.

Diego Restuccia and Richard Rogerson, “The Causes and Costs of Misallocation,” Journal of Economic Perspectives, Summer 2017, 31, 3, 151-174.

Dani Rodrik, “A Surprising Convergence Result,” http://rodrik.typepad.com/dani_rodriks_weblog/2011/06/a-surprising-convergence-result.html, and his paper here http://www.hks.harvard.edu/fs/drodrik/Research%20papers/The%20Future%20of%20Economic%20Convergence%20rev2.pdf

Serguey Braguinsky, Lee G. Branstetter, and Andre Regateiro, “The Incredible Shrinking Portuguese Firm,” http://papers.nber.org/papers/w17265#fromrss.

David Lagakos, “Explaining Cross-Country Productivity Differences in Retail Trade,” Journal of Political Economy, April 2016, 124, 2, 1-49.

Casselman, Ben. “Corporate America Hasn’t Been Disrupted.” FiveThirtyEight, August 8, 2014.

Decker, Ryan and John Haltiwanger, Ron S. Jarmin, and Javier Miranda. “Where Has all the Skewness Gone? The Decline in High-Growth (Young) Firms in the U.S. National Bureau of Economic Research working paper 21776, December 2015. NB: This paper and the three that follow have some repetition, so read them selectively rather than exhaustively.

Decker, Ryan and John Haltiwanger, Ron S. Jarmin, and Javier Miranda. “The Secular Business Dynamism in the U.S.” Working paper, June 2014.

Haltiwanger, John, Ian Hathaway, and Javier Miranda. “Declining Business Dynamism in the U.S. High-Technology Sector.” Ewing Marion Kauffman Foundation, February 2014.

Haltiwanger, John, Ron Jarmin and Javier Miranda. Where Have All the Young Firms Gone? Ewing Marion Kauffman Foundation, May 2012.

Song, Jae, David J. Price, Fatih Guvenen, and Nicholas Bloom. “Firming Up Inequality,” CEP discussion Paper no. 1354, May 2015.

Andrews, Dan, Chiara Criscuolo and Peter N. Gal. “Frontier firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries.” OECD working paper, 2015.

Furman, Jason and Peter Orszag. “A Firm-Level Perspective on the Role of Rents in the Rise in Inequality.” October 16, 2015.

Mueller, Holger M., Paige Ouimet, and Elena Simintzi. “Wage Inequality and Firm Growth.” Centre for Economic Policy Research, working paper 2015.

http://evansoltas.com/2016/05/07/pro-business-reform-pro-growth/

Furman, Jason. ”Business Investment in the United States: Facts, Explanations, Puzzles, and Policy.” Remarks delivered at the Progressive Policy Institute, September 30, 2015, on-line at https://obamawhitehouse.archives.gov/sites/default/files/page/files/20150930_business_investment_in_us_facts_explanations_puzzles_policies_slides.pdf

Scharfstein, David S. and Stein, Jeremy C. “Herd Behavior and Investment.” American Economic Review 80 (June 1990): 465-479.

Chen, Peter, Loukas Karabarbounis, and Brent Neiman. “The Global Rise of Corporate Saving.” National Bureau of Economic Research Working Paper 23133, February 2017.

4. Incentives

Edmans, Adam, Xavier Gabaix, and Dirk Jenter, “Executive Compensation: A Survey of Theory and Evidence,” NBER Working Paper 23596, July 2017.

Kaplan, Steven N. “Executive Compensation and Corporate Governance in the U.S.: Perceptions, Facts and Challenges.” Working paper, July 2012.

Robert J. Gordon and Ian Dew-Becker, “Unresolved Issues in the Rise of American Inequality,” http://www.people.fas.harvard.edu/~idew/papers/BPEA_final_ineq.pdf

Stein, Jeremy C. “Efficient Capital Markets, Inefficient Firms: A Model of Myopic Corporate Behavior.” Quarterly Journal of Economics 104 (November 1989): 655-670.

https://marginalrevolution.com/?s=short-termism

Ben-David, Itzhak, and John R. Graham and Campbell R. Harvey, “Managerial Miscalibration,” NBER working paper 16215, July 2010.

5. Sectors: finance, health care, tech, others

Gorton, Gary B. “Slapped in the Face by the Invisible Hand: Banking and the Panic of 2007,” http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1401882, published on-line in 2009.

Erel, Isil, Nadault, Taylor D., and Stulz, Rene M., “Why Did U.S. Banks Invest in Highly-Rated Securitization Tranches?” NBER Working Paper 17269, August 2011.

Philippon, Thomas. “Has the U.S. Finance Industry Become Less Efficient? On the Theory and Measurement of Financial Intermediation.” Working paper, September 2014.

Gompers, Paul and Lerner, Josh. “The Venture Capital Revolution.” Journal of Economic Perspectives, Spring 2001, 145-168.

Paul Graham, essays, http://www.paulgraham.com/articles.html.

Optional: consider subscribing to Ben Thompson’s Stratechery, periodic emails on the tech industry, note it is expensive.

Friedman, Milton. “The Social Responsibility of Business is to Increase its Profits.” The New York Times Magazine, September 13, 1970.

Healy, Kieran. “The Persistence of the Old Regime.” Crooked Timber blog, August 6, 2014.

More to be added, depending on your interests.

Amazon’s new customer, and the economics of scale in groceries

Ben Thompson writes:

…you can see the outline of similar efforts in logistics: Amazon is building out a delivery network with itself as the first-and-best customer; in the long run it seems obvious said logistics services will be exposed as a platform.

This, though, is what was missing from Amazon’s grocery efforts: there was no first-and-best customer. Absent that, and given all the limitations of groceries, AmazonFresh was doomed to be eternally sub-scale.

WHOLE FOODS: CUSTOMER, NOT RETAILER

This is the key to understanding the purchase of Whole Foods: to the outside it may seem that Amazon is buying a retailer. The truth, though, is that Amazon is buying a customer — the first-and-best customer that will instantly bring its grocery efforts to scale.

Today, all of the logistics that go into a Whole Foods store are for the purpose of stocking physical shelves: the entire operation is integrated. What I expect Amazon to do over the next few years is transform the Whole Foods supply chain into a service architecture based on primitives: meat, fruit, vegetables, baked goods, non-perishables (Whole Foods’ outsized reliance on store brands is something that I’m sure was very attractive to Amazon). What will make this massive investment worth it, though, is that there will be a guaranteed customer: Whole Foods Markets.

…At its core Amazon is a services provider enabled — and protected — by scale.

Here is the full piece, with many more background and points.

The proposed Elon Musk merger: the market speaks

…note that Solar City’s stock, after jumping up 12% at yesterday’s open, ended the day only up 3%; both are well below the 25%~34% premium offered by Tesla, suggesting the market is very skeptical of this deal happening. The problem, though, is that Tesla dropped 9.2% at open (representing a market cap loss that was double Solar City’s worth), but instead of moving back up in the opposite direction of Solar City’s drop, the stock actually closed down even further for a 10.5% decline. This suggests that a good portion of the drop is not due to the possibility of Solar City being acquired, but a loss of confidence in the company.

That is from Ben Thompson’s Stratechery newsletter, worth paying for or so I find at least. Here is basic background on the proposed deal.

Bill Simmons estimate of the day

The trouble with podcasts is that they are difficult to grow: while text can be shared and consumed quickly, a podcast requires a commitment (which again, is why advertising in them is so valuable). Simmons, though, by virtue of his previous writing, is already averaging over 400,000 downloads per episode.

Podcast rates are hard to come by, but I’m aware of a few podcasts a quarter the size that are earning somewhere in excess of $10,000/episode; presuming proportionally similar rates (which may be unrealistic, given the broader audience) The Bill Simmons Podcast, which publishes three times a week, could be on a >$6 million run rate, which, per my envelope math in the footnote above, could nearly pay for a 50-person staff a la Grantland.

Most of the article, by Ben Thompson, is about the economics of Grantland.