Results for “countercyclical asset” 45 found

The countercyclical asset, a continuing series

Cocoa futures hit a

23-year high, capping a successful year for the commodity. Chocolate

has done rather well this year, and not simply because the world has

been fretting about recession and craving comfort food. Constrained

supply coupled with robust demand has helped London cocoa futures rise

by some 71.0% since the end of last year, making cocoa one of the

market’s best performing commodities. On Wednesday, the day before

millions of people around the world offered boxes of the sweet stuff to

their relatives as Christmas gifts, cocoa futures for May 2009 delivery

hit a 23-year high of £1,820.0($2,545.90) per ton in London(…)

Here is the story and I thank John de Palma for the pointer. Here are previous installments in the series.

The countercyclical asset, a continuing series

A study last year may lend some credence to the legend. In “Praying for

Recession: The Business Cycle and Protestant Religiosity in the United

States,” David Beckworth, an assistant professor of economics at Texas

State University, looked at long-established trend lines showing the

growth of evangelical congregations and the decline of mainline

churches and found a more telling detail: During each recession cycle

between 1968 and 2004, the rate of growth in evangelical churches

jumped by 50 percent. By comparison, mainline Protestant churches

continued their decline during recessions, though a bit more slowly.

Here is the full story. Here is the paper. Here is earlier discussion from Mark Thoma’s. Here is David Beckworth’s blog.

Still more countercyclical assets

Pretty soon we’ll get to the point where almost everything in this economy of ours is booming:

All over sunny San Diego,

tough economic times

have forced people to cut back on their $4 lattes and sushi dinners.

But one new business is booming — and ka-booming — precisely

because of frustration from the worst financial crisis to hit the

United States in decades. Welcome to Sarah’s Smash Shack, where pent-up patrons can relieve

stress by hurling dinnerware and bric-a-brac against a wall, as hard as

they can, day and night, seven days a week. San Diego entrepreneur Sarah Lavely charges her clients $10 and up

to pulverize plates and glasses during 15-minute intervals. Music

blares, clients dress in protective gear and a neon sign urges them to

"Break More Stuff."(…)San Diego may boast surf and sunshine year round, but it also has

its share of black economic clouds. Its real estate market has been hit

hard by the high rate of foreclosures in California, the second highest

in the nation, and its unemployment rate has risen to 6.4 percent from

4.8 percent in a year…

Here is the link and I thank John de Palma for the pointer.

The countercyclical asset, a continuing series

It is getting worse: home vaults. The Times of London reports:

Sales of household safes have surged as wealthy savers concerned about the

health of banks opt to keep cash at home.

Leading safe manufacturers contacted by The Times said that they had

seen a big increase in demand. Many predicted that fears of meltdown in the

banking sector would mean a further rush before Christmas.One company said that sales had increased by a quarter, while another said

that its staff had received calls from panicking investors who now wanted to

keep their savings locked away at home.

Here are previous installments in the series.

The countercyclical asset, a continuing series

Nicer than tasers:

Mr. Borg, past

president of the North American Securities Administrators Association,

adds that in past market downturns he saw people turn to chinchillas, worm farms and super-breeds of rabbits.

Emus, too, were big. "Eventually, people got tired of them and just let them go," he says. "To this day, you’ll be in West Texas and a big

emu running wild will just come up next to your car."

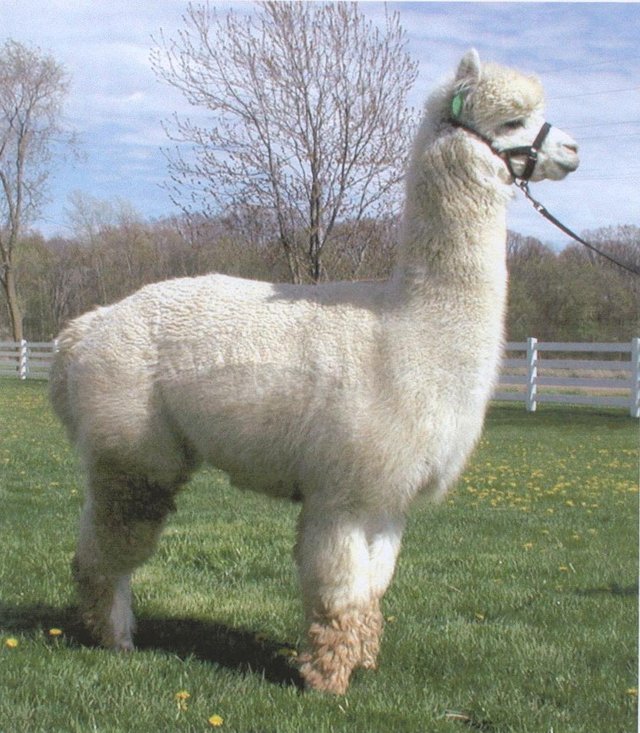

Here is the link and thanks to John De Palma for the pointer. The National Alpaca Registry is doing well:

Peggy Parks, a 49-year-old auditor in Johnstown, Pa., turned to an

unusual farm animal. "I’ve lost a fortune in stocks, and my 401(k) is

falling through the floor. I feel comfortable in alpacas," she says.

She invested $56,000 in a small herd that she believes has a better

outlook than most mutual funds because of the animals’ breeding

potential.

The countercyclical asset, a continuing series, revisited

The countercyclical asset, a continuing series

A sale of pickled sharks, butterfly paintings and other pieces by the

provocative British artist [Damien Hirst] has raised more than US$125 million – a

record for an auction of works by a single artist. And there is more to

come Tuesday.

Here is the story and I thank Chris F. Masse for the pointer. Here are previous installments in the series, including dirt for dinner in Haiti.

The Countercyclical Asset, part II

During a recent book interview, an ABC news anchor asked me what kind of impact the real world’s subprime mortgage crisis and related fallout would have on Second Life’s economy. I speculated that it would probably provide an ironic boost, noting how the last recession of 2003 was important to Second Life’s early growth. "I can’t tell you how many people I met then," I told her, "who were out-of-work programmers and web designers creating content in SL while they looked for jobs."

That was an off-the-cuff answer, but the latest economic figures from Linden Lab suggest a similar pattern may indeed be happening now. In-world spending activity has been increasing steadily since the mid-2007 prohibition against virtual gambling. "The Second Life economy," Zee Linden noted, "does not appear to be affected by the slowing economy of the United States." SL blogger Roland Legrand took a look at the numbers, and had a similar thought to me: "Could it be that people find refuge from the ‘real world’ troubles in virtual worlds and that the SL economy ‘profits’ in that way from the crisis?"

Here is the link. Here is the first installment of The Countercyclical Asset.

The countercyclical asset

Sorry, but the problem has become worse and I have to blog this again:

In Haiti, where three-quarters of the population earns less than $2

a day and one in five children is chronically malnourished, the one

business booming amid all the gloom is the selling of patties made of

mud, oil and sugar, typically consumed only by the most destitute.“It’s salty and it has butter and you don’t know you’re eating dirt,”

said Olwich Louis Jeune, 24, who has taken to eating them more often in

recent months. “It makes your stomach quiet down.”

Art as a wartime investment the asset that is countercyclical

From a new Economic Journal article by Kim Oosterlinck:

During World War II, artworks significantly outperformed all alternative investments in Occupied France. With the surge in demand for portable and easy-to-hide (discreet) assets such as artworks and collectible stamps, prices boomed. This suggests that discreet assets may be viewed as crypto-currencies, demand for which varies depending on the environment and the need to hide value. Regarding art market valuation, this paper argues that while some economic actors derive significant utility from conspicuous consumption, others value the discretion offered by artworks. Motives for purchasing art may thus vary over time.

The pointer is from Kevin Lewis. And via Samir Varma, here is a new piece on how the returns to fine art have been overestimated.

The countercyclical Cypriot asset

The only new arrivals [in the Cypriot economy] were foreign exchange companies, such as MoneyGram, which Cypriots might soon use to send their savings out of the country or to receive money from relatives living abroad.

From the FT here is more, none of it good news.

Countercyclical “asset” of the day — burglary watch

With a lot more unemployed people, a lot more people are staying home, and they see more in their neighborhood," said Sgt. Thomas Lasater, who supervises the burglary unit of the police department in St. Louis County, Mo., where authorities recorded a whopping 35 percent drop in burglaries during the first six months of 2009.

The falling price of raw materials — which had been producing copper and other thefts — may be another reason for the change in trend. Here is the story and I thank Daniel Lippman for the pointer.

Saturday assorted links

1. Bidet sales: the current countercyclical asset. It’s not just suburban real estate, Big Tech, and food service delivery.

3. 1955 University of Chicago Ph.D. price theory exam, chaired by Milton Friedman. Can you guess who got the best grade? How well would you do?

4. ““Nothing says white privilege like trying to orchestrate your own cancellation,” tweeted Sofia Quintero, a writer and activist from the Bronx.” Link here.

Saturday assorted links

2. Did Medicare D affect outcomes?

3. Is drinking a countercyclical asset in Greece?

4. Drug testing is coming to e-Gaming.

5. Interview with William Vollmann. I still think the “By the Book” series in the NYT is the single best thing on the web these days.

6. One billion earths in our galaxy alone? Uh-oh. I don’t regard all that frozen water on Pluto as good news either.

Assorted links

2. Cheapskates, pessimists, and food trucks, by me, on countercyclical assets.

3. On Spufford’s theology, with a link to chapter one.

4. Rogoff on technological unemployment, and interview with John List.

5. How the word “entitlement” became a negative.